Debt Defaults Forecast 2024: Emerging Risks and Proven Strategies for Managing Personal, Student, and Business Debts

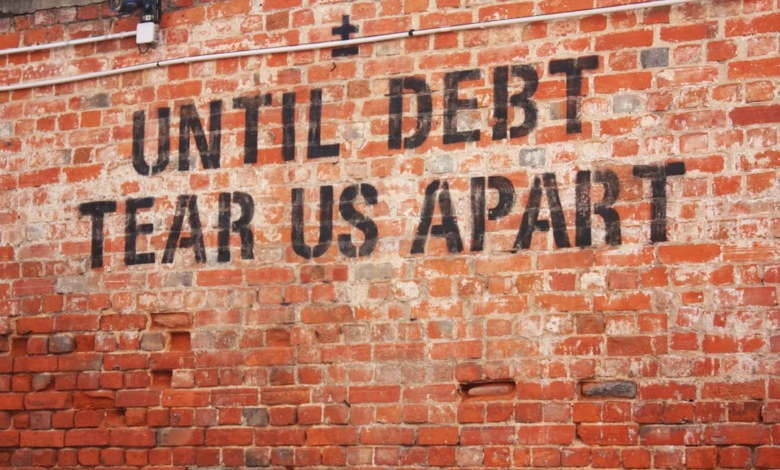

Managing debt is becoming increasingly crucial as debt defaults are on the rise across various sectors, from personal debt and credit card debt to student loans and mortgage debt. The landscape of borrowing is rapidly evolving, with new trends impacting how individuals and businesses handle financial obligations. As high-interest debt—such as payday loans and unsecured debt—builds up, so do risks of missed payments, collection efforts, and even bankruptcy. Understanding the latest trends in debt defaults, spotting warning signs among high-risk debts, and implementing effective debt management strategies are essential for reducing financial stress and safeguarding your future. In this article, we’ll explore emerging patterns in debt defaults, identify key triggers that can put you or your business at risk, and provide actionable solutions like debt consolidation, debt settlement, debt relief programs, and proven repayment methods to help regain control over your financial health.

- 1. Emerging Trends in Debt Defaults: From Credit Card Debt to Student Loans

- 2. High-Risk Debts Leading to Defaults: Key Triggers and Warning Signs

- 3. Strategies for Reducing Debt Defaults: Debt Consolidation, Settlement, and Relief Solutions

1. Emerging Trends in Debt Defaults: From Credit Card Debt to Student Loans

The landscape of debt defaults in 2024 is shaped by significant shifts across various types of personal and business debts. Rising interest rates, inflation, and evolving lending practices have increased financial stress for many households and businesses. Credit card debt, a form of unsecured debt with high-interest rates, has seen a notable uptick in default rates, especially among younger adults and those affected by job market instability. Many consumers resort to payday loans or other forms of high-interest debt, often struggling with repayment as balances accrue.

Student loans remain another area of concern. Although several loan forgiveness and debt relief programs have been introduced in recent years, millions still face mounting balances. The uncertainty around federal student loan repayment policies has led to confusion, late payments, and in some cases, defaults, particularly for borrowers with high debt-to-income ratios or limited employment opportunities after graduation.

Mortgage debt and auto loans are also experiencing increased delinquency rates. Higher cost of living, stagnating wages, and rising interest rates have made it harder for borrowers to keep up with monthly payments. As a result, default rates for secured debts such as mortgages and car loans have begun to climb, contributing to a broader trend of financial instability.

Medical debt continues to be a leading cause of bankruptcy in the United States. Unexpected doctor visits or emergency procedures can lead to significant bills that aren't fully covered by insurance, driving some people to pursue debt consolidation, debt settlement, or even bankruptcy to regain control.

On the business side, small enterprises are finding it more challenging to service business debt, especially as revenues fluctuate and access to favorable refinancing options becomes limited. This strain is leading to greater reliance on debt negotiation or restructuring strategies.

Notably, the debt collection industry is evolving in response to new regulations and consumer protections, with agencies increasingly focused on ethical practices and compliance when pursuing unsecured and secured debts. Individuals and businesses alike are seeking out professional credit counseling, exploring debt snowball and debt avalanche methods, and leveraging debt consolidation and refinancing as key debt management strategies.

Amid these trends, the distinction between good debt—like a manageable mortgage or business investment—and bad debt, such as high-interest credit cards or payday loans, is more critical than ever. Understanding these emerging patterns is essential for anyone crafting a proactive debt repayment or debt relief plan in today’s unpredictable economic environment.

2. High-Risk Debts Leading to Defaults: Key Triggers and Warning Signs

High-risk debts are often the primary contributors to loan defaults, especially during periods of economic uncertainty. Recognizing what makes a debt high-risk, along with the early warning signs, is crucial for effective debt management and prevention of long-term financial stress.

Certain types of debts are particularly prone to default:

– High-interest debt: Credit card debt and payday loans typically carry some of the highest interest rates, making repayment increasingly difficult if balances are not reduced quickly.

– Unsecured debt: Debts without collateral, such as personal loans or medical debt, place all repayment responsibility on the borrower’s ability to maintain cash flow, a challenge during job loss or medical emergencies.

