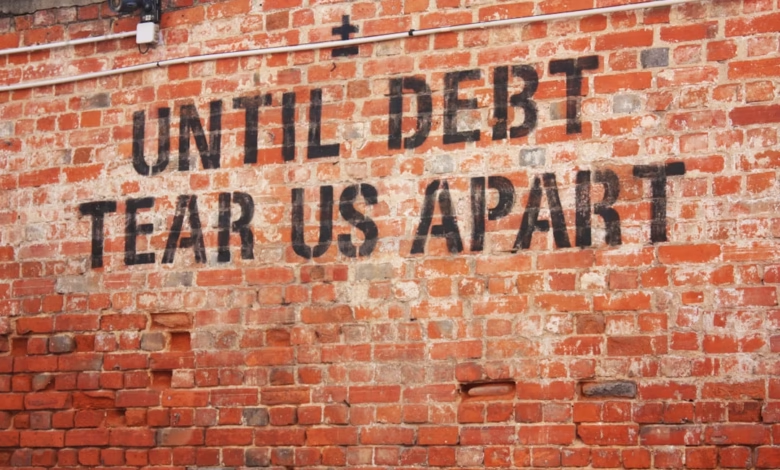

Navigating America’s Debt Landscape in 2024: Types, Financial Impact, and Innovative Debt Management Strategies

Debt is a common aspect of modern financial life, shaping everything from individual budgets to the broader economy. As the landscape of personal debt continues to evolve—spanning credit card debt, mortgage debt, medical loans, student loans, auto loans, and even business debt—many households find themselves juggling payments, managing rising financial stress, and reevaluating their debt strategies. In 2024, understanding the various types of debts, their impact on debt-to-income ratios, and distinguishing between good debt and bad debt has become increasingly essential. With the growing prevalence of high-interest debt, payday loans, and aggressive debt collection practices, Americans are seeking effective solutions, such as debt consolidation, loan forgiveness, credit counseling, bankruptcy, and innovative repayment methods like the debt snowball and debt avalanche approaches. This article provides a concise overview of the current debt outlook, explores the different forms of personal and secured or unsecured debt, examines how rising obligations influence financial well-being, and highlights proven, actionable strategies for achieving lasting debt relief and improved debt management. Whether you’re dealing with debt negotiation, looking at debt settlement options, or considering debt refinancing, understanding your options is the first step toward financial stability.

- 1. Understanding Types of Debt: From Credit Card Debt to Mortgage and Medical Loans

- 2. Assessing the Impact of Rising Debts on Financial Stress and Debt-to-Income Ratios

- 3. Debt Management Strategies: Debt Consolidation, Loan Forgiveness, and Innovative Repayment Methods

1. Understanding Types of Debt: From Credit Card Debt to Mortgage and Medical Loans

When evaluating the landscape of debts, it’s essential to understand the many types that individuals and households commonly encounter. Each type has unique features, interest rates, and implications for your overall financial health.

Credit card debt is one of the most prevalent forms of personal debt, often carrying high-interest rates that can lead to financial stress if not managed properly. While credit cards offer convenience and flexibility, they can also contribute to high-interest debt cycles if you only make minimum payments.

Student loans are another significant source of personal debt in the United States, impacting millions of borrowers for years after graduation. These loans may be federal or private, with each offering different repayment terms, opportunities for loan forgiveness, and debt management strategies.

Mortgage debt, the largest debt category for most households, is considered a form of secured debt because it is backed by a physical asset—your home. While mortgage debt can be considered good debt, since it is tied to a potentially appreciating asset, it represents a long-term financial commitment that requires careful planning.

Auto loans are another type of secured debt, using the vehicle as collateral. While they may have lower interest rates than unsecured debt, missing payments can result in repossession of your car, making timely repayment crucial.

Medical debt often arises unexpectedly and can quickly accumulate, especially if your health insurance doesn’t cover all expenses. This type of debt can be challenging due to its unpredictability and potential impact on credit scores if sent to debt collection.

Additional unsecured debts include payday loans and personal loans. Payday loans typically carry extremely high interest rates and can easily spiral into a cycle of debt, making them a notable source of high-interest debt. Personal loans, on the other hand, may offer more manageable terms but still require close attention to the debt-to-income ratio to prevent overextension.

Some debts, like business debt, are necessary for growth and can be managed through debt refinancing or consolidation if cash flow becomes an issue. Understanding the distinction between good debt—which can help build wealth or achieve important goals—and bad debt—which tends to be high-cost and doesn’t offer long-term value—is vital for long-term financial health.

Effective debt strategies, such as credit counseling or using the debt snowball method (paying off the smallest debts first) and the debt avalanche method (targeting high-interest debts first), can help you take control of your finances. If debts become overwhelming, options like debt settlement, debt negotiation, or even bankruptcy may be considered for debt relief.

Managing different types of debt not only improves your debt-to-income ratio but also reduces financial stress and supports positive long-term outcomes. Taking an informed approach to debt repayment and management can help you avoid the pitfalls of bad debt while making strategic use of good debt for future growth.

2. Assessing the Impact of Rising Debts on Financial Stress and Debt-to-Income Ratios

As personal debts continue to rise across the country, individuals and households face growing financial stress and increasingly strained debt-to-income ratios. The accumulation of credit card debt, student loans, mortgage debt, and auto loans all directly impact a person’s ability to manage their monthly finances. High-interest debt, such as payday loans or credit card balances, can quickly become unmanageable, pushing borrowers to seek out debt relief options like debt consolidation, credit counseling, or even bankruptcy.

