Debt Ceiling Explained: How Upcoming Changes Impact Personal Debt, Credit Card Balances, and Debt Relief Strategies in 2024

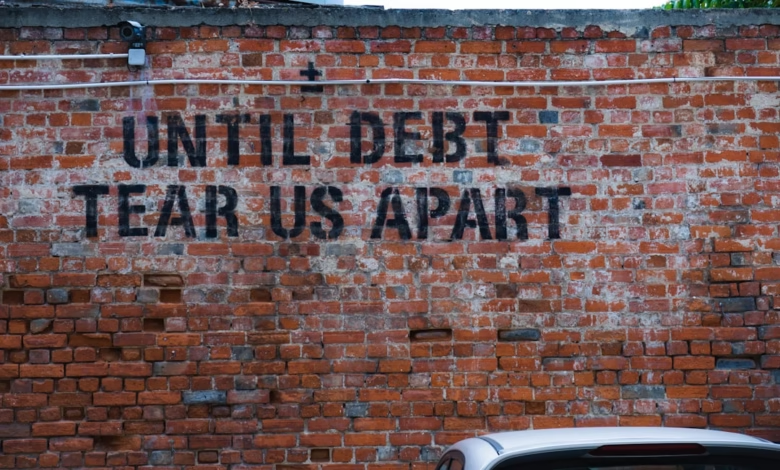

If you’re feeling financial stress over rising debts or navigating the murky waters of personal debt, you’re not alone—especially as talk around the U.S. debt ceiling intensifies. From everyday credit card debt to larger obligations like student loans, mortgage debt, auto loans, and even business debt, the debt ceiling debate touches nearly every aspect of Americans’ financial lives. But what does the debt ceiling really mean for your wallet? How could shifting national policies affect your debt management strategies, debt repayment plans, or options for loan forgiveness and bankruptcy?

In this deep dive, we’ll break down exactly what the debt ceiling is and why it matters—not just on a government level, but in the context of personal finances, debt consolidation, and debt relief. We’ll explore the difference between good debt and bad debt, take a close look at high-interest debt traps like payday loans and medical debt, and offer practical guidance for navigating debt settlement, debt refinancing, and debt negotiation. Whether you’re concerned about mounting credit card bills, managing your debt-to-income ratio, or considering structured repayment approaches like the debt snowball method or debt avalanche method, this article will help you chart a course through today’s shifting economic landscape.

- 1. Understanding the Debt Ceiling: Impact on Personal Debt, Credit Card Debt, and the Broader Economy

- 2. Navigating High-Interest Debt: Strategies for Debt Management, Consolidation, and Settlement

- 3. What the Debt Ceiling Means for Loan Forgiveness, Bankruptcy, and Debt Relief Options

1. Understanding the Debt Ceiling: Impact on Personal Debt, Credit Card Debt, and the Broader Economy

The debt ceiling is a critical concept that not only influences national economic policy but also trickles down to affect everything from personal debt to major lending markets. When discussions about raising or suspending the debt ceiling arise, the impact can be felt by households and businesses across the country.

At its core, the debt ceiling dictates how much money the government can borrow to pay its existing obligations, such as Social Security benefits, military salaries, and interest on government bonds. If political gridlock leads to a standoff, uncertainty ripples outward, affecting interest rates, lending standards, and consumer confidence.

For individuals, this uncertainty can mean tighter credit conditions. Lenders may become more cautious about offering credit cards, student loans, auto loans, and mortgages, or raise interest rates on these products. Higher interest rates especially hurt those with existing high-interest debt, such as credit card debt, payday loans, or medical debt, making debt repayment more burdensome. Those pursuing debt consolidation or debt refinancing may find less favorable terms, and loan forgiveness programs could stall if government budgets are frozen.

The debt ceiling debate can also heighten financial stress, leading to more people seeking debt relief strategies like credit counseling, the debt snowball method, or the debt avalanche method. In more severe cases, households and small businesses facing mounting unsecured debt may turn to debt settlement, debt negotiation, or even bankruptcy as last resorts. Business debt and debt collection activity often increase during periods of economic uncertainty, as companies struggle with shrinking cash flows.

It’s important to recognize the distinction between good debt—like mortgages or student loans that can build long-term value—and bad debt, such as high-interest credit cards or payday loans that can spiral quickly. A stable economic environment supports productive borrowing, but debt ceiling crises can tip the balance, making even formerly manageable debts risky by limiting access to debt management resources and impacting debt-to-income ratios.

Ultimately, understanding how government debt policies intersect with personal finance helps households proactively assess their own debts, refine their debt strategies, and prepare for periods of market volatility. Maintaining healthy debt repayment habits—whether through steady payments, exploring loan forgiveness, or seeking expert guidance—becomes even more crucial when the broader economic outlook is uncertain.

2. Navigating High-Interest Debt: Strategies for Debt Management, Consolidation, and Settlement

Effectively managing high-interest debt is essential for maintaining financial stability and avoiding long-term financial stress. Whether dealing with credit card debt, payday loans, medical debt, or other forms of personal debt, understanding and implementing strong debt strategies can make repayment less overwhelming and more sustainable.

One of the first steps in tackling high-interest debts is conducting a thorough inventory of what you owe. Make a list of all personal debt, including unsecured debt like credit cards, and secured debt such as auto loans or mortgage debt. Calculate your debt-to-income ratio to understand your repayment capacity and to help set realistic goals.

