Weathering the Economic Storm: Understanding Recession Signals, Investment Strategies, and Government’s Role in Recovery

As economic cycles ebb and flow, the specter of recession looms as a significant concern for individuals, businesses, and governments alike. Understanding the early warning signs of an impending downturn is crucial for preparing and responding effectively. This article delves into the multifaceted nature of recessions, exploring how they affect various sectors of the economy and influence consumer behavior. We will examine effective investment strategies that can safeguard assets during turbulent times, alongside the essential role government stimulus plays in cushioning the impacts of economic decline. Additionally, we will discuss the repercussions of recessions on global trade and supply chains, drawing lessons from past downturns to inform our strategies today. Finally, we will highlight proactive measures businesses can take to not only survive but thrive in recessionary environments. By equipping ourselves with knowledge and foresight, we can better navigate the complexities of economic fluctuations and emerge resilient.

- 1. Recognizing the Warning Signs: Early Indicators of Economic Recession

- 2. Navigating the Storm: Investment Strategies for a Recessionary Environment

- 3. Government Intervention: The Role of Stimulus in Economic Recovery and Resilience

1. Recognizing the Warning Signs: Early Indicators of Economic Recession

Early indicators of an economic recession are crucial for businesses, investors, and policymakers to identify potential downturns and prepare accordingly. Recognizing these warning signs can help mitigate risks and inform strategic decisions.

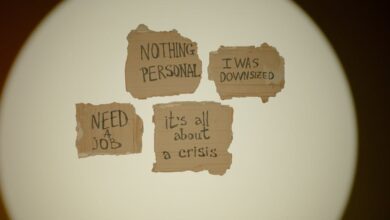

One of the most commonly observed indicators is a decline in consumer confidence. When consumers become pessimistic about their financial future, they tend to reduce spending, which can lead to decreased demand for goods and services. This drop in consumer activity often reflects broader economic concerns, such as rising unemployment or inflation.

Another significant warning sign is a contraction in manufacturing activity, often measured by the Purchasing Managers' Index (PMI). A PMI reading below 50 typically indicates a contraction in the manufacturing sector, which can signal broader economic weakness. Additionally, a drop in retail sales figures can point to weakening consumer demand, further indicating a potential recession.

Changes in the labor market can also serve as a precursor to economic downturns. An increase in unemployment claims or a slowdown in job creation may suggest a weakening economy. Furthermore, if businesses begin to announce layoffs or hiring freezes, it can be a strong signal that they are bracing for tougher times ahead.

Moreover, fluctuations in stock market performance can provide early warnings. A sustained decline in stock prices can reflect investor sentiment that the economy is headed for trouble. In conjunction with this, an inversion of the yield curve, where long-term interest rates fall below short-term rates, has historically been a reliable predictor of recessions.

Finally, external factors such as geopolitical tensions, trade disputes, or significant increases in commodity prices can also serve as early warning signs. These elements can create uncertainty in the markets and disrupt economic stability, further contributing to recessionary pressures.

By monitoring these early indicators, stakeholders can better prepare for the challenges posed by an economic downturn, allowing for strategic adjustments that may mitigate adverse effects.

2. Navigating the Storm: Investment Strategies for a Recessionary Environment

Navigating a recessionary environment requires a strategic approach to investing, as typical market behaviors can become unpredictable. During economic downturns, investors often face heightened volatility and uncertainty, making it essential to adapt their strategies to protect and potentially grow their assets.

One common strategy is to focus on defensive stocks, which tend to perform better during recessions. These are shares in companies that provide essential goods and services, such as utilities, healthcare, and consumer staples. Since demand for these products remains relatively stable, defensive stocks can offer more resilience against market fluctuations.

Another approach is diversifying investments across various asset classes. While equities may suffer, bonds, particularly government securities, often gain appeal as investors seek safer havens. Precious metals, like gold, can also serve as a hedge against market instability and inflation, making them a valuable addition to a recession-resistant portfolio.

