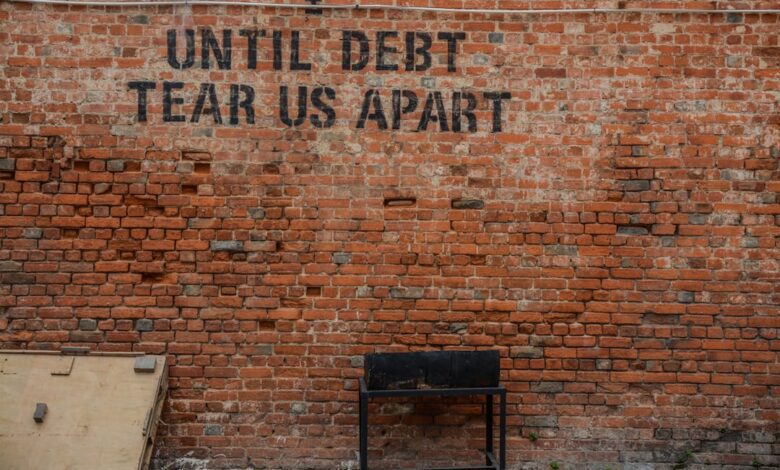

Debt Decoded: Navigating Personal and National Challenges for Economic Resilience

In today's fast-paced financial landscape, managing debt has become a critical concern for individuals, businesses, and governments alike. From the burden of personal loans and credit card debt to the complexities of corporate financing and national obligations, the implications of debt extend far beyond individual circumstances. This article delves into effective strategies for managing and reducing personal debt, highlighting how these practices not only empower individuals to reclaim their financial freedom but also contribute to broader economic stability. We will explore the ripple effects of high debt levels on economic growth, examine the essential role of credit counseling and negotiation in achieving favorable repayment terms, and investigate the delicate balance between leveraging debt for investment and the risks it entails. Additionally, we will look at the impact of student loan debt on financial planning and how corporate debt influences stock performance. Finally, we will consider how governments manage national debt and its implications for the economy. Join us as we navigate the multifaceted world of debt, providing insights and practical solutions for a healthier financial future.

- 1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

- 2. **The Economic Ripple Effect: High Debt Levels and Growth Dynamics**

- 3. **Credit Counseling and Negotiation: Tools for Debt Management Success**

1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

Navigating personal debt requires a strategic approach to regain control over finances and achieve long-term financial freedom. Here are several effective strategies to manage and reduce personal debt:

1. **Create a Comprehensive Budget**: Start by assessing your income and expenses. A detailed budget helps identify areas where you can cut back on spending, enabling you to allocate more funds toward debt repayment. Ensure to categorize your expenses into needs and wants, prioritizing essential payments.

2. **Prioritize Debt Payments**: Use the debt avalanche or debt snowball method. The avalanche method focuses on paying off debts with the highest interest rates first, saving you money in the long run. In contrast, the snowball method emphasizes paying off the smallest debts first, providing psychological motivation as you see debts eliminated.

3. **Negotiate with Creditors**: Reach out to your creditors to discuss your financial situation. Many creditors are willing to negotiate lower interest rates, extended repayment terms, or even settlements for less than the total owed. Being proactive and honest about your circumstances can lead to more favorable terms.

4. **Consider Debt Consolidation**: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and reduce overall interest costs. This approach can make managing payments more manageable, but it's essential to ensure that consolidation does not lead to more debt accumulation.

5. **Seek Professional Help**: Credit counseling services can provide valuable guidance and support. These organizations can assist in creating a personalized debt management plan, negotiate with creditors on your behalf, and offer financial education resources.

6. **Build an Emergency Fund**: Establishing a small emergency fund can prevent the need to incur additional debt in case of unforeseen expenses. Even setting aside a modest amount each month can help create a financial buffer, reducing reliance on credit cards or loans.

7. **Educate Yourself**: Understanding personal finance principles and debt management strategies empowers you to make informed decisions. Numerous resources are available, including books, online courses, and workshops that can enhance your financial literacy.

By implementing these strategies, individuals can take proactive steps toward managing their personal debt, ultimately leading to greater financial stability and freedom.

