Mastering Debt: Strategies for Personal Management and Economic Insight

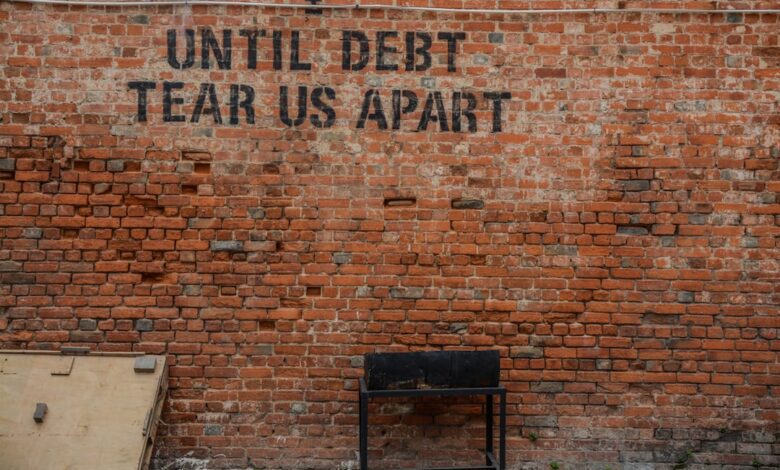

In today's fast-paced financial landscape, personal debt has become an increasingly common challenge for individuals and families alike. As living costs rise and economic uncertainties persist, the burden of debt can weigh heavily on personal finances, affecting not only individual well-being but also broader economic growth. This article delves into effective strategies for managing and reducing personal debt, exploring the critical interplay between high debt levels and overall economic health. We will also discuss the importance of negotiating with creditors to secure better repayment terms and the role of credit counseling in navigating financial difficulties. Additionally, we will examine the complexities of using debt as an investment tool, the implications of student loan debt on financial planning, and the impact of corporate debt on stock performance. Finally, we will look at how governments manage national debt and the economic implications of their strategies. By understanding these interconnected aspects, readers can better navigate their financial journeys and make informed decisions about debt management.

- 1. "Navigating Personal Debt: Effective Strategies for Management and Reduction"

- 2. "The Economic Ripple Effect: How High Debt Levels Influence Growth"

- 3. "Negotiating with Creditors: Securing Better Terms for Financial Relief"

1. "Navigating Personal Debt: Effective Strategies for Management and Reduction"

Managing and reducing personal debt is crucial for achieving financial stability and improving overall well-being. One effective strategy is to create a comprehensive budget that tracks income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Prioritizing high-interest debt, such as credit card balances, is also essential; focusing on these debts first can save money on interest payments over time.

Another helpful approach is the snowball method, which involves paying off the smallest debts first. This can provide a psychological boost as individuals experience quick wins, motivating them to tackle larger debts. Conversely, the avalanche method targets debts with the highest interest rates first, potentially resulting in lower overall interest payments.

Establishing an emergency fund is vital, as it reduces the likelihood of incurring new debt in case of unforeseen expenses. Additionally, individuals should consider consolidating debts through personal loans or balance transfer credit cards, which can simplify payments and lower interest rates.

Regularly reviewing credit reports can help individuals identify errors and understand their credit standing, allowing them to make informed decisions about debt management. Seeking professional assistance from credit counseling services can also provide valuable guidance and resources tailored to individual financial situations. By implementing these strategies, individuals can navigate personal debt more effectively and work towards achieving long-term financial health.

2. "The Economic Ripple Effect: How High Debt Levels Influence Growth"

High levels of personal and corporate debt can create significant ripple effects throughout the economy, influencing growth in various ways. When individuals are burdened by debt, their ability to spend is often curtailed, leading to decreased consumer demand. This reduction in spending can slow down economic growth, as businesses face lower sales and may respond by reducing production, cutting jobs, or delaying investments. Consequently, this can lead to a cycle of declining economic activity, where lower demand results in further job losses and reduced income for households.

Moreover, high debt levels can impair financial stability. When consumers and businesses allocate a substantial portion of their income to servicing debt, they have less available for savings and investment. This lack of investment can stifle innovation and productivity growth, which are crucial for long-term economic expansion. Additionally, if many borrowers default on their loans, banks and financial institutions can face significant losses. This can lead to tighter lending standards, making it more challenging for both individuals and businesses to obtain credit, further constraining economic growth.

On a broader scale, when government debt levels rise significantly, it can lead to increased taxes or reduced public spending in the future, affecting overall economic activity. If investors perceive high levels of national debt as a risk, it can also lead to higher interest rates, which can dampen borrowing and investment across the economy.

Thus, managing debt levels—both personal and corporate—is essential not only for individual financial health but also for fostering a stable and growing economy. Effective strategies for debt management can help mitigate these negative impacts, allowing for a more resilient economic environment that encourages growth and stability.

3. "Negotiating with Creditors: Securing Better Terms for Financial Relief"

Negotiating with creditors can be a vital step toward achieving financial relief and managing personal debt more effectively. It involves communicating directly with lenders to explore options that can alleviate the burden of debt, such as lower interest rates, extended repayment periods, or even settling for a lesser amount than originally owed.

The first step in this negotiation process is to assess one’s financial situation thoroughly. This includes understanding the total amount owed, the interest rates on different debts, and the monthly payment obligations. Having this information readily available will allow individuals to present a clear picture of their financial standing to creditors.

When approaching creditors, it's essential to be honest and transparent about one’s circumstances. This may involve discussing job loss, medical expenses, or other financial hardships that have made repayment challenging. Creditors are often more willing to work with individuals who demonstrate genuine efforts to resolve their debts, especially if they can see that the borrower is committed to finding a solution.

Timing can also play a crucial role in negotiations. Contacting creditors at the right time, such as during a promotional period for debt relief or after demonstrating consistent payment history, can strengthen one’s position. Additionally, being proactive and reaching out before falling behind on payments can often prevent further complications.

During the negotiation, individuals should be prepared to propose specific terms that would make the debt more manageable. This could include requesting a temporary reduction in payments, asking for a lower interest rate, or inquiring about hardship programs that may be available. It’s important to remain flexible and open to alternative solutions that creditors may offer.

Finally, documenting all agreements reached during negotiations is critical. Written confirmation of new terms helps ensure that both parties are clear about the modified repayment plan and provides a reference in case of future disputes. By taking these steps, individuals can gain better control over their financial situation and work towards reducing their overall debt burden.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that requires strategic planning and informed decision-making. Individuals can benefit greatly from understanding the broader economic implications of high debt levels, as these can hinder not only personal financial growth but also overall economic stability. By employing negotiation tactics with creditors and considering the support of credit counseling services, borrowers can secure more favorable repayment terms and regain control over their finances.

Furthermore, while leveraging debt for investment can present opportunities for growth, it also carries inherent risks that must be carefully weighed. Student loan debt, in particular, plays a significant role in shaping financial planning for young adults, highlighting the need for proactive measures to manage this burden. On a larger scale, corporate and national debt levels have profound effects on stock performance and economic health, emphasizing the interconnectedness of debt management across all sectors.

Ultimately, by adopting a comprehensive approach that encompasses personal financial strategies, negotiation skills, and an awareness of the broader economic landscape, individuals can navigate the complexities of debt and work towards a more secure financial future.