Debt Dynamics: Strategies for Personal Management and Economic Implications

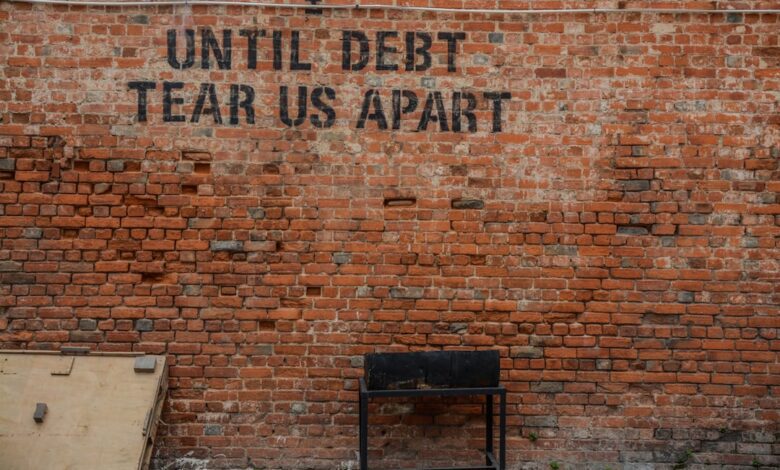

In today's fast-paced financial landscape, managing debt has become a crucial skill for individuals and businesses alike. As personal debt levels reach staggering heights, the ripple effects extend beyond household budgets to influence broader economic growth and stability. This article explores a comprehensive range of strategies aimed at managing and reducing personal debt, from effective negotiation tactics with creditors to the invaluable support offered by credit counseling services. Additionally, we will examine the intricate relationship between high debt levels and economic performance, the potential risks and rewards of leveraging debt for investment, and the implications of student loan burdens on financial planning. Furthermore, we will delve into the corporate realm, discussing how corporate debt can impact stock performance, and consider the methods by which governments manage national debt and its economic ramifications. Join us as we navigate the complex world of debt management, uncovering tools and insights that pave the way toward financial freedom and sustainable economic growth.

- 1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

- 2. **The Economic Ripple Effect: High Debt Levels and Growth Dynamics**

1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

Navigating personal debt effectively is crucial for achieving financial freedom and stability. One of the first strategies individuals can employ is creating a comprehensive budget that outlines income, expenses, and debt obligations. This budget serves as a roadmap, helping to identify areas where spending can be reduced and how much can be allocated toward debt repayment each month.

Another effective strategy is the debt snowball method, which involves paying off smaller debts first to build momentum and motivation. By eliminating these debts, individuals can gain a sense of accomplishment, which can encourage them to tackle larger debts next. Conversely, the debt avalanche method prioritizes debts with the highest interest rates, ultimately saving money on interest payments over time.

Additionally, individuals should explore opportunities to increase their income, whether through side jobs, freelance work, or asking for raises. This additional income can be directed toward debt repayment, accelerating the path to financial freedom.

Negotiating with creditors is also a powerful tool. Many creditors are willing to discuss repayment terms, interest rates, or even settlements if approached proactively. Having a clear understanding of one’s financial situation and demonstrating a commitment to repay can often lead to more favorable terms.

Lastly, seeking assistance from credit counseling services can provide valuable guidance. These organizations can help individuals create manageable repayment plans, educate them on financial management, and negotiate on their behalf. By employing these strategies, individuals can navigate personal debt more effectively, moving toward a healthier financial future.

Personal debt can significantly affect both individuals and the broader economy. To manage and reduce personal debt effectively, individuals can employ several strategies. Creating a detailed budget is essential, as it provides a clear picture of income versus expenses and helps identify areas to cut back. Additionally, prioritizing high-interest debts can lead to substantial savings over time; the avalanche method, which focuses on paying off the highest interest debts first, can be particularly effective. Alternatively, the snowball method, which emphasizes paying off the smallest debts first, can provide psychological motivation through quick wins.

