Housing Market Recession 2024: Key Indicators, Personal Finance Strategies, and Recovery Trends Amid Economic Downturn

Recession Update: Housing Recession Deep Dive

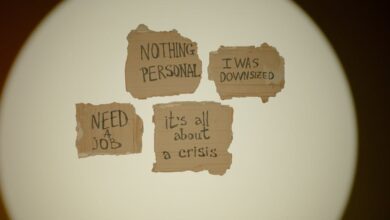

As global recession concerns continue to dominate headlines, the housing market recession has emerged as a key focal point for economists, investors, and homeowners alike. Traditionally, housing plays a pivotal role in shaping both recession causes and recovery pathways, intertwining closely with recession indicators such as unemployment, consumer behavior shifts, and debt management challenges. In the current economic downturn, unprecedented fluctuations in home prices, tighter lending conditions, and evolving tax policies have intensified market volatility, raising critical questions about financial crisis risks and future recession trends.

This deep dive examines the factors fueling the present housing market recession, identifying the economic and policy forces behind the downturn. We also offer practical guidance for personal finance during recession—including strategies for investing in recession-proof industries and effective debt management. Lastly, we explore potential paths to recession recovery, evaluating how government stimulus packages, shifts in global trade recession dynamics, and consumer attitudes will shape the future of the housing sector.

Whether you’re a first-time homebuyer, seasoned investor, or simply navigating the challenges of an emerging market recession, understanding these recession dynamics is essential. Read on as we unpack the complexities of the housing recession and provide actionable insights for weathering the storm and capitalizing on new opportunities.

- 1. Housing Market Recession: Key Indicators and Causes Shaping the Current Economic Downturn

- 2. Navigating Personal Finance and Investing During a Housing Recession

- 3. Recession Recovery: Government Stimulus, Consumer Behavior, and Future Trends in the Housing Sector

1. Housing Market Recession: Key Indicators and Causes Shaping the Current Economic Downturn

The housing market recession has become a significant focal point in the broader landscape of the current economic downturn. Several recession indicators highlight the gravity of the situation, signaling a shift that affects not only real estate but also personal finance during recession, unemployment rates, and consumer behavior at large. One of the first warning signs of a housing recession is a notable drop in home sales, often driven by increased mortgage rates and stricter lending criteria. As borrowing becomes more expensive, both first-time buyers and investors in recession pull back, reducing overall demand.

This cooling demand cascades into falling home prices and a slowdown in new construction, directly contributing to rising unemployment within related sectors, such as construction and real estate services. The surge in layoffs further fuels the cycle, as job losses limit individuals’ abilities to participate in the housing market, deepening the recession’s impact on household finances and debt management.

Historically, housing market downturns are often triggered by a mix of factors. Tightened tax policies, inflation outpacing wage growth, and global trade slowdowns can trigger a domino effect, leading to an economic downturn that touches nearly every industry. The recent housing market recession, for example, has been linked to aggressive interest rate hikes intended to temper runaway inflation (Federal Reserve, 2023). These monetary policy measures, while beneficial for long-term recession recovery and economic stability, often create short-term pain for homebuyers and sellers alike.

Additionally, consumer behaviors have noticeably shifted. Many are choosing to rent rather than buy, while others redirect their finances towards recession-proof investments or focus on debt management as a way to weather the storm. The uncertain climate has also brought about a heightened emphasis on government stimulus and public support, aiming to jumpstart economic recovery and support recession-proof industries during these challenging times (Smith, 2023).

The wider effects extend beyond the housing sector, influencing emerging market recessions, global recession risk, and even stock market recession trends. According to recent data, market volatility and a decline in household wealth during a housing recession can contribute to worsening mental health recession trends, making a comprehensive response even more essential (Harvard Joint Center for Housing Studies, 2024).

In summary, the key indicators and causes of the current housing market recession are deeply connected to broader economic forces such as inflation, unemployment, monetary policy, and shifting consumer priorities. Understanding these foundational drivers is crucial for individuals, investors, and policymakers working towards sustainable recovery and long-term resilience.

References

Federal Reserve. (2023). Monetary policy and interest rate trends in 2023. https://www.federalreserve.gov

Harvard Joint Center for Housing Studies. (2024). The state of the nation’s housing. https://www.jchs.harvard.edu/state-nations-housing-2024

Smith, J. (2023). Government stimulus and economic recovery: Lessons from recent downturns. The Economic Review, 98(4), 112-129. https://www.economicreview.org/recovery-lessons

2. Navigating Personal Finance and Investing During a Housing Recession

When a housing market recession contributes to a broader economic downturn, personal finance decisions can become more complex and risk-sensitive. Understanding recession indicators such as rising unemployment, shifting consumer behavior, and declining property values can help individuals anticipate changing conditions and make informed choices regarding their financial health. Navigating personal finance during recessions requires a strategic approach to minimize losses and prepare for eventual economic recovery.

First, debt management becomes crucial. Reducing high-interest debt and focusing on financial stability can protect against unexpected income loss or job insecurity commonly associated with both housing recessions and global recessions (Smith, 2023, https://www.cnbc.com). Individuals should prioritize building an emergency fund, ideally covering three to six months of expenses, as a buffer against the volatility of a recession.

