Mastering Debt: Strategies for Personal Management and Economic Impact

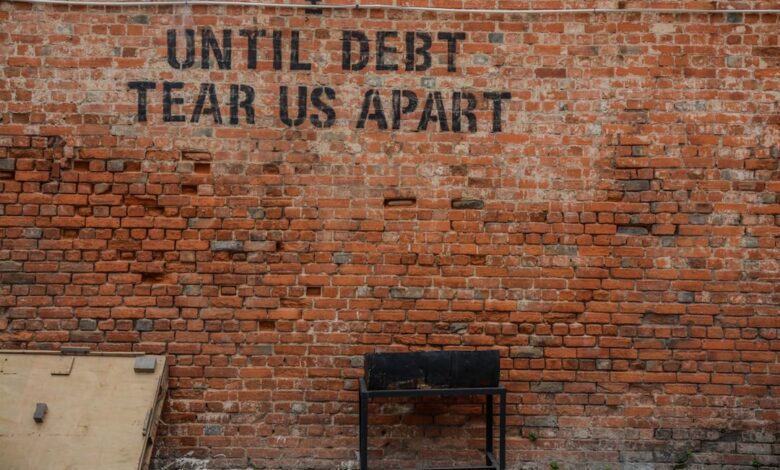

In today’s complex financial landscape, personal debt remains a pressing concern for individuals and families alike. With rising living costs and unexpected expenses, many find themselves grappling with high levels of debt that can hinder their financial stability and overall well-being. This article delves into effective strategies for managing and reducing personal debt, examining how high debt levels not only affect individual finances but also have broader implications for economic growth. We will explore practical approaches to negotiating with creditors for more favorable repayment terms and the pivotal role of credit counseling in navigating these challenges. Additionally, we will discuss the potential risks and rewards of leveraging debt for investment purposes, the impact of student loan debt on financial planning, and the interplay between corporate debt and stock performance. Finally, we will consider how governments manage national debt and the economic repercussions that ensue. By equipping ourselves with knowledge and strategies, we can take proactive steps towards achieving financial health and resilience in an increasingly debt-driven world.

- 1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

- 2. **Debt Dynamics: Understanding Its Influence on Economic Growth and Investment**

1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

Navigating the debt landscape can be challenging, yet effective strategies can significantly ease the burden of personal debt. First and foremost, creating a comprehensive budget is essential. By tracking income and expenses, individuals can identify areas where they can cut back, allowing for more funds to be directed toward debt repayment.

Another effective strategy is the debt snowball method, where debts are tackled from the smallest to the largest. This approach not only provides psychological boosts as smaller debts are eliminated but also creates momentum for addressing larger debts. Conversely, the debt avalanche method focuses on paying off debts with the highest interest rates first, which can save money on interest over time.

Consolidation options, such as personal loans or balance transfer credit cards, can also simplify debt management. By consolidating multiple debts into one payment, individuals can streamline their repayment efforts and potentially secure lower interest rates. However, it is crucial to assess the terms of these options to avoid incurring additional fees or extending the repayment period.

Furthermore, open communication with creditors can lead to more favorable repayment terms. Many creditors are willing to negotiate lower interest rates or extended payment plans, especially if they understand a borrower’s financial struggles.

Lastly, seeking the guidance of a credit counseling service can provide valuable insights and support. These organizations often offer personalized plans and educational resources to help individuals better manage their finances and develop healthier spending habits.

By employing these strategies, individuals can take proactive steps to manage their debt, reduce financial stress, and ultimately gain greater control over their financial future.

Managing and reducing personal debt is a critical aspect of achieving financial stability and well-being. Individuals can adopt several strategies to tackle their debt effectively. One common approach is the debt snowball method, where the borrower focuses on paying off the smallest debts first while making minimum payments on larger ones. This method can provide psychological boosts as debts are eliminated. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, which can lead to more savings in the long run.

High levels of personal debt also have broader implications, affecting economic growth. When consumers are burdened with significant debt, their disposable income decreases, leading to reduced spending. This decline in consumer spending can slow economic growth as businesses face lower demand for goods and services.

