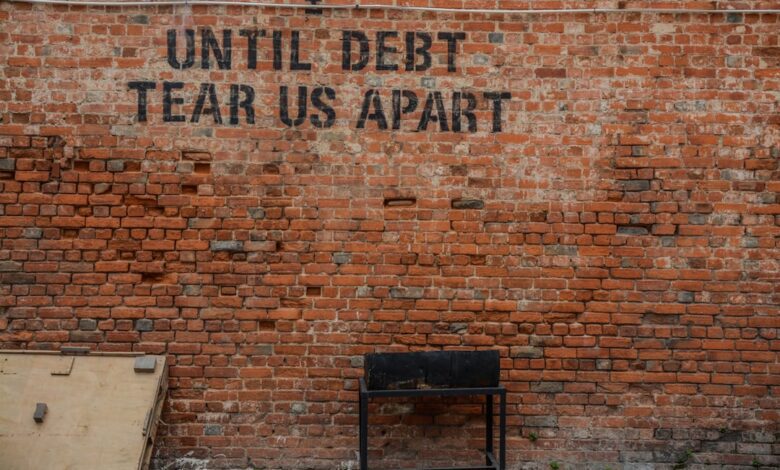

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing debt has become a critical skill for individuals and governments alike. High levels of personal and corporate debt not only affect individual financial stability but also have far-reaching implications for economic growth and market performance. This article delves into a comprehensive exploration of strategies for managing and reducing personal debt, highlighting effective techniques that empower individuals to regain control over their finances. We will examine the broader economic implications of high debt levels, the dynamics of negotiating with creditors, and the role of credit counseling in debt management. Furthermore, we will discuss the intricate balance between leveraging debt for investment purposes and the associated risks, as well as the profound impact of student loan debt on financial planning for young adults. Additionally, we will analyze how corporate debt influences stock performance and the strategies governments employ to manage national debt, shedding light on its economic consequences. Join us as we navigate these interconnected topics to equip you with the knowledge and tools necessary for informed financial decisions in an increasingly debt-driven world.

- 1. **Navigating Personal Debt: Strategies for Effective Management and Reduction**

- 2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

1. **Navigating Personal Debt: Strategies for Effective Management and Reduction**

Managing and reducing personal debt is crucial for maintaining financial stability and achieving long-term financial goals. Here are several effective strategies to navigate personal debt:

1. **Create a Comprehensive Budget**: Start by tracking all income and expenses to gain a clear picture of your financial situation. A well-structured budget helps identify areas where spending can be reduced, enabling more funds to be allocated towards debt repayment.

2. **Prioritize Debts**: Use methods such as the debt snowball or debt avalanche techniques. The debt snowball method involves paying off smaller debts first to build momentum, while the debt avalanche focuses on paying off debts with the highest interest rates first, reducing overall costs in the long run.

3. **Negotiate with Creditors**: Reach out to creditors to discuss your situation. Many are willing to negotiate repayment terms, such as lower interest rates or extended payment plans. Being proactive can lead to more manageable repayment options.

4. **Consider Consolidation**: Debt consolidation combines multiple debts into a single loan, often with a lower interest rate. This can simplify payments and reduce the total interest paid over time, making it easier to manage monthly obligations.

5. **Increase Income**: Explore opportunities to increase income, whether through a part-time job, freelance work, or selling unused items. Additional income can provide extra funds for debt repayment and help accelerate the process.

6. **Utilize Credit Counseling Services**: Professional credit counseling can provide personalized advice and resources for managing debt. Counselors can help create a tailored debt management plan and negotiate with creditors on your behalf.

7. **Stay Committed and Monitor Progress**: Regularly review your financial situation and celebrate milestones along the way. Staying committed to a debt reduction plan requires discipline, but tracking progress can provide motivation and reinforce positive habits.

By implementing these strategies, individuals can take control of their personal debt, paving the way for a healthier financial future.

