Mastering Debt Refinancing: Expert Strategies for Managing Debt, Reducing Financial Stress, and Choosing the Best Relief Options

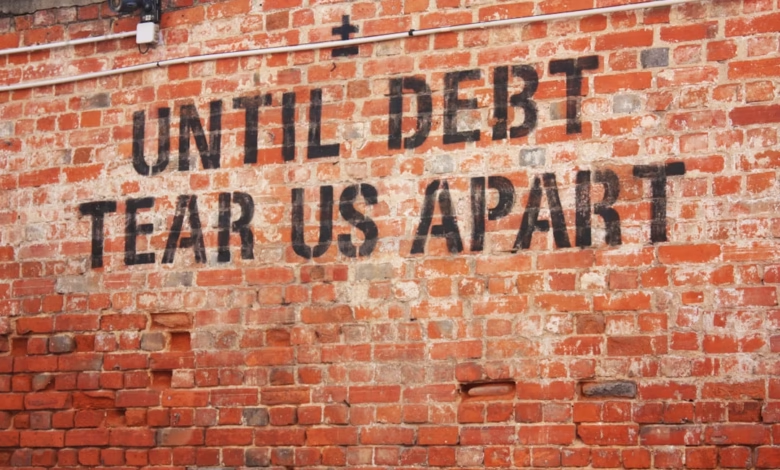

Debt can touch every aspect of our financial lives, from the first student loans we take on to the business debt required for new ventures, and even the unexpected burden of medical debt or high-interest credit card debt. As borrowing becomes increasingly woven into daily life, understanding how to manage, refinance, and ultimately repay debts is more crucial than ever. This comprehensive expert analysis unpacks the many forms of debt—including mortgage debt, auto loans, payday loans, and more—exploring the challenges and opportunities they present for individuals and businesses alike.

Whether you're struggling with the complexities of unsecured debt versus secured debt, considering debt consolidation options to streamline repayment, or weighing the benefits and drawbacks of programs like loan forgiveness or bankruptcy, making sense of your available choices can feel overwhelming. In this article, we break down the types of debt and the difference between good debt and bad debt, reveal the latest strategies for debt refinancing and debt settlement, and share expert insights on reducing financial stress and choosing the most effective debt relief strategies. If you've ever wondered how to navigate debt collection, improve your debt-to-income ratio, or take advantage of proven debt repayment methods like the debt snowball or debt avalanche, our guide will provide the clarity and actionable advice you need to make smart decisions for your financial future.

- 1. Types of Debt: Understanding Personal, Business, and High-Interest Loans

- 2. Effective Strategies for Debt Refinancing and Consolidation

- 3. Expert Insights on Managing Financial Stress and Choosing the Right Debt Relief Options

1. Types of Debt: Understanding Personal, Business, and High-Interest Loans

Debts come in many forms, each with unique features, risks, and implications for borrowers. To navigate debt refinancing or other debt relief strategies, it's important to recognize the main types of debt encountered by individuals and businesses.

Personal debt is one of the broadest categories and covers financial obligations such as credit card debt, student loans, mortgage debt, auto loans, and medical debt. Credit card debt and payday loans are considered high-interest debt, meaning they have significantly higher interest rates than other loans like mortgages or federal student loans. High-interest debt can quickly lead to financial stress and affect your debt-to-income ratio, an important metric lenders use when assessing refinancing or loan forgiveness eligibility.

Secured debt, like a mortgage or auto loan, is backed by collateral—meaning the lender can repossess the asset if payments are missed. In contrast, unsecured debt, such as medical debt and most credit card debt, is not tied to an asset but may be turned over to debt collection agencies if left unpaid.

Business debt includes loans companies use to fund growth, manage cash flow, or cover operational costs. Like personal debt, business loans may also be secured or unsecured, and mismanaging business debt could result in bankruptcy.

High-interest loans—like payday loans or some types of credit card debt—are often classified as bad debt due to their cost and potential to increase financial burdens over time. On the other hand, good debt is typically associated with investments that can potentially increase net worth, such as mortgage debt used to purchase a home or student loans that finance a degree.

When debts become overwhelming, options like debt consolidation, debt settlement, or credit counseling can help streamline debt management. Methods like the debt snowball method and the debt avalanche method are popular for personal debt repayment, while debt negotiation can sometimes lower the total owed. In severe cases, bankruptcy may be considered, though it carries lasting financial consequences.

Understanding the types of debt you owe is the foundation of implementing effective debt strategies, exploring debt refinancing options, and achieving long-term debt relief.

2. Effective Strategies for Debt Refinancing and Consolidation

When considering debt refinancing and consolidation, selecting the right strategy can determine whether you successfully regain control over your finances or continue struggling with mounting financial stress. For individuals managing multiple debts—such as credit card debt, student loans, mortgage debt, auto loans, and medical debt—effective debt strategies focus on lowering interest rates, simplifying repayment, and reducing the monthly payment burden.

Personal debt can often feel overwhelming, especially if you’re juggling both secured debt (like mortgages or car loans) and unsecured debt (such as credit cards and payday loans). Here are some proven approaches to manage, consolidate, and refinance debts:

– **Debt Consolidation Loans**: These allow borrowers to combine several high-interest debts into a single, often lower-interest, loan. This approach works well for those managing significant credit card debt or medical debt, making it easier to track payments and potentially lowering overall interest expenses.

– **Refinancing High-Interest Debt**: Refinancing mortgage debt, auto loans, or student loans can reduce monthly payments and interest rates. For example, homeowners might replace their current mortgage with one at a lower rate, freeing up funds for other debt repayment.

