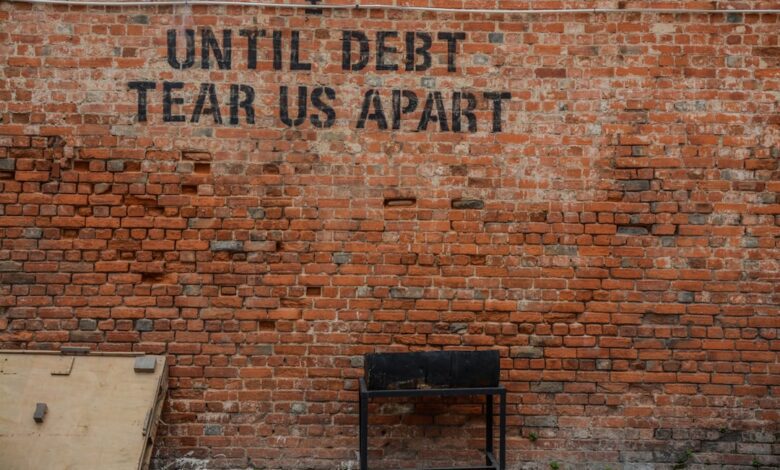

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing debt has become a crucial skill for individuals and businesses alike. With rising living costs and economic uncertainties, many find themselves grappling with personal debt that can hinder their financial stability and future growth. This article delves into effective strategies for managing and reducing personal debt, exploring how high debt levels can stifle economic growth at both personal and national levels. We will discuss the importance of negotiating with creditors to secure better repayment terms and highlight the role credit counseling can play in fostering financial recovery. Additionally, we'll examine the complexities of using debt as a tool for investment, the impact of student loan debt on financial planning, and the implications of corporate debt on stock performance. Finally, we will touch upon how governments manage national debt and its broader economic implications. Join us as we navigate the multifaceted world of debt management and explore pathways to financial freedom.

- 1. "Navigating Personal Finance: Effective Strategies for Managing and Reducing Debt"

- 2. "The Economic Ripple Effect: Understanding High Debt Levels and Their Impact on Growth"

- 3. "Negotiating Your Way to Financial Freedom: Tips for Better Repayment Terms and Credit Counseling"

1. "Navigating Personal Finance: Effective Strategies for Managing and Reducing Debt"

Managing and reducing personal debt is a crucial aspect of navigating personal finance effectively. Individuals can adopt several strategies to regain control over their financial situation and work towards a debt-free future.

One of the first steps is to create a comprehensive budget that outlines all sources of income and expenses. By tracking spending habits, individuals can identify areas where they can cut back and allocate more funds towards debt repayment. This proactive approach not only helps in managing current debt but also fosters better financial habits in the long run.

Another effective strategy is the debt snowball method, which involves paying off smaller debts first while making minimum payments on larger debts. This method can provide quick wins and boost motivation as individuals see their debts diminishing. Conversely, the debt avalanche method focuses on paying off debts with the highest interest rates first, ultimately reducing the total interest paid over time.

Additionally, individuals should consider consolidating their debts. This can be achieved through personal loans or balance transfer credit cards, which often offer lower interest rates. Consolidation simplifies payments by combining multiple debts into a single monthly payment, making it easier to manage.

Communication with creditors is also vital. Many creditors are willing to negotiate repayment terms, such as lower interest rates or extended payment plans, especially if borrowers demonstrate a genuine effort to repay their debts. Establishing an open dialogue can lead to more favorable terms and alleviate some financial pressure.

Lastly, seeking assistance from a credit counseling service can provide valuable guidance. These organizations offer budgeting tools, financial education, and personalized plans to help individuals manage their debts more effectively. They can also negotiate with creditors on behalf of clients, further alleviating stress and improving repayment outcomes.

By employing these strategies, individuals can navigate the complexities of personal finance, ultimately reducing their debt levels and improving their overall financial health.

