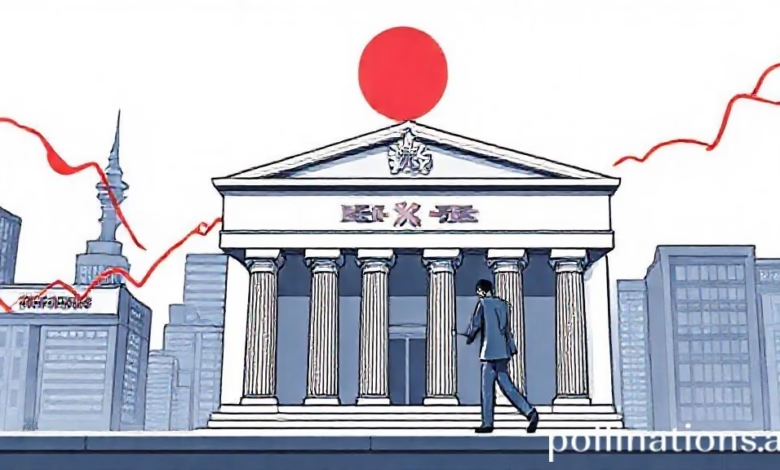

Bank of Japan’s Ueda Rattles Global Bond Markets with Rate Hike Prospect

TOKYO — Bank of Japan Governor Kazuo Ueda’s recent comments on a potential interest rate hike this month have sent tremors through global bond markets, casting uncertainty over the country’s monetary policy and its potential impact on the U.S. equity and bond markets.

The prospect of a rate hike in Japan, combined with the strengthening of the yen, has sparked concerns that capital may shift away from the U.S. markets. Historically, investors have viewed Japan as a safe-haven asset, particularly during periods of economic uncertainty. However, the Bank of Japan’s (BOJ) decision to raise interest rates could alter this calculus, potentially leading to a reduction in bond yields and a stronger yen.

The BOJ’s move could also create a ripple effect in the global financial markets, influencing the Federal Reserve’s (Fed) monetary policy decisions. In recent years, the Fed has been closely watching the BOJ’s actions, particularly in light of the U.S. central bank’s decision to raise interest rates to combat inflation. A potential rate hike in Japan could prompt the Fed to reassess its own monetary policy, potentially leading to a slower pace of rate hikes or even a pause in the tightening cycle.

Interest Rate Hike: A Shift in Monetary Policy

The BOJ’s potential interest rate hike marks a significant shift in the country’s monetary policy. The central bank has traditionally maintained an ultra-accommodative stance, keeping interest rates at extremely low levels to stimulate economic growth. However, with inflation rising above the BOJ’s target, the central bank has been forced to reassess its policy, potentially paving the way for a rate hike.

Impact on U.S. Markets

The prospect of a rate hike in Japan has sent shockwaves through the U.S. bond markets, with yields rising in response to the potential shift in capital flows. The U.S. Treasury market, in particular, has been impacted, with the yield on the benchmark 10-year Treasury note rising to its highest level since 2007. The strengthening yen has also made U.S. assets more expensive for international investors, potentially leading to a reduction in demand for U.S. bonds.

Risk of Currency Volatility

The potential rate hike in Japan has also sparked concerns about currency volatility. A stronger yen could lead to a decline in the value of the U.S. dollar, potentially exacerbating inflation concerns and putting upward pressure on interest rates. The BOJ’s decision to raise interest rates could also create a risk of currency appreciation, potentially leading to a reduction in exports and a slowdown in economic growth.

What to Watch Next

As the BOJ’s decision on interest rates draws closer, investors will be closely watching for any signs of a potential rate hike. A rate hike would mark a significant shift in the BOJ’s monetary policy, potentially influencing the global financial markets and the Fed’s decision-making process. Investors will also be monitoring the impact of the potential rate hike on the U.S. bond markets, with yields and currency volatility expected to remain key areas of focus.

Conclusion

The prospect of a rate hike in Japan has sent shockwaves through global bond markets, threatening to pull capital away from the U.S. equity and bond markets. The BOJ’s decision on interest rates will have far-reaching implications for the global financial markets, influencing the Fed’s monetary policy decisions and potentially leading to a reduction in bond yields and a stronger yen. As investors navigate this uncertain environment, they will be closely watching for any signs of a potential rate hike and its impact on the global markets.