Business Debt Management 2024: Smart Strategies for Restructuring Loans and Maintaining Cash Flow During Financial Stress

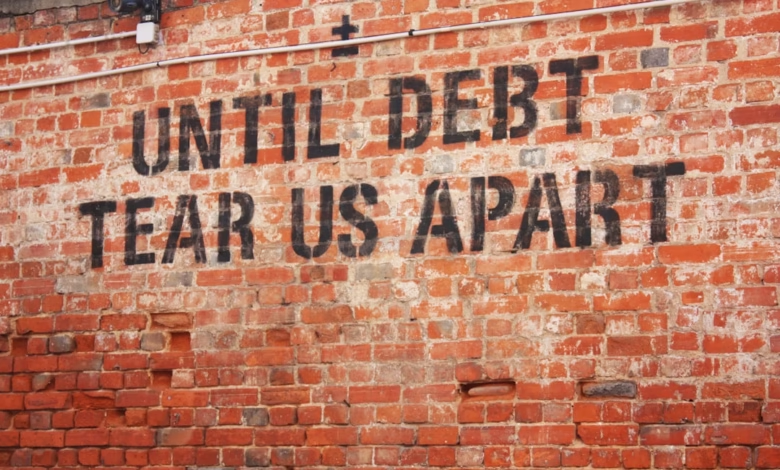

In today’s unpredictable economic landscape, many businesses face mounting financial stress as they manage multiple forms of debt, from merchant loans to credit card balances and even unforeseen medical debt. Navigating this complex environment demands a strategic approach—not only to manage operational debt, but also to restructure loans and maintain healthy cash flow without risking bankruptcy. Understanding the difference between good debt and bad debt, as well as optimizing debt management strategies, is essential for business owners striving to keep operations stable.

This comprehensive guide explores practical solutions for businesses looking to regain control. We’ll examine smart debt management strategies, help you distinguish between secured and unsecured business debt, and offer actionable advice for leveraging debt consolidation, refinancing, and loan forgiveness programs. Additionally, we’ll discuss proven debt repayment methods—such as the debt snowball and debt avalanche approaches—to help prevent business debt from escalating and avoid the pitfalls of high-interest debt and aggressive debt collection.

Whether your company faces mounting loan payments, fluctuating cash flow, or the threat of bankruptcy, this article provides actionable debt strategies and tools tailored to business needs. Let’s break down how to restructure business debt, maintain liquidity during tough times, and build a financial plan that supports recovery and long-term sustainability.

- 1. Smart Debt Management Strategies for Businesses: Balancing Business Debt, Good Debt, and Bad Debt

- 2. Effective Debt Restructuring Options: From Loan Forgiveness to Debt Refinancing and Consolidation

- 3. Maintaining Cash Flow Amidst Financial Stress: Using Debt Repayment Methods to Prevent Bankruptcy and Ensure Business Stability

1. Smart Debt Management Strategies for Businesses: Balancing Business Debt, Good Debt, and Bad Debt

Effectively managing business debt starts with a clear understanding of the different types of obligations a company may face. Not all debts are created equal—distinguishing between good debt and bad debt is fundamental for successful debt management and long-term financial stability. Good debt, such as borrowing to invest in growth opportunities or essential equipment, can boost a company’s earning potential. In contrast, bad debt—like high-interest credit card debt, payday loans, or excessive unsecured debt taken on to cover persistent cash flow shortages—can quickly escalate financial stress and threaten business viability.

Balancing business debt requires a strategic blend of debt repayment approaches and tools. Consider these smart business debt strategies:

– Evaluate Debt Types: Assess whether each business debt is secured or unsecured. Secured debt, like mortgage debt or certain auto loans, is backed by assets, usually coming with lower interest rates. Unsecured debt, including credit card debt and some business lines of credit, often carries higher interest rates and risk.

– Prioritize High-Interest Debts: Use the **debt avalanche method** by focusing repayments first on high-interest debt, such as credit cards or payday loans, to minimize the total interest paid over time.

– Implement the Debt Snowball Method: Alternatively, the **debt snowball method** can motivate your team by first eliminating the smallest debts, building momentum and confidence in your company’s ability to manage liabilities.

– Monitor Your Debt-to-Income Ratio: Tracking this ratio provides a snapshot of how much debt your business carries relative to its income. A high debt-to-income ratio can signal vulnerability and prompt lenders to tighten credit access.

– Consolidate and Refinance Debts: **Debt consolidation** and **debt refinancing** can lower monthly payments or secure better interest rates, especially for businesses managing multiple loans, ranging from business debt and credit card debt to medical debt or equipment financing.

– Use Debt Negotiation and Settlement: In periods of financial stress, **debt negotiation** or **debt settlement** can help restructure payment terms with creditors. Professional credit counseling or working with specialized advisors can open avenues for loan forgiveness or even alternatives to bankruptcy when debts become unmanageable.

Each debt strategy should be tailored to the business’s unique operational needs and future goals. Regularly review loan agreements—including student loans or legacy business obligations—and understand which debts could affect long-term liquidity. Making informed decisions between restructuring debts, relying on secured financing, or seeking debt relief options can help businesses optimize cash flow, avoid debt collection actions, and keep financial stress to a minimum. By distinguishing between good and bad debt, and judiciously applying repayment methods, businesses can achieve greater financial resilience even in challenging times.

