Mastering Debt: Strategies for Personal Management, Economic Impact, and Financial Planning

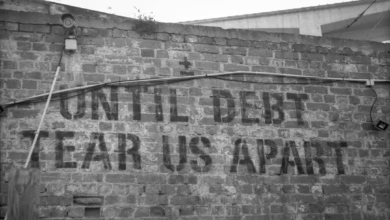

In today's fast-paced financial environment, managing and reducing personal debt has become a pressing concern for individuals and families alike. High levels of personal debt not only strain personal finances but can also hinder economic growth on a broader scale. As we delve into the complexities of debt management, this article will explore effective strategies for navigating the often daunting landscape of personal debt, including practical tips for negotiating with creditors and the invaluable role of credit counseling. Additionally, we will examine the broader economic implications of debt, such as how student loan burdens affect financial planning and how corporate debt influences stock performance. Lastly, we will touch upon how governments manage national debt and its ramifications on the economy. By understanding these interconnected issues, readers can gain insights into not only alleviating their personal financial challenges but also contributing to a healthier economic environment.

- Here are three possible section headlines for your article on managing and reducing personal debt:

- 1. **Effective Strategies for Personal Debt Management: Navigating Your Financial Landscape**

Here are three possible section headlines for your article on managing and reducing personal debt:

Managing and reducing personal debt effectively requires a combination of strategic planning, disciplined budgeting, and informed decision-making. One key approach is to create a comprehensive budget that outlines income, expenses, and debt obligations. This helps individuals identify areas where they can cut back on spending and allocate more funds toward debt repayment.

Another effective strategy is the debt snowball method, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This approach can provide psychological motivation as debts are eliminated, leading to greater momentum in tackling larger obligations. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, ultimately saving money on interest payments over time.

In addition, exploring options for consolidating debt, such as personal loans or balance transfer credit cards, can simplify repayment and potentially reduce interest rates. However, it is crucial to address underlying spending habits and ensure that additional debt does not accumulate during the repayment process.

Moreover, seeking assistance from credit counseling services can provide valuable insights and support. These organizations can offer personalized debt management plans, help negotiate better repayment terms with creditors, and educate individuals on financial literacy to prevent future debt problems. By employing these strategies, individuals can take proactive steps toward reducing their personal debt and achieving financial stability.

1. **Effective Strategies for Personal Debt Management: Navigating Your Financial Landscape**

Managing personal debt effectively is crucial for maintaining financial stability and achieving long-term goals. Here are several strategies that can help individuals navigate their financial landscape and reduce their debt burden:

1. **Create a Comprehensive Budget**: A well-structured budget is the foundation of effective debt management. By tracking income and expenses, individuals can identify areas where they can cut back and allocate more funds toward debt repayment.

2. **Prioritize Debts**: Not all debts are created equal. It’s essential to prioritize debts based on interest rates and repayment terms. The debt snowball method, which focuses on paying off the smallest debts first, can provide psychological motivation, while the debt avalanche method targets high-interest debts for cost savings.

3. **Increase Income**: Finding additional sources of income, such as part-time work or freelance opportunities, can accelerate debt repayment. Even small, consistent extra amounts can make a significant difference over time.

4. **Negotiate with Creditors**: Open communication with creditors can lead to better repayment terms. Many lenders are willing to negotiate lower interest rates, extended payment plans, or even debt settlements. Approaching them with a clear plan can facilitate these discussions.

5. **Utilize Debt Consolidation**: For those with multiple debts, consolidating them into a single loan can simplify payments and potentially lower interest rates. However, it’s vital to understand the terms and ensure that this strategy will not lead to more debt in the long run.

6. **Seek Professional Help**: Credit counseling services offer guidance and support for individuals struggling with debt. These organizations can help create a personalized debt management plan, negotiate with creditors, and provide financial education.

7. **Build an Emergency Fund**: Establishing an emergency fund can prevent the need for additional borrowing in the event of unexpected expenses. This fund should ideally cover three to six months of living expenses.

8. **Stay Informed and Educated**: Understanding personal finance concepts and staying updated on financial news can empower individuals to make informed decisions about their debt and overall financial health.

By implementing these strategies, individuals can take control of their personal debt, reduce financial stress, and work towards a more secure economic future.

Personal debt is a significant issue that affects individuals and families across various demographics. Effective strategies for managing and reducing personal debt include creating a detailed budget, which allows individuals to track their income and expenses, identify areas for cutbacks, and prioritize debt repayments. Additionally, the snowball method—where the smallest debts are paid off first—can provide psychological motivation, while the avalanche method focuses on paying off the debts with the highest interest rates first, ultimately saving money on interest.

High levels of personal debt not only impact individual financial stability but can also have broader implications for economic growth. When consumers are burdened by debt, they may reduce spending on goods and services, leading to decreased demand in the economy. This reduction can stifle business growth and employment opportunities, creating a ripple effect that can hinder overall economic progress.

Negotiating with creditors is a crucial step for those struggling with debt. Individuals can reach out to their lenders to discuss their financial situation and request better repayment terms, such as lower interest rates or extended payment plans. Many creditors are willing to work with borrowers to avoid default, especially if the debtor demonstrates a commitment to repaying the loan.

Credit counseling plays a vital role in debt management. Professional credit counselors can provide guidance on budgeting, debt repayment strategies, and financial education. They often help clients develop a debt management plan that consolidates payments into a single monthly amount, potentially at a lower interest rate, making it easier for individuals to regain control over their finances.

The concept of using debt as a tool for investment carries both risks and rewards. While leveraging debt can amplify potential returns, it also increases exposure to losses. Investors must carefully assess their risk tolerance and the potential impact of debt on their overall financial health before proceeding with this strategy.

Student loan debt poses a particular challenge for many young adults, impacting their financial planning and long-term goals, such as purchasing a home or saving for retirement. The burden of these loans can delay significant life decisions and contribute to financial stress.

Corporate debt, on the other hand, can influence stock performance. Companies with high levels of debt may face challenges in meeting their obligations, which can affect investor confidence and stock prices. Conversely, when managed effectively, corporate debt can finance growth initiatives and enhance shareholder value.

Lastly, governments face the complex task of managing national debt, balancing the need for public funding with economic implications. High national debt can lead to increased interest rates, reduced public investment, and potential inflation. However, strategic use of national debt can stimulate economic growth, particularly during downturns when public investment can help boost demand. Understanding these dynamics is essential for evaluating both personal and national financial health in the broader economic landscape.

In conclusion, managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach and an understanding of its broader economic implications. Effective debt management not only improves individual financial health but also contributes positively to overall economic growth. By employing strategies such as negotiating with creditors, seeking credit counseling, and making informed decisions about investment-related debt, individuals can take proactive steps towards financial stability. Moreover, the pervasive impact of student loan debt underscores the importance of integrating debt considerations into long-term financial planning. As we navigate the complexities of both personal and corporate debt, it becomes clear that while debt can be a useful tool for investment, it carries inherent risks that must be carefully managed. Ultimately, understanding how governments manage national debt further illustrates the interconnectedness of personal finance and macroeconomic stability. By applying these insights and strategies, individuals can better position themselves to achieve financial resilience and prosperity.