Debt Dynamics: Strategies for Personal Management and Economic Implications

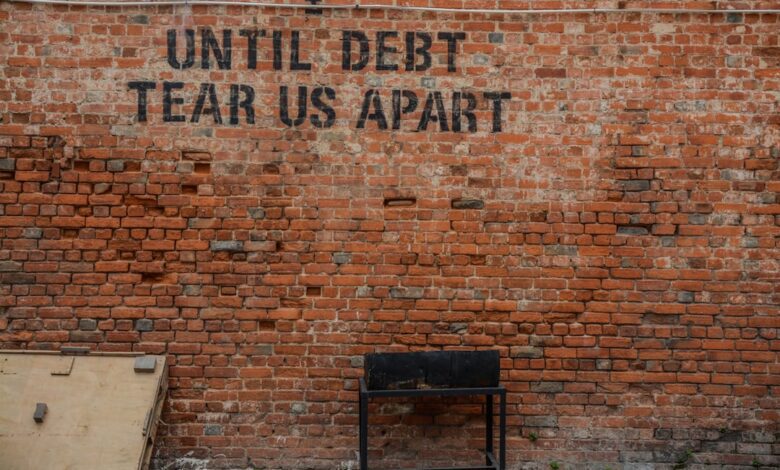

In today's fast-paced economic landscape, personal debt has become an increasingly common reality for many individuals. From student loans to credit card balances, high levels of debt can significantly impact not only personal financial health but also broader economic growth. This article delves into effective strategies for managing and reducing personal debt, highlighting the importance of negotiation with creditors and the role of credit counseling in achieving financial stability. Additionally, we will explore the ripple effect that high debt levels can have on economic performance, the potential risks and rewards of leveraging debt for investment, and the critical implications of both personal and corporate debt on financial planning. By understanding these facets, individuals can navigate their financial challenges more effectively while contributing to a healthier economic environment. Join us as we unpack these essential topics and equip you with the knowledge to take control of your financial future.

- 1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

- 2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

Managing and reducing personal debt requires a strategic approach that combines budgeting, prioritization, and proactive engagement with creditors. The first step in this process is to create a comprehensive budget that outlines all income sources and expenses. This helps individuals identify areas where they can cut back and allocate more funds toward debt repayment.

Next, it is essential to prioritize debts based on interest rates and payment terms. The avalanche method, which focuses on paying off high-interest debts first, can save money in the long run. Alternatively, the snowball method, which emphasizes paying off the smallest debts first, can provide psychological motivation by creating quick wins.

Establishing an emergency fund can also be a critical strategy. Having a financial cushion helps prevent the need to incur additional debt in case of unexpected expenses. Additionally, individuals should consider negotiating with creditors for better repayment terms, such as lower interest rates or extended payment periods. Open communication with creditors can often lead to more manageable payment structures.

Credit counseling services can play a vital role in debt management. These organizations offer guidance and resources to help individuals develop effective repayment plans, negotiate with creditors, and build healthier financial habits. Utilizing these services can provide the necessary support and education to navigate the complexities of personal debt.

Ultimately, reducing personal debt requires discipline, commitment, and a strategic mindset. By employing these effective strategies, individuals can work toward financial stability and reduce the burden of debt over time.

Managing and reducing personal debt is essential for financial stability and overall well-being. High levels of personal debt can lead to increased stress, hinder financial goals, and limit opportunities for investment and savings. To effectively manage debt, individuals should start by creating a comprehensive budget that outlines income, expenses, and debt obligations. This helps in identifying areas where spending can be reduced, allowing more funds to be allocated toward debt repayment.

One effective strategy is the debt snowball method, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This approach can boost motivation as smaller debts are eliminated quickly. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, potentially saving money on interest in the long run.

Negotiating with creditors is also a vital component of debt management. It involves reaching out to creditors to discuss the possibility of lower interest rates, extended repayment terms, or even settling for a reduced payoff amount. Many creditors are willing to work with borrowers who demonstrate a commitment to repayment, especially in difficult financial situations.

Credit counseling services can provide valuable support in navigating debt management. These organizations offer guidance on budgeting, financial planning, and debt repayment strategies. They can also assist in negotiating with creditors and may propose a debt management plan that consolidates payments into a single monthly amount.

While using debt to invest can be tempting, it carries inherent risks. Leveraging debt for investments can amplify returns but can also lead to significant losses if investments perform poorly. Therefore, careful consideration and risk assessment are crucial before pursuing such strategies.

Student loan debt significantly impacts financial planning, often delaying major life decisions such as homeownership or starting a family. Individuals must factor in their student loan obligations when creating long-term financial goals, potentially adjusting their timelines and savings strategies.

Corporate debt, on the other hand, can influence stock performance. Companies with high levels of debt may face increased scrutiny from investors, as excessive leverage can pose risks to financial stability. Conversely, strategic borrowing can enable companies to invest in growth opportunities, which may enhance stock performance if managed wisely.

Lastly, governments manage national debt through various fiscal policies, including taxation and public spending. The implications of national debt on economic growth are complex, as high debt levels can lead to increased interest rates and reduced public investment, while moderate debt can stimulate economic growth if used effectively for infrastructure and education.

Overall, understanding and implementing these strategies can empower individuals and organizations alike to manage debt more effectively, contributing to financial health and economic stability.

2. **The Economic Ripple Effect: How High Debt Levels Stifle Growth**

High levels of personal and corporate debt can create significant barriers to economic growth, leading to a ripple effect that impacts various sectors of the economy. When individuals and businesses are burdened with excessive debt, their spending power diminishes. Consumers may prioritize debt repayment over discretionary spending, reducing demand for goods and services. This decline in consumption can lead to lower revenues for businesses, prompting them to cut costs, limit hiring, or even downsize, which further stifles economic activity.

Moreover, high debt levels can constrain investment. Businesses may be hesitant to pursue expansion or innovation opportunities due to concerns about their existing debt obligations. When companies allocate financial resources primarily toward servicing debt, they miss out on potential growth avenues that could drive productivity and enhance competitiveness.

At the macroeconomic level, a high debt-to-GDP ratio can signal instability and reduce investor confidence. Investors may demand higher interest rates to compensate for perceived risks, making borrowing more expensive for both consumers and businesses. This can lead to a tightening of credit, further exacerbating economic stagnation.

In addition, governments facing high levels of national debt may struggle to implement fiscal policies aimed at stimulating growth. Limited fiscal flexibility can hinder public investment in infrastructure, education, and other critical areas that contribute to long-term economic prosperity. As a result, the overall economic landscape becomes less dynamic, ultimately stalling growth and limiting job creation.

Addressing high debt levels through strategic management and reduction requires a multifaceted approach, including improved financial literacy, effective credit counseling, and policies that encourage responsible borrowing. By tackling the debt issue, economies can enhance their resilience and restore pathways to sustainable growth.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. As we have explored, high levels of personal and corporate debt can hinder economic growth, creating a ripple effect that impacts everyone. By employing strategic negotiation techniques with creditors, seeking support from credit counseling services, and understanding the implications of investing through debt, individuals can take proactive steps toward financial freedom.

Furthermore, the burden of student loan debt significantly shapes financial planning for many, underscoring the need for informed decision-making. On a larger scale, governments' management of national debt plays a pivotal role in sustaining economic prosperity, with serious implications for fiscal policy and public investment.

Ultimately, while debt can serve as a tool for growth and investment, it is essential to weigh the associated risks carefully. By prioritizing responsible debt management and making informed choices, individuals and governments alike can foster a healthier financial landscape that supports both personal aspirations and economic advancement.