The True Cost of Debts: A Deep Dive into Credit Card, Student, and Mortgage Debt—with Practical Strategies for Relief

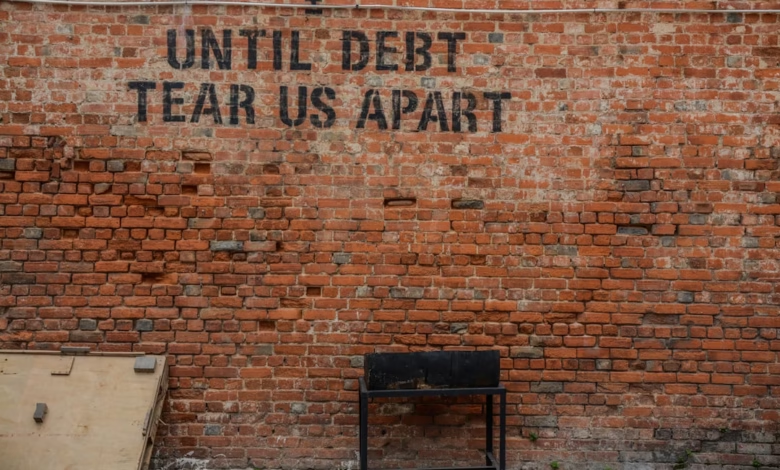

Debt is an inevitable part of modern financial life, but its effects on individuals and households can be profound and long-lasting. From mounting credit card debt and overwhelming student loans to mortgage debt that can stretch across decades, understanding the various types of debts—and the burden they carry—is essential for making informed financial choices. In today’s economic landscape, personal debt is rising steadily, with high-interest debts like payday loans, medical debt, and auto loans affecting millions of Americans every year. For some, what starts as “good debt” tied to investments in education or real estate can become “bad debt” without an effective debt management plan.

Yet, the impact of consumer debt extends far beyond dollars and cents. The real-life consequences of debt can include persistent financial stress, relentless debt collection efforts, and, in the worst cases, bankruptcy. Individuals struggling to navigate debt settlement, loan forgiveness, and debt relief programs can find themselves overwhelmed, often unsure how to rebuild a healthy debt-to-income ratio or escape cycles of debt repayment and negotiation.

This article offers a deep dive into the complex world of consumer debt. We’ll explore the key differences between secured and unsecured debts, explain the risks and nuances of business debt and personal loan refinancing, and shine a light on proven debt management strategies—such as the debt snowball method, debt avalanche method, credit counseling, and debt consolidation. Whether you’re looking for ways to manage high-interest debt, understand your options for debt negotiation, or avoid common debt pitfalls, read on for actionable insights into achieving lasting financial stability.

- 1. Understanding Different Types of Debts: From Credit Card Debt to Student Loans and Mortgages

- 2. The Real-Life Consequences of Personal Debt: Financial Stress, Debt Collection, and Bankruptcy

- 3. Proven Debt Management Strategies: Debt Snowball Method, Credit Counseling, and Debt Consolidation

1. Understanding Different Types of Debts: From Credit Card Debt to Student Loans and Mortgages

When exploring the world of debts, it’s important to understand the various types that impact consumers and their finances. Each debt category comes with unique features, financial implications, and repayment challenges, influencing overall personal debt levels and long-term financial health.

Credit card debt stands as one of the most common forms of unsecured debt in many households. Unlike secured debt—such as mortgage debt or auto loans—credit card balances are not tied to specific collateral. Because of this, credit card debt typically carries higher interest rates, making it a type of high-interest debt that can quickly spiral if not managed carefully. Ongoing reliance on minimum payments or carrying large balances can add to financial stress and increase consumers’ debt-to-income ratio, making it harder to qualify for future loans.

Student loans differ, as they are specifically borrowed to finance education and often come with unique repayment options, including loan forgiveness programs and income-driven repayment plans. While student loans can initially be considered “good debt,” as they are an investment in future earning potential, they may still contribute to overwhelming personal debt loads—especially when job prospects are limited after graduation.

Mortgage debt represents a significant portion of household liabilities. As a form of secured debt, it is backed by the property itself. Mortgages often offer relatively low interest rates compared to other debt types, making them more manageable. However, failing to keep up with payments can result in foreclosure, illustrating the risk tied to this form of borrowing.

Auto loans, also falling into the secured debt category, use your vehicle as collateral. While typically lower-interest than unsecured debt, defaulting on auto loans can lead to repossession of your car, affecting mobility and financial stability.

Medical debt is another major source of financial stress, especially in countries with high healthcare costs. Even with insurance, unexpected medical expenses can lead to debt collection, debt settlement negotiations, or in extreme cases, bankruptcy.

Other high-interest options, such as payday loans, can seem attractive in emergencies but often trap borrowers in cycles of debt due to exorbitant fees and compounding interest. These are generally categorized as bad debt and are often targets for debt relief, debt consolidation, or debt refinancing strategies.

Small business owners may encounter business debt, which carries its own set of challenges. Managing and repaying these obligations requires a firm understanding of cash flow and suitable debt strategies, such as debt management plans or negotiation with creditors.

Finally, it’s important to differentiate between good debt—used to invest in appreciating assets or income-generating opportunities—and bad debt, generally used to finance depreciating items or everyday expenses. Employing methods like the debt snowball method or debt avalanche method can help prioritize debt repayment, while resources like credit counseling and professional debt negotiation can provide tailored solutions for achieving financial wellness.

