Navigating Debt: Strategies for Personal Management and Economic Impact

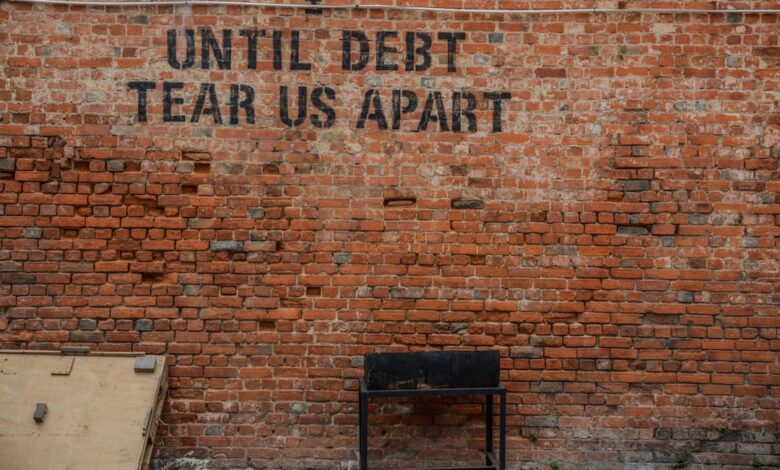

In today's fast-paced financial landscape, managing personal debt has become an increasingly critical concern for individuals and families alike. With rising living costs and economic uncertainties, many find themselves grappling with high debt levels that not only strain personal finances but also have broader implications for economic growth. This article delves into effective strategies for reducing personal debt, exploring practical tools and techniques that empower individuals to regain control over their financial health. Additionally, we will examine the interconnectedness of personal and corporate debt, discussing how excessive borrowing can ripple through the economy, affecting everything from stock performance to national fiscal policies. Readers will also learn how to negotiate with creditors for better repayment terms and the vital role of credit counseling in navigating these challenges. By understanding the risks and rewards of leveraging debt, especially in the context of student loans, we aim to provide a comprehensive overview of debt management that can inform smarter financial planning. Join us as we uncover the complexities of debt and offer actionable insights to help you achieve financial stability.

- Here are three possible section headlines for your article on managing and reducing personal debt:

- 1. **Effective Strategies for Personal Debt Reduction: Tools and Techniques**

- 2. **Understanding the Economic Ripple Effect of High Debt Levels**

Here are three possible section headlines for your article on managing and reducing personal debt:

Managing and reducing personal debt is a crucial aspect of achieving financial stability and fostering economic growth. Individuals often face various types of debt, including credit card balances, personal loans, and student loans, which can accumulate and lead to overwhelming financial stress. To effectively manage and reduce personal debt, it's essential to adopt a multi-faceted approach.

First, creating a budget is a foundational step. By tracking income and expenses, individuals can identify areas where they can cut back and allocate more funds toward debt repayment. Prioritizing high-interest debts can also yield significant savings over time. Strategies such as the snowball method, which focuses on paying off the smallest debts first to build momentum, or the avalanche method, which targets the highest interest debts, can further enhance repayment efforts.

Second, negotiating with creditors can lead to better repayment terms. Many creditors are willing to work with borrowers who are proactive about their financial situations. This may involve requesting lower interest rates, extending repayment periods, or setting up manageable payment plans. Open communication and demonstrating a commitment to repay can often result in favorable adjustments.

Finally, seeking assistance from credit counseling services can provide valuable guidance. Credit counselors can help individuals develop personalized debt management plans, provide budgeting resources, and facilitate negotiations with creditors. These services not only offer support but also empower individuals with knowledge and tools to make informed financial decisions, ultimately fostering a path toward debt reduction and improved financial health.

1. **Effective Strategies for Personal Debt Reduction: Tools and Techniques**

Managing and reducing personal debt requires a strategic approach that combines practical tools and effective techniques. One of the most widely recommended strategies is creating a comprehensive budget. This involves tracking income and expenses to identify areas where spending can be reduced, allowing individuals to allocate more funds toward debt repayment.

Another effective tool is the debt snowball method, where individuals focus on paying off their smallest debts first while making minimum payments on larger debts. This approach can provide psychological motivation as small victories build momentum. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, potentially saving more money in interest payments over time.

Consolidating debts can also be beneficial. This may involve taking out a personal loan to pay off multiple debts, resulting in a single monthly payment with potentially lower interest rates. Balance transfer credit cards offer another option, allowing individuals to transfer high-interest debt to a card with a lower rate, often for an introductory period.

Establishing an emergency fund is crucial to prevent further debt accumulation due to unexpected expenses. Even a small fund can provide a financial buffer, allowing individuals to manage minor emergencies without resorting to credit.

In addition to these strategies, seeking professional assistance through credit counseling can provide tailored advice and support. Counselors can help develop a repayment plan and negotiate with creditors on behalf of the individual, potentially leading to lower interest rates or modified payment terms.

Ultimately, reducing personal debt requires discipline, commitment, and the right combination of tools and techniques tailored to individual circumstances. By employing these strategies, individuals can take significant steps toward regaining financial stability and reducing the burden of debt.

2. **Understanding the Economic Ripple Effect of High Debt Levels**

High debt levels can create significant ripple effects throughout the economy, influencing both individual financial stability and broader economic growth. When individuals and households carry substantial debt, their disposable income is often constrained by monthly repayments, leading to reduced consumer spending. This decline in consumption can slow down economic activity, as businesses face lower demand for goods and services.

Moreover, high levels of personal debt can increase the risk of default, which can strain financial institutions. When borrowers fail to meet their obligations, lenders may tighten their credit standards, making it more difficult for others to obtain loans. This credit contraction can further limit spending and investment, creating a cycle that stifles economic growth.

On a macroeconomic level, excessive personal debt can lead to increased volatility in financial markets. Investors may become wary of the overall financial health of consumers, leading to fluctuations in stock prices and reduced confidence in economic stability. As households prioritize debt repayment over savings or investment, the overall capital available for business expansion diminishes, potentially hindering innovation and job creation.

Additionally, high debt levels can contribute to economic inequality. Individuals burdened by debt may struggle to accumulate wealth, while those with fewer financial obligations can take advantage of investment opportunities. This disparity can exacerbate social tensions and lead to calls for policy interventions aimed at addressing the underlying issues of debt and inequality.

In summary, understanding the economic ripple effect of high debt levels is crucial for policymakers, businesses, and individuals alike. Addressing personal debt not only supports individual financial health but can also foster a more stable and resilient economy.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. By employing strategies such as budgeting, prioritizing high-interest debts, and exploring credit counseling services, individuals can take proactive steps to regain control over their finances. Understanding the broader economic implications of high debt levels—both personal and corporate—highlights the interconnectedness of individual actions and national economic health. Negotiating with creditors can lead to more favorable repayment terms, providing relief for those struggling to meet their obligations. While leveraging debt for investment offers potential rewards, it also carries risks that must be carefully considered, particularly in the context of long-term financial planning, especially for students facing significant loan burdens. Ultimately, a balanced approach to debt management not only fosters personal financial resilience but also contributes to a more robust economy, as sustainable debt practices can lead to increased consumer confidence and growth. By prioritizing responsible debt management, individuals can pave the way for a more secure financial future, benefiting themselves and the economy as a whole.