2. "The Economic Ripple Effect: Understanding High Debt Levels and Their Impact on Growth"

High levels of personal and corporate debt can create significant ripple effects throughout the economy, influencing growth trajectories in various ways. When individuals and businesses are burdened by excessive debt, their ability to spend and invest diminishes. This reduction in consumer spending can lead to lower demand for goods and services, which, in turn, hampers business revenues and growth prospects. As companies experience declining sales, they may be forced to cut costs, often resulting in layoffs or reduced hours for employees. This cycle can create a broader economic slowdown, as higher unemployment leads to even less consumer spending.

Moreover, high debt levels can constrain access to credit. Financial institutions may become more risk-averse and tighten lending standards, making it difficult for borrowers to refinance existing debts or secure new loans. This lack of access to credit can stifle innovation and entrepreneurship, as potential new businesses struggle to obtain the necessary funding to launch or expand.

On a macroeconomic level, the accumulation of debt can lead to increased interest rates. As borrowers default or struggle to repay, lenders may raise rates to mitigate risk, further complicating the financial landscape for consumers and businesses alike. Higher interest rates can deter investment, as the cost of borrowing rises, making it less attractive for companies to finance new projects or for individuals to make significant purchases, such as homes or cars.

Additionally, the burden of high debt can impact government fiscal policies. Governments may face pressure to enact austerity measures to manage national debt levels, which can result in cuts to public services and social programs. Such measures can have detrimental effects on overall economic growth, as reduced government spending can negatively impact job creation and infrastructure development.

In summary, high debt levels create a complex web of economic challenges that can stifle growth, limit consumer and business spending, and lead to broader societal implications. Understanding these dynamics is crucial for policymakers, financial institutions, and individuals as they navigate the intricate relationship between debt and economic performance.

3. "Negotiating Your Way to Financial Freedom: Tips for Better Repayment Terms and Credit Counseling"

Negotiating better repayment terms with creditors can significantly ease the burden of personal debt and pave the way toward financial freedom. Effective negotiation requires preparation and a clear understanding of your financial situation. Start by gathering all necessary documentation, including account statements, payment history, and details of your current income and expenses. This information will help you present a comprehensive picture to your creditors.

When contacting creditors, be honest and straightforward about your financial difficulties. Many creditors are willing to work with you if they believe it will increase the likelihood of repayment. Consider proposing a realistic repayment plan that reflects your financial capacity; this might involve extending the loan term, reducing interest rates, or even negotiating a settlement for less than the total amount owed. It’s essential to remain calm and polite during these conversations, as a positive attitude can foster goodwill and cooperation.

In addition to direct negotiations, credit counseling can serve as a valuable resource in managing debt. Credit counselors are trained professionals who can offer guidance, help create a personalized budget, and negotiate with creditors on your behalf. They often have established relationships with creditors and may secure more favorable terms than you could on your own. When seeking credit counseling, choose a reputable agency that is accredited and offers transparent services.

Ultimately, the combination of effective negotiation skills and the support of credit counseling can empower individuals to take control of their financial situations. By proactively addressing debt and working toward manageable repayment plans, individuals can make significant strides toward financial freedom.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial well-being but also for broader economic stability. By implementing strategies such as budgeting, prioritizing repayments, and seeking credit counseling, individuals can take meaningful steps toward financial freedom. Understanding the implications of high debt levels emphasizes the importance of proactive debt management, as it influences economic growth and can create a ripple effect throughout the economy.

Negotiating with creditors for better repayment terms is a valuable skill that can significantly lessen the burden of debt, allowing individuals to regain control over their finances. However, it is essential to weigh the risks and rewards of using debt as a means of investment, particularly in the context of student loans, which can complicate long-term financial planning.

Moreover, the relationship between corporate debt and stock performance highlights the interconnectedness of personal and corporate finance, underscoring the need for responsible debt practices at all levels. Lastly, understanding how governments manage national debt provides insight into the larger economic landscape, illustrating the importance of sustainable fiscal policies.

By adopting informed strategies and recognizing the broader economic implications of debt, individuals can not only improve their financial situations but also contribute to a healthier economic environment for all.