Mastering Your Finances: How Credit Counseling Can Transform Your Debt Management Strategies

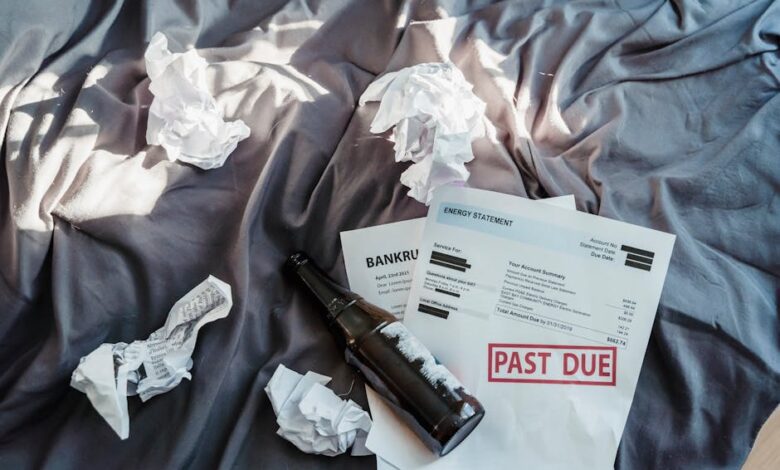

In today’s fast-paced financial landscape, many individuals find themselves grappling with various forms of personal debt, whether it be credit card debt, student loans, or mortgage debt. The burden of these obligations can lead to significant financial stress, affecting not only your wallet but also your overall well-being. If you’re feeling overwhelmed by high-interest debt or struggling to keep up with payments on auto loans or medical bills, seeking professional advice through credit counseling can be a transformative step toward regaining control of your finances. This article delves into the essential role of credit counseling in debt management, offering insights into effective debt strategies like the debt snowball and debt avalanche methods. Additionally, we will explore various debt relief options, including debt settlement and consolidation, to help you navigate the complexities of secured and unsecured debt. By understanding these tools, you can take proactive measures to improve your debt-to-income ratio and pave the way for a more stable financial future. Let’s embark on this journey to demystify credit counseling and equip you with the knowledge to conquer your debts.

- 1. "Understanding Credit Counseling: A Pathway to Manage Personal Debt and Financial Stress"

- 2. "Effective Debt Management Strategies: From Debt Snowball to Debt Avalanche Methods"

1. "Understanding Credit Counseling: A Pathway to Manage Personal Debt and Financial Stress"

Understanding the challenges of managing personal debt is crucial in today’s financial landscape, where high-interest debt from credit cards, student loans, and medical expenses is increasingly common. Credit counseling serves as a valuable resource for individuals grappling with financial stress and seeking effective debt management strategies. By working with certified credit counselors, you can gain insights into various debt relief options tailored to your unique situation, whether it involves tackling mortgage debt, auto loans, or even business debt.

Credit counseling provides a comprehensive assessment of your financial health, including an analysis of your debt-to-income ratio. This evaluation helps identify good debt versus bad debt, allowing you to prioritize repayment strategies effectively. Counselors often introduce methods like the debt snowball method, which focuses on paying off smaller debts first to build momentum, or the debt avalanche method, which targets high-interest debts to minimize overall interest payments.

Moreover, credit counselors can guide you through options such as debt consolidation, which combines multiple debts into a single payment, or debt settlement, where you negotiate with creditors to reduce the total amount owed. For some, understanding the implications of bankruptcy and its effect on future financial opportunities is critical. They can also provide insights into loan forgiveness programs and debt refinancing options to alleviate the burden of payday loans and other forms of high-interest debt.

Ultimately, credit counseling is about empowering individuals to take control of their finances, equipping them with the tools necessary to navigate debt collection and manage both secured and unsecured debts. By leveraging professional advice, you can create a sustainable plan that alleviates financial stress and paves the way for a healthier financial future.

Navigating the world of personal finance can be overwhelming, especially when dealing with various types of debts such as credit card debt, student loans, mortgage debt, auto loans, and medical debt. Many individuals find themselves in financial stress due to high-interest debt or the burden of multiple payment obligations. This is where credit counseling becomes an essential resource for effective debt management.

Credit counseling services provide professional advice tailored to your unique financial situation. A credit counselor can help analyze your debt-to-income ratio, shedding light on whether you are managing good debt, such as a mortgage, or bad debt, like payday loans. Through personalized debt strategies, counselors may suggest options such as debt consolidation or debt settlement to streamline your payments and reduce financial burdens.

