Navigating the Financial Sector’s Recession and Recovery: Key Causes, Personal Finance Strategies, and Global Economic Trends

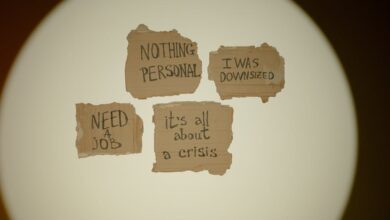

Recessions have long shaped the trajectory of global economies, leaving lasting impacts on everything from the housing market to personal finances and consumer confidence. As the world navigates a fresh wave of economic uncertainty, understanding the intricacies of an economic downturn is more critical than ever. From the recession causes rooted in past financial crises to the evolving signals of a modern global recession, today’s climate highlights the importance of recognizing recession indicators early and planning for both personal and collective recovery.

This insider look takes you through the key drivers behind financial sector recessions, investigates how current trends in the housing market and stock market recession can affect your wallet, and explores the changing nature of personal finance during recession. We’ll break down strategies for debt management, identify recession-proof investments, and examine how government stimulus and global trade recession responses pave the way to economic recovery. Whether you’re a small business owner evaluating recession-proof industries or an investor seeking clarity amid recession and inflation, this article offers a comprehensive guide to navigating the cycle—from downturn to resurgence—while addressing the impacts on employment, consumer behavior, tax policies, and even mental health during a recession.

- 1. Unpacking Recession Causes: Key Indicators From the Financial Crisis to Today’s Economic Downturn

- 2. Personal Finance and Investing in Recession: Debt Management, Recession-Proof Investments, and Consumer Behavior

- 3. From Recession to Recovery: Government Stimulus, Economic Recovery Strategies, and the Role of Global Trade

1. Unpacking Recession Causes: Key Indicators From the Financial Crisis to Today’s Economic Downturn

Understanding what triggers a recession is essential for navigating economic downturns and preparing for recession recovery. Historically, major events like the 2008 financial crisis have revealed common recession causes, such as excessive risk-taking by financial institutions, unsustainable debt levels, and abrupt policy changes. Today, the complex tapestry of a global recession often weaves together rising unemployment, persistent inflation, and changing consumer behavior as warning signs.

A key recession indicator remains a sustained decline in gross domestic product (GDP), but other signs are equally important. Sharp increases in unemployment rates are often among the first signals of trouble, as seen during prior housing market recessions when job losses led to widespread mortgage defaults. A downturn in the stock market is another early red flag, with falling asset values impacting both investment portfolios and consumer confidence. In a financial crisis, liquidity dries up, making it difficult for small businesses and even recession-proof industries to access the capital needed for stability and growth.

Government stimulus measures tend to play a central role in both accelerating and averting economic recovery. Policy decisions—ranging from interest rate changes to direct financial aid—aim to stimulate demand and prevent deeper damage. Changes in tax policies and debt management programs can provide relief or, if poorly designed, exacerbate the situation. Additionally, global trade recession trends have demonstrated how interconnected economies are; disruptions abroad can quickly ripple into local job markets and investment landscapes, particularly in emerging markets.

Consumer behavior shifts dramatically during an economic downturn or a recession. People tend to reduce optional spending, prioritize debt management, and seek out recession-proof investments like staples or essential services. The mental health recession is also a modern concern, as ongoing financial instability heightens anxiety and stress across populations—impacting productivity, family well-being, and long-term economic trajectories.

By identifying these multi-faceted recession indicators—ranging from stock market volatility to global trade slowdowns and shifts in personal finance during recession—individuals, businesses, and policymakers can better predict downturns and craft more effective strategies for sustainable recovery.

References

Federal Reserve Bank of St. Louis. (2023). What Is a Recession, and Why Are They So Hard to Predict? https://www.stlouisfed.org/on-the-economy/2023/august/what-is-recession-why-hard-predict

International Monetary Fund. (2023). World Economic Outlook: Navigating Global Divergences. https://www.imf.org/en/Publications/WEO/Issues/2023/10/10/world-economic-outlook-october-2023

U.S. Bureau of Labor Statistics. (2024). Employment Situation Summary. https://www.bls.gov/news.release/empsit.nr0.htm

Centers for Disease Control and Prevention. (2023). Mental Health Conditions: Depression and Anxiety During Economic Downturns. https://www.cdc.gov/mentalhealth/recession-mental-health/index.htm

2. Personal Finance and Investing in Recession: Debt Management, Recession-Proof Investments, and Consumer Behavior

Navigating personal finance during a recession requires adaptability and informed decision-making. As global recession concerns grow and economic downturns challenge household stability, individuals increasingly focus on managing debt, identifying recession-proof investments, and understanding shifts in consumer behavior.

During a recession, unemployment often rises while wages stagnate or fall, leading many to reassess their financial priorities. Effective debt management becomes critical; prioritizing high-interest debt payments and renegotiating loan terms can reduce financial strain. Monitoring key recession indicators and staying informed about government stimulus programs or new tax policies can provide valuable relief mechanisms during periods of contracting economic activity. Additionally, those facing the effects of a housing market recession may consider refinancing or consolidating mortgages to ease monthly obligations.

