Transforming Tomorrow: The Intersection of AI, Blockchain, Quantum Computing, and Sustainability in Financial Services and Beyond

In an era marked by rapid technological advancement, the financial services sector stands at the forefront of a transformative shift that promises to redefine how we manage, invest, and interact with our money. Artificial intelligence is leading the charge, revolutionizing processes and enhancing decision-making capabilities. Meanwhile, blockchain technology is expanding its reach beyond finance, influencing various industries and creating new paradigms for trust and transparency. As quantum computing emerges on the horizon, its potential implications for cybersecurity raise both excitement and concern.

In this article, we will delve into the innovations shaping fintech, from digital wallets to robo-advisors, and explore how big data is reshaping decision-making in finance and business. We will also confront the ethical challenges posed by these emerging technologies, and examine the role of technological advancements in driving sustainability and fostering green energy solutions. Join us as we navigate this complex landscape, highlighting the intersection of innovation, ethics, and the future of global connectivity in an increasingly digital world.

- Here are three possible headlines for sections of your article covering the specified topics:

- 1. "Harnessing Innovation: How AI, Blockchain, and Quantum Computing are Reshaping Financial Services"

Here are three possible headlines for sections of your article covering the specified topics:

Artificial intelligence (AI) is significantly transforming financial services by enhancing efficiency, personalization, and decision-making processes. AI algorithms analyze vast amounts of data to detect patterns, enabling institutions to assess risks more accurately and tailor financial products to individual customer needs. Chatbots and virtual assistants powered by AI are improving customer service by providing instant support and guidance, allowing human agents to focus on more complex issues. Furthermore, AI-driven analytics are helping financial firms optimize trading strategies and investment decisions, ultimately leading to more informed and strategic approaches to managing assets.

In a parallel development, blockchain technology is making waves beyond the financial sector, impacting industries such as supply chain management, healthcare, and entertainment. By providing a secure, decentralized ledger, blockchain enhances transparency and traceability in transactions, reducing fraud and improving accountability. In supply chains, for instance, blockchain enables real-time tracking of goods, ensuring authenticity and compliance. In healthcare, it can safeguard patient data while allowing secure sharing among providers. This transformative potential is prompting various sectors to explore blockchain solutions, seeking to harness its capabilities for improved operational efficiency and trust.

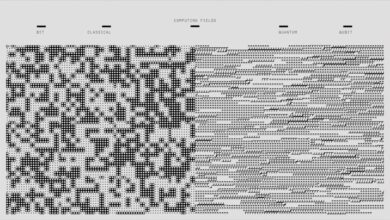

As technology continues to evolve, quantum computing emerges as a game-changer, particularly in the realm of cybersecurity. With its ability to process information at unprecedented speeds, quantum computing poses both risks and rewards. While it has the potential to crack traditional encryption methods, leading to vulnerabilities in data security, it also offers the promise of developing new, more robust encryption techniques that could safeguard sensitive information. Organizations must prepare for a future where quantum threats are a reality, prompting a re-evaluation of current cybersecurity practices and the development of quantum-resistant solutions to protect against potential breaches.

1. "Harnessing Innovation: How AI, Blockchain, and Quantum Computing are Reshaping Financial Services"

The convergence of artificial intelligence (AI), blockchain, and quantum computing is fundamentally reshaping financial services, paving the way for unprecedented innovation and efficiency. AI technologies are being harnessed to analyze vast amounts of financial data, enabling institutions to enhance decision-making processes, reduce risks, and personalize customer experiences. Machine learning algorithms can identify patterns in spending behavior, detect fraudulent transactions, and optimize investment strategies, thereby improving overall service delivery.

Blockchain technology is revolutionizing the way financial transactions are conducted by providing a decentralized and transparent ledger system. This innovation enhances security and trust, reducing the need for intermediaries while streamlining processes such as cross-border payments, trade settlements, and identity verification. As blockchain continues to mature, its potential to create smart contracts and automate compliance processes could further transform the operational landscape of financial services, driving down costs and increasing transaction speeds.