Investors may also consider dollar-cost averaging, a strategy that involves regularly investing a fixed amount of money regardless of market conditions. This method can help mitigate the impact of market volatility by spreading out investment purchases over time, allowing investors to buy more shares when prices are low and fewer when prices are high.

Furthermore, maintaining a strong cash position is crucial during a recession. Having liquidity allows investors to take advantage of buying opportunities that arise when prices drop significantly. This strategy requires a careful balance, as holding too much cash can lead to missed growth opportunities if the market rebounds.

Lastly, it's vital to stay informed and adaptable. Economic indicators, such as unemployment rates and consumer confidence, can provide insights into the recession's progression and potential recovery. By monitoring these signals, investors can adjust their strategies in response to changing market conditions, positioning themselves to emerge stronger when the economy begins to recover.

In summary, successfully navigating a recessionary environment involves a combination of defensive positioning, diversification, maintaining liquidity, and staying informed. By employing these strategies, investors can better weather the storm and potentially capitalize on opportunities that arise during challenging economic times.

3. Government Intervention: The Role of Stimulus in Economic Recovery and Resilience

Government intervention, particularly through stimulus measures, plays a critical role in economic recovery and resilience during and after recessions. Stimulus packages are designed to inject liquidity into the economy, bolster consumer spending, and stabilize key sectors that may be adversely affected by economic downturns. These measures can take various forms, including direct financial assistance to individuals, tax cuts, and increased government spending on infrastructure and public services.

One of the primary objectives of stimulus measures is to restore consumer confidence and spending. During a recession, households often face uncertainty, leading to reduced spending as they prioritize saving over consumption. By providing financial aid, such as direct payments or unemployment benefits, the government can help maintain consumer purchasing power, which is essential for driving economic growth. For instance, the CARES Act in the United States, enacted in response to the COVID-19 pandemic, included direct payments to individuals and expanded unemployment benefits, which significantly boosted consumer spending during a time of crisis.

In addition to supporting consumers, government stimulus can target specific industries that are particularly vulnerable during economic downturns. For example, during the 2008 financial crisis, the U.S. government implemented the Troubled Asset Relief Program (TARP) to stabilize the banking sector, as well as various measures to support the auto industry. By ensuring that critical industries remain operational, the government can prevent job losses and maintain supply chains, which is vital for overall economic stability.

Moreover, government stimulus not only facilitates short-term recovery but also lays the groundwork for long-term resilience. Infrastructure investments can create jobs and enhance productivity, while support for research and development can foster innovation. By strategically investing in these areas, governments can help ensure that economies are better equipped to withstand future shocks.

Ultimately, while stimulus measures are not a panacea for all economic challenges, they serve as a vital tool for mitigating the immediate impacts of recessions and promoting a faster recovery. The effectiveness of these interventions often depends on timely implementation, the scale of the measures, and the overall economic context, highlighting the importance of agile and responsive government action in times of economic distress.

In conclusion, understanding the dynamics of an economic recession is crucial for individuals, businesses, and policymakers alike. By recognizing early warning signs, such as rising unemployment and decreasing consumer spending, stakeholders can better prepare for potential downturns. Different sectors of the economy respond uniquely to recessions, highlighting the importance of tailored investment strategies that focus on resilience and value preservation. Government stimulus plays a vital role in mitigating the adverse effects of economic contractions, providing essential support that helps stabilize markets and bolster consumer confidence.

Moreover, consumer behavior shifts significantly during downturns, influencing spending patterns and demand across various industries. Global trade and supply chains also face challenges, necessitating adaptability and innovation from businesses to maintain their competitive edge. Lessons learned from past recessions offer valuable insights that can guide current and future responses to economic crises.

Ultimately, businesses must prioritize preparedness and resilience, implementing strategies that not only help them survive but potentially thrive in challenging economic conditions. By fostering a culture of adaptability and strategic foresight, organizations can navigate the complexities of recessions and emerge stronger on the other side. As we move forward, the ability to learn from history and adapt to changing economic landscapes will be key to securing a stable and prosperous future.