– Subprime mortgage debt: Mortgages acquired with lower credit scores or minimal down payments face sooner risk of default, especially if property values decline or adjustable rates rise unexpectedly (Federal Reserve, 2023, https://www.federalreserve.gov).

– Private student loans: Compared to federal student loans, private options may have fewer repayment protections, adding risk if borrowers face unemployment or underemployment.

– Business debt: In cash-intensive industries, volatile revenue can make it harder for small businesses to meet monthly obligations.

Key triggers that may push borrowers toward default include:

– Rising debt-to-income ratio: When total monthly debts consume a growing share of income, repayment becomes less sustainable.

– Missed or late payments: Frequently missing due dates for credit card debt, auto loans, or mortgage debt is a common early warning sign.

– Use of debt relief options: Relying on debt consolidation, debt settlement, or payday loans often signals escalating problems rather than a sustainable solution.

– Increased interaction with debt collectors: Multiple contacts from debt collection agencies typically indicate accounts are at risk of charge-off or bankruptcy.

– Rapid debt accumulation: Taking on new personal debt to cover old obligations, especially through cash advances or new credit cards, can lead to a cycle of borrowing that makes default nearly inevitable.

Additional warning signs include plunging credit scores, denied applications for debt refinancing or loan forgiveness, and resorting to credit counseling or debt negotiation as emergency relief. Significant changes in financial circumstances, such as major medical bills or sudden unemployment, also heighten risk.

To distinguish between good debt (investments with potential returns, like student loans or business loans) and bad debt (high-interest revolving balances, payday loans), consider its cost, purpose, and repayment terms. High-risk debts are often bad debt—expensive, unproductive, and difficult to escape—requiring aggressive debt management strategies, such as the debt snowball or debt avalanche method, to mitigate default risk.

References

Federal Reserve. (2023). Economic Well-Being of U.S. Households in 2023. https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households.htm

3. Strategies for Reducing Debt Defaults: Debt Consolidation, Settlement, and Relief Solutions

Reducing the risk of debt defaults requires a clear strategy that addresses specific types of personal debt and business debt. Individuals and organizations can use a variety of debt management solutions to prevent falling behind on payments or facing aggressive debt collection efforts. Three of the most effective strategies are debt consolidation, debt settlement, and debt relief programs. Each approach addresses a range of obligations, including high-interest debt like credit card debt, student loans, auto loans, mortgage debt, and medical debt.

Debt consolidation involves combining multiple debts into a single loan with a lower, fixed interest rate. This process can simplify monthly payments and often results in lower total interest costs over time. For example, consolidating several unsecured debts—such as credit card debt and payday loans—can improve your debt-to-income ratio and make it easier to manage debt repayment. Debt consolidation loans work best for those with good credit, as this can help secure more favorable terms and minimize financial stress.

Debt settlement is a debt negotiation process where a borrower works with creditors to agree on a lump-sum payment that is less than the total owed. This strategy can significantly reduce the balance on unsecured debt, like medical bills or credit cards, but may negatively impact credit scores in the short term. Reputable debt settlement companies can help facilitate negotiations, but it is important to verify their legitimacy to avoid scams.

Debt relief solutions encompass a wider range of programs tailored to individual needs. These may include credit counseling, where certified counselors help develop a realistic debt repayment plan, and structured programs such as the debt snowball method or the debt avalanche method. In some cases, debt relief might involve debt refinancing, which replaces high-interest debt with a more manageable loan, or even loan forgiveness options for certain types of student loans. For individuals facing overwhelming financial hardship, bankruptcy might be the final measure. Though often seen as a last resort, bankruptcy can eliminate or restructure both secured debt and unsecured debt, providing a path to a fresh start.

Selecting the most suitable debt strategies should depend on the type and amount of debts, your financial situation, and your long-term goals. Good debt management practices not only reduce the likelihood of default but also help distinguish between good debt and bad debt, encouraging responsible borrowing and repayment. By proactively applying proven debt solutions and seeking professional advice when needed, individuals and businesses can better navigate challenges and achieve long-term financial stability.

Effectively navigating today's complex debt landscape requires awareness, proactive management, and informed decision-making. As personal debt levels—including credit card debt, student loans, mortgage debt, auto loans, and medical debt—continue to rise, understanding the triggers of debt defaults becomes increasingly vital for individuals and businesses alike. High-interest debt, payday loans, and unsecured debt can quickly escalate financial stress, making timely recognition of warning signs essential.

Fortunately, multiple debt strategies can help mitigate the risk of default. Options such as debt consolidation, debt settlement, debt refinancing, credit counseling, and structured repayment plans—like the debt snowball method or debt avalanche method—offer tailored solutions for regaining control. For those facing overwhelming financial obligations, exploring debt relief programs or loan forgiveness may be viable paths to stability, while keeping a close eye on debt-to-income ratio will support healthier long-term outcomes.

Ultimately, managing debts is not just about payments—it's about understanding the difference between good debt and bad debt, negotiating with lenders, and employing strategic debt management techniques. By employing these tools and remaining vigilant to emerging trends in defaults, individuals and businesses can reduce their vulnerability to bankruptcy and debt collection actions, build greater resilience, and move toward lasting financial well-being.

References

[Add full APA-style citations here based on article sources]