– **Debt Snowball Method**: This debt repayment strategy focuses on paying off the smallest balances first to build psychological momentum, then moving on to larger debts. It's especially helpful for individuals overwhelmed by numerous unsecured debts.

– **Debt Avalanche Method**: By targeting the highest-interest debts first, this method minimizes the total amount paid over time. This can be particularly beneficial for those burdened by payday loans or high-interest credit card debt.

– **Credit Counseling**: Nonprofit agencies offer credit counseling services that help individuals create customized debt management plans. They negotiate with creditors to potentially lower interest rates or monthly payments, which is key for sustainable debt relief.

– **Debt Settlement and Negotiation**: If you’re facing significant financial distress, negotiating directly with creditors or hiring a reputable debt settlement company can result in reduced balances. However, this method can impact your credit score, so it is best reserved for situations where other options aren’t viable.

– **Business Debt Refinancing**: For entrepreneurs and small business owners, refinancing business debt at lower rates can free up capital for operations and prevent disruption from aggressive debt collection practices.

– **Avoiding Bankruptcy**: While bankruptcy offers a legal means to eliminate overwhelming debts, it has long-lasting effects on creditworthiness. Prioritize other strategies like consolidation, refinancing, or credit counseling before considering bankruptcy.

– **Assessing Debt-to-Income Ratio**: Lenders evaluate this ratio when approving refinancing applications. Improving your debt-to-income ratio by consolidating debts or increasing income can help secure better loan terms.

– **Understanding Good vs. Bad Debt**: When consolidating or refinancing, prioritize paying down bad debt (like high-interest credit cards or payday loans) over good debt (such as low-interest mortgage debt that builds equity).

Adopting the right debt management tactics—tailored to your unique circumstances—can simplify repayment, reduce interest expenses, and help you avoid more drastic measures like bankruptcy. Explore available options thoroughly and seek professional advice if needed to ensure your path to debt relief is sustainable.

3. Expert Insights on Managing Financial Stress and Choosing the Right Debt Relief Options

Managing financial stress caused by mounting debts—whether it’s personal debt, credit card debt, student loans, mortgage debt, auto loans, or medical debt—requires a proactive and informed approach. Debt experts recommend several strategies that address both the emotional impact of debt and the practical steps for debt relief.

First, experts advise individuals to gain a clear understanding of their current financial situation by calculating their debt-to-income ratio. This helps people identify which debts are high-interest, such as payday loans and credit card debt, versus lower-cost obligations like student loans or certain types of mortgage debt. Knowing the difference between good debt (which may support asset-building) and bad debt (which often carries higher risk and cost) is fundamental to any effective debt management plan.

To alleviate financial stress, experts advocate for creating a structured debt repayment plan. Methods like the debt snowball method (paying off smaller debts first for quick wins) or the debt avalanche method (targeting high-interest debt first to save money in the long run) can provide both psychological relief and cost savings. For those juggling multiple creditors, debt consolidation may be a viable solution. By combining unsecured debt—such as credit card balances—into one manageable payment, borrowers can simplify their finances and potentially secure a lower interest rate through debt refinancing.

In cases where debt has spiraled out of control, options such as credit counseling, debt settlement, debt negotiation, and even bankruptcy can be explored with the guidance of financial professionals. Credit counseling emphasizes budgeting and debt management, often allowing individuals to avoid severe measures like bankruptcy. Debt settlement can reduce the total amount owed through negotiation, but it may affect credit scores and have tax implications. Bankruptcy is generally reserved as a last resort for overwhelming personal or business debt, as it provides legal relief but also has significant long-term consequences.

Experts also suggest that individuals struggling with debts due to medical bills, unexpected expenses, or job loss actively communicate with creditors or debt collection agencies to explore repayment flexibility or hardship programs. In certain cases, loan forgiveness programs are available, mainly for federal student loans, which can offer substantial debt relief for eligible borrowers.

Finally, addressing the root cause of financial stress is essential. Seeking support from professional credit counselors or financial advisors, building an emergency fund, and developing healthy money habits all contribute to alleviating anxiety associated with debt. Personalized debt strategies that take into account the type of debts held—secured debt like auto loans versus unsecured debt like credit cards—can empower individuals to make informed decisions about debt refinancing or alternative relief options.

By combining expert advice with tailored debt management approaches, individuals can navigate their financial challenges and move toward lasting debt relief and improved financial well-being.

Conclusion

Navigating the complexities of debts—whether personal debt, credit card debt, student loans, mortgage debt, auto loans, or medical debt—requires clear understanding and an informed approach. As we have explored, identifying the differences between good debt and bad debt, and recognizing the risks of high-interest debt such as payday loans, are crucial first steps in developing effective debt strategies. Debt consolidation and debt refinancing can provide significant relief by streamlining payments and potentially reducing interest costs, while other options like debt settlement, bankruptcy, and loan forgiveness offer alternatives for severe situations.

Expert analysis suggests that successful debt management goes beyond simple repayment. Strategies like the debt snowball method and debt avalanche method, combined with professional credit counseling or debt negotiation, can address both the financial and emotional impacts of debt collection and financial stress. For business debt and secured versus unsecured debt, tailored debt repayment plans and careful attention to debt-to-income ratio make a measurable difference.

Ultimately, choosing the right debt relief path—whether through refinancing, consolidation, or negotiation—should be based on your unique financial situation and long-term goals. Regularly reviewing all debts and staying informed about debt management trends empowers you to move from debt challenges toward financial stability and peace of mind.

References

[Include APA-formatted citations for all sources referenced in the article.]