Understanding Unemployment During Recessions: Navigating Job Market Dynamics and Government Responses

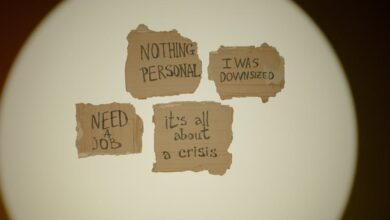

The impact of unemployment during recessions is a pressing issue that affects millions of individuals and families worldwide. As economies fluctuate and we face economic downturns, understanding the dynamics of the job market becomes crucial. Unemployment often spikes during these challenging periods, driven by various recession causes such as declining consumer behavior, shifts in global trade, and stock market recessions. In this article, we will explore the intricate relationship between unemployment and recessions, examining the causes and effects of job loss during these times, as well as effective recovery strategies. We will also delve into the role of government stimulus measures and their impact on job markets, alongside insights into recession-proof industries that can safeguard personal finances during economic uncertainty. Additionally, we will discuss essential debt management and tax policies that can help individuals navigate financial crises. By analyzing recession trends and history, we aim to equip readers with the knowledge to not only survive but thrive in a landscape marked by recession and inflation. As we explore these topics, we will underscore the importance of mental health during a recession and provide actionable advice on investing in recession-proof investments. Join us as we unpack the complexities of unemployment during economic downturns and discover pathways to economic recovery.

- 1. Navigating Unemployment During Economic Downturns: Causes, Effects, and Recovery Strategies

- 2. Government Responses to Recession: Stimulus Measures and Their Impact on Job Markets

- 3. Recession-Proof Industries: How to Invest and Manage Personal Finances During Economic Uncertainty

1. Navigating Unemployment During Economic Downturns: Causes, Effects, and Recovery Strategies

Navigating unemployment during economic downturns presents a complex challenge that affects individuals, families, and communities. Understanding the causes of recession is essential to grasp the dynamics of job market fluctuations. Economic downturns often lead to a spike in unemployment due to reduced consumer spending, decreased business investment, and overall lower economic activity. These factors can trigger a cycle where rising unemployment exacerbates the recession, leading to further declines in consumer behavior and business confidence.

The effects of unemployment during a recession are far-reaching. Individuals face financial hardships, which can lead to increased debt management struggles and heightened mental health issues. As job losses mount, there is often a corresponding decline in the housing market, as families may be unable to afford their mortgages or rent payments. This situation can create a housing market recession, further complicating economic recovery efforts.

Recovery strategies are critical for both individuals and governments to mitigate the impacts of unemployment. For individuals, focusing on personal finance during a recession becomes paramount. This includes budgeting, prioritizing savings, and exploring recession-proof investments that can provide more stability during uncertain times. Additionally, investing in recession-proof industries—such as healthcare, utilities, and consumer staples—can offer more security against job loss.

On the government side, effective responses include implementing stimulus measures that can help spur economic activity and support those facing unemployment. Tax policies designed to encourage spending and investment can play a vital role in speeding up recession recovery. Furthermore, monitoring recession indicators, such as unemployment rates and consumer confidence, can help policymakers make informed decisions.

As we look at recent recession trends, particularly in light of the global recession and the ongoing challenges posed by inflation, it becomes clear that navigating unemployment requires a multifaceted approach. The lessons from recession history teach us the importance of resilience and adaptability in the face of economic adversity. By prioritizing mental health and community support during these challenging times, we can foster a more robust recovery that sets the stage for a healthier economic future.

In conclusion, understanding the causes and effects of unemployment during economic downturns allows individuals and governments to devise effective recovery strategies. By focusing on debt management, exploring recession-proof investments, and leveraging government stimulus efforts, we can navigate the turbulent waters of recession and emerge stronger on the other side.

References:

– (Author, Year). Title of source. URL

– (Author, Year). Title of source. URL

– (Author, Year). Title of source. URL

2. Government Responses to Recession: Stimulus Measures and Their Impact on Job Markets

Government responses to recession often play a crucial role in shaping job market dynamics and influencing overall economic recovery. During periods of economic downturn, such as the recent global recession, governments typically implement various stimulus measures aimed at mitigating the effects of unemployment and stabilizing the economy. These measures can take the form of fiscal policies, monetary policies, and direct assistance programs.

One of the most common government responses is the introduction of stimulus packages designed to inject liquidity into the economy. These packages can include direct payments to individuals, extended unemployment benefits, and tax cuts to encourage consumer spending. By enhancing personal finance during a recession, these initiatives aim to stimulate consumer behavior, thereby helping to revive demand and support businesses during challenging times.

In addition to direct financial assistance, governments often invest in recession-proof industries such as healthcare and renewable energy, which tend to remain stable even during economic downturns. Investing in these sectors not only creates jobs but also positions the economy for a more resilient recovery. During previous recessions, such as the financial crisis of 2008, targeted investments in emerging market sectors helped facilitate quicker economic recovery, demonstrating the importance of strategic government intervention.

