Weathering the Economic Storm: Recognizing Recession Signs, Sector Impacts, and Strategic Responses

As economic cycles ebb and flow, understanding the nuances of recessions becomes crucial for individuals, businesses, and policymakers alike. Early warning signs can often provide valuable insights into impending economic downturns, allowing stakeholders to make informed decisions. In this article, we will explore the multifaceted nature of recessions, examining how they affect various sectors of the economy and the investment strategies that can help mitigate financial losses. Additionally, we will delve into the role of government stimulus in cushioning the impacts of a recession and how consumer behavior shifts in response to economic uncertainty. By analyzing the effects on global trade and supply chains, we can better comprehend the broader implications of downturns. Drawing lessons from past recessions, we will highlight strategies for businesses to prepare for and endure these challenging times. Join us as we navigate the complexities of economic recessions and equip ourselves with the knowledge to thrive in the face of adversity.

- 1. **Identifying the Early Warning Signs: What to Watch For in an Economic Downturn**

- 2. **Navigating the Storm: Sector-Specific Impacts of Recessions and Investment Strategies**

1. **Identifying the Early Warning Signs: What to Watch For in an Economic Downturn**

Identifying early warning signs of an economic downturn is crucial for policymakers, businesses, and investors alike. Several indicators can signal that a recession may be on the horizon.

One of the most closely monitored signs is a decline in consumer confidence. When consumers feel uncertain about their financial future, they tend to reduce spending, which can lead to decreased revenue for businesses. Surveys conducted by organizations such as the Conference Board can provide insights into consumer sentiment, with significant drops often foreshadowing economic contraction.

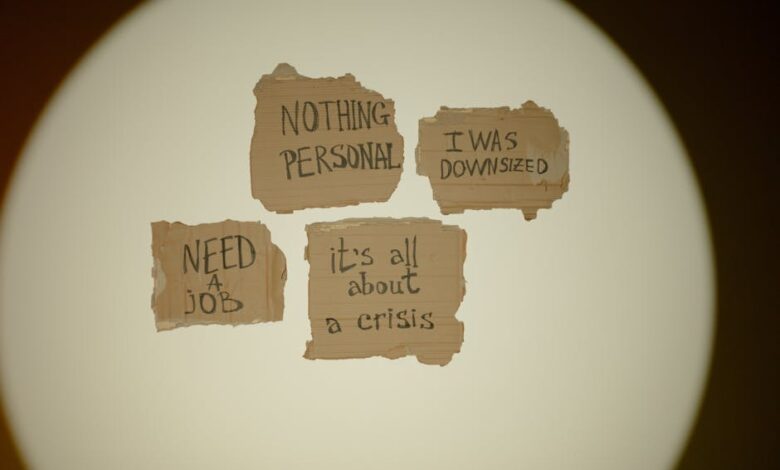

Another important indicator is the trend in unemployment rates. A rising unemployment rate often suggests that companies are beginning to cut back on hiring or laying off workers, which can further dampen consumer spending. Additionally, an increase in jobless claims can signal that the labor market is weakening.

Changes in manufacturing activity are also critical to watch. A decline in manufacturing output, as reflected in indices like the Purchasing Managers' Index (PMI), can indicate that businesses are experiencing lower demand for their products. This slowdown often precedes broader economic weaknesses.

Financial market trends, particularly in the stock market, can also provide clues. A sustained drop in stock prices may reflect investor pessimism about future economic conditions. Moreover, an inverted yield curve, where short-term interest rates exceed long-term rates, has historically been a reliable predictor of recessions.

Lastly, shifts in inflation rates and consumer spending patterns can offer additional insights. An unexpected spike in inflation can erode purchasing power, while stagnant or declining consumer spending can signal that households are tightening their budgets in anticipation of tougher economic times.

By monitoring these indicators, stakeholders can better prepare for potential downturns and make informed decisions to mitigate the impacts of an economic recession.

Recessions are characterized by a significant decline in economic activity, and their early warning signs can often be identified through various indicators. Key indicators include rising unemployment rates, decreasing consumer spending, a decline in manufacturing output, and reduced business investment. Additionally, metrics such as falling stock prices, reduced GDP growth, and increased bankruptcy filings can serve as harbingers of an impending downturn.

The impact of recessions is felt across various sectors of the economy, with consumer discretionary industries often hit hardest as people cut back on non-essential purchases. Conversely, sectors such as healthcare and utilities may experience more stability, as demand for essential services remains relatively constant. However, even these sectors can face challenges, such as reduced funding or changes in consumer behavior.