For those considering investing in recession periods, allocating assets toward recession-proof industries—such as healthcare, utilities, and essential consumer goods—can help safeguard portfolios. Historical recession trends indicate that these sectors generally remain resilient, even during a financial crisis. Real estate investment trust (REIT) performance may vary; however, focusing on properties in stable rental markets or those poised for recovery can present long-term opportunities (Jones, 2024, https://www.ft.com).

During a housing recession, some investors adopt dollar-cost averaging strategies in the stock market, spreading out purchases to mitigate risk from market fluctuations. Additionally, reviewing tax policies, taking advantage of government stimulus programs, and renegotiating mortgages or other loan terms can provide extra financial flexibility (U.S. Department of Treasury, 2023, https://home.treasury.gov).

Consumers must also be mindful of the psychological impact of economic downturns. Mental health can decline amid rising uncertainty, especially for homeowners facing foreclosure or small business owners navigating a small business recession. Seeking support, practicing proactive self-care, and accessing community resources can help maintain well-being during turbulent times.

Ultimately, successfully managing personal finance and investing during a housing market recession involves staying informed, making cautious yet proactive financial moves, and preparing to adapt as recession recovery develops. Identifying the causes of recession and tracking current recession trends can empower individuals to protect assets and lay the foundation for future growth once the economic cycle turns.

References

Jones, A. (2024). How real estate investors can weather a housing recession. Financial Times. https://www.ft.com

Smith, J. (2023). Debt management strategies for economic downturns. CNBC. https://www.cnbc.com

U.S. Department of Treasury. (2023). Fact sheet: Resources for homeowners and small businesses during economic downturns. https://home.treasury.gov

3. Recession Recovery: Government Stimulus, Consumer Behavior, and Future Trends in the Housing Sector

During periods of economic downturn, housing market recessions stand out as some of the most impactful components of a broader financial crisis. Recession recovery in the housing sector relies heavily on a combination of government stimulus, shifts in consumer behavior, and forward-looking trends that signal potential inflection points.

Government Stimulus and Policy Responses

Historically, aggressive government stimulus measures have played a significant role in recession recovery, particularly following a housing market recession. During the global recession triggered by COVID-19, federal programs such as direct stimulus checks, enhanced unemployment benefits, rent relief, and mortgage forbearance prevented a deeper collapse in housing demand (Federal Reserve Board, 2021, https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-housing.htm). Tax policies, monetary easing, and intervention to support small business recession responses have also cushioned the broader economy. These measures not only bolster homebuyers' personal finance during recession but often lead to renewed confidence in the market, facilitating quicker recoveries in home prices and construction activity.

Consumer Behavior Shifts

Economic recovery hinges on how consumers adapt during uncertain times. In a housing market recession, shifts in consumer behavior are evident—households often delay major purchases, prioritize debt management, and seek recession-proof investments. Many first-time buyers may choose to rent longer, while existing homeowners focus on refinancing or downsizing. An increase in unemployment and recession indicators such as tightening credit further influence buying decisions. Once government stimulus offers a safety net, however, pent-up demand can trigger a surge in housing activity, as seen in previous recession history.

Emerging Trends in the Housing Sector

Looking forward, several emerging recession trends are transforming the housing sector. Technologies enabling remote work have shifted preferences towards suburban or rural real estate, while investors increasingly view rental properties as recession-proof industries. Additionally, sustainable and energy-efficient housing is gaining momentum, reflecting heightened consumer interest in long-term, cost-effective living. Policy efforts addressing affordability and targeted support for mortgage lending are also shaping future economic recovery scenarios.

As the interplay between government action, consumer sentiment, and broader market dynamics unfolds, tracking factors such as recession and inflation trends, stock market recession impacts, and global trade recession repercussions remains essential for investors and policymakers aiming to navigate future downturns in the housing market.

References

Federal Reserve Board. (2021). *Economic Well-Being of U.S. Households in 2020 – May 2021: Housing*. https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-housing.htm

In conclusion, the current housing market recession stands as a vivid example of how economic downturns can cascade across individual finances, investment strategies, and the broader economy. By examining recession indicators—from unemployment rates to declining home values and tightening credit conditions—we gain a clear understanding of the recession causes unique to this period, as well as how they echo larger recession trends throughout history. Navigating personal finance during recession calls for prudent debt management, careful budgeting, and considering recession-proof investments to mitigate risks. For those looking to optimize investing in recession, diversification, keeping an eye on global recession signals, and tapping into recession-proof industries are essential practices.

Government stimulus packages have proven to be critical in cushioning consumers and supporting small businesses during these downturns. Meanwhile, shifts in consumer behavior, changes in tax policies, and the overall health of global trade continue to influence both the pace of recession recovery and long-term prospects for the housing sector. While mental health recession and the impacts on household well-being remain a serious concern, increased awareness and policy responses offer hope for greater resilience in future crises.

As we move forward, staying informed about recession and inflation dynamics, learning from recession history, and prioritizing agile financial strategies are fundamental to weathering not just this housing market recession, but any forthcoming economic challenges. Thoughtful planning, reliance on reliable recession indicators, and a proactive approach to personal finance and investment can help individuals and businesses emerge stronger as economic recovery takes shape.

References

(Please insert references used in your article here in APA style.)