For those struggling with various debts, the debt snowball method and the debt avalanche method are popular repayment strategies that can be utilized. The debt snowball method focuses on paying off smaller debts first to build momentum, while the debt avalanche method prioritizes high-interest debts to minimize overall interest paid. Both approaches can be discussed with a credit counselor to determine the best fit for your financial goals.

Moreover, if you find yourself overwhelmed by the thought of bankruptcy or facing aggressive debt collection practices, credit counseling can provide guidance on navigating these challenges. They may also discuss options for loan forgiveness or debt refinancing, which can help lower your monthly payments and alleviate financial stress.

Ultimately, seeking professional advice through credit counseling can empower individuals to take control of their financial futures. With the right support, you can develop a solid plan to manage your debts, whether they are secured or unsecured, and work toward achieving financial stability. Remember, understanding your options is the first step toward effective debt management and ultimately regaining financial freedom.

2. "Effective Debt Management Strategies: From Debt Snowball to Debt Avalanche Methods"

When it comes to effective debt management, understanding the various strategies available can significantly alleviate financial stress. Two popular methods that many individuals consider are the Debt Snowball Method and the Debt Avalanche Method. Each approach has its unique philosophy and can help in tackling personal debt, whether it involves credit card debt, student loans, mortgage debt, auto loans, or even medical debt.

**Debt Snowball Method**: This strategy focuses on paying off the smallest debts first, regardless of the interest rates. By prioritizing lower balances, individuals can achieve quick wins that boost their motivation. Here's how it works:

1. List all debts from smallest to largest.

2. Make minimum payments on all debts except the smallest one.

3. Allocate any extra funds toward the smallest debt until it's paid off.

4. Move to the next smallest debt and repeat the process.

The psychological benefit of this method is powerful; paying off smaller debts provides a sense of accomplishment that can encourage continued progress. This method is particularly effective for those struggling with high-interest debt, as it simplifies the repayment process and can lead to quicker debt relief.

**Debt Avalanche Method**: In contrast, the Debt Avalanche Method prioritizes debts based on interest rates, focusing first on those with the highest rates. This approach is mathematically advantageous, as it minimizes the total interest paid over time. Here’s how to implement this strategy:

1. List all debts from highest to lowest interest rate.

2. Make minimum payments on all debts except the one with the highest interest rate.

3. Channel any extra funds toward the highest interest debt until it is fully paid off.

4. Proceed to the next highest interest debt and repeat the process.

While the Debt Avalanche Method may take longer to see initial results, it often leads to faster overall debt repayment and can save money in the long run, especially for those dealing with secured debt versus unsecured debt.

Both strategies require a disciplined approach to budgeting and spending. Individuals may also consider debt consolidation or debt settlement as complementary options to manage debts more effectively. For those facing overwhelming debt levels, credit counseling can provide essential guidance and support, helping to devise personalized debt strategies.

Ultimately, choosing between the Debt Snowball and Debt Avalanche methods depends on personal preferences and financial situations. Understanding one’s debt-to-income ratio can also play a crucial role in determining the best path forward. With the right strategy in place, navigating personal debt can become a more manageable and less daunting task.

In summary, whether you’re dealing with business debt, payday loans, or considering loan forgiveness or debt refinancing, assessing your options and implementing a structured debt management plan can pave the way to financial freedom.

In conclusion, credit counseling serves as a vital resource for individuals navigating the complexities of personal debt and financial stress. By understanding the various aspects of credit counseling, you can take the first step toward effective debt management and relief. Whether you are struggling with credit card debt, student loans, mortgage debt, or high-interest payday loans, professional guidance can help you explore tailored debt strategies, such as the debt snowball and debt avalanche methods, that suit your unique financial situation.

Moreover, credit counselors can assist in navigating options like debt consolidation, debt settlement, and even loan forgiveness programs to alleviate burdensome debts. By actively engaging in debt negotiation and understanding the implications of secured versus unsecured debt, you can make informed decisions that positively impact your debt-to-income ratio and overall financial health.

Ultimately, seeking professional advice not only empowers you to regain control over your finances but also provides a pathway to sustainable debt repayment and long-term financial stability. Remember, taking action today can lead to a brighter financial future, free from the chains of overwhelming debts. If you're feeling overwhelmed by medical debt, business debt, or any other financial obligations, consider reaching out to a credit counselor who can guide you through the process and help you achieve the debt relief you deserve.

Stay proactive in your financial journey, and know that with the right support and strategies, it’s possible to turn your financial challenges into opportunities for growth and recovery.

—

### References

– National Foundation for Credit Counseling. (2023). Understanding Credit Counseling. Retrieved from [www.nfcc.org](https://www.nfcc.org)

– Consumer Financial Protection Bureau. (2023). Debt Management Strategies. Retrieved from [www.consumerfinance.gov](https://www.consumerfinance.gov)