Meanwhile, the rise of quantum computing introduces a new paradigm in processing power that could significantly impact cybersecurity within the financial sector. Quantum computers possess the ability to solve complex problems at speeds unattainable by classical computers, which raises both opportunities and challenges. While they can enhance encryption methods, making data more secure, they also pose a threat to existing security protocols, necessitating the development of quantum-resistant encryption techniques.

Together, these technologies are not only improving operational efficiencies and customer experiences but also prompting regulatory discussions and ethical considerations. As financial institutions embrace these innovations, the need for a balanced approach that addresses security, privacy, and ethical implications becomes paramount. The ongoing integration of AI, blockchain, and quantum computing will likely define the future of financial services, setting the stage for a more secure, efficient, and user-centric industry.

Artificial intelligence (AI) is profoundly transforming the landscape of financial services by enhancing efficiency, improving customer experiences, and enabling more accurate decision-making. AI algorithms analyze vast datasets to identify patterns and trends, allowing financial institutions to make informed predictions about market movements and customer behavior. This capability is crucial for risk assessment, fraud detection, and personalized financial advice. For instance, machine learning models can detect unusual transaction patterns in real time, significantly reducing the potential for financial fraud.

Moreover, AI-driven chatbots and virtual assistants are redefining customer service in the financial sector. These tools provide instant responses to customer inquiries, streamline account management, and offer tailored product recommendations, which enhance user engagement and satisfaction. As AI technology continues to evolve, its applications in algorithmic trading and portfolio management will likely expand, providing investors with sophisticated tools to optimize their strategies.

In parallel, blockchain technology is making waves beyond finance by introducing transparency and security across various industries. In supply chain management, for example, blockchain enables real-time tracking of goods, ensuring authenticity and reducing fraud. This technology is also being adopted in healthcare for secure patient data sharing, and in real estate for streamlined property transactions, showcasing its versatility and potential to enhance operational efficiency.

Meanwhile, the rise of quantum computing presents both opportunities and challenges for cybersecurity. Quantum computers possess the capability to process complex calculations at unprecedented speeds, which could revolutionize data encryption methods. However, this same power poses a risk to current encryption protocols, necessitating the development of quantum-resistant security measures to safeguard sensitive information.

In the fintech arena, innovations such as digital wallets and robo-advisors are reshaping how consumers and businesses interact with financial services. Digital wallets facilitate seamless transactions and enhance user convenience, while robo-advisors democratize access to investment management by providing low-cost, algorithm-driven advice tailored to individual financial goals.

The advent of 5G technology is poised to further enhance global connectivity, enabling faster data transmission and the proliferation of IoT devices. This increased connectivity will support innovations in various domains, including smart cities and autonomous vehicles, while also amplifying the capabilities of AI and big data analytics.

As organizations leverage big data to inform decision-making, the ethical challenges surrounding emerging technologies become increasingly prominent. Issues such as data privacy, algorithmic bias, and the impact of automation on employment require careful consideration and proactive governance to ensure that technological advancements contribute positively to society.

Lastly, the role of technology in driving sustainability and green energy solutions cannot be overstated. Innovations in renewable energy technologies, coupled with smart grid systems and energy management software, are paving the way for more efficient energy consumption and reduced carbon footprints. As these technologies evolve, they will be integral to addressing the pressing challenges of climate change and fostering a sustainable future.

In conclusion, the intersection of emerging technologies such as artificial intelligence, blockchain, quantum computing, and 5G is not only revolutionizing financial services but also reshaping various industries worldwide. These innovations are enhancing efficiency, improving decision-making, and providing unprecedented opportunities for growth. As digital wallets and robo-advisors gain traction within the fintech landscape, the implications for global connectivity and data-driven strategies become increasingly significant. However, along with these advancements come ethical challenges that necessitate careful consideration, particularly in the realms of AI and automation.

Furthermore, the commitment to sustainability and green energy solutions reflects a broader trend where technology is leveraged to address pressing global issues. As we move forward, the collaboration between technology and finance will be crucial in creating a more inclusive, efficient, and responsible ecosystem. By embracing these changes while remaining vigilant about the ethical implications, we can harness the full potential of these technologies to foster innovation and drive positive societal impact.