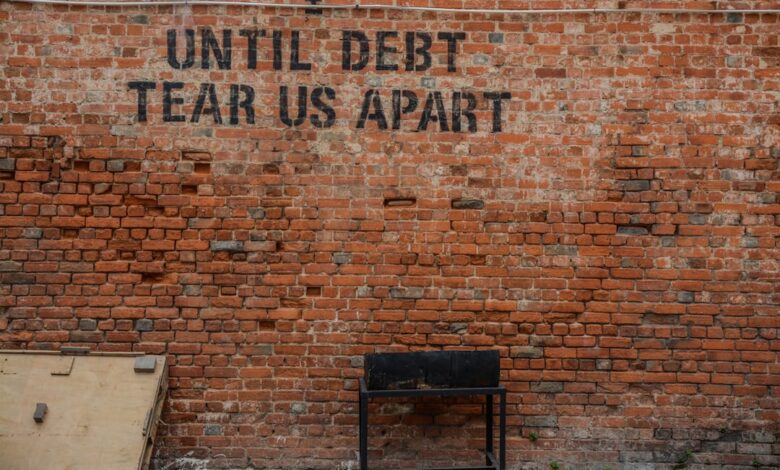

Debt Dynamics: Strategies for Personal Relief and Economic Resilience

In today’s fast-paced financial landscape, managing and reducing personal debt has become a crucial concern for individuals and families alike. With mounting pressure from various forms of debt, including credit cards, student loans, and mortgages, understanding effective strategies for financial freedom is more important than ever. This article delves into the multifaceted world of debt management, exploring not only the personal strategies that can help alleviate financial burdens but also the broader economic implications of high debt levels on growth. We will examine the intricate relationship between personal and corporate debt, the negotiation tactics that can lead to better repayment terms, and the role of credit counseling in navigating financial challenges. Additionally, we will discuss the risks and rewards of leveraging debt for investment purposes, the impact of student loan debt on financial planning, and how national debt is managed by governments, including its potential economic repercussions. Join us as we unpack these essential topics to empower you on your journey toward financial stability and informed decision-making.

- 1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

- 2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

Managing personal debt can be a challenging yet crucial aspect of achieving financial freedom. Implementing effective strategies is essential for individuals looking to reduce their debt burden and regain control over their finances. One of the first steps is to create a comprehensive budget that outlines income, expenses, and debt obligations. This will provide a clear picture of financial standing and help identify areas where spending can be trimmed.

Another effective strategy is the debt snowball method, which involves paying off smaller debts first to build momentum and motivation. By focusing on eliminating one debt at a time, individuals can experience quick wins that encourage continued progress. Alternatively, the debt avalanche method prioritizes paying off debts with the highest interest rates first, potentially saving money on interest payments in the long run.

Consolidation is another option for managing personal debt. This involves combining multiple debts into a single loan with a lower interest rate, simplifying payments and potentially reducing monthly obligations. However, it is essential to ensure that the terms of the new loan do not lead to higher debt levels or extended repayment periods.

Negotiating with creditors can also yield favorable outcomes. Many creditors are willing to work with individuals who proactively communicate their financial difficulties. Requesting lower interest rates, extended payment terms, or even settlements can provide relief and make repayment more manageable.

Finally, seeking guidance from credit counseling services can be beneficial. These organizations offer expertise in budgeting, debt management plans, and financial education, helping individuals develop long-term strategies for managing their debt effectively. By taking a proactive and informed approach, individuals can navigate personal debt and work towards achieving lasting financial stability.

Managing and reducing personal debt is a critical aspect of financial health that can significantly impact overall well-being. Individuals can adopt several strategies to tackle their debt effectively. First, creating a comprehensive budget allows people to track their income and expenses, helping identify areas where spending can be reduced. This enables them to allocate more funds towards debt repayment.

Another effective strategy is the debt snowball method, where individuals focus on paying off their smallest debts first while making minimum payments on larger debts. This approach can provide psychological motivation as small wins are achieved. Alternatively, the debt avalanche method targets debts with the highest interest rates first, minimizing the total interest paid over time.

Negotiating with creditors can also yield favorable repayment terms. Borrowers should communicate openly about their financial situation, as many creditors are willing to work out new payment plans, lower interest rates, or even settle for less than the full amount owed. Being proactive and demonstrating a willingness to repay can lead to more favorable terms.

Credit counseling plays a vital role in debt management, offering professional guidance and support. Certified credit counselors can help individuals develop personalized debt repayment plans and provide financial education, empowering them to make informed decisions about their finances. This support is particularly crucial for those feeling overwhelmed by their debt.

While there are risks associated with using debt to invest, such as market volatility and potential loss of capital, there are also rewards. When leveraged wisely, investments can yield returns that exceed the cost of borrowing, contributing to wealth accumulation. However, it is essential for individuals to assess their risk tolerance and ensure they have a solid financial foundation before pursuing this strategy.

Student loan debt is another significant factor affecting financial planning. It can hinder individuals' ability to save for retirement, purchase homes, or make other long-term investments. As student loans become a larger part of many people's financial obligations, understanding repayment options and managing these debts is crucial for future financial stability.

Lastly, corporate debt can influence stock performance, as high levels of indebtedness may lead investors to perceive companies as risky, potentially affecting stock prices. Companies with manageable debt levels, on the other hand, might be viewed more favorably, as they are often better positioned to invest in growth opportunities. Understanding the dynamics of corporate debt is essential for investors who want to assess the long-term viability of their investments.

Overall, effectively managing debt requires a multifaceted approach, including budgeting, negotiating, seeking professional help, and making informed investment decisions. By adopting these strategies, individuals can work towards reducing their debt and achieving greater financial stability.

2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

High levels of personal and corporate debt can create significant barriers to economic growth. When individuals and businesses are burdened by excessive debt, their ability to spend and invest diminishes. This reduced spending leads to lower consumer demand, which can stifle business revenues and slow down economic expansion.

For households, high debt levels often result in a prioritization of debt repayment over other expenditures. Families may cut back on discretionary spending, which affects retail sales, services, and overall economic activity. Similarly, businesses with heavy debt obligations may be forced to allocate resources toward servicing their debts rather than investing in new projects, hiring employees, or increasing wages. This stagnation can lead to a cycle of slow growth and increased financial stress for both individuals and companies.

Moreover, high debt levels can contribute to economic instability. As debt accumulates, the risk of default rises, which can lead to financial crises that disrupt markets and economies. The 2008 financial crisis serves as a stark reminder of how excessive debt can lead to widespread economic downturns, affecting not only those directly involved in the borrowing but also the broader economy through lost jobs and decreased consumer confidence.

In summary, the economic ripple effect of high debt levels is profound, as it can stifle growth, reduce consumer and business confidence, and ultimately hinder the overall health of the economy. Addressing these debt levels is crucial for fostering a more robust economic environment.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial stability but also for fostering broader economic growth. By adopting strategic approaches to debt management, such as negotiating with creditors and seeking credit counseling, individuals can alleviate their financial burdens and reclaim control over their financial futures. The interconnectedness of personal and corporate debt highlights the importance of responsible borrowing and investment practices. While leveraging debt can offer opportunities for growth, it carries inherent risks that must be carefully weighed, particularly in the context of student loans and their long-term implications on financial planning. Furthermore, the role of government in managing national debt underscores the necessity for sound fiscal policies to ensure economic stability and promote sustainable growth. Ultimately, a comprehensive understanding of these dynamics empowers individuals to make informed decisions, paving the way for a healthier financial landscape for themselves and the economy at large.