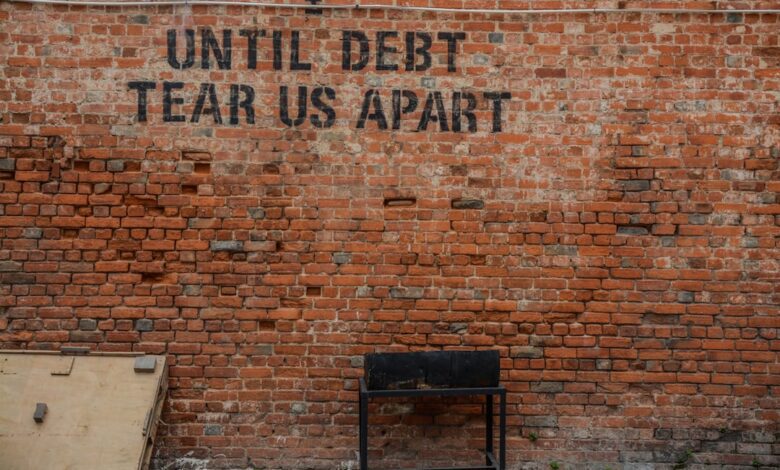

Debt Dynamics: Strategies for Personal Management and Economic Implications

In today's complex financial landscape, managing personal debt has become a crucial skill for individuals striving for economic stability and prosperity. As debt levels continue to rise, not only do they pose significant challenges for personal financial health, but they also exert a broader impact on economic growth and stability. This article delves into effective strategies for reducing personal debt, highlighting the importance of credit counseling, the nuances of negotiating with creditors, and the delicate balance between leveraging debt for investment and managing its risks. Additionally, we will explore how student loan debt shapes financial planning and the implications of corporate debt on stock performance. Finally, we will examine how governments navigate national debt and its effects on the economy. By understanding these interconnected issues, readers will be better equipped to take control of their financial futures while recognizing the far-reaching consequences of debt in both personal and national contexts.

- 1. **Effective Debt Management: Strategies for Personal Financial Health**

- 2. **The Economic Ripple Effect: How High Debt Levels Affect Growth**

- 3. **Navigating Negotiations: Engaging Creditors for Favorable Terms**

1. **Effective Debt Management: Strategies for Personal Financial Health**

Effective debt management is crucial for maintaining personal financial health and achieving long-term financial goals. One of the primary strategies for managing personal debt is creating a comprehensive budget. By tracking income and expenses, individuals can identify areas where they can cut back, allowing them to allocate more funds toward debt repayment.

Another important strategy is the snowball method, where individuals focus on paying off the smallest debts first. This approach can provide quick wins and boost motivation, as seeing debts eliminated can encourage continued progress. Alternatively, the avalanche method targets debts with the highest interest rates first, minimizing the overall interest paid over time.

Consolidating debts can also be an effective strategy. This involves combining multiple debts into a single loan, ideally with a lower interest rate. This not only simplifies payments but can also reduce monthly obligations. However, it is essential to avoid accumulating new debt during this process.

Creating an emergency fund is another key strategy. By setting aside savings for unexpected expenses, individuals can prevent additional debt from accruing during financial emergencies.

Lastly, seeking professional assistance through credit counseling can provide valuable guidance. Credit counselors can help develop a tailored repayment plan, negotiate with creditors, and provide education on financial management skills.

By implementing these strategies, individuals can take proactive steps toward reducing their debt, improving their financial stability, and enhancing their overall economic well-being.

2. **The Economic Ripple Effect: How High Debt Levels Affect Growth**

High levels of personal and corporate debt can significantly hinder economic growth, creating a ripple effect that impacts various facets of the economy. When individuals and businesses are burdened with excessive debt, their financial flexibility diminishes. Consumers facing high debt are often forced to allocate a larger portion of their income toward debt repayment, leaving less available for discretionary spending. This reduction in consumer spending can lead to decreased demand for goods and services, which in turn affects businesses' revenues and growth prospects.

For corporations, high debt levels can limit investment in innovation and expansion. Companies may prioritize servicing their debt over investing in new projects or technologies, stifling productivity improvements and long-term growth potential. Furthermore, if a significant number of companies are highly leveraged, it can lead to broader economic instability. During periods of economic downturn, over-leveraged firms are more likely to default, leading to job losses and a further decrease in consumer confidence and spending.

On a macroeconomic level, high debt levels can also strain financial systems. In an environment where many borrowers are unable to meet their obligations, banks and financial institutions may face increased default rates. This situation can lead to tighter credit conditions, making it more difficult for consumers and businesses to secure loans, thus exacerbating the economic slowdown.

Moreover, high levels of national debt can impact economic growth at the governmental level. When a government allocates a significant portion of its budget to servicing debt, less funding is available for essential services and infrastructure investments that stimulate economic activity. Consequently, the interplay between high debt levels and economic growth forms a complex web, where the effects can be felt at both individual and systemic levels, ultimately influencing the overall health of the economy.

3. **Navigating Negotiations: Engaging Creditors for Favorable Terms**

Navigating negotiations with creditors can be a crucial step in managing personal debt effectively. Engaging creditors for more favorable repayment terms requires preparation, transparency, and effective communication.

First, it's essential to assess your financial situation thoroughly. Before reaching out to creditors, gather all relevant information, including your income, expenses, and outstanding debts. This will help you present a clear picture of your financial circumstances, allowing creditors to understand your position better.

When contacting creditors, be honest about your difficulties. Many creditors are willing to work with borrowers who demonstrate a genuine effort to resolve their debts. Clearly articulate your request, whether it’s for a lower interest rate, extended payment terms, or a temporary forbearance. Providing a valid reason for your request, such as unexpected medical expenses or job loss, can enhance your credibility.

Timing is also an important factor in negotiations. Initiating discussions early, before falling behind on payments, can lead to more favorable outcomes. Creditors often prefer proactive communication, as it indicates a willingness to fulfill obligations rather than a defaulted account.

Additionally, consider proposing a realistic repayment plan that aligns with your financial capabilities. Offering to pay a specific amount each month, even if it’s lower than your current payment, can demonstrate your commitment to repaying the debt and may prompt creditors to agree to revised terms.

Finally, be prepared for potential pushback. Some creditors may not be willing to negotiate, while others might offer terms that are less favorable than you hoped. If negotiations prove challenging, seeking assistance from a credit counseling service can provide additional strategies and support.

By approaching the negotiation process with a clear plan, open communication, and realistic expectations, individuals can often secure more manageable repayment terms, ultimately easing their financial burden.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for the broader economy. As we have explored, high levels of personal debt can stifle economic growth, creating a ripple effect that impacts businesses and communities alike. By employing strategies such as negotiating with creditors, utilizing credit counseling services, and understanding the implications of student loans, individuals can take proactive steps towards financial stability. Moreover, while the use of debt for investment carries inherent risks, it can also yield rewards if approached with caution.

Understanding the complex relationship between corporate debt and stock performance further underscores the importance of prudent financial decision-making. Finally, the way governments manage national debt has significant economic implications that can influence everything from interest rates to public spending. By adopting sound debt management practices and being informed about the financial landscape, individuals can not only improve their personal circumstances but also contribute to a healthier economy overall. Taking control of personal debt is not just a personal endeavor; it is a step towards fostering a more resilient economic future.