Debt Dynamics: Strategies for Personal Management and Economic Implications

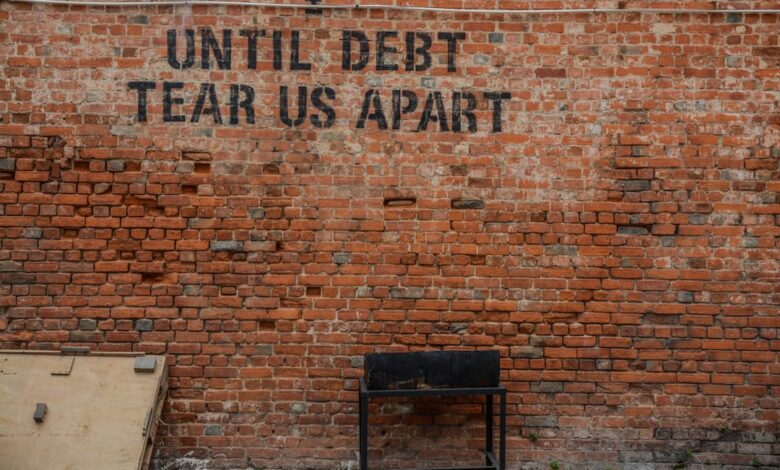

In today’s fast-paced financial landscape, managing personal debt has become an essential skill for individuals striving to achieve financial stability and security. With rising costs of living and the increasing prevalence of consumer credit, many find themselves navigating a complex web of loans and obligations. This article explores effective strategies for managing and reducing personal debt, emphasizing practical approaches that empower individuals to reclaim control over their financial futures. We will also delve into the broader implications of high debt levels on economic growth, examining how personal and corporate debts ripple through the economy. By understanding the dynamics of negotiation with creditors and the role of credit counseling, readers can discover valuable resources to help them navigate their financial challenges. Additionally, we will analyze the risks and rewards of leveraging debt for investment, the long-term impacts of student loan debt on financial planning, and the intricate relationship between corporate debt and stock performance. Finally, we’ll explore how governments manage national debt and the economic consequences of these strategies. Join us as we unpack these critical topics, providing insights and tools to help you successfully manage your financial landscape.

- Here are three possible headlines for sections of the article:

- 1. **Navigating Personal Finance: Effective Strategies for Debt Reduction**

- 2. **Understanding the Broader Picture: The Economic Consequences of High Debt Levels**

Here are three possible headlines for sections of the article:

High levels of personal debt can create significant challenges for individuals, often leading to financial stress and limiting economic growth. Managing and reducing personal debt is essential not only for personal financial stability but also for the broader economy. One effective strategy is to create a comprehensive budget that tracks income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, prioritizing high-interest debts can help minimize interest payments over time.

Negotiating with creditors is another critical aspect of debt management. By communicating openly about financial difficulties, individuals may secure better repayment terms, such as lower interest rates or extended payment periods. Credit counseling services can play a vital role in this process, offering professional guidance and support to help individuals develop a customized debt management plan. These counselors can also assist in negotiating with creditors, ensuring that individuals are equipped with the necessary tools to navigate their financial challenges effectively.

While using debt as a tool for investment can yield rewards, it also carries inherent risks. Individuals must carefully assess their financial situation and the potential returns on investment before taking on additional debt. For students, the burden of student loan debt can complicate financial planning, affecting decisions related to purchasing homes or saving for retirement. Understanding the long-term implications of debt is crucial for forming a sustainable financial future, both on a personal level and within the larger economic landscape.

1. **Navigating Personal Finance: Effective Strategies for Debt Reduction**

Managing personal debt effectively requires a proactive approach and a clear understanding of one’s financial situation. Here are some strategies that can help individuals navigate their personal finances and reduce debt:

1. **Create a Comprehensive Budget**: The first step in debt reduction is to develop a realistic budget that outlines all income sources and expenses. By tracking spending habits, individuals can identify areas where they can cut back and allocate more funds toward debt repayment.

