Navigating Economic Downturns: Early Signs, Sector Impacts, and Strategies for Resilience

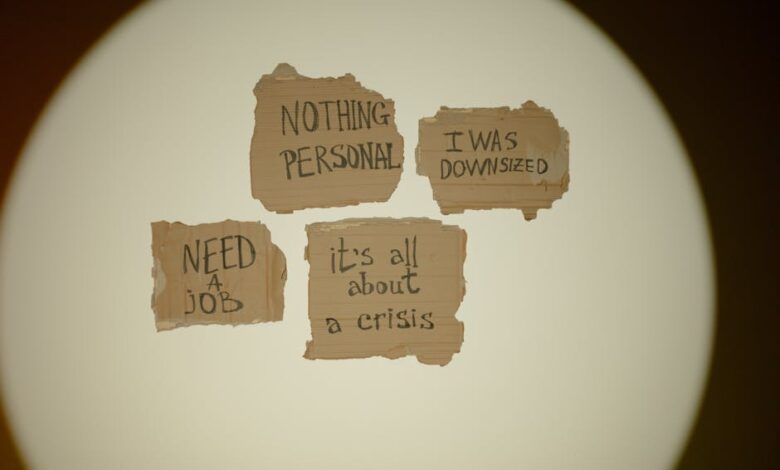

As economic cycles ebb and flow, the specter of recession looms large, prompting both individuals and businesses to brace for impact. Understanding the early warning signs of an economic downturn is crucial for effective planning and response. This article delves into the multifaceted nature of recessions, exploring how they affect various sectors of the economy and the unique challenges they present. We will examine strategies for investing during these turbulent times, the role of government stimulus in alleviating economic strain, and how consumer behavior shifts in response to financial uncertainty. Additionally, we will investigate the repercussions of recessions on global trade and supply chains, and draw valuable lessons from past downturns that remain pertinent today. By equipping ourselves with knowledge and strategies, we can better prepare for and navigate the complexities of recessions, ensuring resilience in the face of economic adversity.

- 1. **Recognizing the Red Flags: Early Warning Signs of an Economic Recession**

- 2. **Sector Sensitivity: Understanding the Diverse Impacts of Recessions on the Economy**

1. **Recognizing the Red Flags: Early Warning Signs of an Economic Recession**

Economic recessions often unfold gradually, and recognizing the early warning signs can be crucial for individuals, businesses, and policymakers. Several key indicators typically signal an impending downturn.

One of the most observable signs is a decline in consumer confidence. When consumers feel uncertain about their financial future, they tend to cut back on spending, which in turn affects businesses and the overall economy. Surveys measuring consumer sentiment can provide valuable insights into this trend.

Another significant indicator is a slowdown in manufacturing activity. A decrease in manufacturing output can lead to reduced orders for raw materials and components, signaling that businesses anticipate lower demand for their products. This trend is often reflected in reports from purchasing managers and the Institute for Supply Management (ISM).

Rising unemployment rates also serve as a warning sign. An uptick in jobless claims indicates that companies are beginning to lay off workers, which can further dampen consumer spending and confidence. Labor market indicators, such as job openings and wage growth, are essential to monitor.

Additionally, a flattening or inverted yield curve in the bond market has historically been a reliable predictor of recessions. When short-term interest rates exceed long-term rates, it suggests that investors expect economic slowdown, leading to reduced lending and investment activity.

Lastly, increasing inflation rates can create economic strain. When prices rise sharply, consumers may reduce spending, and businesses may face higher costs that can squeeze profit margins. Monitoring inflation metrics, alongside wage growth and purchasing power, can provide a comprehensive view of economic health.

By being vigilant about these indicators, stakeholders can better prepare for potential economic challenges and implement strategies to mitigate their impacts.

Economic recessions are characterized by a decline in economic activity across various sectors, leading to significant implications for businesses, consumers, and governments. Understanding the early warning signs of a recession is crucial for stakeholders to prepare and respond effectively. Indicators such as rising unemployment rates, declining consumer confidence, decreased retail sales, and falling stock prices often precede an economic downturn. Monitoring these signals can help individuals and organizations make informed decisions about their finances and investments.

The impact of recessions varies across sectors. Industries like consumer discretionary and hospitality typically experience heightened vulnerability as consumers cut back on spending. In contrast, essential services such as healthcare and utilities tend to remain stable, as demand for these services persists regardless of economic conditions. However, even within stable sectors, companies may face challenges such as reduced investment and increased competition for limited consumer spending.

Investing during a recession requires a strategic approach. Investors often shift towards defensive stocks, which tend to perform better during economic downturns. These include companies in sectors like healthcare, utilities, and consumer staples, which provide essential goods and services. Additionally, diversifying investments and considering bonds or dividend-paying stocks can help mitigate risk during uncertain times.