Understanding the nuances among these types of debts is the first step in effective debt management and in making informed choices about debt repayment and overall financial health.

2. The Real-Life Consequences of Personal Debt: Financial Stress, Debt Collection, and Bankruptcy

Personal debt has profound, far-reaching impacts on individuals and families, often extending far beyond the simple obligation to repay borrowed money. When monthly bills—such as credit card debt, student loans, mortgage debt, auto loans, and even medical debt—pile up, financial stress becomes a daily reality. This stress can affect mental health, relationships, and even physical well-being.

Many people facing overwhelming debts may experience sleepless nights, anxiety, or depression as they struggle to keep up with minimum payments or worry about their debt-to-income ratio. High-interest debt like payday loans or maxed-out credit cards can quickly spiral out of control, making debt management feel unattainable. While some borrowing, such as a mortgage, is often classified as “good debt,” other forms—unsecured debt with high rates—are seen as “bad debt” because they drain resources without building assets.

When payments become unmanageable, debt collection agencies may start contacting borrowers. These persistent calls and letters can feel invasive and intimidating, further increasing financial stress. At this stage, individuals might consider options such as debt consolidation, debt settlement, or debt negotiation to ease the burden. Debt relief programs and credit counseling can also provide structured debt repayment strategies, exploring whether the debt snowball method or debt avalanche method better suits the situation.

For some, however, these interventions may not be enough. Continuous missed payments or a severely strained debt-to-income ratio can eventually lead to bankruptcy. Declaring bankruptcy is a last resort that carries serious, long-term consequences. It can damage your credit score, limit access to new credit, and even impact job prospects in certain industries. Although some debts, like certain student loans or business debt, may not be dischargeable, bankruptcy can offer a fresh start for those overwhelmed by unsecured debt.

The real-life consequences of personal debt underscore the importance of early intervention, proactive debt strategies, and seeking professional financial advice before the situation becomes unmanageable.

3. Proven Debt Management Strategies: Debt Snowball Method, Credit Counseling, and Debt Consolidation

Managing multiple forms of personal debt—such as credit card debt, student loans, mortgage debt, auto loans, and medical debt—can feel overwhelming. Fortunately, proven debt management strategies can make a significant difference. Below are three widely used approaches to tackle financial stress and achieve debt relief.

Debt Snowball Method

The debt snowball method is a popular strategy for taking control of multiple debts. This approach involves listing all your debts—from payday loans to unsecured credit card balances—in order from the smallest to the largest amount owed. You then focus on paying off the smallest debt first, while making minimum payments on all other debts. As soon as the first debt is paid off, you redirect the funds toward the next smallest debt, creating momentum. This psychological boost helps many individuals stay motivated throughout their debt repayment journey. The snowball method is especially helpful for addressing high-interest debt and bad debt, keeping you on track toward improved financial health.

Credit Counseling

Credit counseling provides professional guidance for individuals struggling with personal debt and high debt-to-income ratios. Certified credit counselors develop customized action plans, often including a debt management plan (DMP). These plans allow consumers to make a single monthly payment to the counseling agency, which then distributes funds to creditors, potentially at reduced interest rates. Counseling can be invaluable for managing credit card debt, medical debt, and unsecured debt, as it offers education on budgeting, debt negotiation, and avoiding bankruptcy. Credit counseling agencies can also support debt settlement or even guide borrowers through loan forgiveness or debt refinancing options.

Debt Consolidation

Debt consolidation is a practical solution for streamlining debt repayment. By combining multiple debts—such as business debt, auto loans, payday loans, and medical bills—into a single loan with a lower interest rate, you simplify repayment and potentially reduce monthly costs. This strategy is particularly effective for individuals with several sources of high-interest debt. Debt consolidation can be done via personal loans, balance transfer credit cards, or home equity loans (secured debt). It is important to evaluate your overall debt-to-income ratio to ensure you do not risk taking on more than you can handle. Properly executed, consolidation can help avoid debt collection actions, improve credit, and decrease long-term interest payments compared to managing multiple, disparate debts.

Each of these debt strategies—whether you choose the motivational debt snowball method, seek professional credit counseling, or consolidate your debts—can play a crucial role in regaining financial stability. Assessing the types of debt you carry, your payment capacity, and your long-term financial goals can help you select the most effective debt management approach for your situation.

Conclusion

Understanding the full spectrum of debts—from credit card debt and student loans to mortgage debt and auto loans—is crucial for making informed financial decisions. As this deep dive has shown, personal debt can take many forms, with each carrying its own challenges and consequences. Whether individuals face high-interest debt, medical debt, or even payday loans, the real-life effects are far-reaching, often leading to significant financial stress, debt collection efforts, and in severe cases, bankruptcy.

However, there are proven debt management strategies available, such as the debt snowball method, debt avalanche method, credit counseling, debt consolidation, and debt settlement. These approaches, along with options like debt refinancing, loan forgiveness, and debt negotiation, provide actionable pathways to tackle both secured debt and unsecured debt. Evaluating your debt-to-income ratio and distinguishing between good debt and bad debt are also essential steps in establishing strong debt repayment habits and avoiding future pitfalls.

Ultimately, managing personal debt doesn’t have to be overwhelming. By understanding the distinct types of debt, recognizing the warning signs of financial distress, and choosing a suitable debt relief or repayment strategy, you can regain control of your finances. Take proactive steps today to protect yourself from the costly cycle of debt, and consider seeking professional guidance if you need support. A well-planned approach to debt management can mean the difference between ongoing financial burdens and long-term stability.