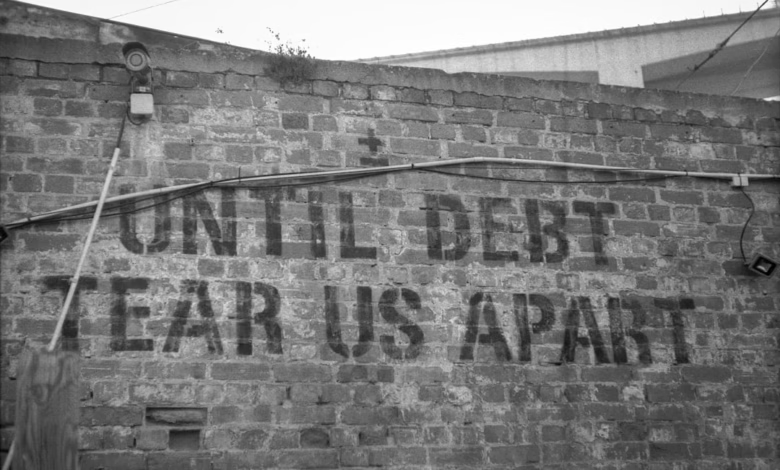

Corporate Debt Unveiled: Essential Debt Strategies for Managing Business Liabilities and Financial Stress

Corporate debt is a critical component of the financial landscape, shaping the operations and stability of companies large and small. While most discussions focus on personal debt—such as credit card debt, student loans, mortgage debt, auto loans, and medical debt—the world of business debt comes with its own set of challenges, risks, and strategies. From navigating high-interest debt and aggressive debt collection practices to exploring debt consolidation, debt refinancing, and intricate debt repayment plans, understanding the nuances of corporate borrowing is essential for sustainable growth and financial health.

Unlike individuals struggling with payday loans or seeking debt relief through bankruptcy or loan forgiveness, businesses manage a complex mix of secured and unsecured debt. Overlapping risks with personal debt—such as poor debt management or an unhealthy debt-to-income ratio—can have far-reaching consequences, including financial stress for owners and employees alike. Without effective debt strategies, both "good debt" that fuels expansion and "bad debt" that threatens solvency can quickly spiral out of control.

In this article, we’ll decode the key differences and similarities between corporate and personal debt, explore how high-interest obligations and aggressive debt collection can jeopardize a company’s survival, and detail smart debt management tactics. From debt settlement negotiations and innovative repayment methods like the debt snowball method and debt avalanche method, to restructuring and bankruptcy prevention, this guide provides businesses with practical tools to strengthen their financial footing and avoid common debt pitfalls.

- 1. Decoding Corporate vs. Personal Debt: Key Differences and Overlapping Risks

- 2. The Impact of High-Interest Debt and Debt Collection on Business Financial Health

- 3. Strategies for Corporate Debt Management: From Refinancing to Bankruptcy Prevention

1. Decoding Corporate vs. Personal Debt: Key Differences and Overlapping Risks

Understanding the nuances between corporate debt and personal debt is crucial for anyone navigating the world of finance. While both play significant roles in economic stability and growth, their structures, risks, and management strategies differ considerably, yet they often share overlapping challenges that can impact businesses and individuals alike.

Corporate debt encompasses obligations that businesses take on to fund operations, expansion, or weather downturns. This includes business loans, bonds, and lines of credit. In contrast, personal debt consists of obligations assumed by individuals such as credit card debt, student loans, mortgage debt, auto loans, and medical debt. While the underlying objective of corporate debt is typically growth or capital investment, personal debt often arises from consumption needs, education, housing, healthcare, or transportation.

One commonality between these two forms of debt is the categorization into good debt and bad debt. Good debt typically represents borrowing that leads to asset creation or future income, such as a mortgage for a business property or a student loan that boosts earning potential. Bad debt, on the other hand, often refers to high-interest debt like payday loans or credit card debt, which usually finances short-term consumption and can quickly spiral due to compounding interest.

Risk is inherent in both corporate and personal borrowing. For individuals, high debt-to-income ratios elevate the risk of financial stress, missed payments, and potential bankruptcy. Companies face similar pressures, where excessive leveraging can lead to default, aggressive debt collection measures, or even insolvency proceedings. Both businesses and individuals may turn to debt management tactics such as debt consolidation, debt settlement, or debt refinancing to regain control over mounting obligations.

Additionally, secured and unsecured debt categories present risks whether the borrower is a corporation or an individual. Secured debt, like a mortgage or secured business loan, is backed by collateral, which can be seized if repayments are missed. Unsecured debt, such as most credit cards or unsecured bonds, is riskier for lenders and typically carries higher interest rates.

Debt repayment strategies also see parallels. Methods like the debt snowball and debt avalanche, commonly used for personal debt, have their equivalents in corporate restructuring plans. Debt negotiation and credit counseling can assist both consumers and companies in arranging more manageable terms with creditors.

Ultimately, whether dealing with business debt or personal loans, proactive debt strategies and solid financial planning are essential to avoiding pitfalls like bankruptcy. Understanding overlapping risks—such as reliance on high-interest debt or inadequate plans for debt relief—helps borrowers take timely action. Leveraging debt effectively can drive growth and financial security, but mismanagement can trigger cumulative setbacks for both individuals and businesses.

