Navigating Debt: Strategies for Personal

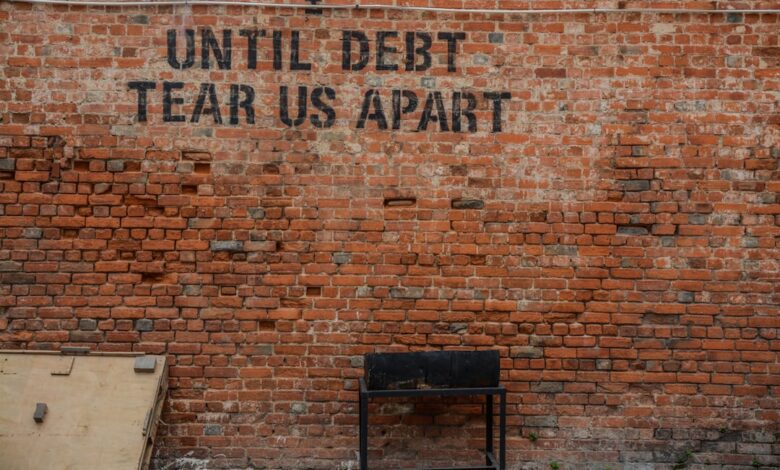

In today's fast-paced financial landscape, managing and reducing personal debt has become a critical concern for individuals and families alike. High levels of personal debt not only burden borrowers but also cast a shadow on broader economic growth, affecting everything from consumer spending to investment behaviors. As the complexities of debt continue to evolve, understanding effective strategies for debt management—such as budgeting, negotiating with creditors, and seeking credit counseling—becomes essential. This article explores the multifaceted nature of debt, examining its implications for personal finances and economic health. We will delve into the impact of student loan debt on financial planning, the interplay between corporate debt and stock performance, and how governments navigate national debt to ensure economic stability. By shedding light on these interconnected topics, we aim to equip readers with the knowledge and tools necessary to navigate the challenging debt landscape and make informed financial decisions.

- Here are three possible section headlines for the article covering the specified topics:

- 1. "Effective Strategies for Personal Debt Management: From Budgeting to Negotiation"

- 2. "Debt Dynamics: Understanding Its Impact on Economic Growth and Investment Strategies"

Here are three possible section headlines for the article covering the specified topics:

Managing personal debt effectively is crucial not only for individual financial health but also for broader economic stability. High levels of personal debt can lead to increased financial stress, limiting consumer spending and ultimately hindering economic growth. Individuals burdened with debt may prioritize repayment over other expenditures, reducing demand for goods and services. This diminished consumer activity can slow down economic expansion and may even lead to a recession if widespread.

Negotiating with creditors can be an effective strategy for managing debt. Open communication with lenders can result in better repayment terms, such as lower interest rates, extended payment plans, or even settlements for less than the owed amount. This proactive approach not only alleviates immediate financial pressure but also can help individuals regain control over their financial situations.

Credit counseling plays a vital role in debt management by providing individuals with the tools and education needed to navigate their financial challenges. Credit counselors can help clients develop personalized budgets, create debt repayment plans, and understand their rights when dealing with creditors. This support can empower individuals to make informed decisions and avoid falling into deeper debt.

When considering the use of debt to invest, it’s essential to weigh the risks and rewards carefully. While leveraging debt can amplify investment returns, it also increases the potential for significant losses, especially in volatile markets. Investors must assess their risk tolerance and the stability of the investment before engaging in such strategies.

Student loan debt is a pressing issue that significantly impacts financial planning for many individuals. The burden of repaying student loans can delay major life milestones, such as purchasing a home or saving for retirement. Understanding the long-term implications of student debt is critical for effective financial planning and can shape how individuals allocate their resources throughout their lives.

In the corporate world, debt levels can influence stock performance. Companies that manage their debt effectively can leverage it for growth, potentially leading to increased profitability and shareholder value. Conversely, high corporate debt can signal financial instability, resulting in decreased investor confidence and lower stock prices.

Governments also face challenges in managing national debt and its economic implications. High levels of national debt can lead to increased interest rates and reduced public investment, potentially stifling economic growth. However, strategic use of debt can fund essential services and infrastructure, promoting long-term economic benefits if managed wisely.

