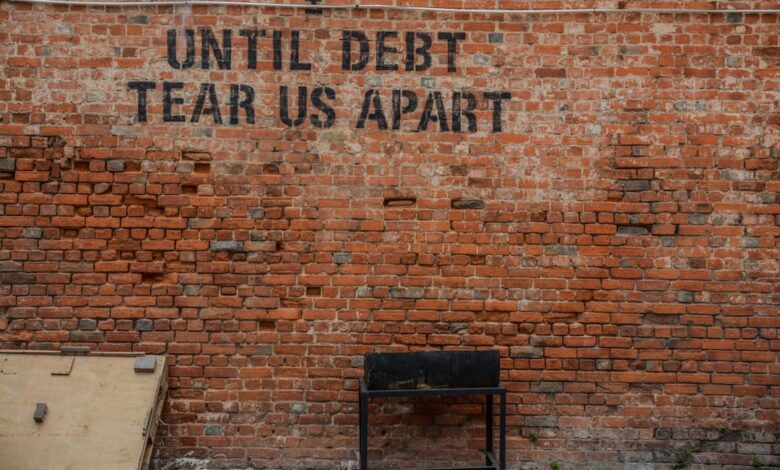

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing personal debt has become a pressing challenge for individuals and families alike. As debt levels continue to rise, understanding effective strategies for reduction and management is crucial not only for personal financial stability but also for the broader economy. High debt burdens can stifle economic growth, limit spending power, and create a cycle of financial distress. This article delves into essential strategies for managing personal debt, exploring the nuances of negotiating with creditors, the benefits of credit counseling, and the complex interplay between personal and corporate debt. Additionally, we will examine how student loan debt shapes financial planning and the implications of national debt on economic health. By equipping readers with practical tools and insights, we aim to empower individuals to take control of their financial futures while recognizing the broader economic implications of debt management.

- Here are three possible section headlines for the article covering the specified topics:

- 1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

Here are three possible section headlines for the article covering the specified topics:

Personal debt can be a significant burden for individuals, affecting their financial stability and overall well-being. To manage and reduce personal debt effectively, several strategies can be employed. First, creating a detailed budget allows individuals to track their income and expenses, identifying areas where they can cut back and allocate more funds toward debt repayment. Additionally, prioritizing high-interest debts can reduce the total interest paid over time. Techniques such as the snowball method, which focuses on paying off the smallest debts first, can also provide psychological benefits and motivation.

High levels of personal debt not only impact individual financial health but also have broader implications for economic growth. When consumers are heavily indebted, they tend to reduce spending, which can slow down economic activity. This reduction in consumption can hinder business growth and lead to lower job creation, creating a cyclical effect that stifles economic development.

Negotiating with creditors is another critical aspect of debt management. Individuals can reach out to their creditors to discuss their financial situations and request better repayment terms, such as lower interest rates or extended payment plans. Open communication can often lead to more favorable conditions, allowing borrowers to manage their debts more effectively.

Credit counseling plays a vital role in helping individuals navigate their debt challenges. Certified credit counselors provide personalized advice and can assist in creating a debt management plan that aligns with an individual's financial goals. They also educate clients about budgeting, credit scores, and financial literacy, empowering them to make informed decisions about their finances.

While using debt to invest can be a strategy for wealth accumulation, it carries inherent risks. Investors must carefully consider their ability to repay borrowed funds and the potential for market fluctuations to impact their investment returns. Balancing the risks and rewards of leveraging debt for investment purposes is crucial in achieving financial stability.

Student loan debt is another significant factor in financial planning. Graduates often face challenges in managing their monthly payments while also trying to save for retirement and other financial goals. Understanding repayment options, including income-driven plans and loan forgiveness programs, is essential for effective financial planning for those carrying student debt.

Corporate debt also plays a crucial role in the financial markets, influencing stock performance. Companies often use debt as a tool to finance growth initiatives. However, excessive corporate debt can lead to increased risk, potentially impacting stock prices and investor confidence. A balanced approach to leveraging debt is necessary for sustaining long-term business health.

Finally, governments manage national debt through various fiscal and monetary policies, which have significant economic implications. Responsible management of national debt is essential for maintaining economic stability, ensuring that debt levels remain sustainable in relation to GDP. High national debt can lead to increased interest rates and reduced public investment, affecting overall economic growth and the financial well-being of citizens.