Government stimulus plays a critical role in mitigating the effects of recessions. By introducing measures such as tax cuts, direct financial assistance, and infrastructure spending, governments can stimulate demand and support economic recovery. These efforts aim to bolster consumer confidence and investment, helping to stabilize the economy and shorten the duration of downturns.

Consumer behavior shifts significantly during economic downturns, characterized by increased saving and reduced spending. Consumers often prioritize essential purchases over discretionary items, leading to changes in demand patterns across various sectors. This shift can compel businesses to adapt their strategies, focusing on value and affordability to cater to budget-conscious consumers.

Recessions also have profound implications for global trade and supply chains. Economic contractions can lead to decreased demand for imports and exports, disrupting established supply chains and affecting international relations. Countries may implement protectionist measures, further complicating trade dynamics and impacting global economic recovery.

Lessons learned from past recessions, such as the 2008 financial crisis, underscore the importance of resilience and adaptability. Businesses that maintain strong cash reserves, diversify their revenue streams, and invest in technology are better positioned to weather economic storms. Developing contingency plans and fostering a culture of innovation can enable companies to not only survive but thrive in challenging economic environments.

To prepare for and survive a recession, businesses should focus on cost management, optimizing operations, and enhancing customer relationships. Building a robust online presence and leveraging digital marketing can help attract and retain customers during downturns. Moreover, fostering strategic partnerships can provide additional support and resources, allowing businesses to navigate economic challenges more effectively. By staying proactive and adaptable, organizations can emerge stronger from recessions, ready to capitalize on opportunities in the recovery phase.

2. **Sector Sensitivity: Understanding the Diverse Impacts of Recessions on the Economy**

Recessions affect various sectors of the economy in distinct ways, largely due to differences in consumer behavior, demand elasticity, and the nature of goods and services provided. Understanding these sensitivities can help investors, businesses, and policymakers navigate the challenges posed by economic downturns.

Consumer discretionary sectors, which include retail, entertainment, and travel, typically experience significant declines during recessions. As individuals tighten their budgets, spending on non-essential goods and services diminishes, leading to lower revenues for companies in these industries. Conversely, essential goods and services—such as utilities, healthcare, and basic consumer staples—tend to remain stable or even thrive, as consumers prioritize necessities over luxuries.

The financial sector can also be heavily impacted during recessions. Increased loan defaults and reduced lending activity can strain banks and financial institutions, leading to tighter credit conditions. As a result, businesses and consumers may find it more challenging to access financing, further slowing economic recovery.

The real estate market often experiences a slowdown as well. Rising unemployment and decreased consumer confidence can lead to reduced demand for housing and commercial properties, resulting in falling prices and increased vacancy rates. Construction activities may also decline, affecting related sectors such as materials and labor.

Conversely, certain sectors, like technology and e-commerce, may exhibit resilience or even growth during economic downturns. The shift towards remote work and digital solutions can bolster demand for technology services and products, while online retailers may capture market share from brick-and-mortar stores struggling to maintain consumer interest.

Internationally, recessions can have ripple effects on global trade. As countries face economic contractions, demand for imported goods typically declines, impacting export-driven economies. Supply chains may also be disrupted, as manufacturers adjust production levels in response to shifting demand patterns.

Understanding the diverse impacts of recessions on different sectors is crucial for stakeholders aiming to make informed decisions during economic downturns. By recognizing which industries are more vulnerable and which may offer opportunities for growth, businesses and investors can better position themselves to weather the storm and emerge stronger when economic conditions improve.

In conclusion, understanding the multifaceted nature of economic recessions is crucial for both individuals and businesses. By recognizing the early warning signs, stakeholders can better prepare for potential downturns and adapt their strategies accordingly. The impact of recessions varies significantly across different sectors, highlighting the importance of sector sensitivity in investment decisions. Effective strategies for investing during challenging times can help mitigate losses and even identify opportunities for growth.

Government intervention through stimulus measures plays a vital role in cushioning the effects of recessions, while shifts in consumer behavior during economic downturns can reshape market dynamics. Additionally, recessions often disrupt global trade and supply chains, emphasizing the need for resilience and flexibility in business operations.

Reflecting on the lessons learned from past recessions provides valuable insights that remain relevant today. Businesses that proactively prepare for economic downturns by developing contingency plans, managing resources wisely, and staying attuned to market changes are more likely to navigate challenges successfully and emerge stronger. As we move forward, it is essential for all economic participants to cultivate a deeper understanding of these dynamics to foster stability and growth in an ever-changing financial landscape.