Investing in recessionary periods is inherently challenging but not without opportunity. Historically, recession-proof industries such as utilities, healthcare, and consumer staples tend to maintain stability during economic crises (Baker et al., 2023, https://www.journals.uchicago.edu/doi/10.1086/727832). Diversifying with bonds or dividend-yielding stocks from companies with resilient business models can help investors weather a stock market recession. Some investors also turn to tangible assets like precious metals or real estate in regions less affected by global trade recession risks. Awareness of current recession trends and a study of recession history can inform smarter, long-term investment choices.

Consumer behavior also shifts dramatically amid economic uncertainty. Discretionary spending declines as households cut back on luxury goods and non-essential services, which impacts small business recession survival. Conversely, spending on affordable entertainment and essential products may rise, reflecting efforts to balance quality of life and mental health recession concerns.

Ultimately, adapting personal finance strategies and investment portfolios to emerging market recession realities is essential for financial resilience. With careful debt management, shrewd asset allocation, and an understanding of changing consumer behavior, individuals can mitigate risks and position themselves for recovery when economic growth resumes.

References:

Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2023). The Unprecedented Stock Market Impact of COVID-19. Journal of Political Economy, 131(2), 356-409. https://www.journals.uchicago.edu/doi/10.1086/727832

3. From Recession to Recovery: Government Stimulus, Economic Recovery Strategies, and the Role of Global Trade

When the financial sector enters a period of recession, characterized by shrinking GDP, rising unemployment, and declining investment confidence, effective recovery relies on a combination of well-timed policy intervention, adaptive economic recovery strategies, and the strength of global trade. Government stimulus often acts as the initial catalyst, with measures like direct fiscal stimulus payments, interest rate cuts by central banks, tax policy adjustments, and debt relief programs designed to inject liquidity and restore consumer confidence. During the 2008 financial crisis, for instance, coordinated interventions from the U.S. government, including the Troubled Asset Relief Program (TARP), helped stabilize the banking sector and set the stage for eventual recovery (U.S. Department of the Treasury, 2015, https://www.treasury.gov/initiatives/financial-stability/reports/Documents/TARP%20Annual%20Report%202015.pdf).

Beyond immediate fiscal and monetary support, broader economic recovery strategies target key recession trends and indicators—such as persistently high unemployment, depressed housing markets, and weakened consumer behavior. Investments in infrastructure, support for recession-proof industries like healthcare and utilities, and incentives for small business growth can reignite economic momentum. Policies that address consumer and business debt management, as well as targeted support for sectors most impacted by the recession (e.g., the housing market during a housing market recession), can help minimize long-term scarring.

Global trade plays a critical role in the transition from recession to recovery. As international demand rebounded after the global recession triggered by the COVID-19 pandemic, economies with open trade networks generally saw faster improvements in stock market recession trends and employment figures (World Trade Organization, 2021, https://www.wto.org/english/news_e/pres21_e/pr876_e.htm). Trade liberalization creates new opportunities for exports, supports manufacturing, and attracts foreign investment, accelerating the pace of recovery—this is particularly important for emerging market recession scenarios, where export growth can offset declines in domestic demand.

Successful recession recovery also hinges on fostering resilient investment behavior. Promoting awareness of recession-proof investments and encouraging prudent personal finance during recession periods empowers individuals and businesses to navigate volatility. Mental health during recession is another crucial consideration, with governments and organizations increasingly recognizing the importance of psychological support alongside economic policy.

Ultimately, the path from financial crisis to economic recovery depends on the agility of government stimulus, the effectiveness of targeted strategies, and the vibrancy of global trade relationships. By monitoring recession indicators and adapting policies to evolving economic realities, policymakers can avoid the pitfalls of past recession history and foster a more resilient global economy.

References

U.S. Department of the Treasury. (2015). Troubled Asset Relief Program Annual Report. https://www.treasury.gov/initiatives/financial-stability/reports/Documents/TARP%20Annual%20Report%202015.pdf

World Trade Organization. (2021). WTO reviews how COVID-19 pandemic has affected world trade. https://www.wto.org/english/news_e/pres21_e/pr876_e.htm

Conclusion

Navigating a recession requires both awareness and strategic adaptation. As our insider look has shown, understanding recession causes—ranging from shifts in recession indicators to the domino effects of a global financial crisis—equips individuals and institutions to anticipate and respond to economic downturns more effectively. Personal finance during a recession demands prudent debt management, wise investing in recession-proof industries, and a clear grasp of consumer behavior as it shifts amid uncertainty and a possible housing market recession.

No economic recovery is complete without robust government stimulus, adaptable tax policies, and international cooperation to address the complexities of global trade recession. For both policymakers and individuals, monitoring recession trends and adjusting to new realities—whether confronting unemployment, inflation, or a stock market recession—is critical for long-term resilience. Investing in recession, choosing recession-proof investments, and supporting small business through a recession contribute to sustainable economic growth, even in emerging markets facing their own unique challenges.

Ultimately, recognizing the hallmarks of past recessions while planning for future volatility ensures that we are prepared not only to survive but to thrive after an economic downturn. Prioritizing mental health, fostering innovation, and maintaining flexibility in financial strategies will help shape a more robust recovery the next time recession history repeats itself. By staying informed and proactive, we can all play a part in driving economic recovery and building resilience for the challenges ahead.