Debt Dynamics: Strategies for Personal Management and Economic Impact

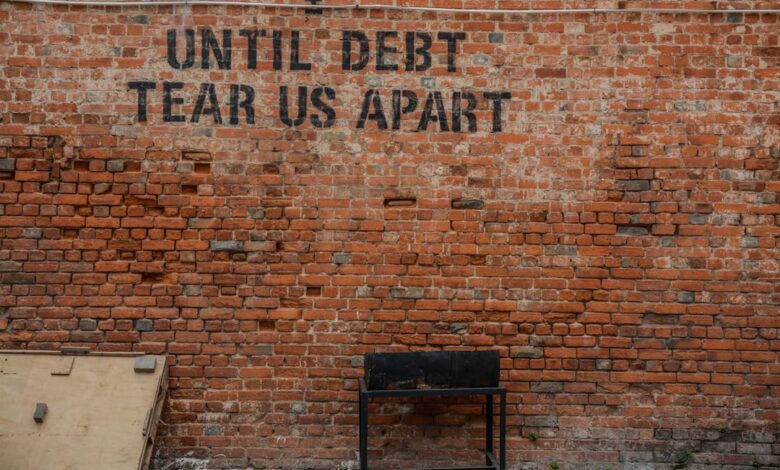

In today's fast-paced financial landscape, the burden of debt can weigh heavily on individuals, families, and even entire economies. Understanding the multifaceted nature of debt is crucial for making informed decisions about personal finance, investment strategies, and broader economic policies. This article delves into effective strategies for managing and reducing personal debt, highlighting the importance of balancing one’s finances while navigating the complexities of credit. We will explore the ripple effects of high debt levels on economic growth, examine how personal and corporate debt influences stock performance, and discuss the critical role of credit counseling in fostering financial resilience. Additionally, we will address the challenges posed by student loan debt on financial planning and the implications of national debt management by governments. By equipping readers with the tools and insights needed to tackle these pressing issues, we aim to empower individuals to take control of their financial futures and contribute to a healthier economic environment for all.

- 1. Balancing the Books: Effective Strategies for Personal Debt Management

- 2. The Ripple Effect: How High Debt Levels Stifle Economic Growth

- 3. Navigating Negotiations: Tips for Securing Favorable Repayment Terms with Creditors

1. Balancing the Books: Effective Strategies for Personal Debt Management

Managing personal debt effectively requires a combination of strategic planning, disciplined budgeting, and proactive communication with creditors. Here are several strategies that can help individuals balance their finances and reduce their debt levels.

First, creating a comprehensive budget is essential. This involves tracking income and expenses to identify areas where spending can be reduced. By allocating funds to essential expenses and prioritizing debt repayment, individuals can gain greater control over their financial situation. Utilizing budgeting tools or apps can simplify this process and provide clear visibility into one’s financial health.

Another effective strategy is the debt snowball method, which involves paying off smaller debts first. By focusing on one debt at a time, individuals can build momentum and boost their motivation as they eliminate balances. Once the smallest debt is paid off, the freed-up funds can be applied to the next smallest debt, creating a cascading effect that accelerates overall debt reduction.

Conversely, the debt avalanche method prioritizes debts by interest rate, allowing individuals to save money on interest over time. This approach focuses on paying off high-interest debts first, which can lead to significant savings in the long run.

In addition to these methods, communicating with creditors can yield better outcomes. Many creditors are open to negotiating repayment terms, such as lower interest rates or extended payment plans, especially if the borrower demonstrates a commitment to repaying the debt. It’s advisable to approach these discussions with a clear proposal and an understanding of one’s financial situation.

Finally, seeking assistance from credit counseling services can be beneficial. These organizations provide guidance on managing debt, budgeting, and negotiating with creditors. They may also offer debt management plans that consolidate payments into a single monthly amount, simplifying the repayment process.

By implementing these strategies, individuals can effectively manage their personal debt, paving the way for improved financial stability and peace of mind.

2. The Ripple Effect: How High Debt Levels Stifle Economic Growth

High levels of personal and corporate debt can significantly stifle economic growth, creating a ripple effect throughout the economy. When individuals or businesses are burdened with excessive debt, their financial resources become constrained, leading to reduced spending and investment. For households, high debt payments often mean less disposable income available for consumption, which is a key driver of economic activity. This can lead to decreased demand for goods and services, ultimately slowing down business revenue and expansion.