When debt levels increase relative to income, the debt-to-income ratio (DTI) climbs—a critical measure used by lenders to assess creditworthiness and loan approval. For example, a high DTI due to large amounts of unsecured debt (such as credit card debt or medical debt) can make it harder to qualify for new loans or even refinance existing mortgage debt. Families and individuals with sustained high DTIs often experience more frequent contact from debt collection agencies and face greater difficulty in managing essential expenses.

This financial strain can manifest in other ways as well, from increased anxiety and stress related to constant debt repayment pressures to reduced savings for emergencies or long-term goals. Many turn to structured debt strategies, such as the debt snowball method, which prioritizes repayment of smaller balances first, or the debt avalanche method, targeting the highest interest rates to minimize total interest paid. Others explore debt negotiation with creditors or loan forgiveness programs for student loans to find relief.

However, the distinction between good debt and bad debt is important. While business debt or mortgage debt used to build assets can improve financial stability over time, accumulating high-interest debt without an effective debt management plan generally worsens household financial health. Relying on short-term solutions like payday loans or repeatedly seeking debt settlement may offer temporary relief, but without addressing underlying income and spending patterns, risks of default and bankruptcy persist.

Understanding the impact of rising debts on financial stress and debt-to-income ratios highlights the need for proactive debt management and timely intervention. Whether through debt refinancing, seeking credit counseling, or building a tailored repayment strategy, acting early is key to alleviating financial pressure and restoring financial stability.

3. Debt Management Strategies: Debt Consolidation, Loan Forgiveness, and Innovative Repayment Methods

Effectively managing debts requires a careful evaluation of your financial situation and a tailored approach to repayment. Several debt management strategies can help individuals and businesses address personal debt, business debt, and financial stress from high-interest debt like credit card debt, payday loans, or medical debt. Here’s a closer look at some widely used strategies, including debt consolidation, loan forgiveness, and innovative repayment methods.

Debt consolidation is a popular approach for those handling multiple unsecured debts, such as credit card debt, auto loans, or medical debt. With debt consolidation, all outstanding balances are combined into a single loan—often with a lower interest rate—simplifying repayment and potentially reducing monthly payments. This method can be a lifeline for borrowers facing high-interest debt or struggling to keep up with multiple payments, improving their debt-to-income ratio and reducing the risk of slipping into debt collection.

Loan forgiveness programs target specific types of loans, most notably student loans. Eligible borrowers may receive partial or full forgiveness of their remaining balance after meeting certain conditions, such as working in public service or making consistent payments over a set period. Loan forgiveness alleviates financial stress and can make a significant difference for those facing burdensome student loans or even certain types of mortgage debt during periods of economic hardship.

Innovative repayment methods offer alternative ways to tackle debt. Two prominent strategies are the debt snowball method and the debt avalanche method.

– The debt snowball method encourages borrowers to pay off their smallest debts first, gaining momentum with each payoff and building motivation to eliminate larger balances later.

– The debt avalanche method prioritizes debts with the highest interest rates. By focusing on high-interest debt first—like payday loans or certain credit card balances—borrowers can save more over time and pay off their debts faster.

Other creative solutions include credit counseling, which provides personalized guidance on debt management and can lead to a debt management plan tailored to individual needs. Debt settlement or negotiation involves working directly with creditors to reduce the total balances owed, particularly helpful for unsecured debt or bad debt.

In special circumstances, debt refinancing or switching from unsecured to secured debt using assets as collateral can lower interest rates and improve terms. Bankruptcy, while a last resort, can offer debt relief for those in severe situations where other strategies aren’t viable.

By thoughtfully evaluating the nature of their debts—distinguishing between good debt, bad debt, secured debt, and unsecured debt—borrowers can select the most effective combination of debt strategies. Embracing the right debt management techniques can help individuals and businesses reduce financial stress, improve their debt-to-income ratio, and move toward greater financial freedom.

Conclusion

Understanding the many forms of personal and business debts—such as credit card debt, student loans, mortgage debt, auto loans, and medical debt—is essential for making informed financial decisions. As highlighted, the continued rise in household and national debts has intensified financial stress for individuals and families, especially amid higher debt-to-income ratios and the proliferation of high-interest debt such as payday loans and some credit card balances.

Fortunately, a variety of debt management strategies are available for consumers. From debt consolidation and loan forgiveness programs to debt settlement and bankruptcy as last resorts, there are ways to address both good debt and bad debt for improved financial well-being. Options like credit counseling, debt snowball and avalanche methods, debt refinancing, and innovative debt repayment plans provide tailored paths for those managing secured debt or unsecured debt. Meanwhile, proactive debt negotiation and embracing new approaches to debt relief can help reduce or eliminate collection efforts and preserve credit health.

Ultimately, the key to navigating personal and national debts lies in increasing financial literacy, early intervention, and selecting debt strategies that align with your unique circumstances. By embracing thoughtful debt management and seeking professional advice when needed, individuals can reduce financial stress and chart a sustainable course for their financial future—even in an environment of rising debts and economic uncertainty.

References

[Include all relevant sources used in the article here following APA format.]