Negotiating with creditors is another crucial strategy for debt management. Borrowers can reach out to their creditors to discuss their financial situation and request better repayment terms, such as lower interest rates or extended payment periods. Many creditors are willing to work with borrowers to avoid defaults, which can be beneficial for both parties.

Credit counseling plays a significant role in helping individuals manage their debt. Professional credit counselors can provide guidance on budgeting, debt repayment strategies, and financial planning. They may also help negotiate with creditors on behalf of the borrower, creating a structured debt repayment plan that can alleviate financial stress.

Using debt to invest carries its own set of risks and rewards. While leveraging borrowed funds can enhance investment returns, it also increases the risk of larger losses if investments do not perform as expected. Investors must weigh these factors carefully and consider their risk tolerance before proceeding.

In the context of education, student loan debt can have long-term effects on financial planning. Graduates may find themselves delaying major life decisions, such as home purchases or retirement savings, due to their debt obligations. This delay can hinder their overall financial growth and stability.

On a corporate level, the impact of corporate debt on stock performance is significant. High levels of corporate debt can increase financial risk, potentially leading to stock price volatility. Investors often scrutinize a company’s debt levels when assessing its financial health and future growth prospects.

Lastly, governments manage national debt through various strategies, including fiscal policy adjustments and monetary policy interventions. National debt can affect a country's economic stability, influencing interest rates, inflation, and investment. The implications of national debt are complex, as high debt levels can lead to concerns about sustainability, impacting both domestic and international perceptions of a country's financial health.

2. **Debt Dynamics: Understanding Its Influence on Economic Growth and Investment**

Debt dynamics play a crucial role in shaping both economic growth and investment patterns. High levels of personal and corporate debt can have significant implications for economic health. When consumers are burdened by large amounts of debt, their disposable income decreases, leading to reduced spending. This contraction in consumer demand can inhibit business growth, as companies may face declining sales and, consequently, lower revenue projections. As a result, high personal debt levels can create a cycle of stagnation where economic growth is hampered by reduced consumer activity.

On the corporate side, excessive debt can limit a company's ability to invest in new projects or expand operations. Firms that are heavily leveraged may prioritize debt servicing over capital investment, stifling innovation and long-term growth. Furthermore, high corporate debt levels can lead to increased volatility in stock performance, as investors may perceive these companies as riskier. When economic conditions fluctuate, heavily indebted firms may struggle to maintain profitability, adversely affecting their stock prices and overall market stability.

Conversely, debt can also serve as a catalyst for growth when managed judiciously. Businesses often use debt to finance expansion, invest in research and development, or acquire new technologies, which can lead to increased productivity and economic output. For individuals, taking on manageable debt to invest in education or homeownership can enhance long-term financial stability and contribute positively to economic growth.

Understanding the balance between leveraging debt for growth and managing the risks associated with high debt levels is essential for both individuals and corporations. Policymakers must also consider these dynamics when crafting economic policies, as fostering an environment that encourages productive investment while minimizing unsustainable debt levels is vital for sustained economic growth.

In conclusion, effectively managing and reducing personal debt requires a multifaceted approach that encompasses strategic planning, negotiation skills, and an understanding of broader economic implications. As we've explored, high levels of personal debt can significantly hinder economic growth, underscoring the necessity for individuals to adopt sound debt management practices. Negotiating with creditors can lead to more favorable repayment terms, providing relief and paving the way for financial recovery. Moreover, credit counseling offers valuable resources for those grappling with debt, guiding them toward sustainable financial habits.

While leveraging debt for investment can present opportunities for growth, it also carries inherent risks that must be carefully weighed. This is particularly true for students, whose loan burdens can complicate future financial planning. On a larger scale, corporate debt influences stock performance, and governments must navigate national debt management to ensure economic stability.

Ultimately, understanding the interconnectedness of personal and national debt dynamics is crucial for fostering a healthier financial landscape. By adopting proactive strategies and seeking guidance, individuals can take control of their financial futures, contributing to both personal well-being and broader economic resilience.