Debt Unraveled: How to Restructure Personal and Business Debts from Credit Cards to Mortgages

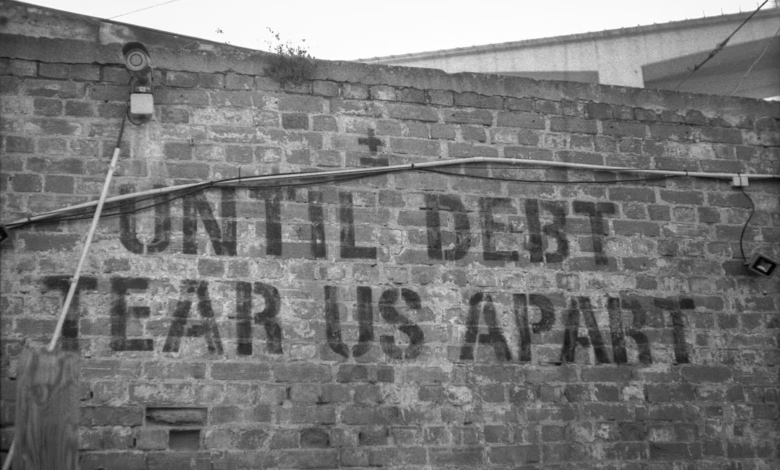

Debt can cast a long shadow over your financial well-being, whether it’s from mounting credit card debt, lingering student loans, or an ever-present mortgage payment. As personal debt and business debt levels continue to climb, understanding the different types of debts and how to manage them has never been more urgent. Many individuals face high-interest debt from payday loans, auto loans, medical debt, and unsecured debt, leading to increasing financial stress and challenges with debt repayment.

If you’re feeling overwhelmed by debt collection calls or struggling to improve your debt-to-income ratio, it may be time to consider debt restructuring. This article will break down the differences between good debt and bad debt, explain popular debt strategies like debt consolidation, debt settlement, and debt refinancing, and examine advanced debt relief options such as bankruptcy, loan forgiveness, and credit counseling. We will also discuss practical methods—like the debt snowball and debt avalanche approaches—to build a sustainable debt management plan tailored to your unique situation.

With clear explanations and actionable insights, this guide is designed to help you navigate the complexities of personal and business debt, choose the right debt negotiation strategies, and move toward a stronger financial future.

- 1. Understanding Different Types of Debts: From Credit Card Debt to Mortgages

- 2. Popular Debt Restructuring Strategies: Debt Consolidation, Settlement, and Refinancing Explained

- 3. Weighing the Benefits and Risks of Debt Relief: Bankruptcy, Loan Forgiveness, and Credit Counseling

1. Understanding Different Types of Debts: From Credit Card Debt to Mortgages

Managing debts effectively starts with understanding the various types of personal and business debt individuals and companies might face. Debt is not a one-size-fits-all concept; different loans and obligations come with varying terms, risks, and solutions. Knowing these distinctions helps shape smart debt strategies and informs decisions about debt repayment, debt consolidation, and other debt relief options.

Credit card debt is among the most common forms of personal debt in the US. It is usually unsecured debt, meaning there is no collateral backing it. As a type of high-interest debt, credit card balances can quickly snowball if not managed, due to compounding interest rates well above many other loan types. Effective strategies for tackling credit card debt include the debt snowball and debt avalanche methods, which prioritize payment order for faster or more motivating results.

Student loans represent another major category, affecting millions of Americans. These debts can be federal or private, each with distinct terms for repayment, loan forgiveness, and even deferment options. Managing student loans often requires careful attention to the borrower’s debt-to-income ratio and may even involve refinancing to reduce interest rates or seek more comfortable payment periods.

Mortgage debt is typically the largest debt most people will ever have. As a form of secured debt, it is backed by real estate. Because mortgage loans usually have lower interest rates compared to unsecured debts, they are often categorized as ‘good debt’—especially if the real estate appreciates in value. However, failure to keep up with mortgage payments can lead to foreclosure, highlighting the importance of effective debt management and negotiation.

Auto loans are another example of secured debt, with the vehicle serving as collateral. While auto loans may have smaller balances compared to mortgages, longer repayment periods can still increase overall costs, particularly for those with poor credit histories.

Medical debt has grown into a significant concern, especially for individuals without sufficient insurance coverage. These debts can quickly become overwhelming and may be sent to debt collection agencies if left unpaid, adding further financial stress. Options like debt settlement, negotiation with healthcare providers, or credit counseling can help manage medical expenses.

Other common debt types include payday loans—short-term, high-interest loans often considered bad debt due to predatory practices—and business debts, which can range from small business loans to lines of credit. When these obligations become unmanageable, options like bankruptcy, debt relief, or debt refinancing may be considered.

Understanding whether a debt is considered good or bad depends on factors like its purpose, interest rate, and effect on your overall financial health. Good debt is typically used to acquire appreciating assets or improve income potential, while bad debt, such as revolving high-interest credit card debt or payday loans, can erode financial stability.

Effectively managing debts hinges on recognizing their type and terms and applying the right strategy—whether debt consolidation, negotiation, or structured repayment methods. This foundational knowledge empowers individuals and businesses to reduce financial pressure, avoid collections, and regain control of their financial future.

2. Popular Debt Restructuring Strategies: Debt Consolidation, Settlement, and Refinancing Explained

When navigating financial stress and juggling multiple debts, understanding the most popular debt restructuring strategies is crucial for effective debt management. Whether you’re overwhelmed by credit card debt, personal loans, mortgage debt, or even medical debt, choosing the right debt relief approach can help you regain control and improve your debt-to-income ratio. Let’s break down the three most commonly used strategies—debt consolidation, debt settlement, and debt refinancing—detailing how each one works and when it can be most effective.

