Weathering the Economic Storm: Understanding Recession Indicators, Impacts, and Survival Strategies

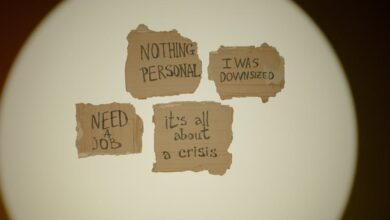

In an increasingly interconnected world, the effects of economic recessions can ripple through various sectors, impacting businesses and consumers alike. Understanding the early warning signs of a recession is crucial for stakeholders at all levels, from policymakers to individual investors. As we delve into the complexities of economic downturns, this article will explore the telltale indicators that signal a potential recession, the specific ramifications for different sectors, and the investment strategies that can help safeguard financial assets during turbulent times. We will also examine the vital role of government stimulus in mitigating recessionary effects, the shifts in consumer behavior that accompany economic challenges, and how global trade and supply chains are influenced by these downturns. Furthermore, by reflecting on lessons learned from past recessions, we will provide insights into how businesses can better prepare for and navigate the storm of a recession. Join us as we unpack these critical themes to better understand the cyclical nature of economies and the strategies that can lead to resilience in the face of adversity.

- 1. Recognizing the Red Flags: Early Warning Signs of an Economic Recession

- 2. Navigating the Storm: Sector-Specific Impacts and Investment Strategies During Recessions

- 3. Government Intervention and Consumer Adaptation: Key Responses to Economic Downturns

1. Recognizing the Red Flags: Early Warning Signs of an Economic Recession

Economic recessions often leave a trail of early warning signs that can help individuals and businesses recognize the impending downturn. One of the most significant indicators is a decline in consumer spending, which accounts for a substantial portion of economic activity. When consumers start to cut back on discretionary purchases, it can signal growing uncertainty about the economy's health.

Another red flag is a rise in unemployment rates. As companies begin to face declining sales, they may resort to layoffs or hiring freezes, leading to increased joblessness. This not only affects those who lose their jobs but also dampens overall consumer confidence, creating a feedback loop that can further suppress spending.

Additionally, a slowdown in manufacturing output is often observed prior to a recession. Key metrics such as the Purchasing Managers' Index (PMI) can provide insights into the manufacturing sector’s health. A PMI reading below 50 typically suggests contraction, indicating that businesses may be reducing production in response to decreased demand.

Investment trends also serve as an important indicator. A significant drop in business investment, particularly in capital goods, can signal that companies are bracing for tougher times ahead. Investors often pull back on spending and expansion plans, which can lead to a slowdown in economic growth.

Finally, changes in consumer confidence surveys can reveal shifts in public sentiment. When consumers express pessimism about their financial future, it can lead to reduced spending and a greater propensity to save, further exacerbating economic challenges.

Recognizing these early warning signs is crucial for policymakers, businesses, and investors to take proactive measures in preparing for an economic downturn. By staying vigilant and responsive to these indicators, stakeholders can better navigate the complexities of a recession.

2. Navigating the Storm: Sector-Specific Impacts and Investment Strategies During Recessions

During a recession, the impacts on various sectors of the economy can be profound and divergent. Notably, essential services such as healthcare, utilities, and consumer staples often demonstrate resilience, as demand for these goods and services remains relatively stable regardless of economic conditions. Investors may find opportunities in these sectors, as companies that provide basic necessities tend to maintain steady revenue streams, making them safer bets during downturns.

Conversely, sectors like luxury goods, travel, and hospitality typically experience significant declines in consumer spending. In these areas, businesses may face rapid revenue drops, leading to layoffs and increased financial strain. Investors should approach these sectors with caution, as the volatility can present both risks and potential opportunities for recovery once economic conditions improve.

To navigate the storm of a recession, investment strategies should focus on diversification and defensive positioning. Investors might consider reallocating their portfolios to include high-quality bonds, dividend-paying stocks, and sectors that historically withstand economic downturns. Additionally, alternative investments, such as real estate or commodities, can provide a hedge against inflation and economic uncertainty.

In times of recession, it’s also crucial to stay informed about market trends and economic indicators. This vigilance allows investors to react swiftly to emerging opportunities or threats, adapting their strategies to the shifting landscape. By understanding the sector-specific impacts of a recession and implementing thoughtful investment strategies, individuals can better position themselves to weather economic storms and potentially capitalize on recovery phases.

3. Government Intervention and Consumer Adaptation: Key Responses to Economic Downturns

Government intervention and consumer adaptation are critical components in responding to economic downturns. When faced with a recession, governments typically implement a range of policies aimed at stabilizing the economy, restoring consumer confidence, and promoting recovery. These interventions can include monetary policy adjustments, such as lowering interest rates to make borrowing cheaper and stimulate spending. Additionally, fiscal policies may involve increased government spending on infrastructure projects or direct financial assistance to individuals and businesses, often in the form of stimulus checks or unemployment benefits. Such measures aim to boost consumer demand, which is essential for economic recovery.

On the consumer side, individuals and families often adapt their spending and saving behaviors during recessions. Faced with uncertainty, many people prioritize essential goods and services, leading to a shift in spending patterns. Discretionary spending on items like luxury goods, dining out, and entertainment frequently declines. As a result, businesses may need to pivot their strategies to focus on value and affordability, catering to changing consumer preferences. Increased savings rates are also common, as consumers become more cautious and prioritize financial security over immediate consumption.

Furthermore, during economic downturns, consumers often seek alternative solutions, such as second-hand shopping, DIY projects, or subscription services that offer perceived value. This shift can lead to the emergence or growth of specific sectors, such as discount retailers and online marketplaces, which thrive on affordability and accessibility. Overall, the interplay between government intervention and consumer adaptation plays a vital role in shaping the trajectory of recovery from recessions, highlighting the importance of responsive policies and consumer resilience in navigating economic challenges.

In conclusion, understanding the multifaceted nature of economic recessions is crucial for individuals, businesses, and policymakers alike. By recognizing early warning signs, stakeholders can take proactive measures to mitigate risks and adapt to changing circumstances. The impacts of a recession ripple through various sectors, influencing investment strategies and necessitating a reevaluation of consumer behavior. Government stimulus plays a pivotal role in alleviating some of the adverse effects, providing essential support to both the economy and its participants during challenging times.

Moreover, the lessons learned from past recessions guide current practices, emphasizing the importance of preparedness and resilience. By implementing strategic planning and fostering adaptability, businesses can not only survive but potentially thrive during economic downturns. As we navigate the complexities of global trade and supply chains, a collaborative approach will be vital for recovery and future stability. Ultimately, while recessions pose significant challenges, they also present opportunities for innovation and growth, reminding us of the importance of vigilance and adaptability in an ever-evolving economic landscape.