2. **Prioritize Debt Payments**: Not all debts are created equal. It can be beneficial to prioritize debts based on interest rates and balances. The avalanche method focuses on paying off high-interest debts first, while the snowball method recommends paying off the smallest debts first for psychological motivation. Choosing the right strategy depends on personal preferences and financial situations.

3. **Increase Income Streams**: Finding ways to boost income can significantly aid in debt reduction. This might involve taking on a part-time job, freelancing, or selling unused items. The additional income can be directly allocated to paying down debts more quickly.

4. **Negotiate with Creditors**: Open communication with creditors can lead to better repayment terms. Many creditors are willing to negotiate lower interest rates, extended payment plans, or even settlement amounts. Being proactive and honest about financial difficulties can result in more favorable terms.

5. **Consider Credit Counseling**: Professional credit counseling services offer guidance and resources for managing debt. These organizations can provide personalized plans and help individuals understand their options, including debt management plans that consolidate payments to creditors.

6. **Use Debt Wisely**: While taking on debt can be risky, it can also be a tool for financial growth when used strategically. Understanding the difference between good debt (like mortgages or education loans) and bad debt (high-interest credit cards) is crucial. Individuals should assess their capacity to manage debt before taking on new obligations.

7. **Establish an Emergency Fund**: Building a small emergency fund can prevent the need to incur new debt in the case of unexpected expenses. Having savings to draw upon can provide a financial cushion, allowing individuals to focus on reducing existing debt without the fear of relying on credit.

8. **Monitor Credit Reports Regularly**: Staying informed about one’s credit status is vital. Regularly checking credit reports helps individuals understand their creditworthiness, identify any inaccuracies, and take steps to improve their scores, which can lead to better loan terms in the future.

By implementing these strategies, individuals can create a systematic approach to managing and reducing personal debt, ultimately leading to improved financial health and stability.

2. **Understanding the Broader Picture: The Economic Consequences of High Debt Levels**

High levels of personal and corporate debt can have significant repercussions on overall economic growth and stability. When individuals and businesses are burdened by excessive debt, their ability to spend and invest is curtailed. This reduces consumer demand, which is a primary driver of economic expansion. As consumers allocate a larger portion of their income to debt repayment, discretionary spending on goods and services diminishes, leading to slower growth for businesses and, consequently, the economy as a whole.

Moreover, high levels of debt can create a ripple effect in financial markets. For instance, when companies are heavily indebted, their stock performance may suffer due to increased interest obligations, which can deter investors. Companies facing debt repayment challenges may also cut back on hiring or capital expenditures, further stalling economic momentum.

At a macroeconomic level, governments grappling with high national debt may face challenges in implementing fiscal policies. High debt levels can limit a government's ability to invest in critical infrastructure, education, and public services. This can hinder long-term economic growth and lead to a cycle of austerity measures, which can exacerbate economic downturns.

In contrast, moderate levels of debt can be beneficial, as they allow for investment in growth opportunities. Thus, understanding the balance between leveraging debt and maintaining financial health is crucial for both individuals and corporations. Overall, managing debt effectively is essential for promoting economic resilience and sustainable growth.

In conclusion, effective debt management is crucial not only for individual financial health but also for the broader economic landscape. By employing strategies such as budgeting, negotiating with creditors, and seeking credit counseling, individuals can take significant steps toward reducing their personal debt and improving their financial stability. As we’ve explored, high levels of personal and corporate debt can stifle economic growth and impact stock performance, underscoring the importance of responsible borrowing and investment practices. Additionally, the burden of student loan debt can complicate financial planning for many, highlighting the need for thoughtful policy solutions. On a national scale, government management of debt plays a pivotal role in shaping economic outcomes, requiring a delicate balance between fiscal responsibility and investment in future growth.

Ultimately, understanding the interconnectedness of personal and national debt can empower individuals to make informed financial decisions. By prioritizing debt reduction and seeking professional guidance when necessary, we can foster a healthier financial future for ourselves and contribute to a more robust economy. As we navigate the complexities of debt, it is essential to remain proactive, informed, and resilient in our financial pursuits.