2. **The Economic Ripple Effect: High Debt Levels and Growth Dynamics**

High levels of personal and corporate debt can significantly hinder economic growth, creating a ripple effect that impacts various sectors of the economy. When individuals and businesses are burdened by excessive debt, their capacity to spend and invest diminishes. Consumers with high debt levels typically allocate a larger portion of their income to debt repayment, which reduces discretionary spending. This decline in consumer spending can stifle demand for goods and services, ultimately leading to slower economic growth.

Moreover, businesses burdened by significant debt may face constraints in their operational and strategic decisions. High debt levels can limit a company's ability to invest in new projects, hire additional staff, or expand its operations. As a result, this can lead to stagnation in productivity and innovation, which are essential drivers of economic growth.

On a macroeconomic scale, when a significant number of households and businesses are struggling with debt, it can create a cycle of reduced economic activity. A slowdown in consumer spending can lead to lower revenues for businesses, which may result in layoffs, further reducing disposable income within the economy. This cycle can create a challenging environment for economic recovery, particularly during periods of economic downturn.

Additionally, high levels of national debt can have long-term implications for economic growth. Governments that are heavily indebted may face higher borrowing costs, which can lead to increased taxes or reduced public spending. This can further constrain economic growth as critical investments in infrastructure, education, and healthcare are delayed or diminished.

Conversely, manageable levels of debt can facilitate growth by enabling individuals and businesses to invest in opportunities that generate returns. When used wisely, debt can drive innovation, enhance productivity, and support economic expansion. The key lies in maintaining a balance that allows for growth while minimizing the risks associated with excessive borrowing.

3. **Credit Counseling and Negotiation: Tools for Debt Management Success**

Credit counseling and negotiation are vital tools for individuals seeking to manage and reduce personal debt effectively. Credit counseling involves working with a professional counselor who can provide guidance on budgeting, financial planning, and debt repayment strategies. These counselors are often affiliated with nonprofit organizations and can help individuals understand their financial situations better, identify spending habits, and create tailored plans to tackle debt.

One of the primary benefits of credit counseling is the development of a debt management plan (DMP). Through a DMP, a credit counselor can negotiate with creditors on behalf of the individual to secure lower interest rates, reduced monthly payments, or even debt forgiveness. This can significantly ease the financial burden on the debtor and make repayment more manageable.

Negotiation is also a critical aspect of debt management. Individuals can directly approach creditors to discuss their circumstances and request better repayment terms. This may include asking for lower interest rates, extended repayment periods, or temporary forbearance in cases of financial hardship. Creditors often prefer to work with borrowers to find mutually beneficial solutions rather than risk default, making negotiation a valuable skill for debtors.

Moreover, credit counseling can provide education on the importance of maintaining a good credit score during and after the debt management process. Understanding how different actions can affect credit ratings helps individuals make informed decisions that can lead to healthier financial futures. In conclusion, leveraging credit counseling and negotiation can empower individuals to regain control over their finances, navigate challenging debt situations, and ultimately foster long-term financial stability.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach, informed decision-making, and a clear understanding of the broader economic implications. By employing practical strategies for debt reduction, individuals can regain control of their finances and pave the way toward financial freedom. The interplay between personal debt and economic growth underscores the importance of maintaining manageable debt levels, not only for individual well-being but also for the overall health of the economy.

Negotiation with creditors and seeking credit counseling can provide essential support, enabling borrowers to secure more favorable repayment terms and develop sustainable financial habits. As we consider the risks and rewards of using debt as an investment tool, it becomes clear that a careful assessment of one's financial situation is crucial to avoid exacerbating existing challenges.

Moreover, the impact of student loan debt on financial planning highlights the need for strategic foresight when pursuing education and career goals. On a larger scale, corporate debt influences stock performance, and understanding how governments manage national debt offers insights into the complex relationship between fiscal policies and economic stability.

Ultimately, navigating the landscape of debt—whether personal, corporate, or national—requires a comprehensive approach that balances immediate financial needs with long-term growth aspirations. By fostering a culture of financial literacy and responsibility, individuals and societies can work toward a more stable economic future, characterized by reduced debt burdens and enhanced prosperity.