Student Loans vs. Other Major Debts: Navigating Repayment, Consolidation, and Financial Health Strategies

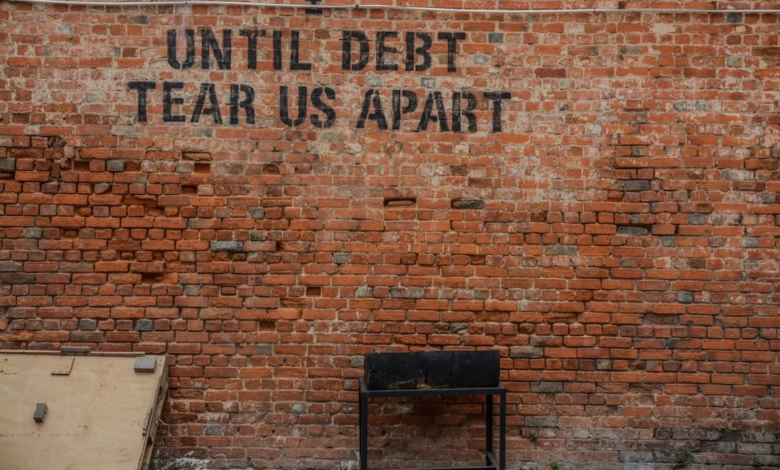

Student debt is a defining feature of today’s financial landscape, influencing everything from credit scores to life choices for millions of Americans. As the cost of higher education rises and borrowing becomes increasingly common, understanding how student loans fit into the broader picture of personal debt is more crucial than ever. For many consumers, student loans are just one part of a complex financial puzzle that may also include mortgage debt, credit card debt, auto loans, medical debt, and even business debt. Navigating this mix can bring significant financial stress, especially as high-interest debt and ongoing payments threaten long-term stability.

This article offers fresh debt insights specifically tailored for those grappling with student loans. We’ll explore how student loan debt compares to other major obligations, such as mortgages and credit cards, and discuss effective debt repayment strategies—from debt consolidation and refinancing to various loan forgiveness options. Whether you’re dealing with secured or unsecured debt, worried about your debt-to-income ratio, or simply looking for smart ways to regain financial control, this guide will help you make informed decisions and manage your debts more confidently.

- 1. Navigating Student Loans: How They Impact Your Personal Debt and Financial Health

- 2. Comparing Student Loan Debt with Credit Card Debt, Mortgage Debt, and Other Major Debts

- 3. Effective Debt Repayment Strategies: Consolidation, Refinancing, and Forgiveness Options for Student Loans

1. Navigating Student Loans: How They Impact Your Personal Debt and Financial Health

Understanding how student loans influence your overall financial health is essential for anyone managing multiple types of debts. Student loans, whether federal or private, contribute directly to your personal debt load and play a significant role in your debt-to-income ratio—a key factor lenders use to assess your ability to repay other obligations like mortgage debt, auto loans, or credit card debt.

When you take on student loans, it’s important to recognize the difference between good debt and bad debt. While investing in education is often considered good debt because it can increase future earning potential, the financial burden becomes problematic when repayments exceed manageable limits or when combined with other high-interest debt such as credit card debt or payday loans.

Many borrowers experience financial stress as they juggle student debt alongside other unsecured debt and secured debt. This stress can impact your credit score and your ability to secure additional loans for major milestones like buying a home or starting a business. If you find yourself struggling to manage monthly payments, exploring debt relief options such as debt consolidation, debt settlement, or even bankruptcy may become necessary. However, these options have long-term implications for your financial health and should be considered carefully.

Repaying student loans often requires deliberate debt strategies. Popular approaches include the debt snowball method—which focuses on paying off smaller balances first for psychological wins—or the debt avalanche method, which targets high-interest debt to minimize total interest paid. Some borrowers may qualify for debt refinancing to lower their interest rates or for loan forgiveness programs, which can significantly reduce personal debt over the long term.

Maintaining a balanced debt management plan is vital as student debt interacts with other forms of debt like medical debt or business debt. If you’re feeling overwhelmed, credit counseling can provide professional guidance, including tailored advice on debt collection issues, debt negotiation, or choosing between secured and unsecured debt repayments. Ultimately, understanding how student loans fit into your broader financial picture empowers you to make informed decisions, reduce financial stress, and move toward a more stable and manageable debt repayment journey.

2. Comparing Student Loan Debt with Credit Card Debt, Mortgage Debt, and Other Major Debts

Understanding how student loans fit into the broader landscape of personal debt is essential for making informed financial decisions. While student loan debt, credit card debt, mortgage debt, auto loans, and medical debt are all significant components of the typical American consumer’s debt profile, each comes with unique characteristics, risks, and repayment strategies.

First, student loans are often categorized as unsecured debt, much like credit card debt and medical debt. This means they are not backed by collateral. Unlike credit card debt, which typically involves high-interest rates and flexible minimum payments, student loans usually come with fixed or variable interest rates that are often lower and have longer repayment terms. However, student loans can rarely be discharged through bankruptcy, making them more persistent financial obligations (Federal Student Aid, 2023, https://studentaid.gov).

