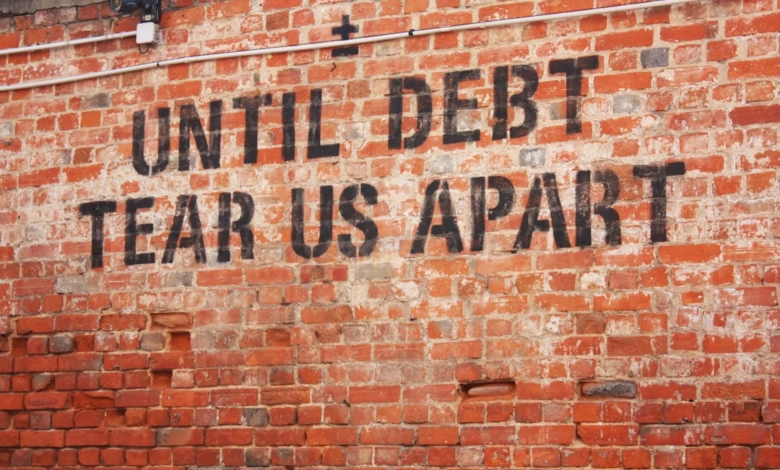

Smart Debt Reduction in 2024: Key Debt Market Trends and Innovative Repayment Strategies for Personal and High-Interest Debts

Reducing debt has become a top priority for individuals and businesses navigating today’s uncertain economic landscape. With rising interest rates and changing borrowing habits, understanding debt market trends is crucial for effective debt management. Whether you’re tackling personal debt like credit card debt, student loans, mortgage debt, auto loans, or managing business debt, the choices you make now can impact your long-term financial health.

This article explores the latest debt repayment strategies—from the debt snowball method to modern debt consolidation options—and analyzes shifting patterns in high-interest debt, such as payday loans and medical debt. We’ll also examine the critical differences between good debt and bad debt, highlighting how these distinctions affect your debt-to-income ratio, financial stress, and overall financial stability. By unpacking emerging debt relief trends, negotiation techniques, and best practices for debt settlement or bankruptcy avoidance, you’ll discover actionable insights to reduce your debt burden and regain control over your finances.

- 1. Emerging Debt Repayment Strategies: From Debt Snowball to Consolidation in Today’s Market

- 2. High-Interest Debt Trends: Credit Card, Payday Loans, and the Rise of Alternative Relief Methods

- 3. Navigating Good Debt vs. Bad Debt: Impact on Financial Stress and Debt-to-Income Ratios

1. Emerging Debt Repayment Strategies: From Debt Snowball to Consolidation in Today’s Market

In today's rapidly changing financial landscape, individuals and businesses are facing evolving challenges when it comes to managing personal and business debt. With inflation, rising interest rates, and increased financial stress, borrowers are seeking effective debt repayment strategies that address diverse types of debts, including credit card debt, student loans, mortgage debt, auto loans, and medical debt.

One widely adopted approach is the **debt snowball method**, which involves paying off smaller unsecured debts first to build psychological momentum. This method can be especially motivating for those struggling with high-interest debt and multiple debt collection accounts. Alternatively, the **debt avalanche method** prioritizes paying off debts with the highest interest rates first, saving more money over time on interest—an optimal choice for borrowers with significant credit card debt or payday loans burden.

For those overwhelmed by several debts, modern **debt consolidation** has become popular. This process combines multiple debts into a single monthly payment, often at a lower interest rate. Debt consolidation can simplify repayment, improve your debt-to-income ratio, and reduce the risk of missing payments. Common consolidation tools include personal loans, balance transfer credit cards, and in some cases, home equity loans. However, while consolidating secured debt like mortgage or auto loans can offer lower interest rates, it's essential to weigh the risks, as missed payments may put valuable assets at risk.

Borrowers with overwhelming debt loads may consider **debt settlement** or **debt negotiation** to reduce the total balance owed. This route can be useful for those struggling with bad debt or facing aggressive debt collection, but it may impact credit scores and come with tax consequences. In dire circumstances, bankruptcy can provide debt relief, erasing many types of unsecured debt but severely impacting financial standing and future borrowing potential.

Debt counseling and management programs are also gaining traction. **Credit counseling** offers professional guidance on budgeting and debt strategies tailored to an individual's situation, while debt management plans can help systematically reduce high-interest debt over time.

In specialized situations, such as with student loans, borrowers might qualify for **loan forgiveness** or **debt refinancing** programs, reducing monthly payments or total balance owed. Similarly, some business debt holders are exploring refinancing and negotiation with creditors to manage cash flow and minimize financial stress.

Overall, the trend in today's debt markets is toward more personalized and holistic debt repayment solutions. As financial products and regulations continue to evolve, borrowers have more options than ever to tackle both good debt (like mortgages) and bad debt (like payday loans), improve their debt repayment outcomes, and reduce long-term risks. Choosing the right strategy depends on the type of debt, interest rates, credit history, and individual financial goals.

