Debt Dynamics: Strategies for Personal Management, Economic Impact, and Effective Negotiation

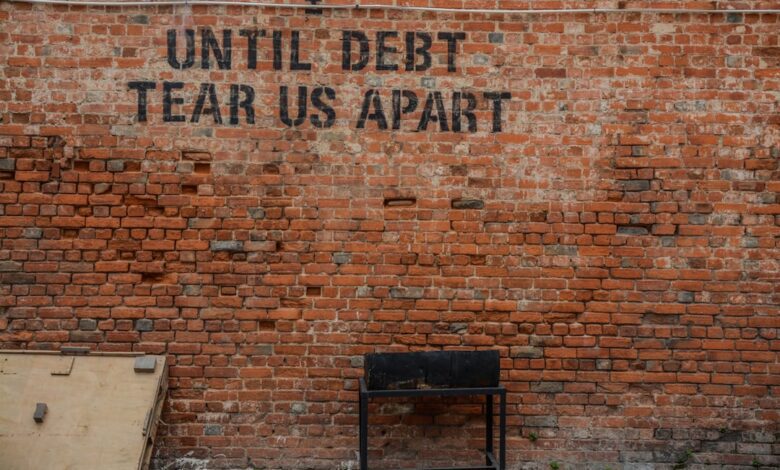

In today's fast-paced financial landscape, personal debt has become an increasingly prevalent concern for individuals and families alike. As the burden of debt weighs heavily on personal finances, it can also exert significant pressure on broader economic growth. This article delves into effective strategies for managing and reducing personal debt, highlighting the importance of negotiating with creditors and the invaluable role of credit counseling in fostering financial recovery. Additionally, we will explore the broader implications of high debt levels, both on individual financial planning—particularly in the context of student loans—and on corporate performance, as companies navigate their own debt burdens. Finally, we will examine how governments manage national debt and its consequential impact on economic stability. By understanding these interconnected factors, readers can gain insights into not only their personal financial health but also the larger economic environment in which they operate.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Economic Ripple Effect: High Debt Levels and Growth Trajectories**

- 3. **Credit Negotiation and Counseling: Tools for Financial Recovery and Success**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines budgeting, prioritization, and negotiation. One of the first steps is to create a comprehensive budget that clearly outlines income, expenses, and debt obligations. This allows individuals to identify areas where they can cut back on spending and allocate more funds toward debt repayment.

Once a budget is in place, it is essential to prioritize debts. One effective method is the debt snowball approach, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This strategy can provide psychological wins and motivation as debts are eliminated. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, ultimately saving more money on interest payments over time.

Negotiating with creditors can also play a crucial role in debt management. Individuals should not hesitate to reach out to their creditors to discuss their financial situation. Many creditors are willing to work with borrowers, offering options such as lower interest rates, extended repayment terms, or payment plans that fit better within the borrower’s budget. Demonstrating a willingness to repay and explaining any financial hardships can often lead to more favorable terms.

Additionally, seeking help from a credit counseling agency can provide valuable resources and guidance. These agencies can assist in creating a realistic repayment plan and may offer debt management programs that consolidate payments into a single monthly installment, often at a reduced interest rate.

Ultimately, the key to navigating personal debt lies in maintaining discipline, being proactive in communication with creditors, and utilizing available resources to create a sustainable path toward financial stability. By adopting these strategies, individuals can effectively manage and reduce their debt, paving the way for improved financial health and future opportunities.

2. **The Economic Ripple Effect: High Debt Levels and Growth Trajectories**

High levels of personal and corporate debt can create significant economic ripple effects that impede growth trajectories at both micro and macroeconomic levels. When individuals and businesses carry excessive debt, their capacity to spend and invest diminishes. This reduced consumer spending can lead to lower demand for goods and services, ultimately stunting economic expansion.

At the household level, high personal debt often forces individuals to allocate a substantial portion of their income to debt servicing, leaving less available for discretionary spending, savings, and investments. This shift not only affects individual well-being but can also constrain local businesses and services that rely on consumer spending for survival and growth.

On a corporate scale, companies burdened with high debt levels may prioritize paying off obligations over investing in innovation, expansion, or employee development. This lack of reinvestment can hinder productivity and slow down overall economic growth. Moreover, when businesses face financial distress due to heavy debt loads, they may resort to downsizing or layoffs, contributing to higher unemployment rates and reduced consumer confidence.

At the national level, excessive debt can lead to increased interest rates as governments seek to attract investors to finance their borrowing needs. This scenario can crowd out private investment, as higher borrowing costs deter businesses from expanding or starting new ventures. Additionally, as debt levels rise, governments may face pressure to implement austerity measures, which can further dampen economic growth by reducing public sector spending and social services.

In summary, high debt levels create a complex web of challenges that can stifle economic growth. Addressing personal and corporate debt through effective management strategies is crucial for fostering a more robust and sustainable economic environment.

3. **Credit Negotiation and Counseling: Tools for Financial Recovery and Success**

Effective credit negotiation and counseling are essential tools for individuals seeking financial recovery and long-term success in managing debt. When faced with overwhelming debt, many individuals may feel powerless; however, proactive negotiation with creditors can lead to more favorable repayment terms. This process typically involves communicating with lenders to discuss options such as lower interest rates, extended payment periods, or debt settlement agreements. By clearly articulating one’s financial situation and demonstrating a willingness to meet obligations, individuals can often secure terms that make repayment more manageable.

Credit counseling plays a complementary role in this process. Certified credit counselors provide guidance on budgeting, financial planning, and debt management strategies. They can assist individuals in creating a personalized plan to address their debts, often recommending a debt management plan (DMP) that consolidates payments to multiple creditors into a single monthly payment. This approach can simplify the repayment process and reduce overall interest costs. Additionally, credit counselors can offer valuable insights into improving one’s credit score, which is crucial for future financial opportunities.

Both credit negotiation and counseling empower individuals to take control of their financial situations, fostering a sense of agency. By leveraging these tools, individuals can not only work towards reducing their current debt but also build a solid foundation for future financial health. Engaging with professionals in credit counseling can provide the necessary support and resources to navigate the challenges of debt, ultimately leading to a more secure and stable financial future.

In conclusion, effectively managing and reducing personal debt is not only crucial for individual financial health but also plays a significant role in the broader economic landscape. High levels of debt can stifle economic growth, underscoring the importance of strategic debt management for both individuals and governments. Negotiating with creditors and seeking credit counseling are essential tools that empower individuals to regain control of their finances and pave the way for a more secure financial future. Additionally, while the potential rewards of using debt for investment can be enticing, they come with inherent risks that must be carefully weighed. Student loan debt remains a pressing issue that impacts financial planning for many, highlighting the need for comprehensive strategies that consider both personal and economic factors. Finally, understanding the implications of corporate debt on stock performance and how governments manage national debt can provide valuable insights into the interconnectedness of personal and public finance. By adopting informed strategies, individuals can not only improve their financial situations but also contribute to a healthier economy overall.