In summary, understanding the complexities of debt—from personal finance to corporate and national levels—can provide valuable insights into effective management strategies and their broader economic implications.

1. "Effective Strategies for Personal Debt Management: From Budgeting to Negotiation"

Managing personal debt effectively requires a multifaceted approach that combines budgeting, negotiation, and informed decision-making. One of the first steps in debt management is creating a detailed budget that outlines income, expenses, and debt obligations. By tracking spending patterns, individuals can identify areas where they can cut back, allowing them to allocate more funds toward debt repayment. Tools such as budgeting apps or spreadsheets can aid in maintaining financial discipline.

In addition to budgeting, prioritizing debts can significantly impact repayment strategies. The avalanche method, where individuals pay off debts with the highest interest rates first, can save money in the long run. Conversely, the snowball method focuses on paying off smaller debts first to build momentum and motivation. Each method has its merits, and individuals should choose the strategy that best aligns with their financial goals and psychological comfort.

Negotiation is another critical component of effective debt management. Individuals should not hesitate to contact creditors to discuss repayment terms. Many creditors are willing to offer options such as lower interest rates, extended payment plans, or temporary forbearance, especially if the borrower can demonstrate financial hardship. Preparation is key; borrowers should gather relevant financial documents and have a clear proposal in mind before initiating discussions.

Lastly, seeking professional assistance, such as credit counseling, can provide valuable insights and resources for managing debt. Credit counselors can help individuals create repayment plans, educate them about financial literacy, and negotiate with creditors on their behalf. This support can be especially beneficial for those feeling overwhelmed by their financial situation.

By combining effective budgeting, strategic prioritization, negotiation with creditors, and professional guidance, individuals can take proactive steps toward managing and reducing their personal debt, ultimately fostering a more stable financial future.

2. "Debt Dynamics: Understanding Its Impact on Economic Growth and Investment Strategies"

High levels of personal and corporate debt can significantly influence economic growth and investment strategies. When individuals or businesses carry substantial debt, their financial flexibility diminishes, often leading to reduced consumer spending and lower investment in growth opportunities. This phenomenon creates a cycle where high debt burdens can stifle economic expansion, as spending drives demand and, consequently, job creation.

From a macroeconomic perspective, excessive personal debt can lead to increased defaults and bankruptcies, which can strain financial institutions and diminish overall consumer confidence. This decline in confidence can result in tighter credit conditions, making it more challenging for both individuals and businesses to secure loans for investments, further slowing economic activity.

Conversely, manageable levels of debt can stimulate growth when used strategically. For instance, investing in education or business expansion can yield returns that exceed the cost of borrowing. However, the key lies in understanding the dynamics of debt—balancing the potential rewards of leveraging debt against the risks of overextension.

In the realm of investment strategies, understanding debt dynamics is crucial. Investors often evaluate a company's debt levels when assessing its financial health and growth potential. High corporate debt can elevate risk but may also indicate aggressive growth strategies that could yield high returns if managed effectively. Thus, investors must analyze not only the debt-to-equity ratio but also the company’s cash flow and earnings potential.

In summary, debt dynamics play a pivotal role in shaping economic growth and investment strategies. While high debt levels can pose significant risks, judicious use of debt can facilitate investment and drive growth, illustrating the importance of a balanced approach in both personal finance and corporate strategy.

In conclusion, effectively managing and reducing personal debt is not only crucial for individual financial stability but also plays a significant role in broader economic health. By employing strategies such as budgeting, negotiating with creditors, and seeking credit counseling, individuals can navigate their financial challenges more effectively. Understanding the dynamics of debt—both personal and corporate—reveals its complex impact on economic growth, investment strategies, and overall financial planning.

Moreover, as student loan debt continues to shape the financial landscape for many, it is essential to address its implications on future financial goals. On a larger scale, governments' management of national debt also carries profound economic implications, influencing everything from interest rates to fiscal policy. Ultimately, while debt can be a double-edged sword, the informed and strategic use of it can lead to opportunities for growth and investment. By recognizing the risks and rewards associated with debt, individuals and policymakers alike can work towards fostering a more sustainable financial future.