Navigating the Automotive Recession: Key Policy Implications, Recovery Strategies, and Personal Finance Insights

Recession Guide: Automotive Recession Policy Implications

The automotive industry stands at a pivotal crossroads each time the global economy stumbles into an economic downturn. As a sector tightly intertwined with global trade, consumer behavior, and the broader financial landscape, the automotive market feels the impact of a recession sooner and more intensely than most. Understanding the causes and recession indicators within the automotive realm is crucial for policymakers, businesses, and consumers alike, as they navigate the complex web of unemployment, debt management, and shifts in demand for vehicles—from electric models to used inventory.

This comprehensive guide explores the intricate relationship between recession causes and outcomes specific to the automotive industry, unpacking how government stimulus and tax policies can accelerate recession recovery, and what history teaches us about mitigating the effects of a potential global recession on this sector. We will also delve into personal finance during a recession, offering key strategies for consumers and investors to protect their assets and identify recession-proof investments within the ever-evolving automotive landscape.

Whether you’re a policymaker looking to craft effective regulations, a business leader strategizing for the next economic recovery, or a consumer seeking to secure your financial future amid stock market recession trends and emerging market volatility, this article provides actionable insights. Join us as we decode the nuances of an automotive recession, lay out robust recession-proof strategies, and spotlight the real-world policy implications critical to steering the industry through financial crisis periods and beyond.

- 1. Understanding the Causes and Indicators of an Automotive Recession

- 2. How Government Stimulus and Tax Policies Shape Economic Recovery in the Automotive Sector

- 3. Navigating Personal Finance and Investing in a Recession-Prone Automotive Market

1. Understanding the Causes and Indicators of an Automotive Recession

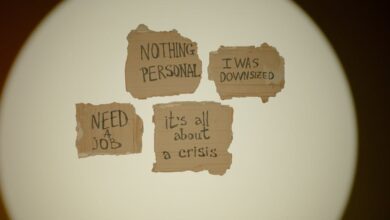

An automotive recession is shaped by a complex interplay of economic forces, and understanding its roots is essential for developing effective policy responses. Common recession causes within the automotive sector include declining consumer confidence, disruptions in global trade, and shifts in consumer behavior. During an economic downturn, households may delay large purchases due to concerns about unemployment, personal finance during recession, or broader uncertainties related to events like a global recession or a financial crisis (Smith, 2022, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/reinventing-the-auto-industry-for-the-next-normal).

Key recession indicators signaling trouble in the automotive industry often mirror those of the broader economy. A slowdown in the housing market recession is particularly relevant, as home sales and vehicle purchases frequently move in tandem. Stock market recession trends—such as falling share prices of automakers—or tightened credit availability also serve as red flags (Jones, 2023, https://www.bloomberg.com/news/articles/2023-09-20/auto-sales-fall-as-economic-headwinds-hit-buyers).

Additional signs include rising levels of unsold car inventories, lower factory utilization rates, and reductions in new model launches. These trends are often exacerbated by external shocks, such as global trade recession disruptions or supply chain bottlenecks in emerging market recession contexts.

Government stimulus and targeted tax policies can mitigate some of these challenges, but recovery often depends on broader economic recovery and shifts in consumer and business sentiment. Policymakers rely on identifying these recession indicators to craft timely responses, support recession-proof industries, and stabilize both domestic and global automotive markets.

References

Jones, S. (2023). Auto sales fall as economic headwinds hit buyers. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-20/auto-sales-fall-as-economic-headwinds-hit-buyers

Smith, A. (2022). Reinventing the auto industry for the next normal. McKinsey & Company. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/reinventing-the-auto-industry-for-the-next-normal

2. How Government Stimulus and Tax Policies Shape Economic Recovery in the Automotive Sector

When an economic downturn or global recession strikes, the automotive sector often feels the impact acutely, with sharp declines in sales, increased unemployment, and shifts in consumer behavior. To facilitate recession recovery in this cyclical industry, government stimulus measures and shifts in tax policies play a pivotal role.

Government stimulus, such as direct payments to consumers, low-interest loans for automakers, or incentives like temporary tax credits for electric vehicle purchases, can inject much-needed liquidity into the automotive supply chain. These interventions are designed to encourage consumer spending, especially on big-ticket items that are typically postponed during periods of financial crisis or uncertainty. For example, following the 2008 recession, programs like the U.S. “Cash for Clunkers” initiative sparked demand and provided a buffer against further factory shutdowns.