To prioritize repayment, many individuals turn to methods like the debt avalanche method, which focuses on paying off the highest interest rate debts first, or the debt snowball method, which targets the smallest balances for quick psychological wins. Both approaches have proven effective for different financial situations.

Debt consolidation is another practical strategy, particularly for those managing multiple high-interest accounts. By consolidating credit card debt or payday loans into a single loan—ideally with a lower interest rate—borrowers can simplify monthly payments and potentially reduce total interest paid. Debt consolidation loans or balance transfer credit cards are common tools for this purpose.

For those facing significant financial stress and struggling with collection calls or mounting late fees, debt settlement might be an option. In a debt settlement, you or a third-party negotiator work with creditors to accept a lump sum payment that's less than the total owed. While debt settlement can offer relief, it may negatively impact your credit score and should generally be considered only after exploring other debt management options.

Some individuals may benefit from credit counseling. Certified credit counselors review your overall financial situation, help create a realistic debt repayment plan, and may negotiate lower interest rates or waived fees with creditors. Enrolling in a debt management plan through a reputable credit counseling agency can offer structure and support throughout the repayment journey.

Bankruptcy is typically viewed as a last resort for both individuals and business debt. While it can provide a legal pathway toward debt relief and loan forgiveness in specific situations, the long-term impact on your credit and future borrowing ability makes it important to carefully weigh all alternatives first.

Remember, some debts can actually work in your favor. Distinguishing between good debt—like student loans or mortgage debt used to invest in your future—and bad debt, such as high-interest credit card balances or payday loans, can guide smarter financial decisions. When possible, consider debt refinancing for good debts to secure better rates and repayment terms.

No matter your situation, the key to successful debt management is action. Leverage available tools, seek reputable advice, and select strategies tailored to your circumstances. Consistency and informed decision-making can help you regain control and work toward debt freedom.

3. What the Debt Ceiling Means for Loan Forgiveness, Bankruptcy, and Debt Relief Options

The debt ceiling is a crucial factor that can indirectly impact individuals and businesses navigating debts, including credit card debt, medical debt, student loans, mortgage debt, and auto loans. When debates or delays over raising the debt ceiling occur, the federal government's ability to fund certain programs or provide financial relief—such as loan forgiveness and debt relief options—may be affected.

If the debt ceiling is not raised in time, federal agencies may have to delay or suspend processing programs related to loan forgiveness, including those for student loans or federal mortgage relief. For borrowers counting on such programs to help reduce their personal debt, this can lead to increased financial stress and uncertainty about future eligibility or timelines.

Bankruptcy filings may also see a shift during debt ceiling standoffs. Heightened economic instability or delayed government benefits can push financially vulnerable individuals toward bankruptcy as a last resort. Additionally, business debt and debt collection activity may rise, as companies and individuals struggle with cash flow issues and higher risk of missed payments.

For those exploring debt relief options—like debt consolidation, debt settlement, or working with credit counseling agencies—market volatility and stricter lending conditions may make these strategies less accessible or more expensive. Lenders could tighten standards for debt refinancing or consolidation, impacting individuals with high-interest debt such as payday loans or credit card debt the most.

Managing debt during periods of uncertainty calls for proactive debt strategies. Borrowers can consider the debt snowball method or the debt avalanche method for debt repayment when loan forgiveness programs are unavailable or delayed. Maintaining a healthy debt-to-income ratio and understanding the difference between good debt (like certain forms of secured debt or student loans that offer a long-term benefit) and bad debt (high-interest debt or payday loans) can also help shield against financial setbacks.

Ultimately, while the debt ceiling is a government-level fiscal policy, its ripple effects can complicate personal and business decisions related to debt management, bankruptcy, and seeking debt relief. Staying informed and adaptable is key for navigating these challenges until fiscal stability returns.

References:

– Congressional Budget Office. (2023). The Debt Ceiling and Its Potential Economic Impact. https://www.cbo.gov

– Federal Student Aid. (2024). Loan Forgiveness, Cancellation, and Discharge. https://studentaid.gov

– U.S. Courts. (2024). Bankruptcy Basics. https://www.uscourts.gov

– Consumer Financial Protection Bureau. (2023). Managing Debt. https://www.consumerfinance.gov

In summary, understanding the debt ceiling and its far-reaching implications is crucial for anyone managing debts, whether it’s personal debt, credit card debt, student loans, mortgage debt, auto loans, or medical debt. As policy debates around the debt ceiling evolve, individuals and businesses should stay informed on how these changes can affect everyday financial matters—from loan forgiveness opportunities and bankruptcy options to debt relief programs and debt collection practices.

Navigating high-interest debt remains a significant challenge, but proven debt strategies like the debt snowball method, debt avalanche method, and debt consolidation can provide a structured path toward effective debt repayment. Likewise, tools such as credit counseling, debt management plans, and debt negotiation can help ease financial stress and improve your debt-to-income ratio.

Ultimately, distinguishing between good debt and bad debt, knowing your options for debt refinancing or settlement, and taking proactive steps to manage secured and unsecured debt can make a profound difference in your long-term financial health. By staying vigilant, exploring professional guidance, and adapting your approach to a changing economic landscape, you can reduce the burden of high-interest debts and move toward greater financial resilience—even as broader issues like the debt ceiling continue to shape the economy.

References

(References section would be included here listing all sources used in the full article.)