1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

Managing personal debt effectively is crucial for achieving financial stability and long-term economic health. Several strategies can be employed to navigate this challenge:

1. **Budgeting and Financial Planning**: Creating a detailed budget is the first step in debt management. By tracking income and expenses, individuals can identify areas where they can cut costs and allocate more funds toward debt repayment. A well-structured financial plan helps prioritize debts, focusing on high-interest obligations first.

2. **Debt Snowball and Debt Avalanche Methods**: The debt snowball method involves paying off the smallest debts first to gain momentum, while the debt avalanche method focuses on paying off debts with the highest interest rates first. Both strategies can be effective, depending on personal preferences and motivations.

3. **Consolidation and Refinancing**: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and reduce overall interest costs. Alternatively, refinancing existing loans can lower monthly payments and interest rates, provided that the borrower has improved their credit score since the original loan was taken out.

4. **Negotiating with Creditors**: Open communication with creditors can lead to better repayment terms. Many creditors are willing to negotiate lower interest rates or extended repayment periods, especially if the borrower demonstrates a commitment to repay the debt.

5. **Credit Counseling**: Seeking help from a credit counseling agency can provide valuable guidance and support. These agencies can assist in creating a personalized debt management plan, negotiating with creditors, and offering financial education resources.

6. **Building an Emergency Fund**: Establishing a small emergency fund can prevent the need to rely on credit for unexpected expenses. This can help avoid further debt accumulation and contribute to overall financial resilience.

7. **Lifestyle Changes**: Making intentional lifestyle changes, such as downsizing living arrangements, reducing discretionary spending, or finding additional sources of income, can accelerate debt repayment and improve financial health.

By employing these strategies, individuals can take proactive steps toward managing and reducing their personal debt, paving the way for improved financial stability and a brighter economic future.

Managing and reducing personal debt is a critical aspect of financial health that can significantly influence both individual and broader economic stability. One effective strategy is to create a detailed budget that tracks income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, employing the debt snowball or avalanche methods can help prioritize payments and reduce the overall interest burden, enabling quicker progress toward becoming debt-free.

High levels of personal debt can adversely affect economic growth by limiting consumer spending, which is a primary driver of economic activity. When individuals allocate a large portion of their income to servicing debt, they have less to spend on goods and services, potentially leading to decreased business revenues and slower job creation.

Negotiating with creditors can also play a vital role in managing debt. Individuals should approach their creditors to discuss their financial situations and explore options such as lower interest rates, extended repayment terms, or settlement offers. Many creditors prefer to negotiate rather than risk default, making it worthwhile for debtors to communicate openly and honestly about their circumstances.

Credit counseling services can provide valuable assistance in debt management. These organizations offer financial education, budgeting resources, and structured repayment plans, helping individuals develop a long-term strategy for managing their debts. They can also facilitate negotiations with creditors, often leading to more favorable repayment terms.

While using debt to invest can offer potential rewards, such as increased returns, it also carries significant risks. Investors must consider the possibility of market downturns that could lead to losses exceeding their original investments. Careful risk assessment and a well-thought-out investment strategy are essential for those considering leveraging debt for investment purposes.

Student loan debt has become a significant barrier to financial planning for many graduates, affecting their ability to save for homes, retirement, and other long-term goals. As student debt levels rise, individuals often find themselves delaying major life decisions, which can have cascading effects on the economy, including reduced consumer spending and slower economic growth.

In the corporate realm, high levels of corporate debt can impact stock performance, as investors weigh the risks associated with increased leverage against potential returns. Companies with manageable debt levels may be viewed more favorably, as they are better positioned to weather economic downturns and invest in growth opportunities.

On a national scale, governments face the challenge of managing national debt while fostering economic growth. Strategies to address national debt include adjusting fiscal policies, fostering economic growth through investment in infrastructure and education, and implementing tax reforms. The implications of national debt management extend to interest rates, inflation, and overall economic stability, making it a critical factor in shaping a nation’s economic future.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. High levels of personal and corporate debt can hinder economic growth and impact stock performance, highlighting the interconnectedness of financial decisions at all levels. By employing strategic negotiation with creditors, seeking credit counseling, and understanding the implications of debt—whether for personal investments or student loans—individuals can take proactive steps towards a more secure financial future. Additionally, recognizing the role of government debt management and its economic consequences underscores the importance of fiscal responsibility. Ultimately, a balanced approach to debt can lead to enhanced financial well-being and contribute positively to the economy as a whole.