Weathering the Storm: Understanding Recession Signs, Impacts, and Strategies for Resilience

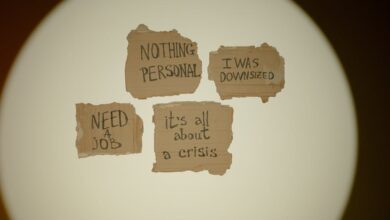

As economic cycles ebb and flow, understanding the early warning signs of a recession becomes crucial for individuals, businesses, and policymakers alike. Recessions, characterized by declining economic activity, can have profound effects on various sectors, from manufacturing to services, and they often lead to shifts in consumer behavior and investment strategies. This article delves into the multifaceted nature of recessions, exploring the early indicators that signal an impending downturn, the specific impacts on different industries, and the strategies investors can employ to navigate these turbulent times. Additionally, we will examine the role of government stimulus in alleviating the effects of recessions, how consumer spending patterns change during economic hardships, and the ripple effects on global trade and supply chains. By reflecting on lessons learned from past recessions, we aim to equip businesses and individuals with the insights needed to prepare for and endure economic challenges. Join us as we unpack these critical topics and provide a roadmap for resilience in the face of uncertainty.

- 1. "Recognizing the Red Flags: Early Indicators of an Economic Recession"

- 2. "Navigating the Downturn: Sector-Specific Impacts and Investment Strategies"

- 3. "Resilience in Crisis: Government Responses and Consumer Adaptations During Recessions"

1. "Recognizing the Red Flags: Early Indicators of an Economic Recession"

Early indicators of an economic recession can often be subtle but impactful, serving as critical warning signs for policymakers, businesses, and investors. One of the most widely monitored indicators is the yield curve, particularly the inversion of the yield curve, which occurs when short-term interest rates exceed long-term rates. This inversion has historically been a reliable predictor of recessions, reflecting investor sentiment that economic growth will slow in the near future.

Another significant indicator is the unemployment rate. A rise in unemployment claims often precedes an economic downturn, as businesses may start to cut jobs in anticipation of reduced demand. Similarly, declining consumer confidence, typically measured by surveys, can signal a shift in spending behavior. When consumers feel uncertain about their financial futures, they tend to reduce spending, which can further exacerbate economic slowdowns.

Additionally, key economic metrics such as Gross Domestic Product (GDP) growth, retail sales, and manufacturing output provide insights into economic health. A sustained decline in these areas can indicate that a recession is on the horizon. For instance, two consecutive quarters of negative GDP growth is a common technical definition of a recession.

Furthermore, changes in business investment, particularly in capital goods, can also serve as a red flag. When companies begin to cut back on spending for new equipment or expansion, it often points to a lack of confidence in future economic conditions.

Monitoring these early warning signs allows stakeholders to take proactive measures, positioning themselves to mitigate the adverse effects of an impending recession. Recognizing these red flags is crucial for informed decision-making and strategic planning in uncertain economic times.

2. "Navigating the Downturn: Sector-Specific Impacts and Investment Strategies"

In times of economic recession, the effects are not uniformly felt across all sectors. Understanding the sector-specific impacts is crucial for investors seeking to navigate the downturn effectively.

Consumer discretionary sectors, such as retail and entertainment, typically experience significant declines as households tighten their budgets. Non-essential purchases are often postponed, leading to reduced revenues for businesses in these categories. Conversely, sectors like consumer staples, healthcare, and utilities tend to remain more resilient, as they provide essential goods and services that consumers prioritize even in tough economic times. Investors may consider reallocating funds to these stable sectors to mitigate risks during a downturn.

The technology sector presents a mixed bag; while some companies may face reduced spending from businesses and consumers, others, particularly those focused on cloud computing or essential software, can thrive. Investors should evaluate individual companies within this sector based on their business models and adaptability.

Real estate often sees varied impacts depending on the market segment. While commercial real estate may struggle due to decreased demand for office space, residential real estate can remain buoyant in certain areas, particularly if housing supply is limited. Identifying emerging trends, such as increased remote work leading to demand for suburban living, can guide investment decisions.

Financial services can be adversely affected by rising loan defaults and decreased consumer spending. However, certain segments, like credit unions and financial technology firms, may offer opportunities for growth. Investors should focus on institutions with strong balance sheets and diversified portfolios.

In terms of investment strategies during a recession, defensive stocks—companies known for stable earnings and dividends—can provide a buffer against market volatility. Additionally, diversifying investments across various sectors can help spread risk.

Investors might also explore opportunities in low-cost index funds or exchange-traded funds (ETFs) that focus on defensive sectors or those poised for recovery once the economy stabilizes. As the recession unfolds, staying informed about policy changes, such as government stimulus efforts, is essential, as these can significantly influence sector performance and investment prospects.

Ultimately, navigating a recession requires a careful analysis of sector dynamics and a proactive approach to investment strategy. By recognizing which sectors are likely to thrive or decline, investors can position themselves to weather the economic storm effectively.

3. "Resilience in Crisis: Government Responses and Consumer Adaptations During Recessions"

During economic recessions, the resilience of both government responses and consumer adaptations plays a critical role in mitigating the negative impacts of downturns. Governments often implement a variety of measures aimed at stabilizing the economy and supporting individuals and businesses facing financial strain. These responses typically include monetary policy adjustments, such as lowering interest rates to encourage borrowing and spending, and fiscal policies, such as direct financial assistance, tax relief, and increased public spending on infrastructure projects. Such measures aim to boost consumer confidence, stimulate demand, and create jobs, helping to prevent a deeper economic decline.

Simultaneously, consumers exhibit remarkable adaptability during recessions. Faced with uncertainty and reduced income, individuals often reassess their spending habits, prioritizing essential goods and services over discretionary expenditures. This shift can lead to increased demand for budget-friendly products and services, prompting businesses to adjust their offerings accordingly. Additionally, consumers may seek alternative sources of income, such as part-time work or freelance opportunities, and embrace frugality, focusing on saving and debt reduction. This behavior not only aids personal financial stability but also contributes to a gradual recovery by preserving consumer spending power.

The interplay between effective government interventions and adaptive consumer behavior can significantly influence the overall trajectory of an economy during a recession. While government initiatives provide a safety net, the willingness of consumers to modify their spending and financial strategies is crucial for sustaining economic activity in challenging times. Together, these factors underscore the importance of resilience in crisis management, demonstrating that both policy responses and consumer adaptability are essential for navigating economic downturns effectively.

In conclusion, understanding the early warning signs of an economic recession is crucial for individuals, businesses, and policymakers alike. By recognizing these red flags, stakeholders can better prepare for the challenges that lie ahead. The impacts of a recession are felt across various sectors, necessitating tailored investment strategies to navigate turbulent waters effectively. Moreover, government stimulus plays a vital role in cushioning the blow, providing a lifeline to both consumers and businesses during downturns.

As consumer behavior shifts in response to economic pressures, businesses must remain agile and innovative to survive. The lessons learned from past recessions highlight the importance of preparedness and adaptability in an ever-changing economic landscape. By employing strategic planning and fostering resilience, businesses can not only endure a recession but also emerge stronger on the other side. Ultimately, the ability to anticipate and respond to economic fluctuations will define the success of entities in an interconnected global economy. By learning from history and adapting to present challenges, we can better equip ourselves for the uncertainties of the future.