Similarly, for corporations, heavy debt loads can limit their ability to invest in new projects, hire additional employees, or innovate. Companies may prioritize debt repayment over reinvestment in their operations, stifling growth potential and productivity improvements. Moreover, when a significant number of businesses face such constraints, it can lead to a broader economic slowdown, as the overall business environment becomes less dynamic.

On a macroeconomic level, high debt levels can also lead to increased risk aversion among lenders. When financial institutions perceive a high risk of default, they may tighten credit conditions. This can create a credit crunch, whereby even financially sound businesses struggle to secure the financing needed for growth. As lending slows, investment declines, leading to a stagnation of economic growth.

Additionally, governments may feel the effects of high debt levels within the population. When citizens are financially strained, they may rely more heavily on social safety net programs, increasing public expenditure and potentially leading to higher taxes or reduced government services. This dynamic can further inhibit economic growth, as government resources are diverted away from investment in infrastructure and education—areas critical for long-term economic development.

In summary, the ripple effect of high debt levels can create a cycle of reduced economic activity, limited investment, and increased financial risk, ultimately stifling economic growth and prosperity. Addressing these debt issues is essential for fostering a healthier economic environment, enabling both individuals and businesses to thrive.

3. Navigating Negotiations: Tips for Securing Favorable Repayment Terms with Creditors

When faced with debt, negotiating with creditors can be a crucial step toward achieving manageable repayment terms. Here are several strategies to help secure favorable outcomes during these negotiations:

First, it’s essential to prepare thoroughly before initiating any discussions. Gather all relevant financial documents, including account statements, income records, and a detailed budget. This information will provide a clear picture of your financial situation and help you articulate your needs effectively. Understanding your current debt obligations and payment history can also strengthen your position.

Next, approach negotiations with a positive attitude and a willingness to communicate openly. Creditors are often more receptive to borrowers who demonstrate a genuine intention to repay their debts. Start the conversation by expressing your commitment to fulfilling your obligations, and explain any challenges you’re facing that may hinder your ability to maintain regular payments.

Timing is also critical in negotiations. Attempt to initiate discussions during business hours when representatives are more likely to have time to engage with your concerns. Additionally, consider negotiating during slower periods for the creditor, such as early in the month, when they may be more willing to accommodate requests.

When proposing new repayment terms, be realistic and specific. Offer a payment plan that is feasible based on your current financial situation. Whether it’s requesting a lower interest rate, an extended repayment period, or temporary forbearance, presenting well-thought-out options shows that you are proactive and serious about finding a solution.

Don’t hesitate to ask for concessions such as waived fees or reduced interest rates. Creditors often prefer to negotiate rather than risk a default, which can lead to more severe consequences for both parties. If the first representative you speak with is unwilling to accommodate your requests, ask to speak with a supervisor or a different department that may have more leeway in decision-making.

Lastly, document all agreements made during the negotiation process. Ensure you receive written confirmation of any new terms, including revised payment amounts, due dates, or interest rates. This documentation will serve as a reference point and protect you in case any discrepancies arise in the future.

By approaching negotiations with preparation, a positive attitude, and clear proposals, individuals can significantly improve their chances of securing more favorable repayment terms from creditors, ultimately easing their financial burden.

In conclusion, effectively managing and reducing personal debt is a multifaceted challenge that requires a proactive approach and a clear understanding of its broader implications. By employing strategies such as budgeting, prioritizing payments, and seeking professional credit counseling, individuals can take significant steps toward financial stability. The consequences of high debt levels extend beyond personal finances, impacting economic growth and corporate performance, which further emphasizes the importance of responsible debt management. Negotiating with creditors can lead to more favorable repayment terms, alleviating some of the burdens associated with debt. Moreover, the complexities of student loan debt necessitate careful financial planning to ensure long-term economic well-being.

As we consider the interplay between personal and national debt, it becomes evident that sound debt management practices are crucial not only for individual financial health but also for the overall economic landscape. By understanding the risks and rewards of leveraging debt, individuals can make informed decisions that contribute to their financial success. Ultimately, a comprehensive approach to debt management—rooted in awareness, negotiation, and strategic planning—can lead to improved financial outcomes for individuals and a more resilient economy.