Credit card debt is considered high-interest debt and can quickly create financial stress due to compounding interest and minimum payment traps. While consumers may use debt consolidation or debt settlement to manage large balances, credit cards stand out as revolving, unsecured debt that increases the risk of financial hardship.

Mortgage debt, in contrast, is a form of secured debt backed by real estate collateral. Mortgages often represent the largest portion of personal debt but usually feature lower interest rates compared to unsecured debts. Mortgage debt may be considered “good debt” if it enables homeownership and asset building, although missed payments could lead to foreclosure.

Auto loans also represent secured debt, with the vehicle itself as collateral. While they often have lower interest rates than credit cards or payday loans, auto loans generally have shorter terms than mortgages and can lead to repossession if not repaid. Excessive auto debt can negatively impact the debt-to-income ratio, making it harder to qualify for favorable loans or credit offers.

Medical debt and payday loans are significant sources of financial stress for many consumers. Medical debt, like student loans, is unsecured but can lead to aggressive debt collection efforts. Payday loans are notorious for their extremely high interest rates and short repayment cycles, frequently trapping borrowers in a cycle of bad debt.

When comparing all these types of personal debt, strategies like debt refinancing, the debt snowball method, or the debt avalanche method can be effective. Debt management and credit counseling services may also help consumers prioritize repayments based on their interest rates and debt types. For insurmountable debts, options like loan forgiveness (for student loans), debt relief, or bankruptcy may be considered, although each option comes with important trade-offs.

Ultimately, understanding where student loans fit in relation to other debts—both in terms of risk and payoff strategies—allows consumers to develop more effective and sustainable debt repayment plans.

3. Effective Debt Repayment Strategies: Consolidation, Refinancing, and Forgiveness Options for Student Loans

Navigating repayment for student loans can be overwhelming, especially when juggling other forms of personal debt like credit card debt, mortgage debt, or auto loans. Fortunately, several debt strategies can help consumers regain control and reduce financial stress. Among these are debt consolidation, debt refinancing, and loan forgiveness, each offering unique benefits depending on your financial situation and the type of debt you hold.

Debt consolidation combines multiple debts—such as federal and private student loans or even high-interest debt like credit card debt—into a single monthly payment. This can simplify debt management and sometimes secure a lower interest rate, especially if you have strong credit. By streamlining payment schedules, it becomes easier to avoid missed payments, which can in turn help prevent future debt collection issues.

Debt refinancing allows borrowers to replace existing student loans with a new loan that ideally offers better terms, such as a lower rate or a more manageable repayment period. This option is best suited for those with solid credit scores and steady income, as lenders typically reserve the best rates for low-risk borrowers. However, borrowers should consider the trade-offs; refinancing federal student loans with a private lender may lead to losing valuable protections such as deferment, forbearance, and loan forgiveness programs.

Loan forgiveness is a unique form of debt relief tailored primarily to federal student loan holders. Qualifying for loan forgiveness, such as through Public Service Loan Forgiveness (PSLF) or income-driven repayment plans, can eliminate part or all of your remaining balance after you meet certain criteria—usually a minimum number of qualifying payments while working in public service or non-profit roles. It represents an effective, long-term way to address unsecured debt like student loans for borrowers who meet program requirements.

Consumers may also want to consider other repayment strategies, such as the debt avalanche method, which targets high-interest debts first, or the debt snowball method, which focuses on paying off the smallest debts quickly to build momentum. In some cases, professional support through credit counseling or debt negotiation can provide guidance tailored to your full debt profile—including student loans, medical debt, or even business debt.

Ultimately, the best debt repayment strategy depends on your personal mix of good debt versus bad debt, your debt-to-income ratio, and your long-term financial goals. By understanding and exploring these repayment pathways, individuals can create an actionable plan that addresses their immediate needs and fosters long-term financial stability.

Conclusion

Understanding the complexities of student loans—and how they compare with other forms of personal debt like credit card debt, mortgage debt, auto loans, and medical debt—is crucial for anyone navigating today’s financial landscape. By recognizing the unique challenges student debt presents, consumers can make informed decisions about debt repayment strategies, whether through debt consolidation, refinancing, loan forgiveness programs, or targeted approaches like the debt snowball method or the debt avalanche method.

It’s essential to differentiate between good debt, which can offer long-term benefits, and bad debt, such as high-interest debt from payday loans or credit cards, which often leads to financial stress and increased debt collection risks. Leveraging tools like credit counseling, debt negotiation, and debt management plans can empower borrowers to avoid severe outcomes, including bankruptcy, while improving their debt-to-income ratio.

No matter your situation—whether you’re facing secured or unsecured debts, or even business debt—taking a proactive stance on debt relief can help restore financial health. Regularly reviewing your debts and adapting your debt strategies will set a stronger foundation for the future, ease financial stress, and ensure you are on the path to effective debt repayment and long-term financial stability.

References

[List all sources used in APA format here.]