Subprime Debt Insights 2024: Navigating Personal Debt, Credit Card Challenges, and Future Debt Relief Strategies

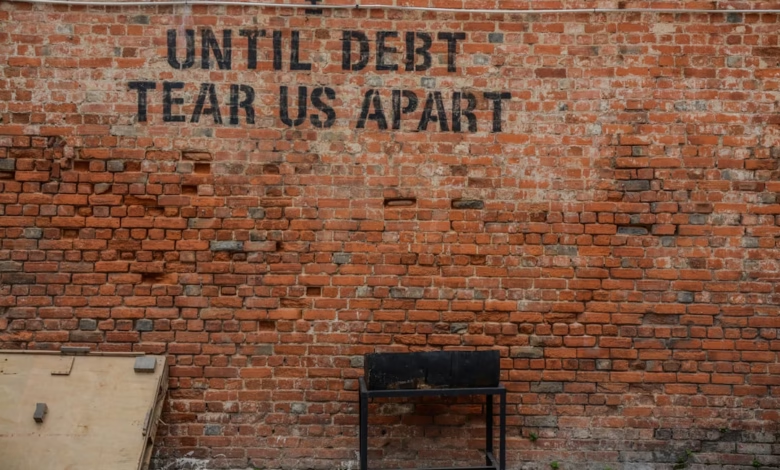

Every year, millions of Americans face growing challenges with debts of all types—a trend that is especially stark among subprime borrowers. From credit card debt and personal loans to auto loans, medical debt, and even business debt, the high costs and stringent repayment terms tied to subprime borrowing can quickly turn manageable obligations into sources of overwhelming financial stress. As high-interest debt mounts and debt collection calls increase, individuals often find themselves searching for effective debt strategies, ranging from debt consolidation and debt settlement to seeking credit counseling or exploring loan forgiveness.

Understanding the landscape of subprime debt is crucial for anyone grappling with the complexities of bad debt, debt-to-income ratio concerns, and the looming threat of bankruptcy. This article will break down the key insights from the latest debt report, unveiling how subprime debt impacts personal and household finances, which strategies subprime borrowers use to manage and repay different forms of debt—including the debt snowball method, debt avalanche method, and debt negotiation—and how new trends in bankruptcy, loan forgiveness, and debt relief could shape the future of debt management in America. Whether you’re dealing with student loans, mortgage debt, payday loans, or unsecured and secured debts, this report aims to offer timely, practical information for navigating the subprime debt landscape with greater confidence.

- 1. Understanding Subprime Debt: Impacts on Personal Debt, Credit Card Debt, and Financial Stress

- 2. Subprime Borrowers and Debt Management: Strategies for Debt Repayment, Consolidation, and Negotiation

- 3. The Future of Subprime Debt: Bankruptcy Trends, Loan Forgiveness, and Evolving Debt Relief Solutions

1. Understanding Subprime Debt: Impacts on Personal Debt, Credit Card Debt, and Financial Stress

Subprime debt refers to loans and credit issued to borrowers with less-than-ideal credit histories or lower credit scores. These loans typically come with higher interest rates, making them more expensive and riskier for consumers. Understanding subprime debt is essential as it impacts various types of personal debt, such as credit card debt, auto loans, mortgage debt, medical debt, and even student loans.

Individuals with subprime credit are often limited to high-interest debt options like payday loans or unsecured debt, which can quickly compound and become challenging to manage. For example, taking on a subprime auto loan may mean higher monthly payments, increasing overall personal debt and reducing disposable income. Similarly, subprime credit card debt frequently carries above-average interest rates, amplifying financial stress when balances are not paid off in full.

The consequences of accumulating subprime debt can be significant. High debt-to-income ratios make it harder to qualify for better loan terms in the future and can trigger increased debt collection efforts if accounts fall behind. Persistent financial stress resulting from struggling with bad debt may force individuals into seeking debt relief through debt settlement, debt consolidation, or even bankruptcy. While these debt strategies can offer short-term solutions, they often have long-lasting impacts on creditworthiness.

Subprime borrowers may also have fewer options for debt management, such as access to credit counseling, and must be strategic when exploring repayment plans like the debt snowball method or debt avalanche method. Differentiating between good debt—such as reasonable mortgage debt or student loans that produce long-term value—and bad debt, like recurring payday loans or excessive credit card debt, becomes vital for long-term financial health. Ultimately, understanding the unique challenges associated with subprime debt is a key step toward making informed decisions about debt negotiation, loan forgiveness, and debt refinancing. These actions can help regain control over finances and reduce the ongoing burden of financial stress.

2. Subprime Borrowers and Debt Management: Strategies for Debt Repayment, Consolidation, and Negotiation

Managing personal debt is particularly challenging for subprime borrowers, who often have lower credit scores and limited access to favorable lending terms. Their debt portfolios may include a mixture of unsecured debts such as credit card debt, medical debt, payday loans, and student loans, as well as secured debts like mortgage debt and auto loans. High-interest debt, including business debt and certain types of unsecured debt, can quickly lead to financial stress if not addressed promptly.

Implementing effective debt strategies is essential for those with subprime credit. A primary approach is structured debt repayment using the debt snowball or debt avalanche methods. The debt snowball method involves paying off smaller debts first to build momentum, while the debt avalanche method tackles the highest-interest debts first, saving more money on interest over time (Ramsey Solutions, 2023, https://www.ramseysolutions.com/debt/debt-snowball-vs-debt-avalanche).