Debt Consolidation: Streamlining Multiple Debts

Debt consolidation combines several debts, such as high-interest credit card debt, auto loans, or student loans, into one manageable payment. This process often involves taking out a new loan with a lower interest rate to pay off your existing unsecured debt. Key benefits of debt consolidation include:

– Simplified monthly payments, reducing the risk of missed payments

– Potentially lower interest rates, especially for high-interest debt like payday loans and credit card balances

– Improved chances for a better debt-to-income ratio over time

However, it's important to evaluate whether consolidation might turn unsecured debt into secured debt—such as rolling it into a mortgage—which could put assets at risk if you default.

Debt Settlement: Negotiating to Reduce Balances

Debt settlement involves negotiating with creditors or debt collection agencies to accept less than the total amount owed on your business debt, personal debt, or other balances. Typically, debt negotiation is pursued as a last resort when debts are significantly overdue and the debtor faces ongoing financial hardship.

– May be suitable for unsecured debt like credit cards, payday loans, and certain types of medical debt

– Can lead to faster debt relief compared to traditional repayment plans

– Possible negative impact on credit scores during and after settlement

– Risk of debt being sent to collections if creditors reject the negotiation

Debt Refinancing: Replacing Debt for Better Terms

Debt refinancing replaces existing debt—such as a mortgage, auto loan, or student loans—with a new loan under improved terms. This strategy is ideal for borrowers with good credit standing who want to reduce monthly payments, lock in a lower interest rate, or extend the repayment period.

– Offers long-term savings on interest for good debt, like a home mortgage

– Can free up cash flow for debt repayment using strategies like the debt avalanche or debt snowball method

– Must be mindful of loan origination fees, prepayment penalties, and the total cost over the new repayment term

Choosing Between Strategies

The best debt restructuring strategy depends on the type of debt (secured vs. unsecured), personal circumstances, and financial goals. For individuals with mainly high-interest debts such as credit cards or payday loans, debt consolidation or debt settlement might offer quicker relief. For those handling mortgage debt or student loans, debt refinancing could be a more strategic option. Consulting with a certified credit counseling agency can also help determine the most effective debt management plan based on your unique situation.

3. Weighing the Benefits and Risks of Debt Relief: Bankruptcy, Loan Forgiveness, and Credit Counseling

Choosing the right path to overcome debts requires a careful balancing act, especially when facing overwhelming personal debt like credit card debt, student loans, mortgage debt, or medical debt. Each debt relief option—bankruptcy, loan forgiveness, and credit counseling—has distinct benefits and risks that can impact your financial future in different ways.

Bankruptcy offers a legal route to potentially eliminate unsecured debt such as some credit card debt and medical debt. For individuals whose debt-to-income ratio has reached unsustainable levels, bankruptcy can pause debt collection efforts and provide a fresh start. However, declaring bankruptcy has lasting consequences. It can significantly lower your credit score, making it challenging to secure future loans such as auto loans or mortgage debt, and may remain on your credit report for up to a decade. Moreover, bankruptcy does not generally discharge student loans, certain tax debts, or ongoing obligations like child support. This option should be considered seriously, usually as a last resort after exploring other debt management strategies.

Loan forgiveness programs mainly target specific types of debts such as federal student loans. For example, Public Service Loan Forgiveness (PSLF) is available to those employed in qualifying public sector jobs after making a set number of payments. The main advantage is allowing borrowers to discharge the remaining balance, reducing long-term financial stress. However, the process for loan forgiveness can be lengthy and complex, often requiring careful documentation and years of reliable payments. Not all debts, such as high-interest debt from payday loans or business debt, are eligible, so this solution serves a narrow audience.

Credit counseling introduces a proactive method for managing debts. Reputable credit counseling agencies provide guidance on budgeting, debt negotiation, and strategies like the debt snowball method or debt avalanche method to prioritize repayment. For those juggling multiple forms of personal debt—credit card debt, secured debt, or unsecured debt—credit counseling can help build a customized debt management plan, sometimes negotiating lower interest rates or waiving fees with creditors. Enrollment in a debt management plan may close most of your credit lines, and it requires strict adherence to the repayment schedule. Still, this approach avoids bankruptcy and preserves your credit rating better than more drastic measures.

Consider all the angles: Which debts do you have, are they categorized as good debt or bad debt, and what kind of relief are you seeking? For some, debt consolidation or debt refinancing may offer additional alternatives. Ultimately, understanding the benefits and drawbacks of bankruptcy, loan forgiveness, and credit counseling enables you to select the most suitable debt relief strategy for a more stable financial future.

Debt restructuring is a powerful tool for individuals and businesses grappling with various forms of debt, from credit card debt and student loans to mortgage debt, auto loans, medical debt, and even business debt. By understanding the full spectrum of options—such as debt consolidation, debt settlement, bankruptcy, loan forgiveness, and credit counseling—you can tailor your debt strategies to your unique financial situation and effectively manage personal debt.

It’s essential to accurately assess your debt-to-income ratio and distinguish between good debt and bad debt, especially when addressing high-interest debt like payday loans or outstanding unsecured debt. Employing proven repayment techniques like the debt snowball method or the debt avalanche method can help regain control and reduce financial stress. On the other hand, debt refinancing and debt negotiation can provide immediate relief and improve long-term debt management outcomes.

Choosing the right approach means carefully balancing benefits and risks, considering consequences like the long-term credit impact of bankruptcy or debt settlement, and determining whether a structured repayment plan or professional help is needed. Ultimately, proactive and informed management of debts can reduce the burden of debt collection, set you on the path to financial resilience, and turn personal debt challenges into opportunities for sustainable financial health.

References:

(Insert APA-style citations for all sources referenced in the article)