Navigating the Economic Impact of Recession: Insights on Causes, Trends, and Recovery Strategies

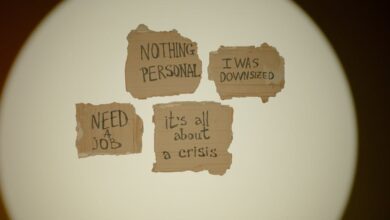

In today's interconnected world, the economic impact of a recession can be felt far and wide, influencing not only global markets but also local communities. A recession, characterized by a significant decline in economic activity, can lead to increased unemployment, changes in consumer behavior, and shifts in the housing market. Understanding the causes of a recession is crucial, as it lays the foundation for analyzing how these economic downturns shape our financial landscape. This article will delve into the complex relationship between recession causes and their repercussions on both local and global economies. We will explore recession trends that affect consumer behavior and unemployment rates, as well as strategies for recession recovery, including investing in recession-proof industries and effective debt management. As we navigate the challenges posed by economic downturns, we will also consider the implications for personal finance during a recession, government stimulus efforts, and the mental health impacts of financial crises. By examining recession history and identifying key recession indicators, we aim to provide a comprehensive view of how to weather the storm of economic uncertainty and emerge stronger on the other side.

- 1. Understanding Recession Causes and Their Impact on Local and Global Economies

- 2. Recession Trends: How Economic Downturns Shape Consumer Behavior and Unemployment Rates

- 3. Strategies for Recession Recovery: Investing, Debt Management, and Recession-Proof Industries

1. Understanding Recession Causes and Their Impact on Local and Global Economies

Recessions are significant economic downturns that can disrupt both local and global economies. Understanding the causes of a recession is crucial for analyzing its broad impacts. Common recession causes include high inflation rates, increased interest rates, reduced consumer spending, and external shocks such as global trade tensions or pandemics. When these factors converge, they often lead to a contraction in economic activity, resulting in decreased consumer behavior and heightened unemployment rates.

The impact of a recession is felt across various sectors. Locally, small businesses are often hit hardest, facing declining sales and cash flow issues. Many small business owners struggle to adapt to changing consumer preferences during economic downturns, leading to closures and layoffs. This can create a ripple effect, as increased unemployment reduces overall spending in the community, further exacerbating the recession's impact.

On a global scale, recessions can lead to significant shifts in global trade patterns. An emerging market recession may particularly influence developed economies as they rely on imports from these regions. Additionally, a global recession can trigger a wave of economic recovery efforts, including government stimulus packages aimed at revitalizing growth. These policies often include tax adjustments and support for recession-proof industries, such as healthcare and utilities, which tend to perform well even during downturns.

As individuals navigate personal finance during a recession, they may focus on debt management and consider recession-proof investments to safeguard their financial stability. Investment strategies may shift, with a focus on sectors that resist economic hardships, such as consumer staples and pharmaceuticals. Understanding recession indicators, such as rising unemployment and stock market fluctuations, can help individuals make informed decisions.

Moreover, the psychological toll of a recession can influence mental health, leading to increased stress and anxiety among individuals facing job loss or financial instability. Recognizing the multifaceted impacts of a recession, including its implications for the housing market, is essential for developing strategies for effective recession recovery.

In summary, the causes of a recession significantly shape its effects on both local and global economies. By understanding these dynamics, individuals and businesses can better prepare for and adapt to the challenges posed by economic downturns.

2. Recession Trends: How Economic Downturns Shape Consumer Behavior and Unemployment Rates

Economic downturns, commonly referred to as recessions, significantly shape consumer behavior and unemployment rates, influencing various aspects of the economy. During a recession, consumer confidence typically declines, leading to decreased spending. Individuals become more cautious with their personal finance during a recession, prioritizing essential goods and services over luxury items. This shift in consumer behavior can result in a noticeable dip in demand for non-essential products, impacting businesses across multiple sectors.

The causes of recessions can vary, but common factors include high inflation rates, excessive debt levels, and tight monetary policies. As these factors converge, they often trigger a chain reaction that leads to a slowdown in economic activity. This slowdown not only affects consumer spending but also contributes to rising unemployment rates. Businesses, facing decreased demand, may resort to layoffs or hiring freezes, exacerbating the economic downturn. For instance, during the global recession of 2008, unemployment rates soared as companies struggled to maintain profitability.