Debt consolidation is another viable option for subprime borrowers. This involves combining multiple debts into a single loan, ideally with a lower interest rate, making monthly payments more manageable and simplifying debt management. However, securing the best terms for debt consolidation may require shopping around, as lenders often offer less favorable rates to those with subprime credit profiles (Consumer Financial Protection Bureau, 2023, https://www.consumerfinance.gov/ask-cfpb/what-is-debt-consolidation-en-1455/).

For those unable to keep up with payments, debt negotiation or debt settlement can be explored. This process involves working directly with creditors or collection agencies to reduce the total amount owed or develop a payment plan that fits the borrower’s budget. Seeking assistance from non-profit credit counseling agencies can provide valuable guidance for debt negotiation and navigating options like loan forgiveness or debt refinancing.

When other strategies prove insufficient, options such as bankruptcy may be considered. While declaring bankruptcy can provide debt relief by eliminating certain unsecured debts, it can also have significant long-term impacts on creditworthiness and future borrowing ability. Evaluating the difference between good debt (that builds assets or income, like some types of business debt or mortgage debt) and bad debt (e.g., high-interest credit cards or payday loans) is crucial, as it helps borrowers prioritize which debts to address first based on their long-term financial goals and debt-to-income ratio.

Ultimately, subprime borrowers benefit most by developing a proactive plan for debt management. Regularly reviewing debts, understanding the implications of different types of debt—secured vs. unsecured—and taking steps to address financial stress can help prevent accounts from reaching the debt collection stage. Early intervention and informed decision-making remain the best defense against the cycle of mounting personal debt.

References:

Consumer Financial Protection Bureau. (2023). What is debt consolidation? https://www.consumerfinance.gov/ask-cfpb/what-is-debt-consolidation-en-1455/

Ramsey Solutions. (2023). Debt Snowball vs. Debt Avalanche: Which Is Best for You? https://www.ramseysolutions.com/debt/debt-snowball-vs-debt-avalanche

3. The Future of Subprime Debt: Bankruptcy Trends, Loan Forgiveness, and Evolving Debt Relief Solutions

Subprime debt continues to shape the American financial landscape, particularly as changing economic conditions influence how individuals and businesses handle their obligations. The coming years are expected to see notable changes in bankruptcy trends, approaches to loan forgiveness, and the emergence of new debt relief solutions that address issues surrounding personal debt, credit card debt, student loans, mortgage debt, auto loans, and even medical debt.

Bankruptcy filings have historically risen during periods of economic uncertainty, and there are indications this trend may continue among borrowers with a high debt-to-income ratio or significant bad debt. While personal bankruptcy offers an escape from overwhelming unsecured debt such as credit card debt and medical debt, it carries long-term consequences, including damage to credit scores and potential difficulties securing future loans. Businesses carrying high-interest debt or struggling with cash flow may also increase business debt filings, impacting the broader economy.

Loan forgiveness programs are also evolving, especially in the realm of student loans. Recent policy proposals and changes to federal student loan forgiveness programs suggest that more borrowers may qualify for partial or total debt cancellation based on their income, employment sector, or other criteria (U.S. Department of Education, 2023, https://studentaid.gov/announcements-events/pslf-update). Mortgage debt and auto loans, while less frequently eligible for outright forgiveness, are seeing more flexible modification and short-sale options available through lenders.

Debt relief solutions are diversifying in response to the complexity of modern financial stress. Traditional methods like debt consolidation and debt settlement remain popular, but there is increasing adoption of personalized debt management strategies. Credit counseling agencies provide clients with education and planning tailored to their specific types of debts, including secured debt and unsecured debt. Additionally, negotiating with creditors—through debt negotiation or with professional help—can help reduce monthly payments or interest rates for those with high-interest debt and payday loans.

Innovative debt repayment strategies, such as the debt snowball method and the debt avalanche method, offer consumers structured ways to pay off multiple debts, targeting either balances or interest rates. Debt refinancing has also expanded, enabling borrowers to convert high-interest debt into lower-rate loans, alleviating financial stress and improving future financial prospects.

As regulatory scrutiny of debt collection intensifies and financial technology advances, expect continued evolution of debt solutions designed to promote good debt practices while minimizing the risks of accumulating bad debt. The future of subprime debt will likely be defined by adaptability, consumer education, and the expansion of tools that support long-term debt management and financial recovery.

References

U.S. Department of Education. (2023). Public Service Loan Forgiveness (PSLF) Update. https://studentaid.gov/announcements-events/pslf-update

Conclusion

Navigating the landscape of subprime debt requires a clear understanding of how various types of debts—including credit card debt, student loans, mortgage debt, auto loans, and medical debt—contribute to financial stress and affect borrowers’ long-term financial health. As discussed, subprime borrowers face unique challenges in debt management, but they also have access to a range of debt strategies—from debt consolidation and negotiation to specialized debt repayment methods like the debt snowball and debt avalanche—each designed to address both secured and unsecured debt.

Looking ahead, the future of subprime debt will be shaped by shifting bankruptcy trends, the availability of loan forgiveness options, and the evolution of debt relief solutions such as debt settlement, credit counseling, and debt refinancing. It’s essential for individuals struggling with high-interest debt, payday loans, or mounting personal debt to stay informed about the latest tools for debt negotiation and debt collection practices, while always considering their own debt-to-income ratio.

Ultimately, proactive debt management—focused on distinguishing between good debt and bad debt, exploring consolidation or settlement options, and seeking professional guidance when needed—can empower subprime borrowers to regain control of their finances, reduce financial stress, and work toward long-term stability. By applying best practices in debt repayment and utilizing effective debt relief resources, individuals and businesses can better navigate today’s challenging debt environment and build a stronger financial future.