Debt Dynamics: Strategies for Personal Management and Economic Implications

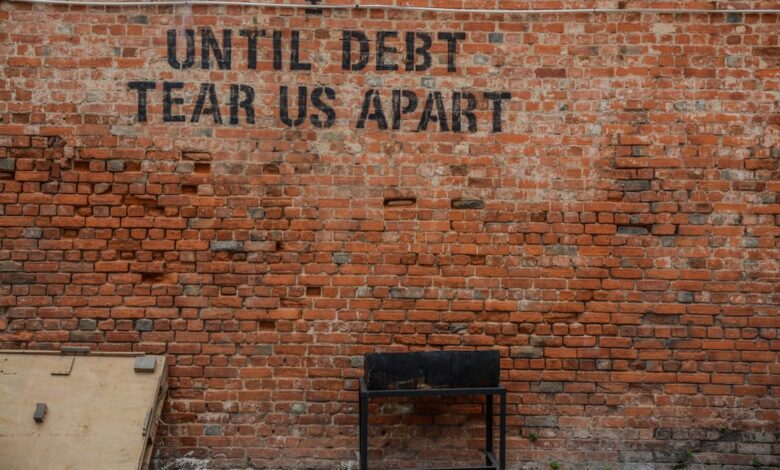

In an increasingly complex financial landscape, personal debt has become a pressing concern for millions of individuals and families. With rising living costs and the ease of credit access, many find themselves grappling with overwhelming financial obligations that can hinder their economic stability and growth. This article explores effective strategies for managing and reducing personal debt, emphasizing practical approaches that empower consumers to regain control of their finances. Additionally, we will examine the broader implications of high debt levels on economic growth, from the individual level to national economies, and how corporate and student loan debts influence financial planning and market performance. By understanding the tools available—such as negotiation with creditors and credit counseling—readers will be better equipped to navigate their debt challenges. Join us as we delve into these critical topics and uncover the intricate relationship between debt and financial well-being.

- Here are three possible section headlines for the article on managing and reducing personal debt:

- 1. **Navigating the Debt Landscape: Strategies for Effective Management and Reduction**

- 2. **The Ripple Effect: Understanding Debt's Impact on Economic Growth and Financial Stability**

Here are three possible section headlines for the article on managing and reducing personal debt:

Managing and reducing personal debt is essential for maintaining financial stability and fostering economic growth. Individuals can adopt various strategies to tackle their debt effectively. One approach is to create a detailed budget that tracks income and expenses, allowing for a clearer understanding of spending habits and areas where cuts can be made. This can free up additional funds to pay down debt more aggressively.

Another strategy is the debt snowball method, where individuals focus on paying off their smallest debts first. This creates a sense of accomplishment and motivation as they eliminate debts one by one. In contrast, the debt avalanche method prioritizes paying off debts with the highest interest rates first, which can save money in the long run.

Additionally, seeking assistance from credit counseling services can provide valuable guidance in developing a personalized debt management plan. These organizations can negotiate with creditors on behalf of individuals, potentially securing lower interest rates or more flexible repayment terms.

Ultimately, the key to managing personal debt lies in proactive planning, disciplined budgeting, and seeking support when needed, all of which contribute to a healthier financial future.

1. **Navigating the Debt Landscape: Strategies for Effective Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines budgeting, prioritization, and communication. One effective strategy is to create a comprehensive budget that outlines all income sources and expenses. This allows individuals to identify areas where they can cut back and allocate more funds toward debt repayment.

Another important aspect is prioritizing debts based on interest rates and balances. Utilizing the debt avalanche method, where higher-interest debts are paid off first, can save money in the long run. Alternatively, the debt snowball method focuses on paying off smaller debts first to build momentum and motivation.

Additionally, individuals should consider consolidating debts, which can simplify payments and potentially lower interest rates. This can be achieved through personal loans or balance transfer credit cards. However, it’s essential to evaluate the terms and fees associated with these options to ensure they provide genuine financial relief.

Communication with creditors is also key. Many creditors are willing to negotiate better repayment terms, such as lower interest rates or extended payment periods, especially if they understand the borrower’s financial situation. Being proactive in reaching out can often lead to more favorable terms.

Credit counseling services can provide valuable support by offering financial education, budgeting assistance, and negotiation help. These services can empower individuals to make informed decisions about their debt management strategies.

Ultimately, effective debt management requires a combination of discipline, informed decision-making, and a willingness to seek help when necessary. By implementing these strategies, individuals can navigate their debt landscape more effectively and work toward achieving financial stability.

2. **The Ripple Effect: Understanding Debt's Impact on Economic Growth and Financial Stability**

High levels of debt can significantly influence economic growth and financial stability, creating a ripple effect that extends beyond individual borrowers to the broader economy. When consumers and businesses are burdened with excessive debt, their spending power diminishes, leading to reduced consumption and investment. This slowdown in spending can stifle economic growth, as consumer demand drives production and employment levels.

Moreover, high debt levels can result in increased default risks, which can destabilize financial institutions and erode consumer confidence. When individuals struggle to meet their debt obligations, it can lead to higher rates of default, prompting lenders to tighten credit availability. This contraction of credit can further depress economic activity, as businesses find it more difficult to secure financing for expansion or operational needs.

Additionally, the psychological effects of debt can impact financial behaviors. Individuals dealing with significant debt may prioritize repayment over other expenditures, leading to decreased investment in education, health, and savings. This shift can hinder long-term economic development, as a less educated workforce and diminished savings rates can limit future growth potential.

On a macroeconomic level, government responses to high levels of personal or corporate debt, such as implementing austerity measures or adjusting interest rates, can also have profound implications for economic stability. These measures can lead to reduced public spending and investment, affecting social programs and infrastructure development, which are critical for sustainable growth.

In summary, the interconnectedness of debt levels, consumer behavior, and economic policies creates a complex landscape where high debt can hinder economic growth and undermine financial stability. Understanding these dynamics is essential for policymakers, businesses, and individuals to navigate the challenges posed by debt in a way that promotes a healthier economic environment.

In conclusion, managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach, awareness of its broader economic implications, and proactive engagement with creditors. By employing effective debt management strategies, individuals can not only regain control over their finances but also contribute to overall economic stability. The ripple effects of high personal debt levels extend beyond individual households, influencing economic growth and financial security at large.

Negotiating with creditors can lead to more favorable repayment terms, easing the burden of debt while credit counseling provides essential guidance for sustainable financial habits. Additionally, while leveraging debt for investment can offer potential rewards, it carries inherent risks that must be carefully weighed. The growing concern of student loan debt further complicates financial planning, underscoring the need for informed decision-making in managing educational expenses.

On a larger scale, the dynamics of corporate debt and national debt management illustrate the interconnectedness of financial decisions across various sectors. Governments play a crucial role in navigating national debt, shaping economic policies that ultimately affect all citizens. By understanding these relationships and adopting comprehensive debt management strategies, individuals can foster not only their own financial health but also contribute positively to the economic landscape. As we move forward, it is imperative to prioritize financial literacy and responsible borrowing practices to ensure a more secure future for individuals and the economy alike.