Managing and reducing personal debt is a critical concern for many individuals and families, as high debt levels can lead to significant financial stress and hinder long-term economic stability. One effective strategy for managing personal debt is creating a comprehensive budget that tracks income and expenses. This allows individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, prioritizing high-interest debts can help reduce the overall cost of borrowing.

Negotiating with creditors is another powerful tool for managing debt. Individuals can approach their creditors to discuss their financial situation and request better repayment terms, such as lower interest rates or extended payment plans. This dialogue can lead to more manageable monthly payments and less financial strain. Credit counseling services also play a vital role in debt management by offering professional advice and support. These counselors can help individuals develop a personalized plan to tackle their debts and may negotiate on their behalf with creditors.

While leveraging debt to invest can potentially yield significant rewards, it also carries inherent risks. Investors must carefully consider their ability to repay the borrowed funds, as market fluctuations can affect the returns on their investments. This is especially pertinent for student loan debt, which can impact financial planning for years. Graduates often face challenges in balancing loan repayments with other financial goals, such as saving for retirement or purchasing a home.

On a broader scale, corporate debt can influence stock performance. Companies with high levels of debt may face increased scrutiny from investors, particularly during economic downturns. High corporate debt can lead to volatility in stock prices, affecting shareholder value and overall market stability.

Finally, governments manage national debt through fiscal policies and economic strategies that aim to balance growth with financial responsibility. The implications of national debt on the economy can be profound, influencing interest rates, inflation, and public spending. A well-managed national debt can support economic growth, while excessive debt levels may lead to economic challenges and reduced investor confidence.

2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

High levels of personal and corporate debt can significantly hinder economic growth, creating a ripple effect that impacts various sectors of the economy. When individuals and businesses are burdened by excessive debt, their ability to spend and invest diminishes. Consumers with high debt levels often prioritize debt repayment over discretionary spending, leading to reduced demand for goods and services. This decline in consumer spending can result in lower sales for businesses, which may subsequently cut back on production, lay off employees, or delay investments in growth initiatives.

Moreover, corporations facing substantial debt may struggle to finance new projects or expand operations due to the need to service existing obligations. This reluctance to invest stifles innovation and job creation, further contributing to economic stagnation. In addition, high levels of corporate debt can lead to increased volatility in the financial markets, as investors become wary of companies that may be unable to meet their repayment commitments. This uncertainty can create a cautious investment climate, deterring capital inflow and hindering overall economic growth.

On a broader scale, when a significant portion of the population is dealing with high debt levels, it can lead to increased financial strain on social services and public resources. Governments may find themselves needing to allocate more funds to address the consequences of financial distress among their citizens, such as increased demand for social safety nets. This shift in focus can divert resources away from productive investments in infrastructure, education, and other areas critical for long-term economic growth.

In summary, high debt levels not only affect individual financial health but can also create systemic challenges that stifle economic growth. Addressing these issues through effective debt management strategies and fostering an environment conducive to investment and consumer confidence is essential for revitalizing economic activity and ensuring sustainable growth.

In conclusion, effectively managing and reducing personal debt is not only crucial for individual financial health but also has far-reaching implications for broader economic stability. By implementing strategic approaches to debt repayment, negotiating favorable terms with creditors, and seeking guidance through credit counseling, individuals can regain control over their finances while contributing to a more robust economy.

Understanding the intricate relationship between high debt levels and economic growth is essential, as excessive borrowing can hinder progress and innovation. Additionally, the risks and rewards of leveraging debt for investment must be carefully weighed, particularly in the context of student loans, which significantly shape financial planning for many young adults.

On a larger scale, corporate and governmental debt management plays a pivotal role in shaping market dynamics and stock performance. As we navigate these complex financial landscapes, it becomes clear that informed decision-making and proactive debt management are vital not only for personal success but also for fostering a healthy economy. By prioritizing financial literacy and responsible borrowing, we can collectively work toward a more sustainable financial future.