Negotiating with creditors is another crucial aspect of debt management. Individuals should not hesitate to reach out to their creditors to discuss potential changes to repayment terms, such as lower interest rates or extended repayment periods. Many creditors are willing to work with borrowers who demonstrate genuine effort to repay their debts, especially if the borrower can show evidence of financial hardship.

Credit counseling services can also play a vital role in assisting individuals with debt management. These organizations provide professional advice and may offer debt management plans that consolidate payments into a single monthly amount, often at a lower interest rate. Such services can help individuals develop sustainable financial habits and restore their creditworthiness.

While using debt to invest can offer potential rewards, it carries significant risks. Investors need to carefully consider their ability to repay any borrowed funds and the likelihood of their investments yielding positive returns. The balance between leveraging debt for investment purposes and maintaining financial stability is delicate and requires thorough analysis.

Student loan debt presents unique challenges for financial planning, often delaying significant life milestones such as homeownership or retirement savings. Individuals must incorporate this debt into their overall financial strategy, considering potential income growth and repayment options available through federal programs.

On a larger scale, corporate debt can influence stock performance. Companies with high levels of debt may face higher risk during economic downturns, potentially leading to stock price volatility. Conversely, strategic use of debt can enhance a firm’s growth prospects and shareholder returns if managed effectively.

Governments also grapple with managing national debt, which has profound economic implications. High levels of national debt can lead to increased interest rates and crowding out of private investment, while manageable debt levels can provide governments with the flexibility to invest in infrastructure and services that promote economic growth. Ultimately, effective debt management—whether personal or national—requires a careful balance of risk and opportunity.

2. **The Economic Ripple Effect: High Debt Levels and Growth Dynamics**

High debt levels can significantly hinder economic growth by creating a ripple effect that impacts various facets of the economy. When individuals, businesses, and governments carry excessive debt, they may face constraints on spending and investment, which can lead to decreased aggregate demand. For households, high debt obligations often result in reduced disposable income, leaving less available for consumption. This decline in consumer spending can slow down business revenues, prompting companies to cut back on production, lay off employees, or reduce investments in new projects.

Moreover, businesses grappling with substantial debt may prioritize debt repayment over expansion or innovation, stifling potential growth. This cautious approach can lead to lower productivity and reduced competitiveness in the market. In the case of corporate debt, an over-leveraged firm may struggle to maintain its operations during economic downturns, impacting stock performance and investor confidence.

At the governmental level, high national debt can lead to increased interest rates as the government competes for available capital in the financial markets. Higher interest rates can crowd out private investment, making borrowing more expensive for businesses and consumers alike. As a result, economic growth may be further impeded, creating a cycle of sluggish expansion.

Additionally, the psychological effects of high debt can lead to a lack of consumer confidence, causing individuals and businesses to adopt a more conservative approach to spending and investment. This shift in behavior can exacerbate economic stagnation, as reduced confidence leads to lower economic activity.

In summary, high debt levels can create a complex web of challenges that stifle economic growth, affecting not only those directly involved but also the broader economy. Addressing these challenges requires a multifaceted approach, including effective debt management strategies and policies that promote sustainable economic practices.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. By implementing strategies such as budgeting, prioritizing debt repayment, and negotiating with creditors, individuals can take significant steps toward financial freedom. Understanding the implications of high debt levels on economic growth underscores the importance of responsible borrowing and spending habits.

Moreover, the role of credit counseling cannot be overstated, as it provides valuable guidance and support for those struggling with debt. While leveraging debt for investment can yield rewards, it also carries inherent risks that must be carefully evaluated. Student loan debt, in particular, presents unique challenges that affect financial planning for many individuals, highlighting the need for comprehensive approaches to debt management.

On a macroeconomic scale, corporate debt influences stock performance, while governments must navigate national debt with strategies that ensure economic resilience. By fostering awareness and encouraging proactive debt management practices, we can create a more stable financial environment for individuals and the economy as a whole. Ultimately, informed decision-making and strategic planning are key to achieving financial well-being and contributing to sustainable economic growth.