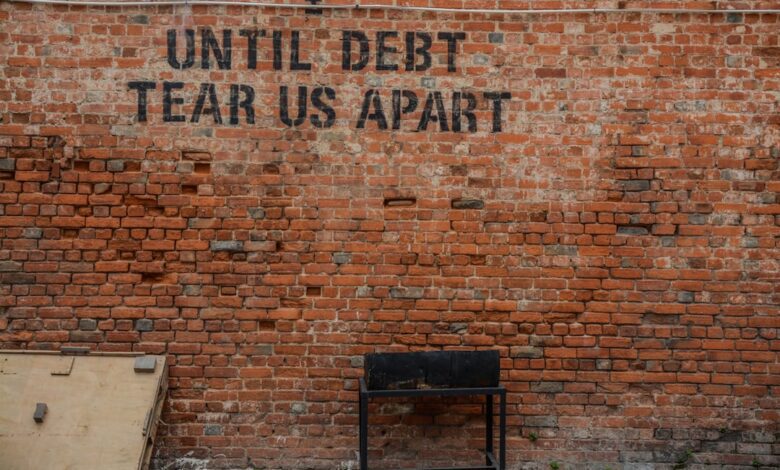

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing and reducing personal debt has become a critical concern for individuals and families alike. As debt levels soar, the implications extend beyond personal finances, influencing broader economic growth and stability. This article delves into effective strategies for individuals to regain control over their financial futures, while also exploring the interconnectedness of personal and corporate debt within the economy. From negotiating favorable repayment terms with creditors to understanding the role of credit counseling, we will provide insights that empower readers to take actionable steps towards financial freedom. Additionally, we will examine how high debt levels impact student loan planning, corporate stock performance, and even national economic policies. Join us as we navigate the complexities of debt management, uncovering both the risks and rewards that come with leveraging debt as a tool for investment and growth.

- Here are three possible section headlines for your article on managing and reducing personal debt:

- 1. **Navigating Personal Debt: Strategies for Financial Freedom**

- 2. **The Economic Ripple Effect: High Debt Levels and Their Impact on Growth**

Here are three possible section headlines for your article on managing and reducing personal debt:

When it comes to managing and reducing personal debt, several effective strategies can help individuals regain control of their financial situation. One of the most critical steps is creating a detailed budget that outlines all sources of income and expenses. By tracking spending habits, individuals can identify areas where they can cut back and allocate more funds toward debt repayment.

Another vital approach is prioritizing debt payments using methods such as the snowball or avalanche techniques. The snowball method involves paying off the smallest debts first to build momentum, while the avalanche method focuses on paying off debts with the highest interest rates first to save on overall interest costs. Both strategies can provide a sense of accomplishment and motivate individuals to stay committed to their repayment plans.

Additionally, exploring options for consolidating debt can be beneficial. This may involve taking out a personal loan to pay off multiple debts or using a balance transfer credit card with a lower interest rate. Consolidation can simplify payments and potentially reduce the total interest paid over time.

Lastly, seeking assistance from credit counseling services can provide valuable guidance. These organizations can help individuals create a customized debt management plan, offering support and negotiation with creditors to achieve better repayment terms. By employing these strategies, individuals can effectively manage and reduce their personal debt, paving the way for a healthier financial future.

1. **Navigating Personal Debt: Strategies for Financial Freedom**

Managing personal debt effectively is crucial for achieving financial freedom and stability. Here are several strategies individuals can employ to navigate their debt and regain control over their finances.

First, it is essential to create a comprehensive budget that outlines income, expenses, and debt obligations. This will help identify areas where spending can be reduced and allocate more funds toward debt repayment. Prioritizing debts by interest rates can also be beneficial; focusing on high-interest debts first—often referred to as the avalanche method—can save money on interest in the long run.

Another effective strategy is to consider debt consolidation. By consolidating multiple debts into a single loan with a lower interest rate, individuals can simplify their payments and potentially reduce their overall debt burden. This can be done through personal loans, balance transfer credit cards, or home equity loans, depending on one’s financial situation.

Additionally, negotiating with creditors can lead to better repayment terms. Many creditors are willing to work with borrowers facing financial difficulties, offering options such as lower interest rates, extended payment plans, or even debt settlement agreements. Open communication with creditors can often lead to more manageable repayment options.

Seeking the assistance of a credit counseling service can also be beneficial. These organizations provide valuable resources, including personalized financial advice, budgeting assistance, and debt management plans that can help individuals create a structured approach to paying off their debts.

Lastly, maintaining a healthy credit score is vital while managing debt. Consistently making on-time payments, keeping credit utilization low, and avoiding taking on new debts can help improve creditworthiness, ultimately leading to better loan terms and financial opportunities in the future.

By implementing these strategies, individuals can work toward reducing their debt burdens, achieving financial stability, and ultimately reaching a state of financial freedom.

2. **The Economic Ripple Effect: High Debt Levels and Their Impact on Growth**

High levels of personal and corporate debt can create significant challenges for economic growth, often leading to a ripple effect throughout the economy. When individuals and businesses are burdened by excessive debt, their capacity to spend, invest, and contribute to economic activity diminishes. This reduced spending can lower demand for goods and services, ultimately leading to slower economic growth or even recession.

On a personal level, individuals with high debt levels may prioritize debt repayment over discretionary spending, which directly impacts businesses that rely on consumer spending for revenue. This shift can result in reduced profits, layoffs, and further economic contraction. Additionally, high personal debt often leads to increased stress and mental health issues, which can reduce productivity and workforce participation.

For corporations, high levels of debt can hinder investment in growth opportunities, such as new projects or research and development. Companies may become more risk-averse, focusing instead on managing existing debt rather than pursuing expansion. This cautious approach can stifle innovation and job creation, further affecting overall economic vitality.

Moreover, the interconnected nature of the economy means that high debt levels in one sector can affect others. For instance, if consumers are unable to manage their debt effectively, they may default on loans, leading to increased losses for financial institutions. This can result in tighter credit conditions, making it more difficult for others to borrow and invest, thereby amplifying the slowdown in economic activity.

In summary, high debt levels can create a cycle of reduced spending, investment stagnation, and economic growth challenges. Addressing personal and corporate debt effectively is crucial for fostering a healthier economic environment that supports long-term growth and stability.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. By employing strategies such as budgeting, prioritizing repayment, and negotiating with creditors, individuals can take significant steps toward achieving financial freedom. Understanding the implications of high debt levels on economic growth further emphasizes the importance of responsible borrowing and repayment practices.

The role of credit counseling cannot be overstated, as it provides valuable support and guidance for those struggling with debt. While using debt as a tool for investment can yield rewards, it also comes with substantial risks that necessitate careful consideration. Additionally, the burden of student loan debt underscores the need for strategic financial planning, particularly for younger generations entering the workforce.

On a larger scale, corporate debt impacts stock performance, and the management of national debt by governments has far-reaching economic implications. By fostering a culture of debt awareness and responsible management at both personal and institutional levels, we can pave the way for a more sustainable financial future. Ultimately, the journey toward financial well-being is one that requires informed decision-making and ongoing commitment to sound financial practices.