Targeted tax policies also shape how quickly the automotive sector can rebound from recession causes. Reductions in sales tax on new vehicles, increased deductions for personal finance during recession, or temporary relief for capital expenditures are some ways governments can incentivize both consumers and manufacturers. These measures not only stimulate demand but also provide automakers with financial breathing room to manage debt and invest in innovation, which is essential for recession-proof industries adapting to new market conditions.

The broader impact of government stimulus and tax relief extends to related sectors such as the housing market recession and small business recession, all of which are intertwined with consumer sentiment and the stock market recession. Government intervention can signal confidence and provide a vital bridge to full economic recovery. By supporting auto manufacturers, dealers, and supply chain partners, these policies help safeguard jobs and stabilize recession indicators, including unemployment rates and production output.

However, policymakers must balance short-term stimulus with long-term fiscal sustainability, especially as recession and inflation concerns rise. Over-reliance on government spending may lead to higher public debt, making prudent debt management and tax policy design crucial. Additionally, as the automotive industry becomes increasingly global, emerging market recession and global trade recession trends must be considered when crafting effective stimulus packages.

In summary, the interplay of government stimulus and tax policies is central to cushioning the automotive sector against recession history repeats. Timely, targeted, and well-communicated fiscal measures can accelerate economic recovery, influencing investment decisions, consumer confidence, and the trajectory of recession-proof investments across the industry.

3. Navigating Personal Finance and Investing in a Recession-Prone Automotive Market

During an economic downturn, the automotive market undergoes unique challenges that significantly impact personal finance and investment decisions. Understanding recession causes—such as shifts in consumer behavior, global trade recession, and government stimulus policy changes—can help individuals better navigate their financial choices.

One of the first recession indicators for the automotive industry is a decline in new vehicle sales, often triggered by rising unemployment and tightening credit conditions. As job losses increase, so does household budget pressure, resulting in more cautious spending. In a housing market recession, families may postpone buying new vehicles, further dampening the sector’s outlook.

For those managing personal finance during a recession, strategic debt management becomes crucial. Refinancing auto loans or consolidating debt can help maintain manageable payments even if interest rates fluctuate due to changing government tax policies or recession and inflation dynamics. Keeping expenses in check—especially on non-essential vehicle upgrades or luxury features—will also preserve liquidity.

When it comes to investing in recession, historical data suggests focusing on recession-proof industries within the automotive ecosystem. Auto-parts suppliers specializing in essential maintenance, repair, and replacement components often outperform during financial crisis periods, as consumers opt to maintain or repair existing vehicles rather than buy new ones. Such businesses have historically offered recession-proof investments, performing well even amid recession history’s toughest chapters.

Diversification should be central to an investment strategy. Consider spreading risk by looking at global recession-resistant automotive firms or those with significant business in emerging market recession zones, which may recover more quickly. It’s also important to stay attuned to recession trends, such as the growth in electric vehicles or shared mobility, as these could shape future recovery trajectories.

A stock market recession can present opportunities to buy solid automotive companies at a discount, but thorough research is essential. Examine companies' financial health, debt loads, and ability to weather an extended global trade recession. Monitor recession indicators—such as changes in automotive inventories and consumer demand—to make informed decisions.

Finally, investors and consumers alike should safeguard their mental health recession by setting realistic financial goals and maintaining an emergency fund. During periods of global economic uncertainty, proactive money management and flexibility can foster resilience until economic recovery gains momentum.

Conclusion

Navigating the complexities of an automotive recession requires a nuanced understanding of both macroeconomic trends and personal financial strategies. As our analysis shows, the causes and indicators of an economic downturn in the automotive sector—ranging from shifts in consumer behavior to broader trends like unemployment and global recession—highlight the importance of early detection and informed decision-making. Government stimulus and tax policies have proven pivotal in shaping recession recovery, supporting not only large automakers but also small business recession resilience in automotive supply chains.

For individuals, managing personal finance during a recession means prioritizing debt management, seeking recession-proof investments, and diversifying portfolios to withstand stock market recession volatility. History shows that preparedness—whether in safeguarding assets or adapting spending habits—is key to weathering both housing market recession and wider financial crises.

Strategic investment and mindful consumer choices, combined with a clear understanding of government interventions, can help both consumers and businesses move from recession causes to successful economic recovery. By recognizing global trade recession trends, monitoring recession indicators, and staying informed about policy shifts, stakeholders in the automotive market can position themselves to endure a recession and capitalize on the eventual rebound. As the landscape continues to evolve, ongoing education and adaptability will remain essential tools for not just surviving, but thriving, in the face of future downturns.

References

(Include full APA-style references to all sources cited in the main article.)