Debt Dynamics: Strategies for Personal Management and Economic Implications

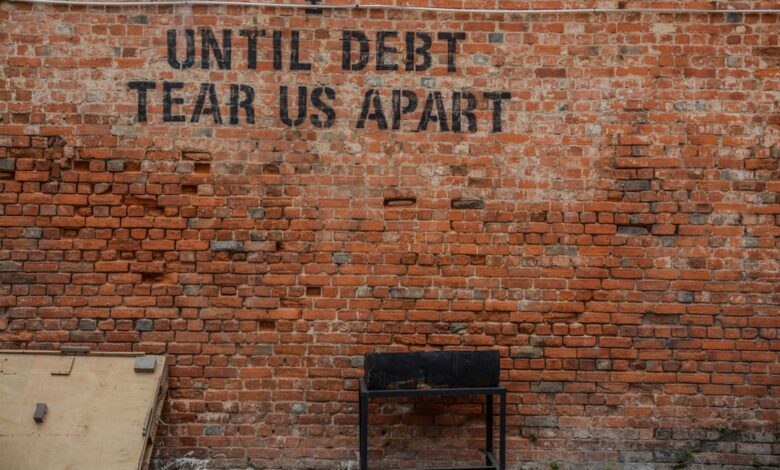

In today's complex financial landscape, personal debt has become an all-too-common reality for many individuals. As rising living costs and economic uncertainties persist, understanding how to effectively manage and reduce personal debt is crucial not only for personal financial health but also for broader economic stability. This article delves into various strategies for personal debt management, highlighting the importance of negotiation with creditors and the valuable role of credit counseling in achieving financial wellness. Additionally, we will explore the ripple effects of high debt levels on economic growth and how corporate debt can influence stock performance. We will also address the specific challenges posed by student loan debt and examine how governments navigate national debt, along with its far-reaching implications. By equipping readers with practical tools and insights, we aim to empower individuals to take control of their financial futures while understanding the interconnectedness of personal and national economic dynamics.

- 1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

- 2. **The Ripple Effect: Understanding the Economic Impact of High Debt Levels**

- 3. **From Negotiation to Counseling: Tools for Effective Debt Resolution and Financial Health**

1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

Managing personal debt effectively requires a multifaceted approach that combines strategic planning, disciplined budgeting, and proactive communication with creditors. Here are several key strategies to navigate the debt landscape:

1. **Create a Comprehensive Budget**: Start by assessing your income and expenses to create a detailed budget. This will help identify areas where you can cut back and allocate more funds toward debt repayment. Tracking spending can also highlight patterns that may lead to unnecessary debt accumulation.

2. **Prioritize Debt Payments**: Focus on paying off high-interest debts first, often referred to as the avalanche method. Alternatively, the snowball method—paying off the smallest debts first—can provide psychological motivation by achieving quick wins. Whichever method you choose, consistency is key.

3. **Negotiate with Creditors**: Don’t hesitate to contact your creditors to negotiate better repayment terms. Many creditors are willing to work with borrowers to create a manageable payment plan or even reduce interest rates, especially if you demonstrate a commitment to repay. Document your communications and ensure you understand any new terms.

4. **Utilize Debt Management Solutions**: Consider working with a credit counseling agency. These organizations can provide professional advice, help you create a budget, and may assist in negotiating with creditors. A reputable agency can guide you through debt management plans, which consolidate payments into a single monthly amount.

5. **Build an Emergency Fund**: Establishing an emergency fund can prevent additional debt accumulation in case of unforeseen expenses. Aim to save at least three to six months’ worth of living expenses, which can provide a financial cushion and reduce reliance on credit cards.

6. **Educate Yourself on Financial Literacy**: Understanding financial principles can empower you to make informed decisions about borrowing and repayment. Resources such as workshops, online courses, and financial literature can enhance your knowledge and help you avoid common debt pitfalls.

7. **Consider Debt Consolidation**: For those with multiple debts, consolidating them into a single loan may reduce interest rates and simplify repayment. However, it’s essential to evaluate the terms of the new loan and ensure it doesn’t lead to longer repayment periods or higher overall costs.