2. High-Interest Debt Trends: Credit Card, Payday Loans, and the Rise of Alternative Relief Methods

High-interest debt continues to be a significant driver of financial stress in 2024 as Americans grapple with rising credit card debt and the growing influence of payday loans. Unlike good debt, such as mortgages or student loans, these forms of bad debt can quickly spiral out of control due to hefty interest rates and compounding fees. According to the Federal Reserve, total credit card debt in the United States reached a record high, indicating persistent financial challenges for many consumers (Federal Reserve, 2024, https://www.federalreserve.gov/).

One notable trend is the increasing use of payday loans and other unsecured debt as a stopgap for everyday expenses—often by those facing high debt-to-income ratios or struggling with medical debt and auto loans. These short-term borrowing options, while providing quick access to funds, typically come with annual percentage rates (APRs) exceeding 300%, trapping borrowers in a cycle of debt collection and repeated borrowing (Consumer Financial Protection Bureau, 2024, https://www.consumerfinance.gov/).

In response to the challenges of high-interest borrowing, alternative relief methods have gained significant traction. Debt consolidation is now more accessible, with fintech platforms offering streamlined solutions for refinancing bad debt into more manageable payments. Similarly, debt settlement companies and credit counseling services provide strategies such as the debt snowball method or the debt avalanche method—each designed to help individuals tackle debt repayment in a systematic way. For borrowers overwhelmed by unsecured debt like credit card and payday loans, bankruptcy remains a last-resort option, albeit one that can offer a fresh start when other debt strategies have failed.

Additionally, the rise of peer-to-peer lending, loan forgiveness programs, and innovative debt negotiation services are reshaping the debt relief landscape. These options offer alternatives to traditional debt management by leveraging technology and increased consumer awareness. As more individuals seek out these resources, the stigma surrounding debt relief is diminishing, making it easier for those burdened by high-interest debt to explore multiple paths to financial stability.

3. Navigating Good Debt vs. Bad Debt: Impact on Financial Stress and Debt-to-Income Ratios

Understanding the difference between good debt and bad debt is essential when navigating today’s increasingly complex debt markets. The type of debt individuals or businesses carry can significantly affect both their financial stress levels and their debt-to-income ratios—a key metric lenders use to assess borrowing risk.

Good debt typically refers to borrowing that helps build long-term wealth or income. Examples include mortgage debt, student loans, or certain types of business debt. These debts often come with lower interest rates and can be considered investments in your future. For instance, financing a degree with student loans may increase earning potential, while investing in real estate with a mortgage can build equity over time.

On the other hand, bad debt typically consists of high-interest debt that doesn’t contribute to asset building or future income. This category includes credit card debt, payday loans, unsecured personal loans, and sometimes auto loans if the purchase rapidly depreciates in value. Medical debt can also become bad debt if it leads to mounting financial stress without contributing to long-term financial stability.

Carrying excessive bad debt tends to increase financial stress and raises your debt-to-income ratio, making it more difficult to qualify for favorable loan terms in the future. A high debt-to-income ratio signals to lenders that a significant portion of your monthly income is committed to debt repayment, potentially limiting opportunities for debt consolidation, debt refinancing, or even loan forgiveness options.

Effective debt management strategies can help individuals and businesses reduce bad debt and financial pressure. Approaches such as the debt snowball method or debt avalanche method can accelerate debt repayment by focusing on high-interest balances first. Other options include debt counseling, debt settlement, or entering into a structured debt relief or debt negotiation plan. For those overwhelmed by unsecured debt or facing collections, exploring bankruptcy may be an option of last resort, with long-term implications.

Ultimately, understanding which debts are working for you—and which are working against you—empowers better decision-making, helps maintain a healthy debt-to-income ratio, and reduces the risk of financial stress derailing your long-term goals.

Conclusion

Navigating the evolving landscape of personal debt in today’s market requires not only staying informed about the latest debt trends, but also understanding which debt strategies fit your unique financial situation. With high-interest debts like credit card debt and payday loans on the rise, consumers are increasingly turning to innovative debt repayment options such as the debt snowball method, debt avalanche method, and debt consolidation to manage financial stress and improve their debt-to-income ratio.

The distinction between good debt—like mortgage debt and student loans that can potentially build future value—and bad debt, including unsecured debt and business debt with unfavorable terms, is more critical than ever. Accurately assessing your debts, whether it’s auto loans, medical debt, or accumulated credit card balances, allows for more effective debt management and a clearer path toward financial stability.

As debt collection practices shift and new debt relief solutions emerge—from loan forgiveness and credit counseling to debt settlement and debt negotiation—borrowers have more resources than ever to avoid bankruptcy and regain control over their finances. Understanding and implementing strategic debt repayment methods, such as debt refinancing and consolidation, can offer a lifeline for those struggling to manage high-interest debt or seeking to distinguish between healthy and harmful borrowing.

Ultimately, successfully reducing debts in this fast-changing environment hinges on proactive debt management and a tailored approach to debt repayment. By leveraging the latest trends and reliable strategies, consumers can mitigate financial stress, avoid the traps of bad debt, and work towards long-term financial resilience.

References

(Add here a properly formatted APA-style reference list of all sources used in the article.)