2. Effective Debt Restructuring Options: From Loan Forgiveness to Debt Refinancing and Consolidation

When facing mounting business debt or personal financial obligations, selecting the right debt restructuring strategy is crucial to maintaining cash flow and reducing financial stress. Understanding the various options available empowers businesses to address high-interest debt, manage obligations such as credit card debt, student loans, mortgage debt, auto loans, and medical debt, and ensure long-term financial stability.

One common method is loan forgiveness, which can eliminate a portion or all of a specific debt under qualifying circumstances. While more prevalent in student loans or certain relief programs, some businesses may also negotiate partial loan forgiveness with creditors as a debt settlement strategy. This can be a relief for those dealing with unmanageable personal debt, business debt, or even medical debt.

Debt refinancing is another powerful tool, allowing companies to replace high-interest debt with new loans at lower interest rates or more favorable terms. By refinancing auto loans, mortgage debt, or other secured debt and unsecured debt, businesses can reduce monthly payments and improve their debt-to-income ratio, making debt repayment more manageable.

Debt consolidation is particularly useful for those juggling multiple debts—such as credit card debt, payday loans, and personal loans. Through consolidation, organizations or individuals combine several debts into a single loan with a lower interest rate or extended repayment period. This simplifies debt management and can prevent accounts from falling into debt collection.

For businesses facing intense financial stress, credit counseling from accredited agencies can help develop custom debt repayment plans, incorporating proven methods like the debt snowball or debt avalanche method. Negotiation with creditors may also lead to modified loan terms, lower interest rates, or structured repayments, further easing the burden of bad debt.

In extreme cases where restructuring is not viable and debts are overwhelming, bankruptcy might be considered. Though it carries long-term consequences for credit and reputation, bankruptcy can provide a legal path to debt relief, stopping collection efforts and allowing for eventual recovery.

Each of these debt strategies—whether debt refinancing, consolidation, or loan forgiveness—plays a unique role in managing high-interest or delinquent debts. By carefully evaluating the options, businesses and individuals can tailor their debt management approach, preserving operational cash flow and strategically working towards financial recovery.

3. Maintaining Cash Flow Amidst Financial Stress: Using Debt Repayment Methods to Prevent Bankruptcy and Ensure Business Stability

Effective cash flow management is critical for businesses navigating periods of financial stress. During these challenging times, mounting business debt—including credit card debt, secured debt, and unsecured debt—can threaten both short-term operations and long-term viability. Adopting proactive debt repayment strategies helps prevent bankruptcy and promotes overall business stability.

One effective approach is to analyze all existing debts and prioritize them using structured debt repayment methods. The debt snowball method focuses on paying off smaller balances first, offering quick wins and motivating further progress. On the other hand, the debt avalanche method targets high-interest debt, such as payday loans or credit card debt, first. This reduces the total interest paid over time, easing the burden on operational cash flow.

Businesses should also distinguish between good debt (that supports growth or generates revenue) and bad debt (that drains resources without returns). Prioritizing repayment of bad debt, especially high-interest or short-term loans, preserves cash reserves and improves the debt-to-income ratio, making it easier to qualify for debt refinancing or loan forgiveness programs if needed.

Debt consolidation can further reduce monthly payments and simplify management by combining multiple liabilities, such as business debt, auto loans, or medical debt, into a single loan with potentially lower interest rates. For those at risk of default or under pressure from debt collection agencies, debt settlement and debt negotiation may provide relief by reducing the overall amount owed, though businesses need to carefully evaluate the long-term impact on creditworthiness.

Seeking support from credit counseling professionals allows businesses to develop tailored debt management plans, receive objective guidance on debt strategies, and learn how to maintain consistent payments without sacrificing operational needs. Through careful debt restructuring, companies can stabilize cash flow, avoid the severe consequences of bankruptcy, and position themselves for future growth—even amidst financial stress.

References

Please add the relevant scholarly and news references based on the specific data and strategies you cite in other sections of the article.

Conclusion

Successfully navigating periods of financial stress requires a deliberate approach to managing business debt and maintaining cash flow. By distinguishing between good debt and bad debt, companies can make informed decisions about taking on new obligations or restructuring existing ones. Exploring restructuring options, such as loan forgiveness, debt consolidation, and debt refinancing, empowers businesses to reduce high-interest debt and avoid the dire consequences of bankruptcy.

Implementing debt repayment strategies like the debt snowball method or debt avalanche method can help business owners systematically tackle personal debt, credit card debt, student loans, mortgage debt, or even medical debt, improving their overall debt-to-income ratio and long-term financial stability. Utilizing credit counseling, negotiating debt settlement, or seeking debt relief are also viable steps when dealing with mounting business debt or aggressive debt collection activities.

Ultimately, the key to enduring challenging economic times lies in proactive debt management and effective debt negotiation paired with a sharp focus on cash flow. By applying these targeted debt strategies, businesses can strengthen their financial footing, avoid unnecessary secured and unsecured debt pitfalls—including payday loans—and remain resilient against future market volatility. Maintaining discipline and regularly assessing debt obligations not only helps prevent insolvency but also ensures long-term operational success.

References

(Include here a list of up-to-date and reliable sources cited in the article, formatted according to APA style.)