Mastering Debt: Strategies for Personal Management, Economic Impact, and Negotiation Tactics

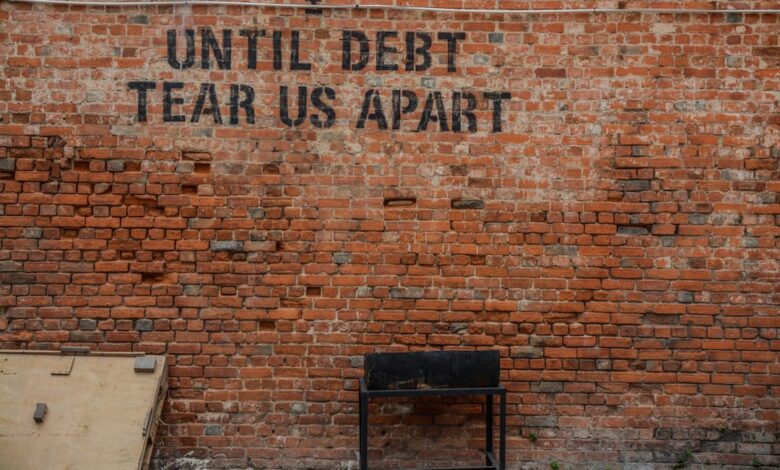

In today's fast-paced financial landscape, managing debt has become a critical concern for individuals, businesses, and governments alike. Personal debt can weigh heavily on one’s financial health, impacting everything from day-to-day budgeting to long-term financial goals. As high debt levels continue to challenge economic growth on a broader scale, understanding effective strategies for debt management is essential. This article explores various dimensions of debt, beginning with practical approaches to navigate and reduce personal debt, before delving into the economic implications of rising debt levels. It also highlights the importance of negotiation with creditors for favorable repayment terms and the supportive role of credit counseling. Furthermore, we will examine the complex relationship between debt and investment, the specific challenges posed by student loan debt, and the influence of corporate debt on stock performance. Finally, we will analyze how governments manage national debt and its far-reaching economic implications. By addressing these topics, we aim to provide a comprehensive guide to understanding and managing debt in a way that promotes both personal and economic well-being.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **Debt Dynamics: Understanding the Economic Implications of High Debt Levels**

- 3. **Negotiation and Support: Tools for Better Repayment Terms and Credit Counseling**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a proactive approach and a solid understanding of one’s financial situation. The first step is to conduct a comprehensive assessment of all debts, including credit cards, student loans, and other obligations. This inventory should detail the total amount owed, interest rates, and minimum monthly payments. Knowing this information provides a clear picture of the debt landscape.

One effective strategy is the debt snowball method, which involves focusing on paying off the smallest debts first while making minimum payments on larger debts. This approach can boost motivation as individuals experience quick wins. Alternatively, the debt avalanche method targets debts with the highest interest rates first, potentially saving money on interest in the long run.

Creating a realistic budget is essential for managing debt. This budget should account for all monthly expenses, including debt repayments, and highlight areas where spending can be reduced. Cutting unnecessary expenses can free up additional funds to allocate toward debt reduction.

Negotiating with creditors is another key strategy. Many creditors are willing to work with individuals facing financial difficulties, offering options such as lower interest rates, extended payment terms, or reduced settlements. Open and honest communication can lead to more favorable repayment terms, easing the burden of debt.

Additionally, seeking assistance from a credit counseling service can provide valuable guidance. These organizations can help negotiate with creditors, create personalized debt management plans, and offer financial education to prevent future debt accumulation.

Ultimately, reducing personal debt requires a combination of effective strategies, disciplined budgeting, and, when necessary, professional support. By taking control of their financial situation, individuals can work towards achieving debt-free living and improved financial stability.

2. **Debt Dynamics: Understanding the Economic Implications of High Debt Levels**

High levels of debt, both personal and corporate, can have significant implications for economic growth and stability. When individuals or businesses are heavily indebted, their financial resources are often tied up in servicing that debt, which can limit their ability to invest, spend, or save. This reduction in disposable income can lead to decreased consumer spending, one of the primary drivers of economic growth. As consumers cut back on expenditures to manage their debt, businesses may experience lower sales and revenues, potentially leading to a slowdown in economic activity.

Furthermore, high debt levels can create a cycle of dependency on borrowing. For individuals, this might mean taking on more debt to pay off existing obligations, leading to a precarious financial situation. For companies, excessive corporate debt can result in reduced flexibility to respond to market changes, as they may prioritize debt repayment over strategic investments or innovation.

On a macroeconomic level, when debt levels reach unsustainable levels, it can lead to financial crises. For instance, a sudden increase in interest rates can make it more difficult for borrowers to meet their obligations, leading to defaults and bankruptcies. This not only affects the borrowers but also has a ripple effect on creditors and the broader financial system, potentially triggering a recession.

Moreover, high levels of national debt can also impose constraints on government spending and investment. Governments may need to allocate a significant portion of their budgets to interest payments, which can limit funding for essential public services and infrastructure projects. This can stifle economic growth in the long term, as the government plays a crucial role in fostering an environment conducive to investment and development.

Ultimately, while some level of debt can be a useful tool for fueling growth and investment, it is essential to maintain a balance. Understanding the dynamics of debt and its broader economic implications can help individuals, businesses, and policymakers make informed decisions that promote financial stability and sustainable economic growth.

3. **Negotiation and Support: Tools for Better Repayment Terms and Credit Counseling**

Negotiating with creditors can be a crucial step in managing personal debt effectively. Borrowers who proactively reach out to their lenders often find that many creditors are willing to work with them to establish more manageable repayment terms. This may include negotiating lower interest rates, extending the repayment period, or restructuring the loan altogether. It is vital to approach these discussions prepared with relevant information, such as current financial circumstances and a proposed plan for repayment. Demonstrating a genuine commitment to fulfilling obligations can foster goodwill and lead to more favorable outcomes.

In addition to direct negotiations, credit counseling services provide valuable support for individuals struggling with debt. These organizations offer professional guidance and educational resources to help borrowers understand their financial situation and develop a personalized debt management plan. Credit counselors can assist in budgeting, prioritizing debts, and communicating with creditors on the borrower’s behalf, which can alleviate some of the stress associated with debt management.

Moreover, credit counseling can help borrowers identify and avoid predatory lending practices, ensuring they make informed financial decisions. While some credit counseling services charge fees, many are non-profit organizations that offer free or low-cost support, making them accessible to a broad audience. By utilizing these tools, individuals can better navigate their debt challenges, ultimately leading to improved financial stability and a clearer path toward debt reduction.

In conclusion, managing and reducing personal debt is a multifaceted challenge that requires a combination of strategic planning, negotiation skills, and an understanding of broader economic implications. High levels of personal and corporate debt can stifle economic growth, highlighting the importance of responsible borrowing and effective debt management. By employing strategies such as negotiating with creditors and seeking credit counseling, individuals can improve their financial situations and work towards sustainable repayment plans. Additionally, the complexities of student loan debt and its impact on long-term financial planning cannot be overlooked, as they significantly influence life choices for many.

While leveraging debt for investment can present opportunities, it is essential to weigh the associated risks carefully. On a larger scale, the management of national debt by governments plays a crucial role in shaping economic stability and influencing market performance. As we navigate our financial landscapes, understanding these interconnected aspects of debt will empower individuals to make informed decisions, ultimately fostering a healthier financial future for both themselves and the economy at large.