Weathering the Economic Storm: Early Warning Signs, Investment Strategies, and the Role of Government in Recession Resilience

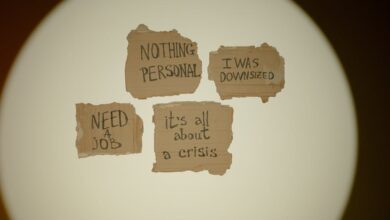

As economic cycles ebb and flow, the specter of recession looms as a significant concern for individuals, businesses, and governments alike. Understanding the early warning signs of an economic downturn is crucial for proactive decision-making and strategic planning. In this article, we will explore the indicators that signal an impending recession, how these downturns affect various sectors of the economy, and the shifting landscape of consumer behavior during such times. We will delve into effective investment strategies that can help mitigate risks, the pivotal role of government stimulus in cushioning the impact, and the lessons learned from previous recessions that provide valuable insights for today’s economic climate. Additionally, we will discuss how businesses can prepare for and endure the challenges posed by recessions, ensuring resilience and adaptability in the face of uncertainty. Join us as we navigate the complexities of economic downturns and equip ourselves with the knowledge to weather the storm.

- 1. **Identifying the Red Flags: Early Warning Signs of an Economic Recession**

- 2. **Navigating the Storm: Strategies for Investing and Surviving Economic Downturns**

- 3. **Resilience in Crisis: The Role of Government Stimulus and Business Adaptation**

1. **Identifying the Red Flags: Early Warning Signs of an Economic Recession**

Identifying early warning signs of an economic recession is crucial for policymakers, businesses, and investors alike. Several key indicators can signal an impending downturn, allowing stakeholders to prepare and respond effectively.

One of the primary red flags is a decline in consumer confidence, which can be measured through surveys that assess households' perceptions of their financial situation and the overall economy. When consumers become anxious about their economic prospects, they tend to reduce spending, which can lead to decreased demand for goods and services.

Another significant indicator is a slowdown in GDP growth. A sustained decline in GDP over two consecutive quarters is often the technical definition of a recession. Therefore, monitoring economic reports for signs of stagnation or contraction is vital.

Rising unemployment rates also serve as a critical signal. As businesses face reduced demand, they may begin to cut jobs, leading to higher unemployment figures. This, in turn, further erodes consumer confidence and spending, creating a negative feedback loop.

Additionally, changes in manufacturing activity can provide early insight. A drop in manufacturing output, as reported by indices such as the Purchasing Managers' Index (PMI), often precedes broader economic slowdowns.

Financial markets can also reflect economic sentiment; declining stock prices or increased volatility may indicate investor concerns about future growth. Furthermore, an inverted yield curve—where short-term interest rates exceed long-term rates—has historically been a reliable predictor of recessions, as it suggests that investors expect slower economic growth.

Lastly, fluctuations in housing markets, such as falling home sales or declining prices, can signal broader economic troubles. The housing market is closely tied to consumer wealth and spending, making it a critical area to monitor.

By keeping an eye on these early warning signs, stakeholders can better navigate the complexities of an approaching recession and make informed decisions to mitigate its impacts.

2. **Navigating the Storm: Strategies for Investing and Surviving Economic Downturns**

Investing during an economic downturn requires a strategic approach that balances risk and opportunity. Historically, recessions can create significant market volatility, but they also present unique chances for investors who are prepared. One key strategy is to focus on defensive stocks, which typically include companies in sectors such as healthcare, utilities, and consumer staples. These businesses tend to maintain stable earnings even in challenging economic climates, as they provide essential goods and services.

Another important strategy is diversification. By spreading investments across various asset classes—such as bonds, real estate, and commodities—investors can mitigate risks associated with significant downturns in any single market. Additionally, considering the allocation of funds to high-quality bonds can offer stability and income during periods of equity market decline.

For those with a longer investment horizon, recessions can also be a time to capitalize on discounted assets. Market corrections often lead to lower prices for fundamentally strong companies, presenting opportunities for value investing. It is crucial, however, to perform thorough due diligence to ensure that the selected investments will rebound when economic conditions improve.

Moreover, maintaining a liquidity reserve is vital. Having cash or cash equivalents on hand allows investors to act quickly on opportunities that arise during a downturn, such as purchasing undervalued stocks or assets. This liquidity can also provide a cushion against unexpected expenses or financial emergencies.

From a business perspective, surviving a recession involves more than just financial strategies; it requires operational resilience. Companies should evaluate their cost structures, streamline operations, and focus on maintaining customer relationships. Investing in technology and digital transformation can enhance efficiency and adaptability, allowing businesses to respond more effectively to changing market conditions.

Ultimately, the key to navigating economic downturns lies in a proactive and well-rounded approach to both investing and managing business operations. By understanding market dynamics and preparing strategically, investors and businesses can not only weather the storm but emerge stronger and more resilient.

3. **Resilience in Crisis: The Role of Government Stimulus and Business Adaptation**

In times of economic downturn, government stimulus plays a critical role in stabilizing the economy and fostering resilience among businesses. Stimulus measures, which can include direct financial aid, tax relief, and low-interest loans, aim to boost consumer spending and enhance liquidity in the marketplace. By injecting capital into the economy, governments can help mitigate the adverse effects of a recession, enabling businesses to maintain operations, retain employees, and avoid closures.

The effectiveness of government intervention is often contingent on how businesses choose to adapt during challenging times. Companies that proactively adjust their strategies can leverage stimulus funds to innovate and diversify their offerings. For instance, businesses may pivot to e-commerce, streamline operations, or invest in digital transformation to meet changing consumer demands. By embracing flexibility and resilience, firms can not only weather the storm but also emerge stronger post-recession.

Moreover, the collaboration between government and businesses is crucial in fostering a robust recovery. Stimulus programs can be tailored to support specific sectors most affected by a recession, such as hospitality or retail, ensuring that assistance reaches those in greatest need. At the same time, businesses that engage in strategic planning and risk management can better position themselves to capitalize on emerging opportunities as the economy begins to recover. This dynamic interplay between government support and business adaptation underscores the importance of resilience in crisis, highlighting that a proactive approach can significantly enhance the prospects of recovery and long-term growth.

In conclusion, understanding the early warning signs of an economic recession is crucial for individuals and businesses alike to navigate the challenges of a downturn successfully. By recognizing indicators such as declining consumer confidence, rising unemployment rates, and decreased industrial production, stakeholders can take proactive measures to mitigate risks.

Furthermore, the strategies for investing during a recession highlight the importance of diversification and a focus on value-driven assets. Government stimulus plays a pivotal role in cushioning the effects of a recession, providing essential support to both consumers and businesses, and fostering economic recovery.

As consumer behavior shifts during these challenging times, adaptability becomes key for businesses striving to maintain stability and growth. Learning from past recessions provides valuable insights into effective preparation and resilience, equipping businesses with the tools to not only survive but to thrive in the face of adversity.

Ultimately, by embracing strategic planning, understanding consumer dynamics, and leveraging governmental support, we can better navigate the complexities of economic downturns, turning potential crisis into opportunities for innovation and growth.