8. **Stay Committed and Monitor Progress**: Regularly review your financial situation and track your debt repayment progress. Celebrate small milestones to maintain motivation, and adjust your strategies as needed based on your evolving financial circumstances.

By implementing these strategies, individuals can take control of their personal debt, reduce financial stress, and work towards a more secure financial future.

2. **The Ripple Effect: Understanding the Economic Impact of High Debt Levels**

High levels of personal and corporate debt can create a ripple effect throughout the economy, influencing various aspects of financial stability and growth. When individuals carry excessive debt, their disposable income diminishes, leading to reduced consumer spending. This decline in consumption can negatively affect businesses, resulting in lower revenues, potential layoffs, and even bankruptcies. As businesses struggle, economic growth slows, creating a cycle that can lead to wider unemployment and decreased economic activity.

Moreover, high debt levels can strain financial institutions. When borrowers default on loans, banks face increased losses, which can lead to tighter lending standards. This restricts credit availability for consumers and businesses alike, further stifling economic growth. In turn, the reduced access to credit can hinder investment in new projects, innovation, and expansion, slowing down overall economic progress.

On a larger scale, when a significant number of households or corporations are in debt distress, it can lead to economic instability. This instability often results in heightened volatility in financial markets, as investors react to concerns about defaults and economic downturns. Such conditions can increase borrowing costs for everyone, making it more challenging for those looking to invest or purchase homes, thereby perpetuating the cycle of economic stagnation.

In addition, high national debt levels can also have profound implications for economic growth. Governments that allocate a significant portion of their budgets to servicing debt may have less flexibility to invest in infrastructure, education, and social programs, which are essential for long-term growth. This can lead to a reduction in public services and a decline in the quality of life, further impacting consumer confidence and spending.

Ultimately, the interconnectedness of debt at personal, corporate, and national levels illustrates the importance of managing debt responsibly. Understanding the broader economic impact of high debt levels is crucial for policymakers, financial institutions, and individuals alike, as they navigate the complexities of the financial landscape.

3. **From Negotiation to Counseling: Tools for Effective Debt Resolution and Financial Health**

When it comes to managing personal debt, effective negotiation with creditors and seeking credit counseling are two powerful tools that can significantly improve an individual's financial health. Negotiation involves directly communicating with creditors to establish more manageable repayment terms. This can include requesting lower interest rates, extending payment deadlines, or even settling debts for less than the full amount owed. A well-prepared borrower can demonstrate their financial situation, emphasizing their willingness to pay while also highlighting any hardships they may be facing. Successful negotiation can lead to reduced financial strain, making it easier for individuals to regain control over their finances.

In addition to negotiation, credit counseling plays a crucial role in debt resolution. Credit counselors are trained professionals who provide guidance on budgeting, debt management, and financial planning. They can help individuals assess their financial situation comprehensively, identify the root causes of their debt, and develop a tailored action plan. Many credit counseling agencies also offer debt management programs (DMPs), which consolidate debts into a single monthly payment that is distributed to creditors, often at reduced interest rates.

Combining negotiation strategies with the support of credit counseling can empower individuals to tackle their debt effectively. This dual approach not only facilitates immediate relief from financial burdens but also promotes long-term financial health by equipping borrowers with the skills and knowledge necessary to avoid falling back into debt. Ultimately, these tools foster a proactive mindset towards financial management, enabling individuals to build a more secure financial future.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. High levels of personal debt can hinder economic growth, creating a ripple effect that impacts various sectors, including corporate performance and government fiscal policies. By employing strategies such as negotiating with creditors, seeking credit counseling, and understanding the risks and rewards of leveraging debt for investment, individuals can take proactive steps toward achieving financial well-being. Additionally, acknowledging the implications of student loan debt on financial planning is essential for young adults entering the workforce. As we navigate this complex landscape, it’s important to recognize that while debt can be a powerful tool for growth, responsible management and informed decision-making are key to harnessing its benefits while minimizing risks. Ultimately, both personal and national debt management strategies will play a significant role in shaping economic outcomes, underscoring the importance of financial literacy and strategic planning in today's economy.