Mastering Debt: Strategies for Personal Finance, Economic Growth, and Effective Negotiation

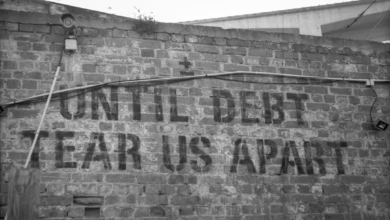

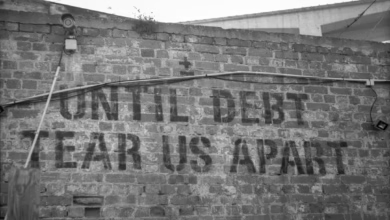

In today's fast-paced financial landscape, managing debt has become a critical concern for individuals, businesses, and governments alike. With personal debt levels soaring, many find themselves grappling with the weight of financial obligations that can hinder their economic well-being and overall quality of life. This article delves into effective strategies for managing and reducing personal debt, while also examining the broader implications of high debt levels on economic growth. We will explore practical approaches to negotiating with creditors, the essential role of credit counseling in debt management, and the complex interplay between student loan debt and financial planning. Furthermore, we will analyze how corporate debt influences stock performance and discuss the strategies governments employ to manage national debt and its economic ramifications. By understanding these interconnected issues, readers can gain valuable insights into navigating their financial landscape and making informed decisions that foster long-term stability and growth.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Economic Ripple Effect: Understanding High Debt Levels and Growth**

- 3. **Negotiating for Relief: Strategies for Engaging Creditors and Securing Better Terms**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Navigating personal debt requires a strategic approach to effectively manage and reduce outstanding obligations. One of the first steps is to create a comprehensive budget that outlines income, expenses, and debt repayments. This budget serves as a roadmap for financial health, enabling individuals to identify areas where they can cut back on discretionary spending and allocate more funds toward debt repayment.

Another effective strategy is the debt snowball method, which involves focusing on paying off the smallest debts first while making minimum payments on larger debts. This approach not only reduces the number of creditors but also fosters a sense of accomplishment as each debt is paid off, motivating individuals to continue their efforts. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, minimizing overall interest payments and potentially shortening the repayment period.

Individuals should also consider consolidating debt through personal loans or balance transfer credit cards, which can lower interest rates and simplify payments. However, it’s crucial to assess the terms of consolidation options to avoid falling into a cycle of further debt.

Regular communication with creditors is essential for negotiating better repayment terms. Many creditors are willing to work with individuals facing financial hardship, offering options such as reduced interest rates, extended payment plans, or settlement agreements.

Lastly, seeking support from credit counseling services can provide valuable insights and resources. These organizations can assist individuals in creating a debt management plan, helping them navigate their financial challenges more effectively while offering educational resources for long-term financial stability. By employing these strategies, individuals can take proactive steps toward managing and reducing their personal debt, ultimately fostering a healthier financial future.

2. **The Economic Ripple Effect: Understanding High Debt Levels and Growth**

High levels of personal, corporate, and national debt can create significant ripple effects throughout the economy, impacting growth and stability. When individuals carry excessive personal debt, they often reduce their spending on goods and services, which can slow down economic activity. This decline in consumer spending can lead businesses to experience lower revenues, prompting them to cut back on investments, reduce hiring, or even lay off employees. As consumer confidence wanes, a cycle of reduced spending and economic stagnation can ensue.

At the corporate level, high debt levels can limit a company’s ability to invest in growth opportunities or adapt to changing market conditions. When firms allocate a significant portion of their cash flow to servicing debt, they may forego important investments in innovation, technology, or workforce development. This can hinder their competitiveness and ultimately impact the broader economy, as stagnant companies contribute less to job creation and productivity growth.

On a national scale, high government debt can also have profound implications for economic growth. While some level of public debt can be beneficial for funding essential services and stimulating economic activity, excessive debt may lead to higher interest rates. Governments facing high debt levels may need to increase taxes or cut public spending to manage repayments, both of which can further suppress economic growth. Additionally, concerns over a country’s ability to service its debt can lead to reduced investor confidence, resulting in capital flight and currency depreciation.

In summary, the interconnectedness of debt at personal, corporate, and national levels highlights the importance of prudent debt management. High debt levels can create a self-reinforcing cycle that dampens economic growth, making it essential for individuals, businesses, and governments to adopt strategies that promote sustainable financial practices.

3. **Negotiating for Relief: Strategies for Engaging Creditors and Securing Better Terms**

Negotiating with creditors can be a pivotal step in managing personal debt and improving financial stability. Engaging in constructive communication can lead to securing better repayment terms, reducing interest rates, or even settling for a lower total amount owed. Here are several strategies that can help individuals effectively negotiate with their creditors:

1. **Prepare Thoroughly**: Before initiating any conversation with creditors, it is essential to gather all relevant financial documents, including account statements, payment history, and a detailed budget. Understanding your financial situation will help you articulate your needs and demonstrate your commitment to resolving the debt.

2. **Know Your Rights**: Familiarize yourself with consumer rights laws, such as the Fair Debt Collection Practices Act (FDCPA) in the United States. Knowing your rights can empower you during negotiations and help you identify any potential violations by creditors.

3. **Establish Clear Goals**: Determine what you aim to achieve through negotiation. Whether it's a lower interest rate, a temporary forbearance, or a debt settlement, having clear goals will guide your discussions and keep you focused.

4. **Initiate Contact**: Reach out to your creditors directly, either by phone or in writing. When initiating contact, be polite but assertive. Explain your situation honestly, including any financial hardships you are experiencing, and express your desire to find a workable solution.

5. **Propose a Solution**: Be ready to suggest specific repayment options that are feasible for you. This could include a request for a temporary reduction in payments, a longer repayment period, or a one-time lump-sum payment to settle the debt. Providing a clear plan can make it easier for creditors to consider your proposal.

6. **Follow Up in Writing**: After any verbal discussions, follow up with a written summary of your conversation and any agreements made. This creates a record of your negotiations and can be useful if there are discrepancies in the future.

7. **Stay Persistent**: If your initial request is denied, don’t be discouraged. Persistence can pay off. Consider revisiting the negotiation after some time or when your financial situation changes. Additionally, if you face repeated refusals, consider asking to speak with a supervisor or a different department that may have more authority to approve your request.

8. **Consider Professional Help**: If negotiating directly with creditors feels overwhelming, seeking assistance from a credit counseling service can be beneficial. These professionals are trained to negotiate on behalf of clients and may have established relationships with creditors that can facilitate better terms.

By employing these strategies, individuals can improve their chances of negotiating favorable terms with creditors, ultimately leading to a more manageable debt situation and healthier financial future.

In conclusion, managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach and an understanding of both individual and broader economic implications. As illustrated throughout this article, high debt levels can stifle economic growth, affecting not just individuals but also corporations and governments. By employing effective strategies for debt management, negotiating with creditors, and seeking assistance from credit counseling, individuals can regain control of their financial futures.

Furthermore, while the risks and rewards of leveraging debt for investment can be enticing, it is crucial to approach such decisions with caution, particularly in the context of student loan debt, which significantly impacts long-term financial planning. The interplay between corporate debt and stock performance also highlights the importance of financial health at all levels of the economy. Finally, understanding how governments manage national debt sheds light on the broader economic landscape and its implications for individual financial strategies.

Ultimately, achieving financial stability and growth requires a proactive mindset, informed decision-making, and the willingness to seek help when necessary. By taking these steps, individuals can pave the way toward a more secure financial future, contributing positively to the economy as a whole.