Investing during a recession requires a strategic approach. Investors may seek to diversify their portfolios, focusing on defensive stocks—companies that tend to perform well regardless of economic conditions—or consider assets like bonds and precious metals. Additionally, value investing may become more attractive as stock prices decline, presenting opportunities to purchase undervalued companies.

Government stimulus plays a crucial role in mitigating the effects of recessions. Stimulus measures, such as tax cuts, increased government spending, and direct financial assistance to individuals and businesses, aim to boost demand and stabilize the economy. These interventions can help prevent deeper economic contractions and facilitate a quicker recovery.

Consumer behavior typically shifts during economic downturns, characterized by increased saving, reduced spending, and a focus on essential goods and services. Consumers may prioritize necessities over luxuries, leading to changes in retail dynamics and influencing business strategies.

Recessions also have significant implications for global trade and supply chains. Economic slowdowns can disrupt supply chains as demand decreases, leading to reduced exports and imports. Countries dependent on trade may face heightened vulnerabilities, resulting in broader economic ramifications.

Lessons learned from past recessions, such as the 2008 financial crisis, highlight the importance of economic resilience and preparedness. Businesses that proactively manage their finances, maintain healthy cash reserves, and adapt to changing market conditions are more likely to survive economic downturns.

To navigate a recession successfully, businesses should focus on cost management, maintaining strong customer relationships, and exploring new revenue streams. Flexibility and innovation can help companies pivot in response to shifting consumer preferences and market realities, ultimately enhancing their chances of enduring challenging economic times.

2. **Navigating the Storm: Sector-Specific Impacts of Recessions and Investment Strategies**

Recessions impact various sectors of the economy differently, creating both challenges and opportunities for investors. Understanding these sector-specific dynamics is crucial for navigating economic downturns effectively.

In general, consumer discretionary sectors, such as retail and hospitality, tend to suffer the most during recessions as consumers cut back on non-essential spending. Companies in these sectors may experience declining revenues, leading to layoffs and reduced investment. Conversely, essential services such as utilities, healthcare, and grocery retailers often remain stable or even thrive, as demand for basic needs persists regardless of economic conditions.

Investors might consider reallocating their portfolios to focus on these defensive sectors during a downturn. Stocks in consumer staples, healthcare, and utilities can provide more stability, as they are less sensitive to economic fluctuations. Additionally, dividend-paying stocks from these sectors can offer reliable income streams, which can be particularly appealing in uncertain times.

The technology sector presents a mixed bag. While some tech firms may face reduced spending from businesses and consumers, others, particularly those providing essential services or remote solutions, may see increased demand. For instance, companies specializing in cloud computing or cybersecurity may benefit as businesses adapt to shifting work environments. Investors should closely evaluate individual tech firms' fundamentals and market positions to identify potential opportunities.

The real estate market can also be affected differently depending on the economic landscape. While residential properties may experience a slowdown in sales, rental markets can remain strong, particularly in urban areas with high demand. Real estate investment trusts (REITs) that focus on residential or essential retail properties may offer resilience during downturns.

Moreover, certain sectors like travel, leisure, and luxury goods typically face significant declines during recessions, as consumers prioritize essential spending. However, post-recession recovery can also present opportunities for investors willing to take calculated risks. Historically, sectors that have been hit hardest often rebound strongly after a recession, presenting potential for substantial gains.

Overall, navigating the storm of a recession requires a keen understanding of sector dynamics and a strategic approach to investment. By diversifying portfolios and focusing on defensive sectors while remaining vigilant to emerging opportunities in others, investors can better position themselves to weather the economic downturn and capitalize on the eventual recovery.

In summary, understanding the early warning signs of an economic recession is crucial for individuals and businesses alike, as it allows for proactive measures to mitigate potential impacts. Each sector of the economy experiences unique challenges during downturns, necessitating tailored investment strategies that can weather the storm while capitalizing on emerging opportunities. Government stimulus plays a vital role in cushioning the blow of recessions, providing essential support to both consumers and businesses, while shifts in consumer behavior can signal broader economic trends.

Moreover, the repercussions of recessions extend beyond national borders, affecting global trade and supply chains, which can lead to significant adjustments in how businesses operate. By reflecting on the lessons learned from past recessions, we can better navigate the complexities of today's economic landscape. Ultimately, businesses that prioritize strategic planning, adaptability, and resilience are more likely to survive and even thrive in challenging economic conditions. As we look to the future, staying informed and prepared will be key to successfully navigating the uncertainties that lie ahead.