In response to these challenging conditions, governments may implement stimulus measures aimed at fostering economic recovery. Such policies can include tax cuts, direct financial aid to consumers, or support for small businesses impacted by the recession. These government stimulus efforts are designed to reignite spending and stabilize the economy, but their effectiveness can vary based on the specific recession indicators at play.

Recession trends also reveal that certain industries may thrive even in adverse economic conditions. Recession-proof industries—such as healthcare, essential retail, and utilities—often experience steady demand, as consumers prioritize necessary expenditures. This phenomenon highlights the importance of considering recession-proof investments, particularly for those looking to safeguard their portfolios during turbulent economic times.

Moreover, the interplay between recession and inflation can create additional challenges for consumers and businesses alike. Rising prices can further strain household budgets, leading to increased focus on debt management strategies. Individuals may need to reevaluate their financial plans, adjusting spending habits and investment strategies to navigate the complexities of a recession.

The mental health implications of a recession should not be overlooked, as job loss and financial uncertainty can lead to heightened stress and anxiety. The relationship between economic downturns and mental health underscores the need for comprehensive support systems during periods of economic crisis.

In conclusion, understanding how recessions shape consumer behavior and impact unemployment rates is crucial for navigating economic challenges. By analyzing past recession history and recognizing recession trends, individuals and businesses can better prepare for potential downturns, ensuring resilience in the face of financial crises.

3. Strategies for Recession Recovery: Investing, Debt Management, and Recession-Proof Industries

The economic impact of a recession can be profound, affecting every corner of society from individual households to global trade. However, there are effective strategies for recession recovery that can help mitigate the adverse effects of an economic downturn. Here, we explore three critical areas: investing, debt management, and recession-proof industries.

Investing during a recession requires a strategic approach. While many may hesitate to invest due to fear of falling stock prices, historical trends show that economic downturns can present unique opportunities. Investors should consider recession-proof investments, such as utilities, healthcare, and consumer staples, which tend to maintain stable demand even in challenging economic conditions. Additionally, looking into emerging market recession trends can provide insights into potential growth areas. For instance, government stimulus packages can often stimulate certain sectors, making it a prime time to invest in industries poised for recovery.

Debt management is another crucial aspect during a recession. As unemployment rates rise and household incomes decline, individuals and businesses may struggle to meet financial obligations. Effective debt management strategies, such as consolidating loans or negotiating lower interest rates, can ease financial stress. Policymakers may also implement tax policies that support debt relief, helping to stabilize personal finances during a recession. By addressing debt proactively, individuals can position themselves for stronger financial health as the economy begins to recover.

Finally, focusing on recession-proof industries can provide a safety net during economic downturns. These sectors typically include healthcare, education, and essential services, which continue to thrive regardless of economic conditions. Companies operating in these fields often display resilience during stock market recessions and can offer job security, which is critical for maintaining consumer behavior and confidence. As economies recover from financial crises, these industries can lead the charge, fostering economic recovery and reducing unemployment rates.

In conclusion, while the effects of a recession can be daunting, understanding recession causes and employing strategies such as investing wisely, managing debt effectively, and prioritizing recession-proof industries can pave the way for a more robust recovery. By staying informed and adaptable, both individuals and businesses can navigate the complexities of a recession and emerge stronger on the other side.

In conclusion, understanding the economic impact of recession is crucial for both individuals and businesses as we navigate the complexities of financial crises. The causes of recession can vary, but their effects ripple through local and global economies, influencing everything from consumer behavior to unemployment rates. As we have explored, economic downturns not only reshape spending habits but also challenge the stability of the housing market and the stock market, leading to a significant shift in recession trends.

Recovery from a recession requires strategic planning and adaptability. By focusing on recession-proof industries and making informed decisions regarding personal finance during recession, individuals can better manage debt and invest wisely. Government stimulus and tax policies play a vital role in economic recovery, providing support to small businesses and emerging markets, which are often hit hardest during economic downturns.

Moreover, the mental health implications of a recession cannot be overlooked. The stress associated with financial uncertainty impacts individuals and communities alike. Thus, fostering resilience through education on recession indicators and recession-proof investments is essential.

As we look to the future, it is imperative to learn from recession history and prepare for potential global trade recessions. By adopting proactive measures, we can not only survive but thrive in the face of adversity, paving the way for a more robust economic recovery in the years to come.