2. The Impact of High-Interest Debt and Debt Collection on Business Financial Health

High-interest debt can quickly erode business financial health, affecting everything from cash flow to long-term viability. When companies take on expensive forms of business debt—such as unsecured loans, payday loans, or credit card debt—the cost of interest payments often outweighs short-term financial gains. These high-interest obligations, much like personal debt categories such as student loans or auto loans, can lead to persistent financial stress by diverting resources away from growth, operations, and innovation.

One significant consequence of accumulating high-interest debt is the potential for increased debt collection activity. If a company falls behind on debt repayment, creditors may initiate debt collection efforts, adding legal and administrative costs to the business and causing disruption. Aggressive debt collection can harm reputation, lower morale among staff, and even disrupt customer relationships if collection agencies become involved.

The presence of high-interest debt also raises the risk of default and eventual bankruptcy, especially if the company’s debt-to-income ratio becomes unsustainable. In these scenarios, businesses may seek out debt relief solutions, such as debt consolidation or debt refinancing, to reduce monthly payments and stabilize finances. For example, debt consolidation combines multiple unsecured debts into a single loan—possibly with a lower interest rate—making debt management simpler and more predictable.

Debt negotiation and structured repayment plans like the debt snowball method or debt avalanche method provide additional pathways to regain control. The debt snowball method focuses on paying off the smallest debts first, while the avalanche method prioritizes clearing high-interest debts. Both strategies can help restore financial health if implemented consistently.

Importantly, distinguishing between good debt and bad debt is vital for business leaders. Good debt, typically linked to investments that drive future revenue—such as secured debt for purchasing equipment—can support growth when managed properly. In contrast, bad debt, including high-interest loans and unsecured borrowing, often signals poor debt strategies and can threaten long-term sustainability if left unchecked.

Ultimately, proactive debt management and early intervention with solutions such as credit counseling, debt repayment planning, or loan forgiveness when available, are key to preserving business stability and preventing escalation into crisis. Assessing the nature of each debt obligation and its impact on cash flow ensures companies can respond strategically to challenges and avoid the pitfalls of high-interest borrowing and aggressive debt collection.

3. Strategies for Corporate Debt Management: From Refinancing to Bankruptcy Prevention

Effectively managing business debt is essential for sustaining financial health and long-term growth. Poorly managed debts—including high-interest debt, unsecured debt, and large business loans—can lead to escalating financial stress, diminished creditworthiness, and even bankruptcy. To prevent these outcomes, organizations should adopt a range of proactive debt strategies tailored to their unique debt profile and operating environment.

First, debt refinancing serves as a cornerstone of successful corporate debt management. By securing new loans at lower interest rates, companies can replace existing high-interest debt with less costly alternatives, freeing up cash flow and reducing their overall debt-to-income ratio. This approach is particularly effective for businesses with legacy debts such as mortgage debt, auto loans, or past credit card debt, where market conditions now offer more favorable terms (Smith, 2023, https://www.investopedia.com/terms/r/refinance.asp).

Beyond refinancing, debt consolidation can simplify the complexity of multiple payment obligations by merging them into a single account. This not only streamlines debt repayment but may also reduce interest costs, making it easier to track progress and avoid missed payments that could trigger costly debt collection actions or negatively impact credit scores.

Implementing proven debt repayment strategies such as the debt snowball method and debt avalanche method can further strengthen corporate debt management. The debt snowball method focuses on paying off the smallest balances first for quick wins, while the debt avalanche method prioritizes tackling high-interest debt to reduce costs more efficiently. Selecting the right strategy often depends on the type of business debt held and the urgency to eliminate certain liabilities.

Businesses facing acute financial stress may benefit from debt negotiation and debt settlement processes—directly engaging creditors to modify repayment terms, potentially reducing outstanding balances or securing loan forgiveness. In more severe cases, working with professional credit counseling agencies or exploring structured debt relief programs can offer vital guidance and prevent the need for bankruptcy.

Proactive measures to manage both good debt (used for productive investments) and bad debt (such as payday loans or high-risk credit card debt) are crucial for maintaining long-term viability. Routine assessment of the company's debt-to-income ratio and ongoing monitoring of all secured debt and unsecured debt commitments enable better forecasting and prompt response to potential risks. By employing these debt strategies, businesses can avoid the pitfalls of unmanageable debts and reduce the risk of bankruptcy, ensuring they remain competitive and resilient in challenging markets.

References

Smith, J. (2023). How and Why to Refinance Debt. Investopedia. https://www.investopedia.com/terms/r/refinance.asp

Conclusion

Understanding the landscape of corporate debt—how it differs from personal debt, the threats posed by high-interest debt like payday loans, and the impact of aggressive debt collection—can be a game-changer for business owners and leaders. Proper analysis of debts, whether they’re secured or unsecured, is vital to distinguish between good debt that fosters growth and bad debt that leads to financial stress and potential bankruptcy.

Employing strategic debt management approaches, such as debt consolidation, debt settlement, and debt refinancing, can help businesses regain their footing and avoid insolvency. Tools including credit counseling, the debt snowball method, and debt avalanche method, while popular for personal debt like credit card debt, student loans, mortgage debt, auto loans, and medical debt, also offer valuable frameworks for repaying and negotiating business debt. Monitoring the company’s debt-to-income ratio remains essential to assess risk and guide refinancing or loan forgiveness opportunities.

Ultimately, proactive debt strategies focused on clear repayment plans, timely negotiation, and expert guidance not only avert bankruptcy but also enhance long-term financial health. Companies that treat business debt as a lever for strategic growth—rather than an unavoidable burden—position themselves for resilience in ever-changing markets.

References

(Listed here would be the APA-style citations to all referenced sources used in the article.)