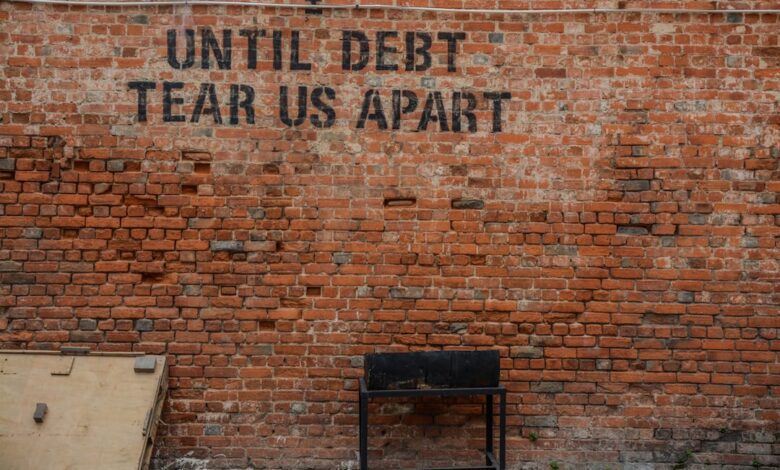

Debt Dilemmas: Strategies for Personal Management and Economic Impact

In today’s fast-paced financial landscape, personal debt has become an increasingly prevalent challenge for individuals and families alike. As high levels of debt can hinder personal financial stability and impact overall economic growth, it is crucial to explore effective strategies for managing and reducing personal debt. This article delves into practical approaches for navigating the complexities of debt, from negotiating better repayment terms with creditors to the invaluable role of credit counseling in facilitating financial recovery. Additionally, we will examine how personal debt intertwines with broader economic dynamics, including the implications of corporate debt on stock performance and the impact of student loan debt on financial planning. Finally, we will consider how governments manage national debt and its economic consequences, providing a comprehensive view of both personal and institutional debt in our interconnected world. Whether you are looking to regain control over your finances or seeking a deeper understanding of debt's role in the economy, this article offers insights and strategies to empower your financial journey.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **Debt Dynamics: Understanding the Broader Economic Impact of High Debt Levels**

- 3. **From Negotiation to Counseling: Tools for Debt Management and Financial Recovery**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines financial awareness, disciplined budgeting, and proactive communication with creditors. One of the first steps individuals should take is to create a comprehensive budget that outlines all income sources and expenses. This helps identify areas where spending can be reduced, allowing for more funds to be allocated toward debt repayment.

A prioritized debt repayment strategy, such as the snowball or avalanche method, can also be beneficial. The snowball method involves paying off the smallest debts first to build momentum, while the avalanche method focuses on tackling debts with the highest interest rates first to minimize overall interest costs. Both methods encourage consistency and motivation as individuals see their debts decrease over time.

Additionally, exploring options for consolidation can help streamline debt management. This may involve taking out a personal loan to pay off multiple debts or transferring high-interest credit card balances to a card with a lower interest rate. Consolidation can simplify payments and potentially reduce interest expenses.

Effective communication with creditors is crucial. Individuals should not hesitate to reach out to their creditors to discuss repayment options, which may include lower interest rates, extended payment terms, or temporary hardship programs. Many creditors are willing to negotiate, especially if they believe it will increase the likelihood of repayment.

Lastly, seeking the assistance of credit counseling services can provide valuable support. These organizations can offer professional advice on budgeting, debt management plans, and financial education, helping individuals navigate their debt situations more effectively. By employing these strategies, individuals can take control of their personal debt, paving the way for a more secure financial future.

2. **Debt Dynamics: Understanding the Broader Economic Impact of High Debt Levels**

High levels of personal and corporate debt can have significant implications for economic growth. When individuals and businesses are burdened by excessive debt, their spending power diminishes, leading to reduced consumption and investment. This contraction in demand can slow down economic activity, as businesses may face lower sales and profits, prompting them to cut back on hiring, wages, and expansion plans.

Moreover, high debt levels can lead to increased risk of defaults, which can create a ripple effect throughout the economy. When borrowers fail to meet their obligations, creditors may tighten lending standards, making it more difficult for others to access credit. This can result in a credit crunch, further stifling economic growth and innovation.

On a macroeconomic level, high aggregate debt levels can also influence interest rates. When governments or central banks perceive elevated debt risks within the economy, they may opt to raise interest rates to mitigate inflationary pressures or stabilize financial markets. Higher interest rates can discourage borrowing and spending, exacerbating the slowdown in economic growth.

Additionally, the burden of debt can lead to increased uncertainty among consumers and businesses. When individuals are preoccupied with managing their debt, they may be less likely to invest in long-term financial goals, such as homeownership or retirement savings. This can create a cycle where economic stagnation becomes self-reinforcing, as lower investment leads to reduced economic potential.

Ultimately, understanding the broader economic impact of high debt levels is crucial for policymakers and stakeholders. Strategies aimed at managing and reducing debt can foster a healthier economic environment, promoting sustainable growth and financial stability for individuals, businesses, and the economy as a whole.

3. **From Negotiation to Counseling: Tools for Debt Management and Financial Recovery**

Managing personal debt effectively requires a multifaceted approach that combines negotiation skills with professional assistance. One of the first steps individuals can take is to negotiate directly with creditors. Open communication can often lead to better repayment terms, such as lower interest rates, extended payment plans, or even debt forgiveness. It's important for individuals to come prepared with a clear understanding of their financial situation, including income, expenses, and the total amount owed. This transparency can foster goodwill and facilitate more favorable outcomes.

In addition to negotiation, credit counseling can play a crucial role in debt management. Credit counselors are trained professionals who provide education and resources to help individuals understand their financial options. They can assist clients in developing personalized budgets, exploring debt management plans, and improving overall financial literacy. Many nonprofit organizations offer these services at little to no cost. Engaging with a credit counselor can be particularly beneficial for individuals feeling overwhelmed by debt, as it provides structured support and accountability.

Combining negotiation efforts with credit counseling can enhance an individual’s ability to achieve financial recovery. By actively engaging with creditors and seeking guidance from professionals, people can create a comprehensive strategy that not only addresses current debt but also lays the groundwork for a more stable financial future. This dual approach empowers individuals to regain control over their finances and fosters healthier financial habits moving forward.

In conclusion, managing and reducing personal debt is not only vital for individual financial health but also for fostering broader economic stability. By employing effective strategies such as budgeting, prioritizing high-interest debts, and engaging in open negotiations with creditors, individuals can take significant steps toward regaining control over their financial futures. Understanding the wider implications of high debt levels on economic growth emphasizes the importance of collective financial responsibility.

Furthermore, credit counseling serves as a valuable resource, providing guidance and support to those navigating challenging financial landscapes. While the risks of using debt to invest must be carefully weighed against potential rewards, responsible management can lead to opportunities for growth. Additionally, the burden of student loan debt necessitates thoughtful financial planning to ensure long-term stability.

As we have explored, the interplay between personal, corporate, and national debt is complex, with each layer influencing economic performance and individual well-being. By fostering informed discussions about debt management and encouraging proactive measures, we can cultivate a more financially literate society equipped to handle the challenges and opportunities that debt presents. Ultimately, the path to financial freedom and economic resilience lies in understanding these dynamics and taking deliberate action toward sustainable financial practices.