Debt Dynamics: Strategies for Personal Management, Economic Impact, and Effective Negotiation

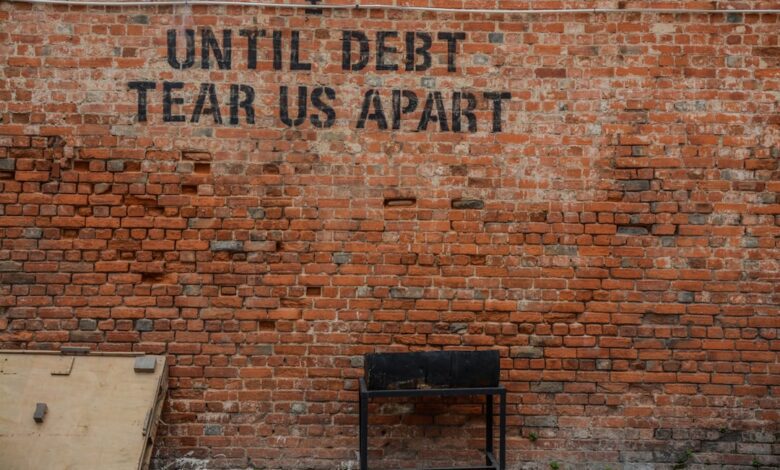

In today’s complex financial landscape, personal debt has emerged as a pressing concern for individuals and economies alike. As households grapple with rising expenses, the burden of debt can hinder not only personal financial stability but also broader economic growth. Understanding how to effectively manage and reduce personal debt is crucial in this context. This article delves into a multifaceted exploration of debt management strategies, highlighting practical approaches for individuals seeking relief and sustainability. We will examine the impact of high debt levels on economic growth, the importance of negotiating with creditors for better repayment terms, and the role of credit counseling in fostering financial health. Furthermore, we will touch on the nuanced relationship between investment and debt, the implications of student loan burdens on financial planning, and how corporate debt influences stock performance. Finally, we will consider how governments navigate national debt and its economic implications. By shedding light on these interconnected issues, we aim to equip readers with the knowledge to make informed decisions in their pursuit of financial well-being.

- 1. Navigating Personal Debt: Effective Strategies for Reduction and Management

- 2. The Economic Ripple Effect: Understanding High Debt Levels and Growth

- 3. Negotiation Tactics and Support: Partnering with Creditors and Counselors for Financial Relief

1. Navigating Personal Debt: Effective Strategies for Reduction and Management

Managing personal debt is a critical aspect of maintaining financial health and stability. Individuals looking to reduce their debt levels can adopt several effective strategies to navigate this challenge.

First, it is essential to create a comprehensive budget that outlines income, expenses, and debt obligations. This allows individuals to gain a clear understanding of their financial situation and identify areas where spending can be reduced. Prioritizing essential expenses while minimizing discretionary spending can free up additional funds for debt repayment.

Second, the snowball or avalanche method can be employed to tackle debts. The snowball method involves paying off the smallest debts first to build momentum and motivation, while the avalanche method focuses on paying off debts with the highest interest rates first to minimize overall interest paid. Choosing the method that aligns with personal motivation and financial goals can enhance the effectiveness of the repayment strategy.

Third, consolidating debts through a personal loan or a balance transfer credit card can simplify payments and potentially lower interest rates. This approach can make it easier to manage multiple debts and reduce the total interest burden. However, it is crucial to read the fine print and understand any fees associated with consolidation.

Additionally, individuals should consider reaching out to creditors to negotiate better repayment terms. Many creditors are willing to work with borrowers facing financial difficulties, offering options such as lower interest rates, extended payment plans, or temporary forbearance. Open communication is key, and borrowers should be prepared to explain their situation and propose reasonable solutions.

Credit counseling services can also play a vital role in debt management. These organizations provide guidance and support for individuals struggling with debt, offering tools to create a budget, develop a repayment plan, and negotiate with creditors. Engaging with a certified credit counselor can provide valuable insights and strategies tailored to an individual’s unique financial circumstances.

