Debt Dynamics: Strategies for Personal Management and Economic Impact

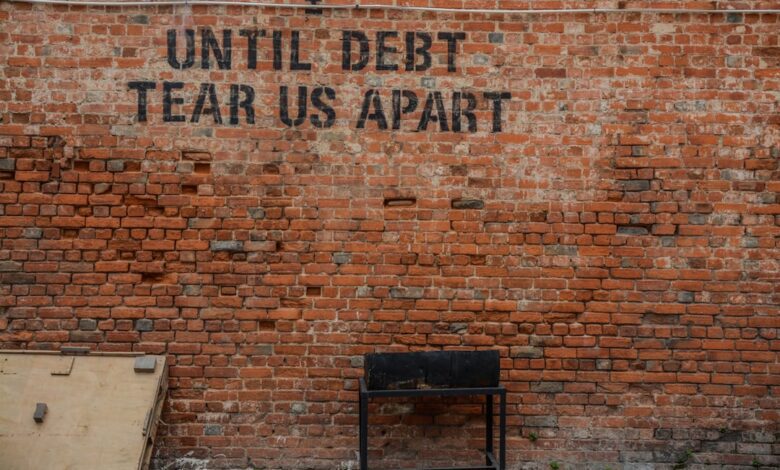

In today’s fast-paced financial landscape, managing personal debt has become an increasingly pressing concern for individuals and families alike. As debt levels rise, they not only affect personal finances but also have broader implications for economic growth and stability. This article explores a multifaceted approach to understanding and managing debt, offering strategies for reduction and negotiation with creditors while highlighting the vital role of credit counseling in achieving financial health. Furthermore, we delve into how personal debt intersects with larger economic issues, such as the impact of corporate debt on stock performance and the complexities of national debt management. By examining these interconnected elements, we aim to provide readers with a comprehensive guide to navigating the challenges of debt, ultimately fostering a more informed and empowered approach to personal and economic financial planning.

- 1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

- 2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

- 3. **Mastering Negotiations: Securing Favorable Terms with Creditors**

1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

Managing and reducing personal debt requires a strategic approach that encompasses budgeting, prioritization, and communication. One of the first steps individuals should take is to create a detailed budget that accounts for all income and expenses. This helps identify areas where spending can be reduced, allowing for more funds to be allocated toward debt repayment.

Next, it’s essential to prioritize debts. A common method is the avalanche or snowball strategy. The avalanche method focuses on paying off high-interest debts first, which can save money in the long run. Conversely, the snowball method involves paying off smaller debts first to build momentum and motivation. Choosing the right strategy depends on personal preferences and financial situations.

Another effective strategy is to negotiate with creditors to secure better repayment terms. This could involve requesting lower interest rates, extended repayment periods, or even settling for a reduced amount owed. Open communication with creditors can often lead to more manageable payment plans.

Additionally, individuals may benefit from credit counseling services. These organizations can provide personalized guidance, help create a debt management plan, and facilitate communication with creditors. Participating in a credit counseling program can also help individuals learn more about budgeting and financial literacy.

Lastly, it's vital to approach debt management with a long-term perspective. Building an emergency fund can prevent reliance on credit in times of financial strain, while regularly reviewing and adjusting the budget can ensure continued progress. By adopting these strategies, individuals can navigate personal debt more effectively and work toward a more secure financial future.

2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

High levels of personal and corporate debt can create a ripple effect that stifles economic growth across various sectors. When individuals or businesses are heavily indebted, they often prioritize debt repayment over spending and investment. This reduced consumer spending can lead to declining sales for businesses, which in turn may result in lower production levels, layoffs, and decreased hiring. As a result, the overall demand in the economy diminishes, creating a cycle that further exacerbates economic stagnation.

Moreover, high debt levels can limit access to credit. Lenders may become more cautious, raising interest rates or tightening lending standards. This makes it difficult for consumers and businesses to secure loans for essential investments, such as home purchases or expansion projects. Consequently, innovation and entrepreneurship may suffer, leading to fewer new businesses and job creation.

In the context of government debt, excessive borrowing can have similar consequences. When governments allocate a significant portion of their budgets to debt servicing, less funding is available for critical areas such as education, infrastructure, and social services. This underinvestment can hinder long-term economic growth and reduce the overall quality of life for citizens.

Additionally, high debt levels can create uncertainty in financial markets. Investors may perceive heavily indebted entities as risky, leading to volatility in stock prices and reduced investment in those economies. This uncertainty can deter both domestic and foreign investment, further limiting growth potential.

Ultimately, the interplay between high debt levels and economic growth underscores the importance of managing debt effectively. By addressing personal, corporate, and national debt levels, economies can foster a more stable and conducive environment for growth and prosperity.

3. **Mastering Negotiations: Securing Favorable Terms with Creditors**

Negotiating with creditors can be a crucial step in managing personal debt, enabling individuals to secure more favorable repayment terms that can alleviate financial strain. The key to successful negotiations lies in preparation, communication, and understanding one's financial position.

First, it's essential to gather all relevant financial information before engaging with creditors. This includes understanding the total amount owed, interest rates, monthly payments, and any fees associated with the debt. Having a clear picture of your financial situation helps in formulating a realistic repayment plan that you can propose during negotiations.

Next, effective communication is vital. When reaching out to creditors, approach the conversation with a calm and respectful demeanor. Clearly articulate your current financial difficulties without placing blame or expressing frustration. Most creditors are willing to work with customers who are honest about their circumstances and actively seeking solutions.

One common negotiation tactic is to request a lower interest rate or a temporary reduction in monthly payments. In some cases, creditors may offer hardship programs that provide relief for a specified period. Additionally, consider asking about the possibility of waiving late fees or restructuring the loan to extend the repayment period, which could lower monthly obligations.

It can also be beneficial to express a willingness to prioritize the debt and maintain open lines of communication throughout the process. Document any agreements reached during negotiations, ensuring both parties have a clear understanding of the new terms. This documentation can help prevent misunderstandings and provide a reference point for future discussions.

Lastly, if negotiations with creditors feel overwhelming, seeking assistance from a financial advisor or credit counselor can provide valuable guidance. These professionals can help navigate the negotiation process and advocate on your behalf, increasing the likelihood of securing favorable terms.

In summary, mastering negotiations with creditors involves thorough preparation, respectful communication, and a proactive approach to finding mutually beneficial solutions. By effectively advocating for oneself, individuals can take meaningful steps towards managing and reducing their debt burden.

In conclusion, effectively managing personal debt is a multifaceted endeavor that requires a strategic approach encompassing various aspects of financial planning and negotiation. By employing proven strategies to reduce and manage debt, individuals can alleviate the burden that high debt levels impose not only on their personal finances but also on the broader economy. The interplay between personal and corporate debt highlights the importance of responsible borrowing and investing, as excessive debt can hinder economic growth and impact stock performance.

Moreover, negotiating with creditors and seeking credit counseling services can lead to more favorable repayment terms, providing individuals with the tools necessary to regain control of their financial futures. As we consider the implications of student loan debt on financial planning, it is evident that the decisions made today will resonate well into the future. Similarly, understanding how governments manage national debt can shed light on the complexities of economic stability and growth.

Ultimately, while the risks associated with debt are significant, the rewards of strategic, informed debt management can pave the way toward a more secure financial future. By staying proactive and informed, individuals can navigate their financial landscapes with confidence, turning the challenges of debt into opportunities for growth and financial independence.