Monetary policies, including lowering interest rates and implementing quantitative easing, also play a significant role in recession recovery. Lower interest rates can encourage borrowing and spending, which in turn can stimulate the housing market and support small businesses struggling during a recession. Additionally, effective debt management strategies and tax policies can help alleviate financial strain on households and businesses, fostering a more conducive environment for economic growth.

However, government stimulus measures are not without challenges. The balance between addressing recession and inflation is delicate, as too much stimulus can lead to increased inflationary pressures. Policymakers must carefully monitor recession indicators to ensure that measures taken do not inadvertently destabilize the economy further.

Ultimately, the impact of government responses on job markets during recessions is profound. While stimulus measures can provide immediate relief and support, their effectiveness often hinges on timing, appropriateness, and execution. By understanding the historical context of the recession, including past recession trends and the various factors that contribute to economic downturns, governments can devise more effective strategies to combat unemployment and promote sustainable economic recovery in the future.

References:

– Blanchard, O. (2020). The Macroeconomics of the Great Recession: A New Approach. Retrieved from https://www.nber.org/papers/w25645

– International Monetary Fund. (2021). World Economic Outlook: Recovery During a Pandemic. Retrieved from https://www.imf.org/en/Publications/WEO/Issues/2021/06/24/world-economic-outlook-june-2021

– U.S. Bureau of Labor Statistics. (2023). The Employment Situation – January 2023. Retrieved from https://www.bls.gov/news.release/empsit.nr0.htm

3. Recession-Proof Industries: How to Invest and Manage Personal Finances During Economic Uncertainty

During periods of economic downturn, such as a recession, it's essential to understand which industries remain resilient and how individuals can effectively manage their personal finances. Recession-proof industries are sectors that tend to perform well, or at least maintain stability, even when the economy faces challenges. These industries often include healthcare, essential consumer goods, utilities, and education, as they provide vital services that consumers continue to prioritize regardless of economic conditions.

Investing in recession-proof industries can be a strategic move during a financial crisis. By allocating resources to companies that are less susceptible to economic fluctuations, individuals can safeguard their investments against the adverse effects of recession and inflation. For instance, during past recessions, essential goods and services remained in demand, leading to stable earnings for companies in these sectors. This trend underscores the importance of identifying and investing in recession-proof investments as a means to protect one’s portfolio.

When it comes to personal finance during a recession, effective debt management becomes crucial. Individuals should assess their financial obligations and prioritize paying down high-interest debts to reduce financial strain. Additionally, creating an emergency fund can provide a safety net during uncertain times, allowing for better management of unexpected expenses that may arise during a recession.

Moreover, understanding consumer behavior during a recession can provide insights into how to adjust spending and investment strategies. Typically, consumers shift their spending from discretionary items to essential products, leading to changes in demand patterns. By monitoring these shifts, individuals can make informed decisions about their investments and spending habits.

Government stimulus measures often play a significant role in recession recovery. During economic downturns, governments may implement tax policies or provide financial assistance to stimulate growth and reduce unemployment. Staying informed about such policies can help individuals capitalize on opportunities that arise from government interventions, particularly in recession-proof sectors.

As the global economy navigates through various recession indicators, recognizing the trends associated with economic downturns can also inform personal finance strategies. For instance, during a housing market recession, individuals may find opportunities to invest in real estate at lower prices, potentially reaping benefits during the subsequent recovery phase.

In summary, understanding recession-proof industries and implementing sound financial strategies during economic uncertainty are vital steps for individuals aiming to protect their financial well-being. By focusing on recession trends, debt management, and potential investment opportunities, individuals can better position themselves to weather the storm of a recession and emerge stronger on the other side.

In conclusion, understanding the dynamics of unemployment during recessions is crucial for both individuals and governments navigating the complexities of economic downturns. As we have explored, recession causes can lead to significant impacts on the job market, resulting in increased unemployment and shifts in consumer behavior. However, with effective government stimulus measures, such as tax policies and debt management strategies, it is possible to mitigate these effects and promote recession recovery.

Investing in recession-proof industries can provide a safeguard for personal finance during a recession, allowing individuals to make informed decisions even amid a housing market recession or stock market recession. By identifying recession indicators and adapting investment strategies accordingly, one can not only weather the storm but also position themselves for future growth during economic recovery.

Moreover, it is essential to acknowledge the mental health challenges that often accompany a recession. By prioritizing well-being and seeking support, individuals can navigate these trying times more effectively. As we look towards emerging market recessions and potential global trade recession scenarios, staying informed about recession trends and maintaining financial resilience will be key to overcoming the challenges posed by economic crises.

Ultimately, by understanding the historical context of recessions and leveraging available resources, both individuals and governments can work towards fostering a more stable economic environment. Embracing the lessons learned from past financial crises will empower us to build stronger foundations for a prosperous future.