Lastly, it’s important to cultivate a mindset focused on long-term financial health. This includes building an emergency fund to prevent future reliance on credit and adopting responsible spending habits. By implementing these strategies, individuals can effectively manage and reduce their personal debt, paving the way for a more secure financial future.

2. The Economic Ripple Effect: Understanding High Debt Levels and Growth

High debt levels can significantly hinder economic growth, creating a ripple effect that impacts various sectors of the economy. When individuals and households are burdened by excessive debt, their ability to spend is constrained. This reduced consumer spending leads to lower demand for goods and services, ultimately slowing down business revenues and stifling investment.

Moreover, high levels of personal debt often result in increased financial stress, which can affect productivity and overall well-being. As individuals prioritize debt repayment over other expenditures, essential services such as healthcare and education may suffer, further limiting growth potential. This can create a cycle where poor financial health leads to decreased economic activity, which in turn perpetuates high debt levels.

On a broader scale, when businesses face a market with constrained consumer spending due to widespread debt, they may be less inclined to hire new employees or invest in expansion. This stagnation can lead to a slowdown in job creation, which affects income levels and, consequently, consumer confidence. The interplay between high debt and economic growth illustrates the importance of maintaining manageable debt levels, as both personal and corporate debt can significantly shape economic landscapes.

Additionally, high debt levels can influence government policy and fiscal health. As citizens struggle with personal debt, governments may face pressure to implement social safety nets and financial assistance programs, which can strain public resources. In turn, this can lead to increased national debt, creating a complex web of economic implications that policymakers must navigate carefully.

In summary, understanding the economic ripple effect of high debt levels is crucial for devising strategies that promote sustainable growth. By addressing debt management and fostering financial literacy, both individuals and policymakers can work towards creating a more resilient economy that supports long-term prosperity.

3. Negotiation Tactics and Support: Partnering with Creditors and Counselors for Financial Relief

Negotiating with creditors is a crucial step in managing and reducing personal debt. Effective negotiation can lead to more favorable repayment terms, lower interest rates, or even debt forgiveness, which can significantly alleviate financial pressure. To initiate contact, individuals should prepare by gathering all relevant financial documents, including account statements and a budget outlining their income and expenses. This preparation will enable them to present a clear picture of their financial situation to creditors.

One effective tactic is to demonstrate a willingness to pay, even if it's a reduced amount. Creditors may be more inclined to negotiate if they see that the borrower is committed to resolving the debt. It can be beneficial to propose a realistic repayment plan or settlement offer, explaining how it aligns with the borrower’s financial capabilities. Timing is also important; reaching out during periods when creditors are more likely to be flexible, such as after a missed payment, can improve the chances of a favorable outcome.

In addition to direct negotiation with creditors, seeking support from credit counseling services can provide valuable assistance. These organizations offer professional advice and can help individuals develop personalized debt management plans. Credit counselors can act as intermediaries, negotiating with creditors on behalf of their clients to secure better terms. They also provide education on financial literacy, which can empower individuals to make informed decisions and avoid falling back into debt.

It’s essential for individuals to choose reputable credit counseling services that are certified and non-profit. By leveraging both negotiation tactics and the expertise of credit counselors, individuals can create a pathway toward financial relief and regain control over their financial futures.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for the broader economic landscape. By employing strategic approaches to debt reduction, individuals can mitigate the adverse effects of high debt levels, which can stifle economic growth. Negotiating with creditors and seeking assistance from credit counseling services are vital steps in achieving more favorable repayment terms, providing a lifeline for those struggling to regain financial stability.

Furthermore, while leveraging debt for investment can yield significant rewards, it carries inherent risks that must be carefully considered, particularly in light of the growing burden of student loan debt on financial planning for young adults. On a larger scale, corporate debt impacts stock performance, underscoring the interconnectedness of personal and business finances within the economy.

Lastly, understanding how governments manage national debt highlights the implications of fiscal policy on economic stability. By recognizing these multifaceted relationships, individuals can make informed decisions that not only enhance their financial well-being but also contribute positively to the economy as a whole. Ultimately, a proactive approach to debt management can pave the way for a more secure financial future and a healthier economic environment.