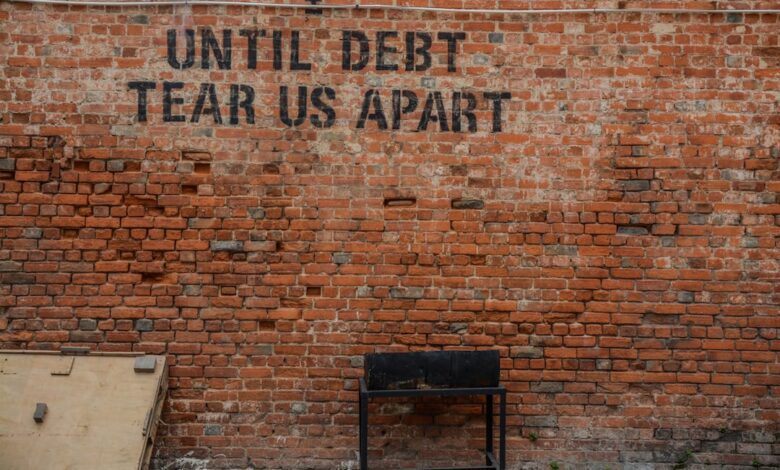

Debt Dynamics: Strategies for Personal Management and Economic Implications

In an increasingly debt-driven society, managing personal debt has become a critical concern for individuals and families alike. With rising living costs and economic uncertainties, many find themselves grappling with financial burdens that can hinder their progress and well-being. This article explores effective strategies for managing and reducing personal debt, while also examining the broader implications of debt on economic growth. High levels of personal and corporate debt can ripple through the economy, impacting everything from consumer spending to stock performance. We will delve into essential techniques for negotiating with creditors, the pivotal role of credit counseling, and the complex interplay of student loan debt in financial planning. Additionally, we will discuss the risks and rewards associated with using debt as an investment tool, and how governments navigate national debt to maintain economic stability. By understanding these dynamics, individuals can better equip themselves to take control of their financial futures in a landscape where debt is both a tool and a potential pitfall.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Ripple Effect: High Debt Levels and Their Consequences on Economic Growth**

- 3. **Negotiating with Creditors: Securing Favorable Repayment Terms for Personal Stability**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines practical financial habits with a proactive mindset. One of the first steps in navigating personal debt is to create a comprehensive budget that outlines income, expenses, and debt obligations. This transparency allows individuals to identify areas where they can cut costs and reallocate funds toward debt repayment.

Establishing an emergency fund is also crucial, as it can prevent the need to incur additional debt in case of unforeseen expenses. Once a budget is in place, individuals should consider the snowball or avalanche method for debt repayment. The snowball method involves paying off the smallest debts first, which can provide quick wins and motivate continued progress. In contrast, the avalanche method focuses on paying off debts with the highest interest rates first, ultimately saving money on interest payments in the long run.

Additionally, individuals should regularly review their financial situation and adjust their strategies as needed. This may involve consolidating high-interest debts into a lower-interest loan or negotiating with creditors for more favorable repayment terms. Open communication with creditors can yield better options, such as reduced interest rates or extended payment plans.

Seeking assistance from credit counseling services can also be beneficial. These organizations provide financial education and may offer debt management plans that enable individuals to pay off debts over a more manageable timeline. Ultimately, the key to effective debt management lies in maintaining discipline, staying informed about financial options, and remaining committed to a long-term strategy for financial health.

2. **The Ripple Effect: High Debt Levels and Their Consequences on Economic Growth**

High debt levels can have significant repercussions on economic growth, creating a ripple effect that impacts various sectors of the economy. When individuals and households are burdened with excessive debt, their discretionary spending often declines. This reduction in consumption can lead to lower demand for goods and services, which in turn can stall business growth and hinder job creation. As businesses experience reduced sales, they may cut back on investments, further limiting their ability to expand and innovate.

Moreover, high personal debt levels can lead to increased defaults and bankruptcies, putting additional pressure on financial institutions. When banks face higher rates of default, they may tighten lending standards, making it more difficult for consumers and businesses to secure loans. This credit contraction can stifle economic activity and reduce overall investment in the economy.

At the national level, high levels of government debt can also pose challenges to economic growth. Excessive national debt can lead to higher interest rates as governments compete for borrowing in financial markets. Increased borrowing costs can discourage both public and private investment, ultimately slowing down economic expansion. Additionally, when a significant portion of government revenue is directed toward servicing debt, fewer resources are available for public services and infrastructure, which are essential for long-term economic growth.

Overall, the interplay between high debt levels and economic growth highlights the importance of sound financial management at both personal and governmental levels. Addressing debt-related issues can stimulate economic activity, fostering a more robust and sustainable growth trajectory.

3. **Negotiating with Creditors: Securing Favorable Repayment Terms for Personal Stability**

Negotiating with creditors can be a crucial step for individuals seeking to regain control over their financial situation. The process begins with understanding one’s financial standing and identifying specific challenges, such as high interest rates, unaffordable monthly payments, or looming deadlines. By approaching creditors with a clear and honest assessment of one’s circumstances, individuals can open a dialogue that may lead to more favorable repayment terms.

Effective negotiation often involves preparing a realistic budget that highlights income and expenses, allowing individuals to present a feasible repayment plan. Creditors are more likely to be receptive when they see that the borrower is committed to repaying the debt, albeit under modified terms. It is also beneficial to research the creditor’s policies and any available hardship programs, as many lenders have options designed to assist borrowers in distress.

Maintaining open communication throughout the negotiation process is vital. Individuals should be proactive in reaching out to creditors, rather than waiting for them to initiate contact. Demonstrating willingness to work together can foster goodwill and may lead to concessions such as lower interest rates, extended repayment periods, or even partial debt forgiveness.

Additionally, documenting all communications and agreements is essential for avoiding misunderstandings and ensuring that both parties adhere to the new terms. In some cases, enlisting the help of a credit counselor can provide guidance and additional leverage during negotiations. By taking these steps, individuals can secure more manageable repayment terms that promote personal stability and pave the way toward financial recovery.

In conclusion, effectively managing and reducing personal debt is critical not only for individual financial health but also for broader economic stability. The strategies discussed highlight the importance of proactive debt management, emphasizing that taking control of one’s finances can mitigate the adverse effects of high debt levels on economic growth. By negotiating with creditors for better repayment terms and seeking support from credit counseling services, individuals can carve a path toward financial recovery and sustainability.

Moreover, understanding the complexities of debt, including its role in investment and the implications of student loan burdens, is essential for informed financial planning. Similarly, acknowledging the impact of corporate debt on stock performance and the government’s management of national debt can provide valuable insights into the interconnectedness of personal and macroeconomic finance. Ultimately, while debt can serve as a tool for growth, it must be approached with caution and strategic planning to harness its rewards without falling prey to its risks. By adopting these practices, individuals can work towards a more secure financial future, contributing positively to the economy as a whole.